[ad_1]

QuickBooks payroll tax desk replace permits QB customers to make the most of the newest tax tables and calculate their payroll quantities. When the software program releases the newest tax desk variations, customers should get them instantly to maintain them in keeping with federal norms. Listed below are insights into the newest QB payroll tax desk updates accessible so that you can use.

The newest Payroll updates of QuickBooks desktop supply up-to-date, exact charges and calculations suited as per federal and provincial tax tables, e-file choices, and payroll tax varieties to payroll clients with energetic subscriptions. For extra data concerning Payroll Tax Desk Updates, comply with the entire article till the tip.

The QuickBooks utility retains providing the newest tax desk updates, and it turns into tough to maintain observe of them. Fear not, as a result of our weblog covers particulars about all the present updates. Equally, our licensed QB technicians give you support to seamlessly obtain and set up these updates in your system. You simply have to allow them to know your queries and doubts at +1- 855 738 2784. We guarantee to make clear and let the newest payroll replace tax tables run easily in your system.

What are QuickBooks Payroll Tax Tables?

QuickBooks replace payroll tax tables are important parts of QuickBooks Payroll, a preferred payroll processing software program. These tax tables are units of knowledge and knowledge that QuickBooks makes use of to calculate the quantity of federal, state, and native payroll taxes that should be withheld from worker’s paychecks and the employer’s payroll tax obligations. Now we have damaged down QuickBooks Desktop Payroll tax tables and the way they work:

Tax Charges and Guidelines

Tax tables comprise up-to-date tax charges, guidelines, and formulation that decide how a lot cash ought to be withheld from every worker’s paycheck for earnings taxes, Social Safety taxes, Medicare taxes, and different relevant payroll taxes. Thus, it will assist when you discovered learn how to replace QuickBooks payroll tax tables. Moreover, delving into QB tax tables provides you with particulars in regards to the employer’s share of those taxes.

Federal, State, and Native Taxes

Should you make use of the newest QB payroll tax tables, it offers you insights into numerous ranges of taxation, together with federal taxes, state taxes (for states with earnings tax), and native taxes (for municipalities with earnings taxes). Realizing them aids you in sustaining compliance with tax laws in any respect authorities ranges.

Worker and Employer Contributions

QuickBooks replace payroll tax tables to incorporate details about each worker and employer contributions to payroll taxes. It permits QuickBooks to calculate the right quantities for each side of the payroll tax equation.

Common Updates

Tax legal guidelines and laws change incessantly, so QuickBooks offers common updates to its tax tables to make sure precision and compliance with the newest tax codes. Your respective tax authority usually publishes these tax desk updates quarterly or yearly.

Person-Pleasant Integration

QuickBooks customers can simply combine these QuickBooks tax tables into their payroll processing workflows. The software program routinely applies the right tax charges and calculations primarily based on the worker’s location and withholding allowances.

Payroll Tax Kinds

QuickBooks additionally makes use of tax desk data to generate correct payroll tax varieties, like W-2s and 1099s, simplifying the tax reporting course of for companies. Studying what’s the newest QuickBooks payroll replace can help with compliance with these varieties.

E-Submitting

Some variations of QuickBooks Payroll supply e-filing capabilities, permitting customers to electronically file payroll tax varieties immediately with the related tax companies. QuickBooks desktop tax desk replace ensures the accuracy of those digital filings.

Compliance and Avoiding Penalties

Through the use of QuickBooks payroll tax tables and staying present with updates, companies can decrease the chance of payroll tax errors and non-compliance, ensuing penalties, and fines from tax authorities.

What’s QuickBooks Payroll Tax Desk Updates?

QuickBooks utility permits its customers to maximise their potential by automating their payroll. It uncomplicates the process and streamlines the duties. Nevertheless, since federal norms, charges, and many others., preserve altering yearly, the software program should replace and incorporate these modifications. Thus, the QuickBooks payroll tax tables are up to date yearly, permitting QB Payroll subscribers to depend on the newest data.

Essentially the most present and correct charges and computations for the supported federal and state tax tables, payroll tax varieties, e-file, and pay choices are solely accessible within the newest QuickBooks Desktop payroll tax desk updates. Customers want an energetic payroll subscription to get the newest payroll replace from QB. If you use QB On-line Payroll, the tax tables get up to date routinely. It means you don’t have to do something about the identical.

