[ad_1]

Making a finances and sticking to it might probably appear to be an awesome job, particularly should you receives a commission biweekly! There are a whole lot of suggestions on the market for easy methods to handle your month-to-month earnings. However what about when each different week?

If you have to finances on a biweekly earnings and also you aren’t positive the place to start out, then you definitely’re in the fitting place. I’ve laid out easy steps to assist information you in the fitting route. These are the precise steps that I’ve used to assist our household finances after we are paid biweekly.

Under are the 5 steps that can assist you finances biweekly:

- Listing out your payments

- Fill Out A Invoice Fee Calendar

- Write Your First Biweekly Funds

- Write Your Second Biweekly Funds

- Observe Your Spending

Earlier than we go into depth on every of those steps, let’s cowl what being paid biweekly truly appears like.

What’s biweekly pay?

There are 52 weeks in a 12 months. In case you are paid biweekly you’ll obtain 26 paychecks all through the course of the 12 months. Most months you’ll obtain two paychecks, however 2 months out of the 12 months you’ll obtain 3 paychecks.

Questioning what you need to do with this third paycheck? Don’t fear! We are going to cowl that on this article.

Is biweekly pay the identical as getting twice a month?

Biweekly pay isn’t the identical as getting paid twice every month. Those that are paid twice every month will solely obtain 24 paychecks. They received’t have the chance to take pleasure in these third paycheck months.

Irrespective of in case you are paid biweekly or twice a month, the next steps will make it easier to write a finances that you may persist with!

Step 1: Listing Out Your Payments

Seize a bit of paper and checklist out all of your payments, the quantity due, and their due dates. To be sure you don’t miss any payments, print out your final 2 month’s financial institution statements. Undergo each transaction and spotlight the payments that come out each monty. Add these to your checklist of payments.

In case you neglect so as to add a month-to-month expense to your checklist, your complete biweekly finances will be thrown off. Though no finances will probably be good, that is when so many individuals quit on their finances. The extra ready you might be to your finances, the extra doubtless it’s to work!

