[ad_1]

Save $10,000 in a yr by following these easy saving suggestions. We’ve compiled a few of the very best methods so that you can get monetary savings and it received’t take lengthy earlier than your financial savings account has grown to $10,000!

What would you do with an additional $10,000? I guess the concepts are flooding your thoughts proper now! I’m right here to inform you that it’s attainable to avoid wasting up this quantity in only a yr. It’d take some self-discipline and persistence, however it can save you as much as 10 grand in simply 52 weeks. Simply observe these sensible steps.

How To Save $10,000 In A 12 months

I’ll be trustworthy, saving up 5 figures in a yr will take some dedication and focus. There are such a lot of issues which can be tempting to spend your cash on – and others which can be vital purchases.

These are probably the most invaluable suggestions that work for me – I do know they may help you too.

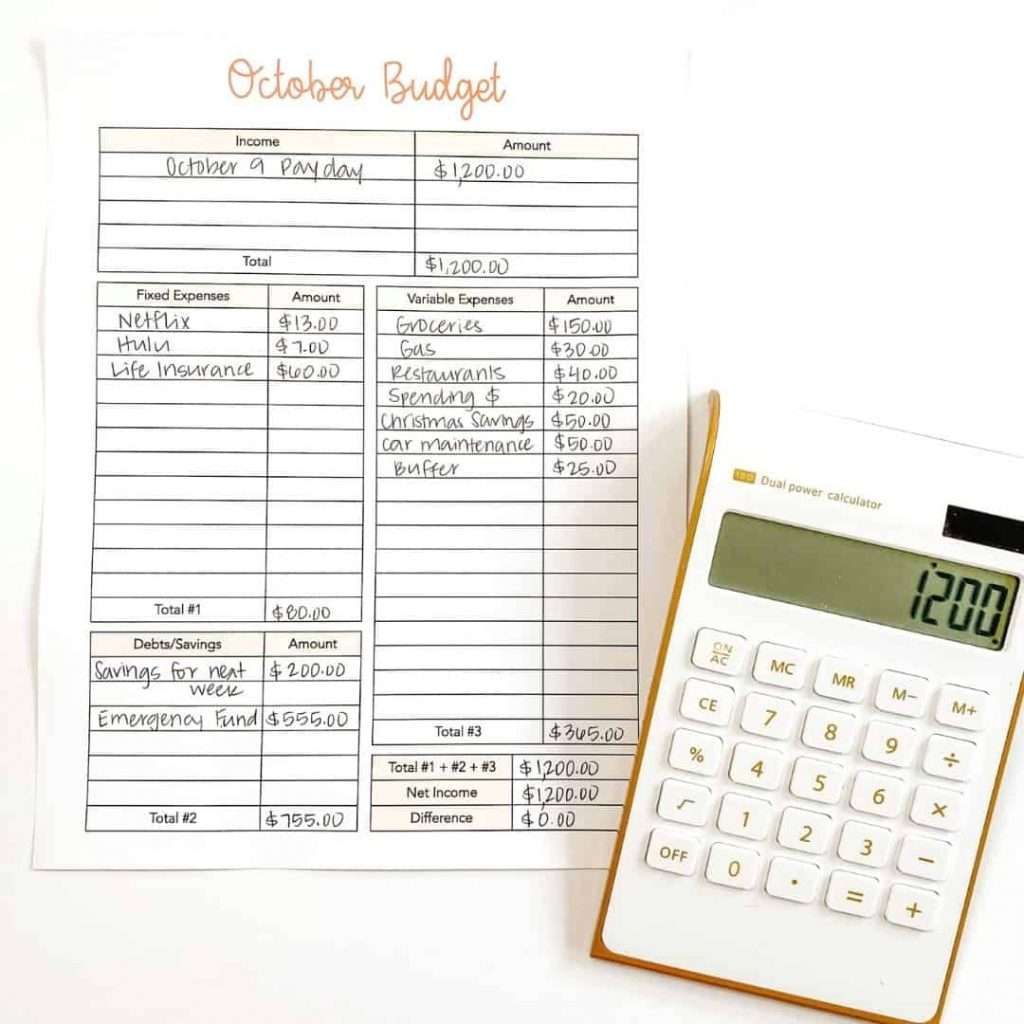

#1 Set Objectives And A Finances

The very first step goes to be to determine why you might be doing this. What’s your final objective? Put this someplace seen. As you get by way of the yr, you’ll be tempted to spend your financial savings. It’s good to discuss with your targets so that you keep targeted and disciplined.