It’s essential to notice that SUI isn’t part of the common payroll tax desk updates in QB Desktop Payroll. As a substitute, undertake handbook updates for a similar.

Really helpful To Learn – How To Repair QuickBooks Error PS107

Crucial Issues to Be taught About QuickBooks Payroll Tax Desk Replace

Since adhering to legal guidelines and guidelines is sort of crucial, a QuickBooks Payroll tax desk replace works on sustaining their accuracy and present nature whereas estimating payroll tax computations. Every QB tax desk replace brings forth the next:

Tax Charges and Tables

Each payroll and tax desk replace is accompanied by the latest federal, state, and native tax charges and tables. A businessperson wants these particulars to precisely cater to earnings tax, Social Safety tax, Medicare tax, and different payroll-related taxes.

Tax Kinds

The present QuickBooks tax desk model accommodates probably the most delinquent tax varieties and submitting necessities. It ensures that your payroll tax filings, corresponding to W-2s and 1099s, are generated appropriately.

Tax Deductions and Contributions

Modifications in tax legal guidelines can affect worker deductions and contributions, corresponding to retirement plan contributions and medical health insurance premiums. Studying learn how to replace QuickBooks tax tables ensures you take into account these facets and be sure that these calculations are exact.

Compliance

Each enterprise needs to keep away from penalties and fines and would do something to maintain this stuff at bay. It consists of complying with federal, state, and native tax laws concerning payroll tax charges.

Automated Updates

The payroll tax tables provided by QB are normally set to automated. Nevertheless, customers ought to be sure that their software program is ready as much as obtain these updates and that they’re put in on time.

Frequency

The QuickBooks tax desk replace is normally launched quarterly or yearly (the latest one being in August 2023 after July 2023), leaning on the frequency of tax legislation modifications. Some updates could also be extra frequent, primarily when vital tax legislation modifications happen.

Subscription-Primarily based Service

QuickBooks Payroll is commonly provided as a subscription-based service; these updates represent a portion of the service. Customers pay an everyday subscription charge to obtain entry to the newest tax tables and different payroll options.

E-filing

Many variations of QuickBooks Payroll additionally help e-filing, permitting companies to file payroll taxes immediately with the suitable tax companies electronically. Tax desk updates assist make sure the accuracy of those digital filings.

Now that we’ve got the small print about what constitutes a tax desk replace in QuickBooks desktop let’s assess the newest replace.

The Most Latest QuickBooks Tax Desk Replace- August 10, 2023

The present QuickBooks tax desk model comes with the payroll replace 22314, unleashed on August 10, 2023.

Issues included in Payroll Replace 22314 (August 10, 2023)

Right here’s what is available in payroll replace 22314, discharged on August 10, 2023:

Tax Desk Replace

QuickBooks Tax Desk Replace

New York: Efforts required so as to add Zone 2 Metropolitan Commuter Transportation Mobility Tax efficient 7/1/2023.

Kinds Replace

This payroll replace accommodates no varieties replace.

E-file and e-pay updates

No e-file and e-pay updates can be found on this QuickBooks Desktop payroll tax desk replace.

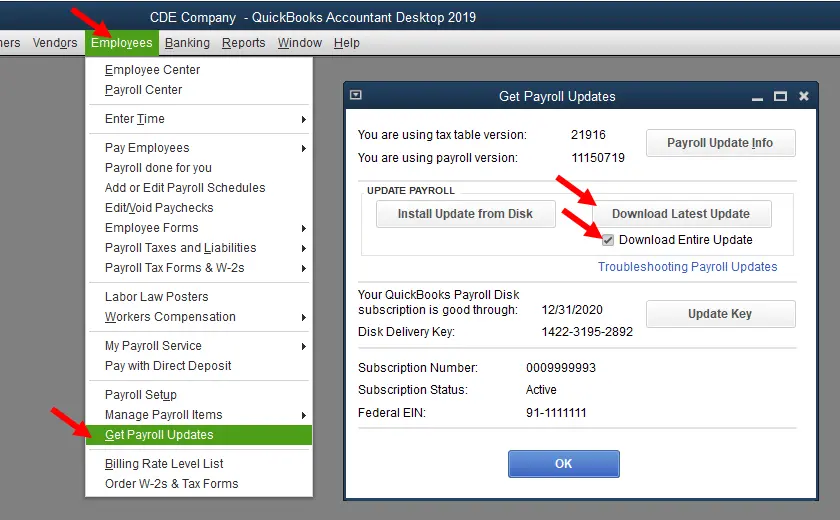

You’ll be able to entry particulars about the newest payroll tax desk replace out of your QB Desktop firm file as follows:

- Faucet Workers.