Step 2: Create Your Invoice Fee Calendar

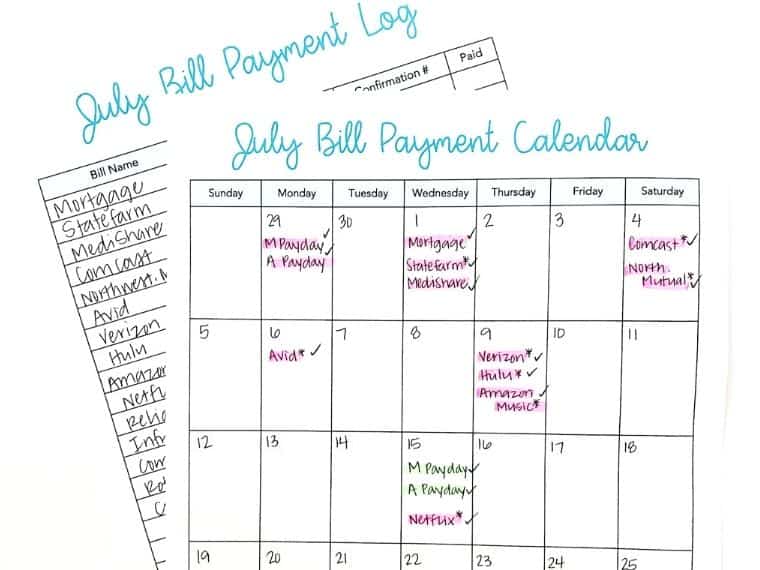

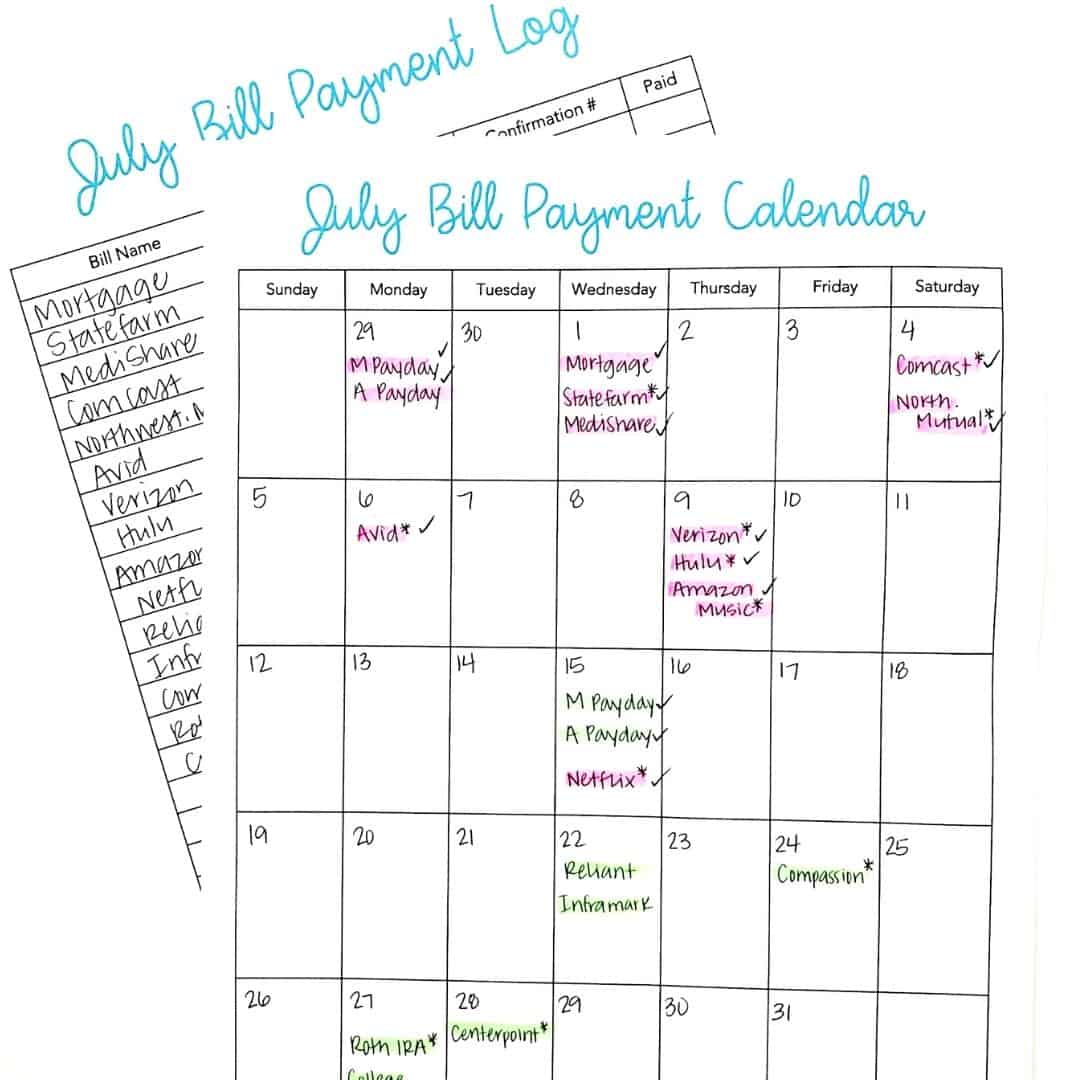

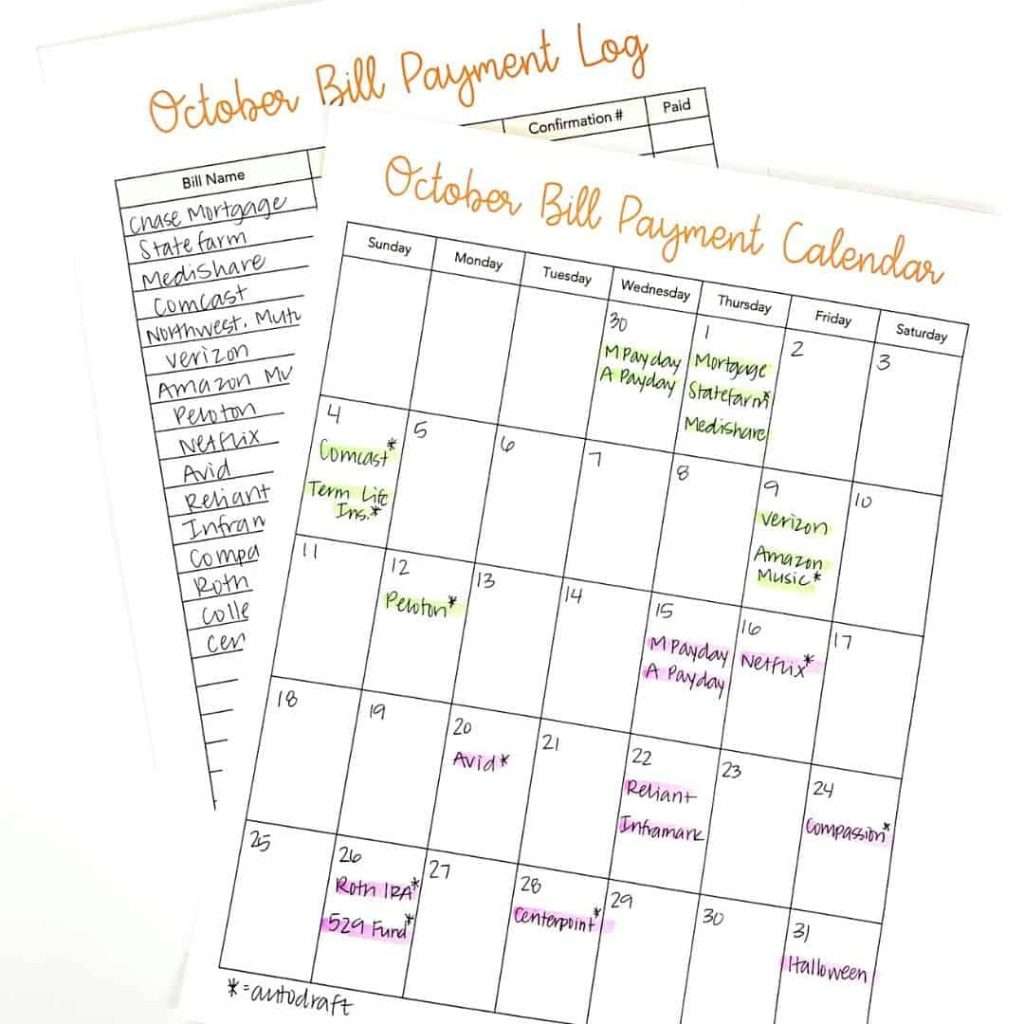

When you’ve listed out all of your payments, it’s time so as to add them to your Invoice Fee Calendar. This kind of calendar helps you set up your payments based mostly on when they’re paid. In case you’re a visible individual, then this can be a should!

A easy month-to-month calendar will work, or you should use this web page from my Funds Life Planner.

As you write your biweekly finances, spotlight all of the payments that will probably be paid out of your first paycheck with one coloration. Then, spotlight all of the payments that can come out of your second paycheck with one other coloration.

Invoice cost calendars are good for monitoring whenever you’ve paid payments. I at all times put a checkmark subsequent to every invoice after I’ve paid it or after it has been mechanically drafted from my account.

You may even draw an asterisk subsequent to each invoice that will probably be mechanically drafted out of your account. This manner you recognize which payments will probably be paid mechanically and which of them you might be liable for paying.

One other nice tip is so as to add different notes or particular dates to your invoice cost calendar that can assist you together with your finances. As an illustration, add any household’s birthdays or holidays to your invoice cost calendar.

Hold your invoice cost calendar someplace you possibly can refer again to it typically. Don’t tuck it away or else you would possibly neglect to reference it all through the month. A invoice cost calendar is the good solution to hold your self organized and make budgeting biweekly a simple job!