A part of setting your targets is establishing a finances. With a purpose to save $10,000 in a yr, you’ll need to put about $834 into financial savings every month. Earlier than you strive to determine how you’re going to do this, you want a primary finances in place so you understand the place your cash goes every week.

I’ve a number of sources that can assist you arrange a finances. Whenever you get your finances in place, use the fitting finances classes so you’ll be able to see the place you’ll be able to reduce.

Many individuals discover success utilizing the money envelope system to chop again on frivolous spending. If that works together with your thoughts too, then create envelopes to your most important finances classes. You’ll be stunned how easy saving cash turns into when you might have a plan in place.

Above all, crucial factor is to have the ability to see the place all your cash goes and the place you may make modifications to avoid wasting much more cash every week.

#2 Put All Your Change Into Financial savings

This subsequent tip may offer you $500 in a yr with none further effort. Each time you purchase one thing, spherical as much as the closest greenback and put the change instantly into financial savings.

Some banks – like Financial institution of America – will do that routinely for you after you set it up. Speak to your financial institution and ask if they provide one thing like this.

In the event that they don’t, then use the money envelope system after which take your unfastened change again to the financial institution as soon as per week (or month). You can even maintain monitor of how a lot you spent in a checkbook register, after which make a switch as soon as per week. (That’s the old fashioned technique).

Regardless of which means you do it, it’s fairly wonderful how a lot you’ll save with this one approach.

#3 Pay Your self First

One other technique to save $10,000 in a yr is to make it your highest precedence. Earlier than you pay a single invoice or spend something out of your paycheck, deposit cash into financial savings. Spend what’s left after you pay your financial savings account.

If cash is tight, then this quantity could possibly be fairly small at first. Make it a objective of accelerating how a lot you place into financial savings from every paycheck.

#4 Reduce Down On Payments

After you might have an in depth finances arrange, look actually shut at each single expense. Search for methods you’ll be able to reduce.

Search for cheaper choices for every little thing. Is there a less expensive cable possibility? How are you going to decrease your electrical invoice? What about saving cash in your garments every month?

That is the right alternative to buy round for various automotive insurance coverage or name your present agent and ask for them to replace your account with new reductions that you simply may qualify for.

There may even be some subscriptions that you simply don’t use usually anymore. Reduce them out till you meet your financial savings objective.

