[ad_1]

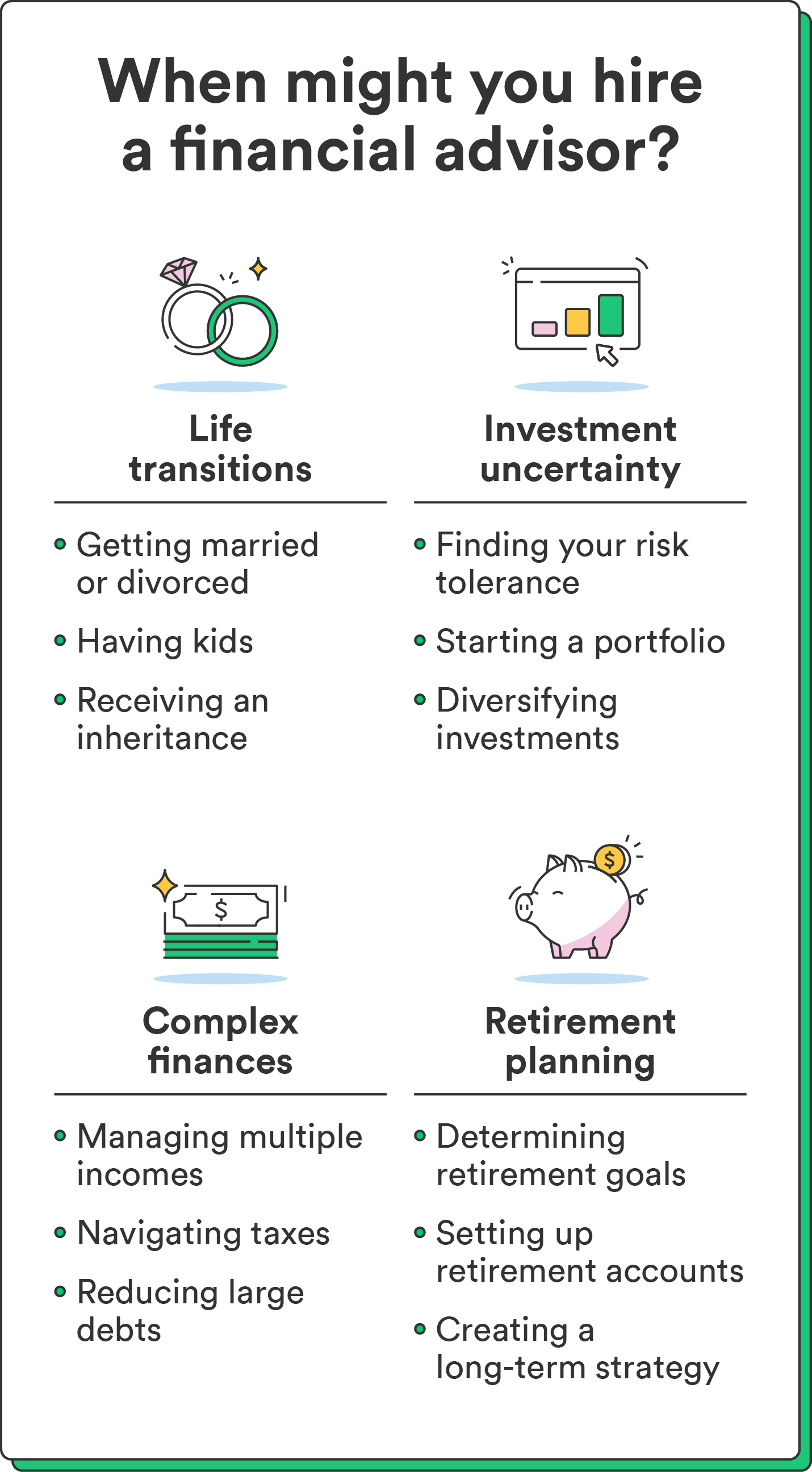

Hiring knowledgeable is greatest when your monetary scenario feels too complicated to navigate. Think about the next eventualities when you’re questioning when to rent a monetary advisor.

Important life modifications

Sure circumstances, like altering your budgeting technique or updating your retirement accounts, can have an effect on your funds. The next life occasions might name for skilled monetary recommendation:

- Marriage

- Divorce

- Having youngsters

- Receiving an inheritance

- Beginning or promoting a enterprise

These transitions typically have complicated monetary implications, like tax standing modifications, insurance coverage wants, and long-term monetary objectives.

Organising or managing your first funding portfolio

Investing builds wealth and helps you attain long-term objectives, however it may possibly really feel overwhelming with out correct data. A monetary advisor can assist when you’re able to begin investing however don’t know the place to begin. They will assess your threat tolerance, monetary objectives, and time horizon, then create a diversified funding technique that aligns together with your distinctive circumstances.

If you have already got an funding portfolio, a monetary advisor may allow you to unfold your investments round to keep away from volatility and stop your investments from fluctuating an excessive amount of.

For instance, in case your portfolio is heavy on riskier industries, your monetary advisor can assist transfer some investments to lower your threat of main dips.

Advanced funds

Bringing in a monetary advisor might be sensible when your monetary scenario will get tough. Situations like juggling a number of revenue streams, working a enterprise, co-managing funds, or tackling complicated tax issues can name for superior monetary planning.

A monetary advisor can steer you in the appropriate route, craft customized monetary plans, and fine-tune your funds to spice up your wealth and preserve dangers and taxes in verify.

Particular monetary objectives

You probably have particular monetary objectives, like changing into a house owner, retiring early, or beginning a enterprise, it’s possible you’ll want a monetary advisor.

Reaching these objectives can require a well-structured monetary plan based mostly in your distinctive circumstances. A monetary advisor can assist you make the appropriate monetary choices and keep on monitor to achieve your particular milestones.

[ad_2]