- Click on Get Payroll Updates.

- Select Payroll Replace Data.

An outline of previous payroll replace tax desk in QuickBooks desktop consists of:

| Payroll Replace Quantity | Date Launched |

| 22313 | July 20, 2023 |

| 22312 | June 15, 2023 |

| 22310 | April 13, 2023 |

| 22308 | March 13, 2023 |

| 22306 | February 16, 2023 |

What does the Newest Payroll Tax Desk Replace have (US)?

The newest payroll information and updates state that 22308 is the newest payroll model. Launched on March 16, 2023, this payroll replace accommodates correct, present charges and computations for payroll gadgets. As well as, it permits customers to take care of compliance with the federal and state norms.

Issues included within the newest payroll replace 22308 (US) (March 16, 2023)

The newest payroll replace doesn’t comprise something concerning payroll tax tables. Nevertheless, federal and state varieties have been up to date.

- Federal Type 941 for Reporting Brokers has been upgraded to the present model for Accountants subscribers of Enhanced Payroll.

- Federal Type 941 has been up to date to the present Commonplace and Enhanced Payroll subscribers model.

- Additional, examine the desk to search out the state varieties up to date to their present variations for Enhanced Payroll subscribers:

| Alabama | A-1, A-3, A-6 |

| Arizona | A1-QRT, UC-018 |

| Colorado | A worksheet for CO PFML has been added |

| Delaware | WTH-TAX |

| Florida | RT-6 |

| Hawaii | HW-14 |

| Iowa | 44-095 |

| Louisiana | L-1 |

| Maine | UC1 for Seasonal and UC1 for Non-Seasonal Wages |

| Michigan | 5081 |

| Rhode Island | RI-941, TX-17 |

| South Carolina | WH-1605 |

| Vermont | WHT-436 |

| Virginia | VA-16 |

Aside from varieties, there have been updates in e-file and e-pay as follows:

- The e-file Type 941 for Reporting Brokers is up to date to the present digital kind model for Accountants subscribers of the Enhanced Payroll model.

- The e-file Type 941 is up to date to the present digital kind model for subscribers of Enhanced Payroll.

You will discover the latest payroll tax desk updates by selecting the QB Desktop 12 months from the checklist beneath:

- QB Desktop 2023

- QB Desktop 2022

- QB Desktop 2021

- QB Desktop 2020

You can too entry this data through the next actions:

- Faucet Workers in QuickBooks Payroll.

- Choose Get Payroll Updates.

- Lastly, faucet Payroll Replace Data.

Previous Payroll Updates

The earlier payroll updates and launch dates are talked about beneath:

| The Quantity for Payroll Replace | Launch Date |

| 22306 | February 16, 2023 |

| 22304 | February 2, 2023 |

| 22302 | January 12, 2023 |

| 22301 | December 15, 2022 |

| 22216 | September 16, 2022 |

Learn how to Verify in case you are having the Newest Model of Payroll Tax Desk and its Options

As launched on September 19, 2019, model 21916 is the newest model of the payroll tax desk.

- Below the “Workers” menu in QuickBooks, choose “My Payroll Service” after which click on “Tax Desk Data“.

- Then choose the “You’re utilizing tax desk model” tab beneath the “Tax Desk Data” part. Right here, the primary three numbers point out the Tax Desk Model; the newest model shows 21916 as its first three numbers.

- Till now, this replace is offered in QuickBooks Desktop Enterprise Options 19.0 and QuickBooks Desktop 2019, so that you simply want one in every of them to get the newest tax desk updates. In case you don’t have QuickBooks Desktop Enterprise Options 19.0 or QuickBooks Desktop 2019 and also you wish to get the newest updates, you may obtain them from the hyperlinks given beneath:-

Learn Additionally – How To Resolve QuickBooks Occasion ID 4 Error

Learn how to obtain the newest tax tables?