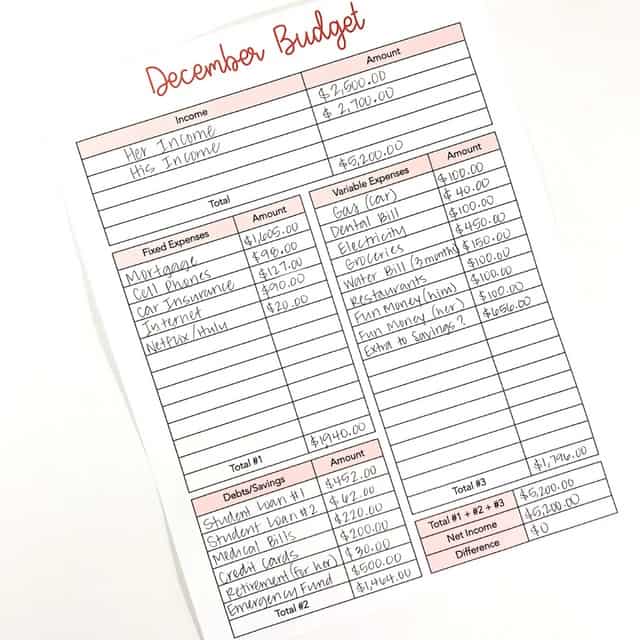

Step 3: Write Your First Biweekly Funds

When you’ve stuffed out your invoice cost calendar, you’ll know which payments should be paid together with your first paycheck. Subsequent, add any further bills into your finances similar to groceries, fuel, and spending cash. Remember to embrace each expense you’ll have earlier than your subsequent payday in your finances.

By creating an intensive finances, you’ll be setting your self up for achievement!

In case you have any cash left over you possibly can ship them to your sinking funds or make an additional cost in direction of debt! This can make it easier to attain your financial savings and debt freedom targets sooner.

Step 4: Write Your Second Biweekly Funds

After your second test has hit your checking account, then you possibly can pay the remainder of your payments for the month. You’ll additionally have to put aside cash for groceries, fuel, and different bills.

Don’t neglect to incorporate these 10 objects which are mostly lacking from budgets!

If there’s any leftover cash after you have got budgeted for all of your bills, ship it to financial savings or debt.

Step 5: Observe Your Spending

After getting your biweekly finances written, it’s necessary to trace your spending. By monitoring your bills and spending, you’ll get a good suggestion of whether or not or not your finances is practical. It’s not unusual to put in writing a finances that you simply suppose is ideal solely to seek out that you simply’ve blown your finances inside per week of payday.

Monitoring your spending has many advantages, however by far these 3 advantages stand out above the remaining:

- You study extra about your cash habits. As you observe your spending, you’ll begin studying extra about your self and even your companion’s spending habits. The extra perception you have got into your spending, the better it can change into to put in writing a finances that you may truly persist with.

- You’ll find methods to save cash. As you begin to observe your spending, you may be shocked by simply how a lot cash you’re spending! This can mean you can discover areas in your spending the place you possibly can reduce and save extra money. Attempt to discover one new expense to chop out of your spending every month.

- You may be extra accountable for your cash. Monitoring your spending lets you face your monetary fact. When you recognize precisely the place your cash goes, you’ll be extra assured and really feel accountable for your funds. That is the greatest advantage of understanding the place your cash goes.

Budgeting Biweekly Ideas and Hacks

Studying easy methods to write a finances each different week might sound troublesome at first, however the following pointers will assist make it easy!

Get Your self and Funds Organized

Irrespective of the way you receives a commission, getting your self and your funds organized won’t solely make budgeting extra environment friendly, however even enjoyable!

The way you select to get your self organized relies upon utterly on you. Are you extra technical and like spreadsheets? Good! Hold all the pieces organized in Excel and even in Quicken. In case you take pleasure in making budgets and dealing with your funds with paper and pencil, then a Funds Binder is ideal for you!

You may also have a combination of the 2. Our household personally makes use of Quicken to trace our spending. We even have a finances binder the place we hold any papers, payments, and our finances calendars organized.

When you will get your funds organized, you’ll stress much less about your cash. You’ll know that writing a finances or paying payments doesn’t need to be daunting. Who is aware of, you would possibly even take pleasure in it sooner or later!

Embody a buffer in your finances

Irrespective of how you finances, think about together with a buffer into your finances every pay interval. A buffer is just an quantity that acts as a boundary so that you simply don’t overspend. It covers any further bills that may take you unexpectedly.

Likewise, a buffer may assist cowl payments that find yourself costing greater than you had deliberate. You realize, like that electrical energy invoice that ended up being $50 greater than you had anticipated!