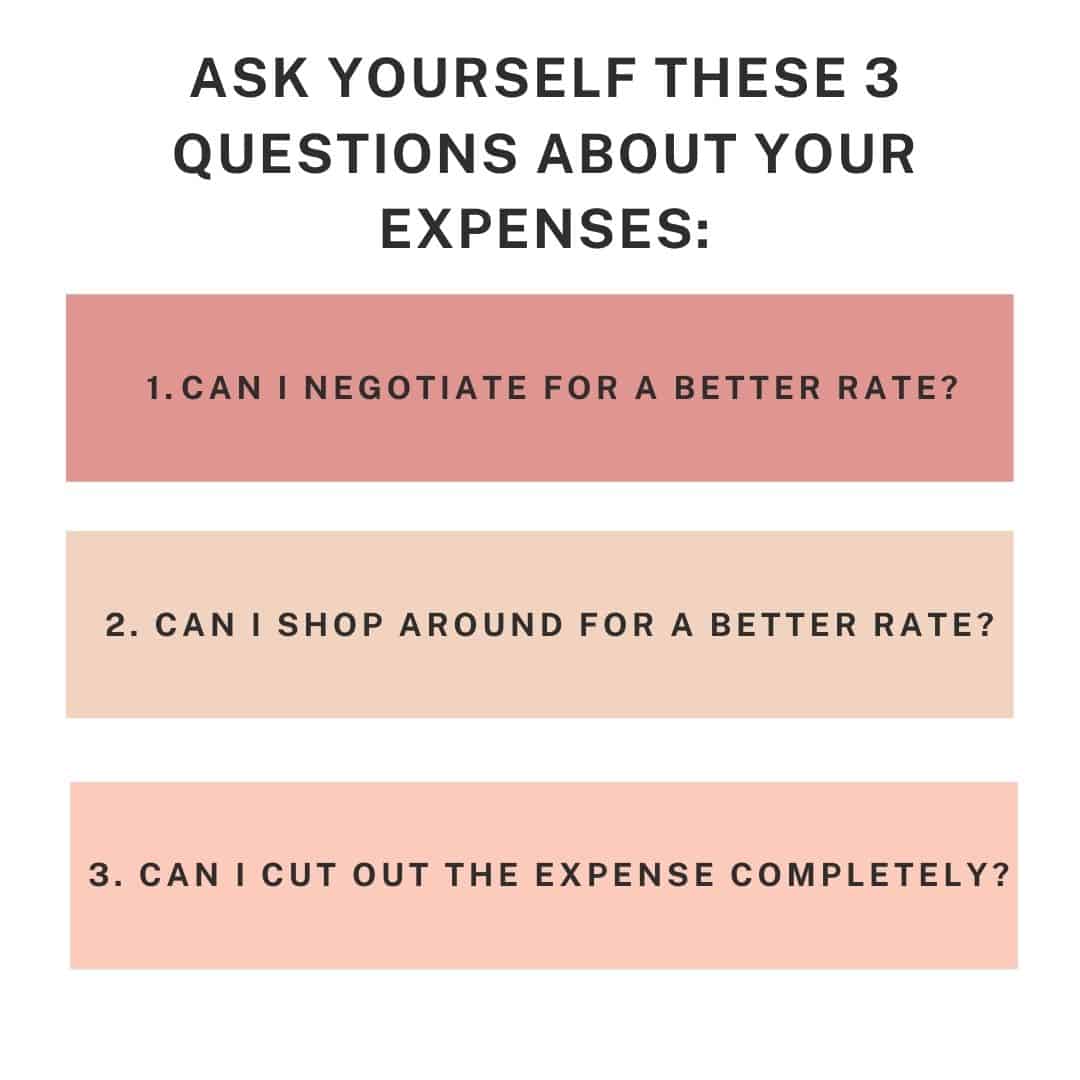

A simple technique to look over each invoice is to print off your final month’s financial institution assertion. Undergo every transaction, spotlight each invoice and ask your self these 3 questions:

- Can I negotiate for a greater charge?

- Can I store round for a greater charge?

- Can I cancel or minimize out this expense fully?

#5 Break Down The Objective Into Achievable Items

If this begins to really feel overwhelming, break it down into smaller, extra digestible, items. As an alternative of it like you need to save $10,000, divide it into quarterly, month-to-month, and even weekly targets.

The smaller the quantity, the better it’ll really feel like it’s to realize! In reality, do you know that so as to save $10,000 every year that breaks right down to $27.40 every day? By breaking your targets down, you’ll be shocked to see how achievable they really are!

Typically with huge targets like this, it’s principally thoughts over matter. Discover a technique to consider in your means to fulfill this objective.

#6 Begin A Facet Hustle

Should you undergo all of those steps and notice you might be nonetheless arising brief, it is perhaps time to begin a short lived aspect hustle. What’s a aspect hustle? It’s a technique to earn cash on the aspect. It’s like a part-time job, however you often work at home and solely for so long as you want the additional cash.

Examples of aspect hustles embrace:

- Freelance Writing

- Promoting Crafts

- Uber/Instacart

- Canine Strolling/Pet Sitting

- Babysitting

Discovering these jobs is simple with companies – you’ll be able to join on Care.com or Sittercity to promote your babysitting companies!

If the thought of taking over a aspect hustle is overwhelming, simply do not forget that that is merely a season in your life. You don’t need to maintain this aspect hustle perpetually. In reality, you can truly solely tackle a aspect hustle for just a few months to speed up you towards your $10,000 objective.

Remember the fact that you’ll have to maintain monitor of how a lot cash you make together with your aspect hustle and pay revenue tax on it on the finish of the yr.

#7 Set Spending Priorities

One other technique to reduce on spending is to set priorities for every little thing you’re going to purchase. Do you actually want this merchandise? Whenever you set your financial savings account as the very best precedence, it’s simpler to say “no” to further spending and meet your targets.

One thing else that works is whenever you permit your self just a few actually invaluable purchases. As an alternative of a bunch of things that don’t imply a lot, for those who solely spend cash on just a few actually essential issues, they’ll imply extra to you, and also you received’t be tempted to spend cash on different issues.

