[ad_1]

In Dec 2022, a number of the smartest and best-paid analysts had been already 100% incorrect.

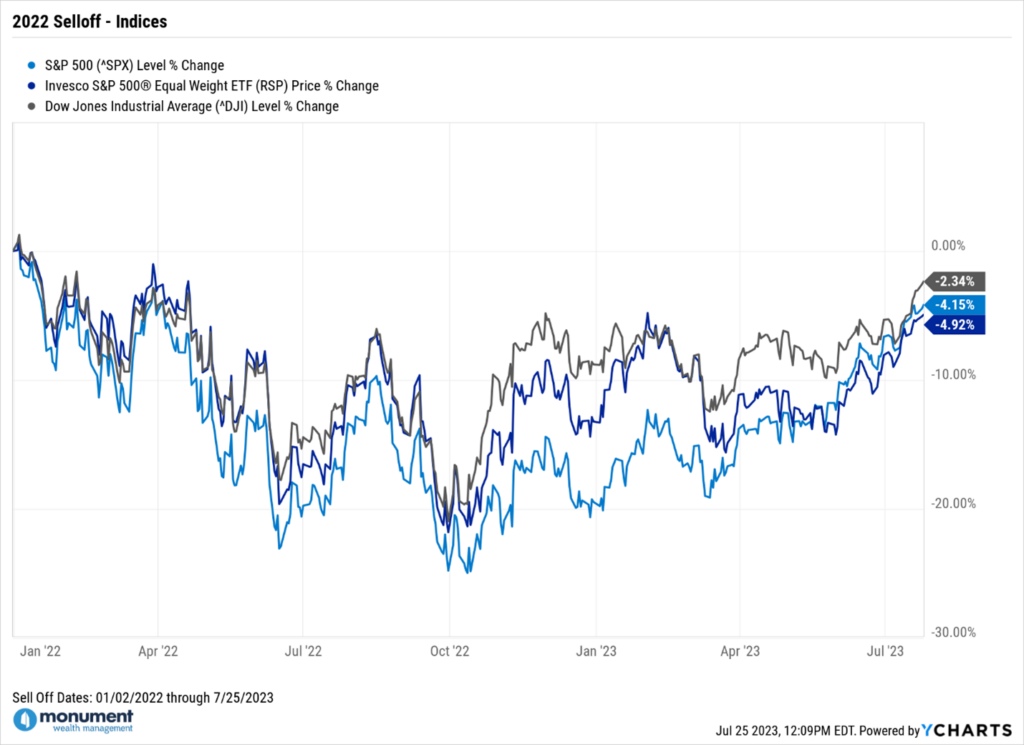

What started on October thirteenth, 2022, as a rally propelled nearly completely by a handful of know-how Mega caps, developed right into a sector-wide surge spurred by diminishing recession fears.

And the newest surge is being led by economically delicate shares throughout the board. In truth, the Dow (as of seven/25/23) has risen for an eleventh straight day and gained 5% over that interval.

This marks the longest win streak since 2017 for the Dow…as within the Dow Jones INDUSTRIAL Common.

However let’s shift over to the S&P 500 index for some context.

