[ad_1]

22 million People have a private mortgage debt – and we owe about $210 billion altogether.¹ Whereas this quantity could appear fairly excessive, loans are simply one other a part of day-to-day funds to account for whereas sustaining your monetary well being.

It is best to prioritize your common month-to-month funds, nonetheless, you don’t have to stay to the minimal quantity. Ideally, you possibly can repay your bank card, mortgage, or auto loans faster and save on whole curiosity. Simply guarantee there aren’t any penalties and charges your lender may apply for making additional or early funds.

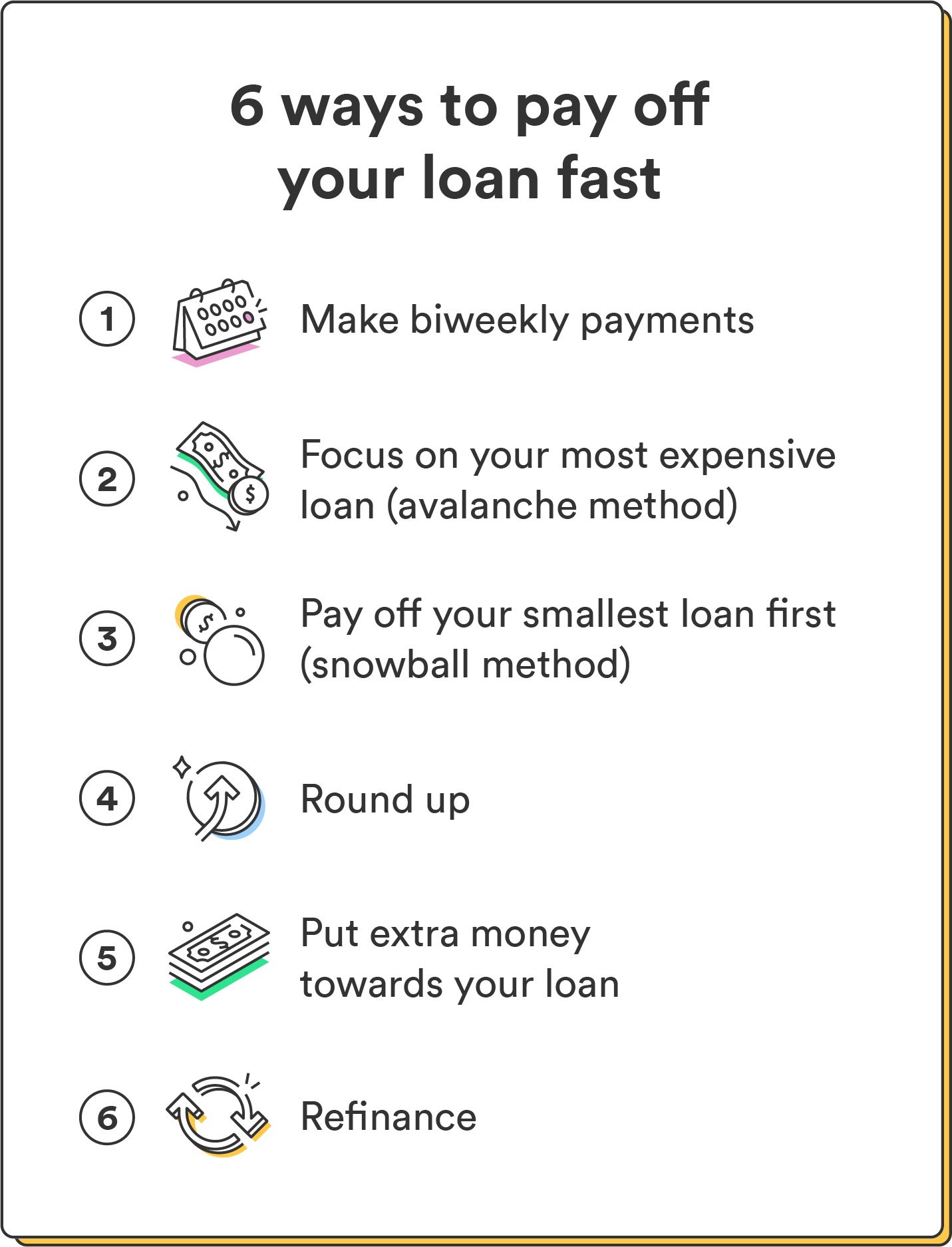

We suggest these tried-and-true strategies in case you’re keen and capable of repay your mortgage quicker:

Swap month-to-month for biweekly funds

Paying half your month-to-month mortgage fee each two weeks is a foolproof strategy to reduce the curiosity accrued in your mortgage with out feeling such as you’re spending extra monthly.

With this methodology, you’ll make 26 half-payments a 12 months, which equals a full additional month-to-month fee. You possibly can shorten your mortgage time period by a number of months or years!²

Repay your costliest mortgage first

Should you’re paying off a couple of mortgage, deal with the best rate of interest first and work your means down. This “avalanche methodology” will scale back the general quantity of curiosity you pay in your loans and reduce your general debt. Simply keep in mind to pay the minimal month-to-month funds in your different loans to keep away from any late charges or penalties.

Repay your smallest steadiness first

Versus the avalanche methodology, the snowball methodology prioritizes paying off the loans with the smallest quantity first. Seeing all these smaller accounts attain zero quick can assist construct confidence and momentum as you progress towards your largest mortgage.

Spherical as much as the closest $50

Rounding up your month-to-month funds to the closest $50 is one other strategy to repay your loans quick. For instance, in case your minimal month-to-month automobile fee is $365, make funds of $400 to shorten the time period. The distinction is sufficient to lower a number of months off your time period and prevent an honest quantity of curiosity.

Put all of your extra cash in the direction of your mortgage

Anticipating a promotion quickly? Congratulations – you’ll be in an awesome place to begin making additional funds in your mortgage! Facet hustles, wage negotiations, and slicing impulse purchases can assist you internet some additional money to your debt-free targets.

Refinance

If rates of interest have dropped because you took out your mortgage otherwise you’ve had an enormous enhance to your credit score, the most effective methods to repay your mortgage quicker is by refinancing. Chances are you’ll be eligible for a decrease rate of interest that would prevent hundreds and assist you to repay the principal early.

[ad_2]