If you need the present tax desk model of QuickBooks, it’s essential to undertake the next actions:

- Head to the Workers part in QB and select Get Payroll Updates.

- You’ll be able to study your tax desk model as follows:

- See the You’re utilizing tax desk model field and examine the numbers subsequent to it.

- Confirm in case your model is the newest by confirming by means of official sources.

- Get extra particulars about your tax desk model by choosing the Payroll Replace Data choice.

- The steps to get the newest tax desk updates are as follows:

- Faucet the Obtain Total Replace choice.

- Select the Replace choice, and an informational window will emerge indicating the completed obtain course of.

How can we replace the payroll tax desk to the newest model?

A subscribed consumer of QuickBooks payroll can simply obtain the newest updates from the web.

There are two approaches to getting Payroll Tax Desk Updates.

- If automated updates are turned on, then QuickBooks will routinely obtain each replace as quickly as it’s accessible, and it’s thought-about probably the most handy method to get the newest updates.

- You can too get the newest updates manually by choosing the next choices in QuickBooks anytime:

- Below the Assist menu, choose “Replace QuickBooks“.

- Hit the “Replace Now” tab.

- Then hit “Get Updates” to get the newest updates.

- Exit the applying as soon as the obtain is accomplished.

Whereas automated replace is the simplest method to get the newest QuickBooks payroll tax tables, in handbook replace, customers can face Replace Error 12007 if superior connection settings aren’t appropriately configured. On this scenario, the simplest method to get superior connection settings configured is to get assist from the payroll help contact quantity.

The Newest QuickBooks Payroll Tax Desk Updates for Canada

QuickBooks Desktop provides data about learn how to replace tax desk in QuickBooks Desktop to its energetic Payroll subscription clients, delivering the newest and exact charges, calculations, and choices for provincial and federal tax tables, payroll tax varieties, and EFILE performance.

The present QuickBooks payroll tax desk model for QuickBooks Desktop 2023 Canada is 11833003, unleashed on June 15, 2023, efficient from July 1, 2023, to December 1, 2023.

You’ll be able to confirm your model to replace payroll tax tables in QuickBooks as follows:

- Unleash QB.

- Entry the Workers part.

- Faucet My Payroll Service.

- Select Tax Desk Data.

- Examine the primary three numbers beneath You’re utilizing tax desk model.

- They replicate your QuickBooks replace tax tables model.

- It ought to learn 11833003.

- Merchandise up to date earlier this 12 months will have already got 118.

A crucial word: You have to have QuickBooks Desktop Enterprise Options 23.0 and QB Desktop 2023 to replace QuickBooks tax desk.

How do you get the latest payroll tax desk updates?

Subscribing to QuickBooks Payroll will mean you can obtain updates over the web. Essentially the most handy methodology for this job is to configure automated updates, permitting QuickBooks to obtain payroll updates as quickly as they change into accessible routinely.

Alternatively, you may manually obtain the newest QuickBooks payroll replace throughout the app by following these steps:

- See the Assist menu in QB.

- Hit “Replace QuickBooks.”

- Result in the “Replace Now” tab.

- Faucet “Get Updates.”

- Click on “File” after which “Exit.”

- Reboot QuickBooks Desktop.

Please word that an internet patch gained’t be accessible for the 2023 QuickBooks payroll desk replace, so these updates should be accomplished immediately throughout the product.

Inclusions within the Present QuickBooks Payroll Tax Desk Replace

A number of TD1 modifications from the January 2023 payroll tax desk replace are included within the July 2023 QuickBooks payroll updates:

