[ad_1]

It’s time to test in on the state of the housing market.

Eventually look, mortgage charges have been nonetheless above 7%, although they did see a bit little bit of aid previously week.

In the meantime, housing provide continues to be closely constrained, preserving residence costs close to all-time highs in a lot of the nation.

This has proved to be a boon for residence builders, as they haven’t any competitors from present provide.

However it appears the house builders, and maybe these with 2-3% 30-year fastened mortgage charges, are the one actual winners proper now.

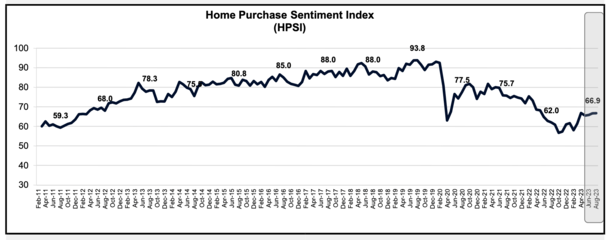

Residence Buy Sentiment Has Been Flat with Excessive Charges and Excessive Costs

Fannie Mae’s newest month-to-month Residence Buy Sentiment Index (HPSI), which gauges the housing market’s temperature, was largely unchanged from July.

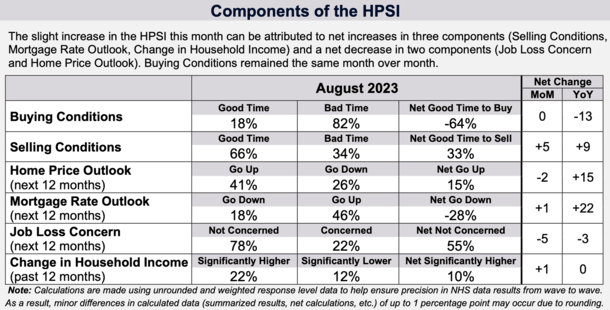

A complete of six elements make up the HPSI, together with shopping for situations, promoting situations, residence value outlook, mortgage price outlook, job loss concern, and alter in family earnings.

The share of respondents who stated it’s a good time to purchase a house was unchanged at a really low 18%.

In the meantime, the proportion who stated it’s a unhealthy time to purchase stood at 82%. So nothing modified there.

Consequently, the web share of those that say it’s a good time to purchase remained unchanged month over month.

When it got here to promoting a house, 66% of respondents (up from 64%) stated it’s a good time to unload a property. And simply 34% stated it’s a nasty time to promote, down from 36%.

As such, the web share of those that really feel it’s a very good time to promote elevated 5 share factors month-over-month from July.

That every one is sensible, given the truth that residence costs are excessive so promoting could be fairly worthwhile for many.

Talking of, the common residence vendor bought for $200,000 greater than they bought for over the previous three months.

That brings us to residence value expectations. Some 41% of respondents consider residence costs will rise over the subsequent 12 months, unchanged from July.

Conversely, 26% say residence costs will go down, up from 24% a month earlier.

And 33% consider residence costs can be flat, which decreased from 34% in July.

Taken collectively, the share who stated residence costs will go up within the subsequent 12 months fell two share factors month-to-month.

Once more, is sensible as mortgage charges are steep in the mean time and the financial outlook has gotten a bit cloudier.

Simply 18% Count on Mortgage Charges to Go Down Over the Subsequent 12 Months

Talking of mortgage charges, simply 18% consider mortgage charges will go down within the subsequent 12 months, up barely from 16% in July.

And 46% count on mortgage charges to go up, a sliver higher than the 45% final month.

The share who assume mortgage charges will keep put fell from 38% to 34%.

This meant the web share of those that assume mortgage charges will go down over the subsequent 12 months went up one share level month-to-month.

That’s fairly fascinating since Fannie themselves forecast a 30-year fastened at 6.2% by the third quarter of 2024.

What concerning the state of the family funds? Effectively, 78% stated they don’t seem to be involved about dropping their job within the subsequent 12 months, which was down from 80% a month prior.

And 22% stated they have been involved a few job loss, up from 20%. This aligns with latest employment reviews that present fewer People are quitting and are as a substitute staying put, seemingly as a result of fewer prospects.

Lastly, 22% stated their family earnings is considerably increased than it was 12 months in the past, up from 19%, and 12% stated their family earnings is considerably decrease, up from 10%.

And 71% stated their family earnings is roughly the identical, up from 65%. This pushed the web share who stated their family earnings is considerably increased by one share level.

All in all, the HPSI was fairly flat month-to-month due to offsetting sentiment within the varied classes.

What Makes the Present Housing Market Uncommon?

Within the phrases of Fannie Mae SVP and chief economist Doug Duncan, the housing market is “uncommon.”

He factors to the low-level plateauing of the HPSI, which doesn’t seem prone to change anytime quickly.

Merely put, present householders are mainly caught, whether or not it’s the mortgage price lock-in impact or an absence of alternative houses.

In the meantime, many potential consumers can’t even afford to purchase a house, however costs aren’t falling as a result of there’s restricted provide.

“The general HPSI is sustaining the low-level plateau set a couple of months again, and we don’t see a lot upside to the index within the close to future, barring important enhancements to residence affordability, which we additionally don’t count on,” he stated.

Duncan notes that it’s “a story of two markets,” with present householders sitting fairly on their 2-3% 30-year fastened mortgages and comparatively low buy costs.

And potential residence consumers stifled by excessive asking costs, an absence of provide, and greater than a doubling in mortgage charges in a few yr and a half.

Briefly, the Fed created a gaggle of haves and have nots, due to their accommodative price coverage and mortgage-backed securities (MBS) shopping for spree often known as Quantitative Easing (QE).

This has made it tough for present homeowners to purchase move-up houses and unlock starter residence stock for first-time residence consumers.

However it has benefited residence builders, who at the moment are the one recreation on the town. Usually, present residence gross sales account for about 85-90% of complete residence gross sales.

So it’s clear the builders received’t be capable of make up for the large shortfall, thereby preserving housing affordability low.

At this level, it seems the one approach we’d see a significant enhance in housing provide could be by way of widespread misery, comparable to if there was a nasty recession with plenty of unemployment. It’s attainable.

[ad_2]