[ad_1]

For these of you continue to questioning why house costs haven’t plummeted, regardless of considerably greater mortgage charges, it’s as a result of there isn’t a unfavourable correlation.

Lots of people appear to assume that house costs and mortgage charges have an inverse relationship, however it merely isn’t true.

Simply have a look at historical past and also you’ll see that it’s completely regular for house costs and rates of interest to rise.

Or for each charges and costs to fall in tandem. Finally, there isn’t a powerful correlation both manner.

Nevertheless, house gross sales definitely decelerate when the price of financing rises, as we’ve seen this 12 months.

Why House Costs Go Up In Spite of Increased Mortgage Charges

First off, let’s have a look at the present dynamic within the housing market. Each mortgage charges and residential costs have risen significantly over the previous 12 months and alter.

The 30-year mounted has climbed from round 3% to begin 2022 to 7.63% as we speak, per Freddie Mac weekly survey knowledge.

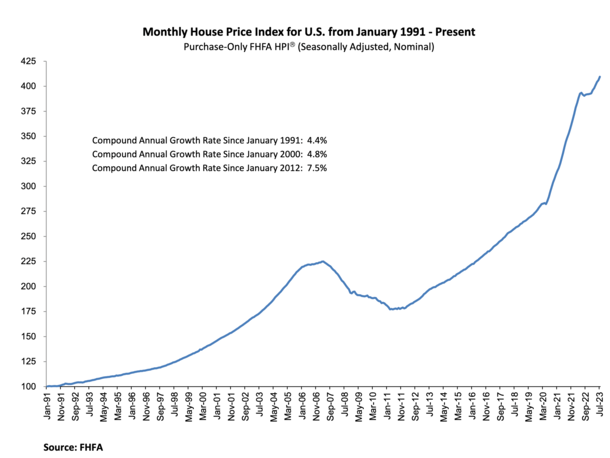

Regardless of this greater than doubling in rates of interest, house costs elevated 4.6% from July 2022 to July 2023, per the FHFA’s newest seasonally adjusted month-to-month Home Worth Index (HPI).

That is greater than the annual development charge since 1991, which looks like a head-scratcher. How may house costs outperform with mortgage charges surging?

Properly, greater mortgage charges usually point out that the economic system is sizzling, which it most definitely has been over the previous 12 months and alter.

Extra jobs and elevated wages, coupled with a low rate of interest surroundings, elevated the cash provide and led to much more shopper spending and a rise in costs, house costs included.

Sadly, this additionally resulted in excessive inflation, which is why the Fed has raised its personal coverage charge 11 instances since early final 12 months.

However this financial energy is what continues to propel house costs greater, coupled with a extreme lack of for-sale stock.

So should you’re questioning why 8% mortgage charges haven’t sunk the house costs, now you recognize.

Gross sales Quantity Will get Crushed When Mortgage Charges Rise

Then again, when mortgage charges improve considerably, house gross sales are likely to take a giant hit.

This occurs for apparent causes, the principle one being a scarcity of affordability. Fewer house patrons can qualify when financing prices are prohibitively excessive.

Certain, people have seen their wages improve they usually may need an excellent job, however their DTI ratios aren’t what they was.

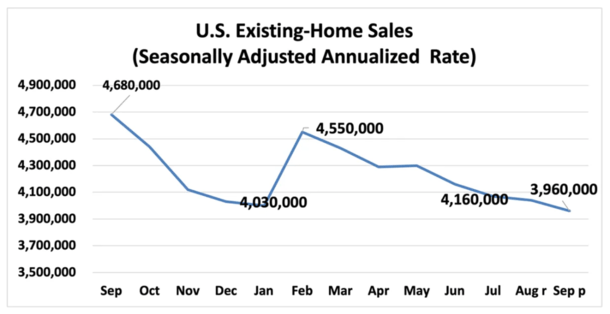

Per NAR, complete existing-home gross sales fell 2.0% in September from August to a seasonally adjusted annual charge of three.96 million.

Gross sales have been down 15.4% year-over-year from 4.68 million in September 2022, and at the moment are at their lowest gross sales tempo since October 2010.

For reference, current house gross sales exceeded the six million mark again in 2021, the best degree since 2006.

In the meantime, the stock of unsold listings was up 2.7% in September from a month earlier, totaling 1,130,000 properties on the market.

However provide was off 8.1% in contrast with September of 2022, representing simply 3.4 months on the present gross sales tempo. That’s properly beneath NAR’s desired 6-month provide.

Nevertheless, regardless of much less demand and fewer patrons, the decrease variety of gross sales isn’t leading to decrease costs.

As a substitute, we merely have a housing market with low demand and low provide, and never lots of budging from sellers on worth.

That might change as time goes on, however even with mortgage charges round 8% we’ve but to see large worth declines. And we’d not.

When Mortgage Charges Surge Increased, House Costs Appear to Enhance Even Extra

What’s even perhaps stranger to the untrained eye is that when mortgage charges swing greater, house costs appear to outperform.

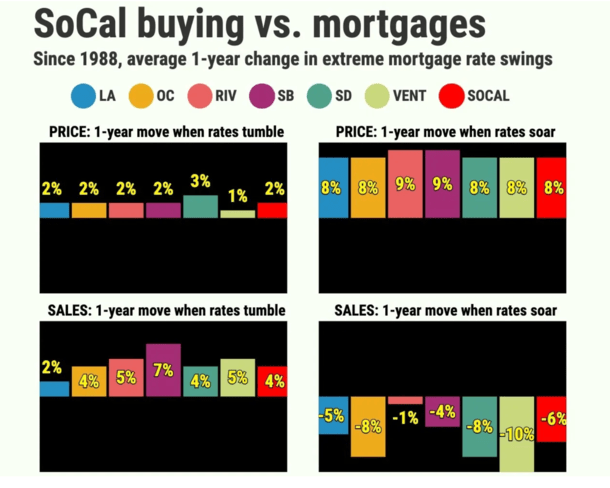

That brings me to an fascinating piece written by Jonathan Lansner, who checked out house costs and gross sales quantity in Southern California, and the impression of upper/decrease mortgage charges.

He discovered that median costs have appreciated 4.7% since 1988, however this annual acquire in Los Angeles averaged 7.6% when mortgages “have been of their steepest jumps.”

In the meantime, when mortgage charges “have been of their steepest drops,” LA median house costs solely skilled 1.6% beneficial properties.

So that you’re telling me excessive mortgage charges fueled even greater house costs. And declining mortgage charge resulted in falling house costs?

Apparently, sure. As for why, it’s the economic system! Bear in mind, mortgage charges are likely to rise when the economic system is doing properly.

And so they typically decline when the economic system goes downhill, or falls right into a recession, which some imagine is overdue at this level.

I wrote a bit some time again relating to this very matter and located that mortgage charges went down throughout each recession since 1980.

The one exception was the 1973-1975 recession, when 30-year mounted mortgage charges elevated barely from 8.58% to eight.89%.

With regard to jobs, Lansner famous that over the previous 35 years, employment grew 2.7% yearly in California when mortgage charges “surged,” however shrank at a 0.7% annual tempo when charges “tumbled.”

So perhaps simply perhaps, potential house patrons will uncover that decrease mortgage charges are accompanied by decrease asking costs, probably in 2024.

Learn extra: Mortgage charges and residential costs can fall collectively.

[ad_2]