| Efficient Date | July 1, 2023 | January 1, 2023 |

| Tax Desk model # | 118 | 117 |

| TD1 Quantities | ||

| Federal | 15,000 | 15,000 |

| AB | 21,003 | 21,003 |

| BC | 11,981 | 11,981 |

| MB | 19,145 | 10,855 |

| NB | 12,458 | 12,458 |

| NL | 10,382 | 10,382 |

| NS | 11,481 | 11,481 |

| NT | 16,593 | 16,593 |

| NU | 17,925 | 17,925 |

| ON | 11,865 | 11,865 |

| PE | 12,000 | 12,000 |

| QC | 17,183 | 17,183 |

| SK | 17,661 | 17,661 |

| YT | 15,000 | 15,000 |

| ZZ (workers exterior Canada) | 0 | 0 |

| Efficient Date | January 1, 2023 | July 1, 2022 |

| Tax Desk model # | 118 | 117 |

| Canada Pension Plan (CPP) – exterior Quebec | ||

| Most Pensionable Earnings | 66,600 | 66,600 |

| Fundamental Exemption | 3,500 | 3,500 |

| Contribution Charge | 5.95% | 5.95% |

| Most Contribution (EE) | 3,754.45 | 3,754.45 |

| Most Contribution (ER) | 3,754.45 | 3,754.45 |

| Employment Insurance coverage (EI) – exterior Quebec | ||

| Most Insurable Earnings | 61,500 | 61,500 |

| Premium EI Charge (EE) | 1.63% | 1.63% |

| Premium EI Charge (ER) (1.4*EE) | 2.28% | 2.28% |

| Most Premium (EE) | 1,002.45 | 1,002.45 |

| Most Premium (ER) | 1,403.43 | 1,403.43 |

| Efficient Date | July 1, 2023 | January 1, 2023 |

| Tax Desk model # | 118 | 117 |

| Quebec Pension Plan (QPP) | ||

| Most Pensionable Earnings | 66,600 | 66,600 |

| Fundamental Exemption | 3,500 | 3,500 |

| Contribution Charge | 6.40% | 6.40% |

| Most Contribution (EE) | 4,038.40 | 3,776.10 |

| Most Contribution (ER) | 4,038.40 | 3,776.10 |

| Employment Insurance coverage (EI – Quebec solely) | ||

| Most Insurable Earnings | 61,500 | 61,500 |

| Premium EI Charge (EE) | 1.27% | 1.27% |

| Premium EI Charge (ER) (1.4*EE) | 1.778% | 1.778% |

| Most Premium (EE) | 781.05 | 781.05 |

| Most Premium (ER) (1.4*EE) | 1,093.47 | 1,093.47 |

| Quebec Parental Insurance coverage Plan (QPIP) | ||

| Most Insurable Earnings | 91,000 | 91,000 |

| Contribution Charge (EE) | 0.49% | 0.49% |

| Contribution Charge (ER) (1.4*EE) | 0.69% | 0.69% |

| Most Contribution (EE) | 449.54 | 449.54 |

| Most Contribution (ER) (1.4*EE) | 629.72 | 629.72 |

| Fee des normes du travail (CNT) | ||

| Most earnings topic to CNT | 91,000 | 91000 |

Addressing Payroll Replace Issues

In case your TD1 quantities haven’t been up to date following learn how to replace payroll tax desk in QuickBooks desktop, please take into account the next steps:

Verify the Efficient Date

Make sure that at this time’s date is on or after the tax desk’s efficient date. Should you downloaded tax desk model 118 on or after June 15, 2023, you gained’t observe the up to date quantities till the tax desk turns into energetic on July 1, 2023.

Publish-July 1, 2023

After July 1, 2023, when you’ve obtained the product replace incorporating the brand new tax tables:

- Assessment Guide Changes: Verify when you’ve ever manually adjusted TD1 quantities previously or after creating a brand new worker file. Should you’ve manually up to date TD1 quantities for an worker beforehand, the brand new tax desk gained’t routinely override any beforehand modified figures. You’ll have to proceed manually updating TD1 quantities.

- Look at Worker Settings: Confirm if any of your workers have TD1 quantities set above the usual TD1 quantities. QuickBooks Desktop will routinely revise TD1 quantities solely for workers with the usual quantities laid out in earlier tax tables.

These checks ought to enable you to troubleshoot and resolve any points associated to payroll updates and TD1 quantities in QuickBooks Desktop.

Payroll Tax Desk Updates (Canada)

To get the QuickBooks 2023 payroll tax desk replace (Canada), customers should use QuickBooks Desktop 2022, QuickBooks Desktop 2023, QB Desktop Enterprise Options 22.0, and QB Desktop Enterprise Options 23.0. The Jan 2023 tax desk replace in Canada consists of a number of TD1 modifications from the July 2022 payroll tax desk replace.