By setting strict spending priorities, you’ll discover extra money in your finances every month to place towards financial savings.

#8 Swap As an alternative of Purchase

One other means to save cash on stuff you may buy is to seek out swap teams in your space. You can even simply get along with different folks from your loved ones or your mates.

You’ll be able to swap out gently used kids’s garments, child gear, even cooking/baking home equipment you by no means use. Arrange a bunch and begin posting issues comparable to, “anybody want this?” The extra people who take part, the extra you’ll save!

#9 Save On Meals

Consuming out is pricey. Prepare dinner at house and use the leftovers in additional recipes. This one alternative will prevent at the least $100 a month (possibly much more!).

Whenever you eat out much less ceaselessly, it makes it really feel extra particular and enjoyable! There are many methods to save cash on the grocery retailer. Under are simple suggestions that can assist you save on groceries:

- Make a meal plan and persist with it.

- Purchase vegatables and fruits which can be in season.

- Skip out on name-brand meals. Purchase the shop model as a substitute.

- Order your groceries on-line to assist reduce impulse buying.

- Solely go down the aisles the place you want gadgets.

- Use money envelopes that can assist you keep on monitor.

Don’t overlook to join a rebate app like Fetch Rewards or Ibotta to earn extra cash or present playing cards.

#10 Finances Enjoyable Cash

Don’t minimize out enjoyable cash completely, it’ll result in burn out. Simply reduce or discover low cost/free methods to have enjoyable.

That is all a part of giving your self grace and ensuring you might have the endurance to avoid wasting all yr lengthy. Should you attempt to minimize out all enjoyable cash completely, you’ll really feel extra wired and have a damaging perspective about your entire financial savings course of.

Saving up $10,000 ought to be a optimistic and enjoyable factor! Give your self a set sum of money that you’ll spend every month. You’ll be able to even save up this enjoyable cash for just a few months and splurge on one thing huge!

Bear in mind, life is about stability. It’s okay to chop again so long as you continue to permit your self to benefit from the cash you make.

#11 Set Up Passive Revenue Streams

What’s a passive revenue? It’s a supply of revenue that generates extra revenue with out a lot upkeep after the preliminary arrange.

This seems like a dream come true, proper?

One instance of passive revenue is promoting on a weblog. One other thought is to hire out further rooms on Airbnb.

Passive revenue takes some effort to arrange initially, however it’ll proceed to usher in revenue, after which you’ll be able to focus your time on different avenues of revenue.

#12 Continually Readjust Your Finances

Lastly, don’t simply set your finances and overlook it. Return usually and have a look at your finances to make any changes that you simply want. Issues will come up – like shock medical or automotive bills. Possibly you’ll need to spend a little bit further on a present to your partner. Regardless of the motive, this finances ought to be fluid and changeable.

You’ll be extra more likely to persist with your finances (and crush your financial savings objective) when you understand that you simply aren’t caught! Should you discover out that you’ll be able to save much more cash, return in and alter it.

Monitor Your $10,000 Financial savings Objective

When you’ve determined that saving $10,000 is definitely worth the effort and time, you then’ll need a enjoyable and visible technique to monitor your financial savings! Maintaining monitor of your financial savings objective is not going to solely maintain you motivated however may even encourage your family and friends to arrange their very own financial savings objective.

Seize your free printable financial savings objective web page beneath. Coloration in a field each time you save $100. Grasp this free printable someplace in an effort to have a look at it usually!

Ultimate Ideas

Whenever you uncover the way to save $10,000 in a yr, you’ll notice that it’s so a lot simpler than you may suppose! Make up your thoughts that you’re going to persist with it. Create a plan with your loved ones and maintain one another accountable. Whenever you do that with help, you’ll be extra more likely to succeed!

If you have to decide up a aspect hustle, discover one thing that matches naturally in your life and that you simply get pleasure from doing. With the following pointers, you’ll obtain your financial savings objective and be capable to plan for a good greater one.

[ad_2]

![12 Steps To Save $10,000 in a 12 months [2023] 12 Steps To Save $10,000 in a 12 months [2023]](https://inspiredbudget.com/wp-content/uploads/2022/02/how-to-save-10000-featured-image.jpg)