[ad_1]

Just lately, a pal of mine with an adjustable-rate mortgage instructed me his charge was as a consequence of modify considerably increased.

His present mortgage, a 7/1 ARM, has an rate of interest of three.25%, however that’s solely good for the primary 84 months.

After that, the mortgage turns into yearly adjustable, and the speed is decided by the index and margin.

In case you haven’t observed, 30-year mounted mortgage charges have skyrocketed over the previous 18 months, from round 3% to 7.5% in the present day.

On the similar time, mortgage indexes have additionally surged from near-zero to over 5%, that means the mortgage will modify a lot increased if stored lengthy sufficient.

First Take a look at Your Paperwork and Examine the Caps

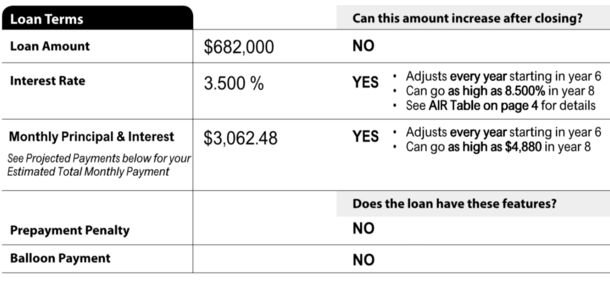

Once you took out your adjustable-rate mortgage (ARM) or any house mortgage for that matter, you got a Closing Disclosure (CD).

It lists all of the essential particulars of your mortgage, together with the rate of interest, mortgage quantity, month-to-month fee, mortgage sort, and whether or not or not it may modify.

If it’s an ARM, it should point out that the month-to-month fee can improve after closing. It would additionally element when it may improve and by how a lot.

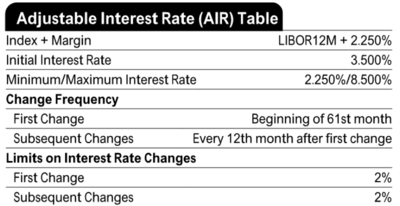

There will likely be a piece on web page 4 known as the “Adjustable Curiosity Price (AIR) Desk” that gives further info.

That is in all probability the primary place it’s best to look when you’re uncertain of when your ARM is about to regulate, and the way a lot it’d rise when it does.

You’ll additionally discover the mortgage index it’s tied to, together with the margin. Collectively, these two gadgets make up your fully-indexed charge as soon as the mortgage turns into adjustable.

Let’s Examine Out at an Instance of an ARM Resetting Increased

Within the AIR Desk pictured above, we now have a 5/1 ARM with an preliminary rate of interest of three.5%.

The primary adjustment comes after 60 months, that means the borrower will get to get pleasure from a low charge of three.5% for sixty months.

Whereas that seems like a very long time, it may creep up on you quicker than chances are you’ll understand.

After these 5 years are up, assuming you continue to maintain the mortgage, it turns into adjustable starting in month 61.

The brand new charge will likely be regardless of the index is + a 2.25 margin. This CD used the outdated LIBOR index, which has since been changed with the Secured In a single day Financing Price (SOFR).

Finally look, the 12-month SOFR is priced round 5.5%, which mixed with 2.25 would lead to a charge of seven.75%.

That’s fairly the leap from 3.5%. Nonetheless, there are caps in place to stop such an enormous fee shock.

If we glance carefully on the AIR Desk, we’ll see that the First Change is restricted to 2%. This implies the speed can solely rise to five.5% in yr six.

That’s fairly the distinction in comparison with a fully-indexed charge of seven.75%.

And every subsequent improve, equivalent to in yr seven, can solely be one other 2%. So for yr seven, the max charge could be capped at 7.5%.

There’s additionally a lifetime cap of 8.5%, that means it doesn’t matter what the index does, the speed can’t exceed that degree.

Given mortgage charges are already near these ranges, the argument may very well be made to only preserve the unique mortgage, particularly when the speed is 5.5%.

The hope is charges enhance from these ranges sooner or later inside the yr and a refinance turns into extra enticing.

There’s no assure, however there isn’t a ton of draw back if the worst your charge will likely be is 8.5%.

Not All Mortgage Caps Are Created Equal

However not all caps are created equal. The instance above is from a conforming mortgage with comparatively pleasant changes.

My pal’s caps, that are tied to a jumbo house mortgage, enable the speed to regulate to the ceiling on the first adjustment.

So there isn’t a gradual step up in charges like there may be on the instance above. This implies the mortgage charge can go straight to the fully-indexed charge, which is the margin + index.

If we assume a margin of two.25 and an index of 5.5%, that’s 7.5% proper off the bat, in contrast to the decrease 5.5% within the prior instance.

On this case, a mortgage refinance would possibly make sense, even when the speed is comparatively related. In spite of everything, you may get right into a fixed-rate mortgage at these costs.

Or pay a reduction level and get a charge even decrease, hopefully.

And when you’re involved mortgage charges might go even increased, you’d be protected against further fee shock.

On the similar time, you could possibly nonetheless make the argument of taking the 7.5% if refinance charges aren’t a lot better and hope for enhancements sooner or later.

However you’d have to take a look at the ceiling charge, which in his case is within the 9% vary.

To summarize, take a great take a look at your disclosures so you already know all the small print of your adjustable-rate mortgage lengthy earlier than it’s scheduled to regulate.

That method you possibly can keep away from any pointless surprises and plan accordingly, ideally earlier than mortgage charges double.

[ad_2]