Listed below are the variations within the present and historic CPP, TD1, and EI quantities:

| Date of effectiveness | January 1, 2023 | July 1, 2022 |

| # model of the Tax Desk | 117 | 116 |

| Quantities for TD1 | ||

| Federal | 15,000 | 14,398 |

| AB | 21,003 | 19,369 |

| BC | 11,981 | 11,302 |

| MB | 10,855 | 10,145 |

| NB | 12,458 | 12,623 |

| NL | 10,382 | 9,803 |

| NS | BPANS | BPANS |

| NT | 16,593 | 15,609 |

| NU | 17,925 | 16,862 |

| ON | 11,865 | 11,141 |

| PE | 12,000 | 11,250 |

| QC | 17,661 | 16,143 |

| SK | 17,661 | 16,615 |

| YT | BPAYT | BPAYT |

| ZZ (workers exterior Canada) | 0 | 0 |

| Date of effectiveness | January 1, 2023 | July 1, 2022 |

| The Model of the tax desk (#) | 117 | 116 |

| Canada Pension Plan (CPP) – exterior Quebec | ||

| Most Pensionable Earnings | 66,600 | 64,900 |

| Fundamental Exemption | 3,500 | 3,500 |

| Contribution Charge | 5.95% | 5.70% |

| Most Contribution (EE) | 3,754.45 | 3,499.80 |

| Most Contribution (ER) | 3,754.45 | 3,499.80 |

| Employment Insurance coverage (EI) – exterior Quebec | ||

| Most Insurable Earnings | 61,500 | 60,300 |

| Premium EI Charge (EE) | 1.63% | 1.58% |

| Premium EI Charge (ER) (1.4*EE) | 2.28% | 2.21% |

| Most Premium (EE) | 1,002.45 | 952.74 |

| Most Premium (ER) | 1,403.43 | 1,333.84 |

| Date of effectiveness | January 1, 2023 | July 1, 2022 |

| # model of Tax Desk | 117 | 116 |

| Quebec Pension Plan (QPP) | ||

| Most Pensionable Earnings | 66,600 | 64,900 |

| Fundamental Exemption | 3,500 | 3,500 |

| Contribution Charge | 6.40% | 6.15% |

| Most Contribution (EE) | 4,038.40 | 3,776.10 |

| Most Contribution (ER) | 4,038.40 | 3,776.10 |

| Employment Insurance coverage (EI – Quebec solely) | ||

| Most Insurable Earnings | 61,500 | 60,300 |

| Premium EI Charge (EE) | 1.27% | 1.20% |

| Premium EI Charge (ER) (1.4*EE) | 1.78% | 1.68% |

| Most Premium (EE) | 781.05 | 723.60 |

| Most Premium (ER) (1.4*EE) | 1,093.47 | 1,013.04 |

| Quebec Parental Insurance coverage Plan (QPIP) | ||

| Most Insurable Earnings | 91,000 | 88,000 |

| Contribution Charge (EE) | 0.49% | 0.49% |

| Contribution Charge (ER) (1.4*EE) | 0.69% | 0.69% |

| Most Contribution (EE) | 449.54 | 434.72 |

| Most Contribution (ER) (1.4*EE) | 629.72 | 608.96 |

| Fee des normes du travail (CNT) | ||

| Most earnings topic to CNT | 91,000 | 88,000 |

Analysis of some frequent payroll replace points:

Contemplate rechecking these factors in case your TD1 quantities aren’t up to date after updating the tax desk to the newest model:

- The tax desk will solely be efficient after July 1, 2018, so when you’ve got up to date it earlier than, it won’t present you the up to date quantities.

- You have to begin a payroll or restart the QuickBooks desktop utility after updating the tax desk on or after July 1, 2018.

- The newest replace won’t modify any manually up to date TD1 quantity previously, so you will have to manually replace any of an worker’s beforehand up to date TD1 quantities.

- Entry QuickBooks payroll options for the newest data and troubleshooting assist when you face any points after performing the above crosschecks.

You Might Learn Additionally – I get QuickBooks Error 15276

Troubleshooting frequent payroll replace points (Present):

In case your TD1 quantities haven’t been up to date after QuickBooks replace tax tables, examine the next issues:

- The tax desk turns into efficient solely after January 1, 2023. So, if the tax desk model 117 is what you downloaded on or after December 19, 2022, you’ll solely be capable to see the up to date quantities after January 1, 2023.