Analyst Forecasts Had been Unsuitable

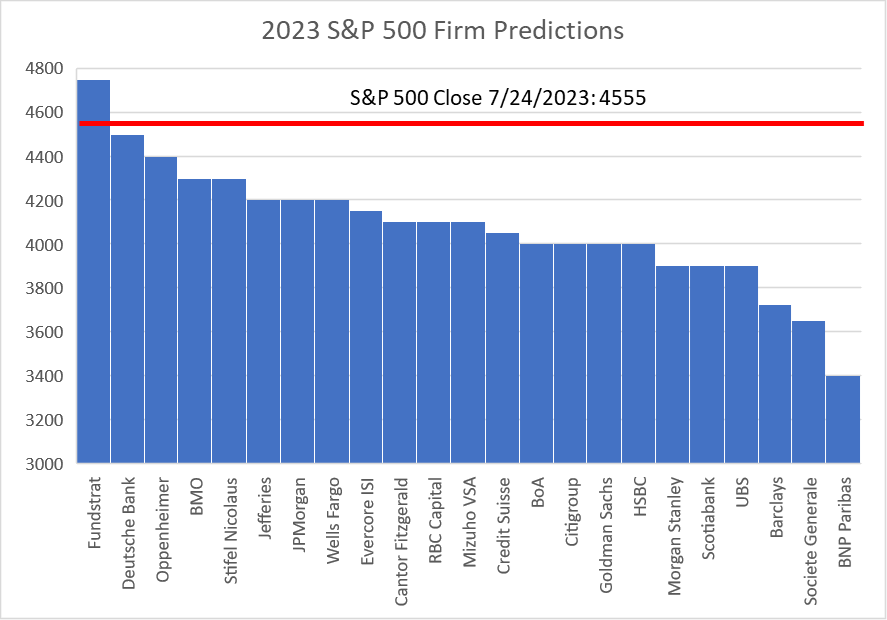

Wanting again on forecasts made by 23 analysts (chart beneath) in late 2022, the common worth goal for the S&P 500 for 2023 was 4080.

Some highlights from “2023 Outlooks” printed by essentially the most cufflinked of the Wall Avenue corporations.

JPMorgan:

“In 1H23 we anticipate S&P 500 to re-test this yr’s lows because the Fed overtightens into weaker fundamentals.”

- Dave right here: The S&P 500 1H23 returns got here in at roughly +15%

“…pushing S&P 500 to 4,200 by year-end 2023.”

- Dave right here: The S&P 500 closed at 4555 (as of seven/24/23)

Morgan Stanley:

“Our 2023 EPS forecast for the S&P 500 of $195 is constant with a 15% to twenty% retreat from the present index worth, which we anticipate to be adopted by restoration by way of year-end to a stage primarily flat with at present.”

- Dave right here: They predicted S&P 500 at 3900 for year-end 2023. There may be nonetheless time to be proper, although.

See this chart for the larger image of the place the predictions had been as we headed into Jan 2023. (I made this chart from information I gathered up throughout media sources.)

If you happen to turned dazzled by the cufflinks and costly sneakers, listened to those analysts, and adjusted your portfolio, you possible missed the most effective begins of a yr for the S&P 500 in historical past…one thing NONE of these people predicted.

I’m not insinuating they’re silly…in reality, I maintain their mind within the highest regard. Look, and I imply this sincerely, they’re good people who find themselves pressured by their corporations to guess about one thing they’ve zero info about. (Bear in mind, there are ZERO FACTS in regards to the FUTURE.)

I would like their paychecks, not their jobs…and undoubtedly not their fits. Okay, possibly one…for when I’ve to go to the Metropolitan Membership in DC, the place they require a go well with, tie, and costume sneakers simply to have a drink. Facepalm – I’d hate to be their new membership coordinator.

What I’m saying is that utilizing predictions to make portfolio selections will not be a superb technique. They’re entertaining and thought-provoking, however they’re NOT designed so that you can act on.

An excellent technique eschews predictions and depends on a strong funding portfolio buttressed by a rules-based course of incorporating possibilities reasonably than prospects to maintain you on monitor.

See beneath. For the reason that sell-off started on Jan 2, 2022, the S&P 500 has a few -4.15% return as of July 25, 2023, the Equal Weight S&P ETF (RSP) return is -4.93%, and the Dow’s return is about -2.34%. Fairly near being even.

What We Have Been Saying

If you happen to monitor our recommendation, you recognize we advocate having a money bucket and dwelling out of that when equities are in a sell-off or downturn, so that you don’t need to liquidate securities when they’re down.

If you happen to didn’t promote something within the downturn (In different phrases, you caught to the funding technique you selected previous to Jan 2022), and lived out of your money reserves, you might be most likely near being again to even.

Normal Recommendation Going Ahead

We’re nearly again to all-time highs, so now could be the time to contemplate replenishing money.

Potential Lure: You be ok with the market going up, so that you begin to contemplate ready longer to boost the money. That’s rife with threat – remember to hold a stage head and comply with your technique. Buyers who fell for this lure in January 2022 regretted it and would have given something to replenish money reserves at these ranges in October 2022.

Don’t have a method or really feel like you aren’t getting good recommendation out of your present advisor? Attain out. Giving folks unfiltered opinions and easy recommendation is our price proposition.

Oh yeah, and we additionally love canines.

Preserve wanting ahead,

[ad_2]