Buffers might help you persist with your finances. They go away room for grace in your on a regular basis funds. To incorporate a buffer in your finances, merely write the phrase “buffer” as a line merchandise in your finances. Determine how a lot cash you wish to have as a buffer and make it a precedence to incorporate the identical quantity every paycheck!

Set a day and time to work in your finances

Life occurs. And typically the very last thing you need to do is sit right down to evaluation or write a finances each different week. Look, I get it. I might simply discover 100 issues I’d moderately be doing than sitting right down to work on my funds.

However if you wish to attain your cash targets, then you definitely have to make budgeting and your funds a precedence.

Even whenever you don’t wish to.

The easiest way to make your finances a precedence is to set a day and time that you simply’ll work in your funds. Deal with this time as an appointment with your self that’s non-negotiable.

In case you had been sick, you’d see a health care provider. In case you had a cavity, you’d see a dentist. You’d by no means miss a dentist appointment should you tooth ached! Deal with these appointments with your self simply as necessary as a health care provider’s go to that you’ve got scheduled!

Throughout these scheduled finances conferences, you possibly can:

- pay payments which are developing

- write a brand new finances if payday is close to

- observe any bills or spending from the previous couple of days

- observe how a lot cash you have got in financial savings

- discover methods to chop again in your spending to be able to save extra money

This small tip can really change your funds and make it easier to finances higher than ever!

Transfer your due dates round

In case you don’t have the funds for to cowl all of your bills in your biweekly finances, then think about calling your invoice firms and shifting the due dates of your payments round. That is an extremely straightforward job that can assist make budgeting simpler for you each single month.

As an illustration, in case your cellular phone invoice is due on the 18th, however you’d moderately pay it together with your first paycheck, then name the corporate up and easily request that the date be moved. Most firms will probably be prepared to work with you as a result of they know that this implies you’ll be extra more likely to pay your invoice on time.

Traps To Keep away from When You’re Paid Biweekly

There are 2 major traps that individuals fall into after they begin engaged on their biweekly finances. Let’s cowl them under so that you simply don’t fall into the identical traps.

Entice #1: Don’t Spend Your Total Third Paycheck

We are going to go into depth under about what you need to do together with your third paycheck, however simply know this: it has a goal. These third paychecks ought to not be seen as your bonus or further spending cash. You’ll wish to be particular with how you utilize this further paycheck to be able to proceed to make progress towards your cash targets.

Entice #2: Don’t Get Off Observe

In case you’re paid biweekly, then it’s a must to test in typically to be sure you’re on observe together with your finances and invoice paying. In contrast to somebody who’s paid as soon as a month, you’ll doubtless need to pay payments a number of instances every month.

Don’t get off observe together with your invoice paying schedule. Hold your invoice cost calendar seen so that you simply don’t miss any payments. The very last thing you wish to do is be confronted with late charges!

What To Do With A Third Paycheck

Twice a 12 months the clouds will half, the heavens will shine down on you, and also you’ll obtain that wonderful third paycheck! Every part will really feel proper on this planet and the spender in you would possibly wish to head straight to the Goal residence decor part. However let me encourage you to ship that “more money” elsewhere.

First, you’ll have to put aside any cash that you simply’ll want for the subsequent 2 weeks. This can embrace any payments that may come up and on a regular basis bills. Don’t let any expense go neglected.

Then, take all of your leftover cash and throw it at your debt snowball or financial savings account. In case you’re attempting to avoid wasting up for a trip, then this can be a nice alternative to ship extra money towards that aim. Plus, in case you have cash put aside in financial savings, you received’t need to put any of your trip bills on a bank card.

You may as well use this cash to arrange a big buffer in your checking account. The third paycheck is an excellent instrument, but it surely ought to be used as such.

The Backside Line

Writing a finances is rather like some other job. Apply makes progress! The extra you write a biweekly finances, the better it can change into. Give your self time and I promise that you may be a budgeting professional very quickly!

In search of motivation to cease residing paycheck to paycheck and FINALLY repay your debt for good? This straightforward and actionable Budgeting and Debt cheat sheet will make it easier to get your cash below management as soon as and for all. You don’t work this tough to dwell paycheck to paycheck, proper?

[ad_2]