- If in case you have undertaken handbook TD1 quantity updates for workers, the brand new tax desk gained’t overwrite the beforehand adjusted quantities. So, you’ll need to replace the TD1 quantities manually sooner or later.

- The workers with the essential quantities for the earlier tax tables will see an automated replace in TD1 quantities by QB Desktop.

- If you undertake the QuickBooks tax desk replace, it’s possible you’ll expertise the next errors:

You’ll have to confirm the explanations and resolve the errors earlier than persevering with with the tax desk updates.

Significance of QuickBooks Newest Payroll Tax Desk Updates

The newest payroll replace QuickBooks Desktop brings the next significance:

- Precision and adherence to the legal guidelines to stop recordsdata and penalties.

- Avoiding over and underpaying taxes because of outdated QuickBooks payroll tax tables.

- Persistently offering correct paychecks and tax withholding builds belief and satisfaction amongst your workforce.

- The executive burden will get decreased with the automated process of learn how to replace QuickBooks payroll.

- Compliance reporting doesn’t encounter hassles and discrepancies.

- Tax audits change into a factor of the previous with QuickBooks newest payroll replace.

- Correct worker advantages and deduction calculations.

Thus, inquiring learn how to get payroll updates in QuickBooks desktop advantages you in the long term and allows you to entry a number of advantages.

Summing Up

If the issue persists, the consumer can get QuickBooks Payroll assist at any time limit by our helpline quantity +1- 855 738 2784.

FAQs

What are some essential concerns earlier than downloading the payroll tax desk updates?

You need to take into account the next conditions earlier than downloading payroll tax desk updates:

- Guarantee to have an energetic QB payroll subscription.

- Your QuickBooks utility ought to be the newest model.

- Whereas updating payroll tax tables, your web connection ought to be strong and secure.

- Allow the automated replace function to by no means miss them.

How can I get the newest QuickBooks payroll updates?

Customers can get the newest payroll updates by means of the Assist menu. However, QB disk supply subscribers get updates on CDs through mail. You need to obtain and set up the payroll updates when you’ve got web entry. Enabling automated updates will mean you can get them as quickly as they change into accessible on the web.

What data is included in a tax desk replace?

Tax desk updates embody the newest tax charges, withholding allowances, contribution limits, and different payroll-related data for federal, state, and native tax authorities.

Do I have to make any handbook changes after putting in a tax desk replace?

Generally, it’s possible you’ll have to make handbook changes when you’ve beforehand modified worker tax settings or if sure workers have distinctive circumstances. The replace could not override these handbook modifications.

What occurs if I don’t set up the newest tax desk replace?

Failing to put in updates can result in payroll calculation errors, non-compliance with tax legal guidelines, and potential penalties from tax authorities. It’s important to remain present with tax desk updates.

Can I entry earlier tax desk variations in QuickBooks?

QuickBooks usually retains earlier tax desk variations for reference. Nevertheless, utilizing the newest model for correct payroll processing is essential.

How can I verify that the tax desk replace has been efficiently put in?

You’ll be able to confirm the set up by reviewing QuickBooks’s tax desk model quantity. The model quantity ought to replicate the newest launch if the replace had been profitable.

Is there a price related to tax desk updates?

Tax desk updates are usually included as a part of your QuickBooks Payroll subscription. Nevertheless, it’s important to make sure that your subscription is updated to obtain these updates.

Associated Posts –

Fixation for QuickBooks Unable to Backup Firm File Error

What’s QuickBooks Information Migration Providers & Learn how to do Migration

Resolve QuickBooks Error 15240 with Superior Options

Let’s Deal with QuickBooks Error 15241 Like a Professional

Troubleshoot QuickBooks Error 3140 with Professional-recommended Strategies

Abstract

Article Identify

Most Latest QuickBooks Payroll Tax Desk Updates Out there for Obtain

Description

For detailed and step-by-step directions to get the newest QuickBooks payroll tax desk replace for seamless payroll operations, comply with this information by the specialists.

Creator

Accounting Helpline

Writer Identify

Accounting Helpline

Writer Emblem

[ad_2]