[ad_1]

What number of YNAB classes ought to I’ve? 12, 24, 158?

It is a query we’ve been getting because the daybreak of time—err, nicely, because the daybreak of YNAB in 2004.

It’s not simply new budgeters that get slowed down with this query, both. As you progress farther alongside the educational curve and develop a greater understanding of your monetary targets, it’s possible you’ll notice that your preliminary YNAB price range class setup won’t serve you in addition to it as soon as did—and that’s factor! Your price range ought to evolve as your monetary scenario (and life!) does.

There’s No Mistaken Technique to Categorize

Similar to there’s no mistaken strategy to eat a Reese’s, there’s no mistaken strategy to categorize your price range. Certain, there are impassioned hordes on the web which may have a definitive (and contradictory) stance on this query, however with regards to your YNAB classes, you do you.

How Many YNAB Classes is Too Many?

You most likely need me to say the reply is one thing definitive (like, 29) however it might make for a extremely brief weblog publish. To be trustworthy, the reply is completely different for everybody. Some folks have 45, some folks have 145. One lady (who met her now boyfriend by way of YNAB) had simply eight classes when she was targeted on paying down her debt.

So why isn’t there an accurate variety of classes? Nicely, a month-to-month price range isn’t only a file of your spending. It’s a private finance software designed to make your life higher throughout. Your classes are a part of that course of. When you will have simply the correct quantity, they’ll most successfully level you in the precise route—whether or not that’s eliminating overspending, paying down bank card debt, build up an emergency fund, or assembly your financial savings targets.

When in Doubt, Easy is Higher

We recommend that budgeting rookies begin with fewer classes after which let any new ones earn their method into your price range. You possibly can all the time add or change them at any time, simply keep in mind: easy is best.

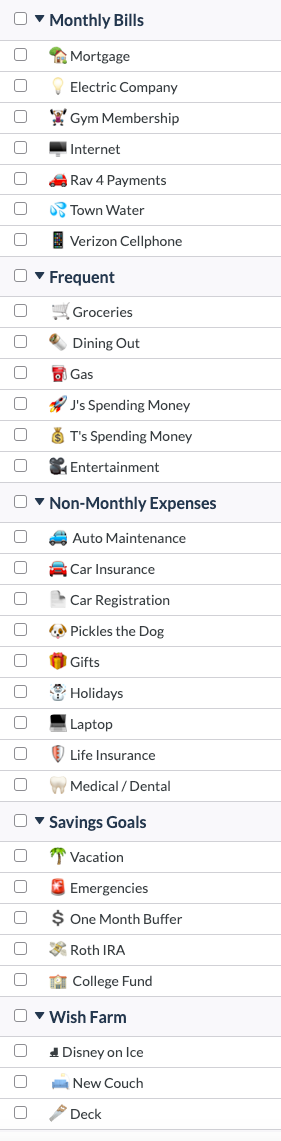

While you began utilizing YNAB, whether or not it was right now, final week, or final yr, we gave you some classes and teams that we thought could also be helpful to get you began. The default class teams included:

- Payments – Create classes on your month-to-month bills.

- Frequent – Consists of bills like groceries, transportation, and consuming out.

- Non-Month-to-month – Classes to interrupt True Bills (like vacation presents, annual subscription prices, or automobile insurance coverage premiums) into manageable month-to-month chunks.

- Objectives – Classes of bills you’re saving up for, like journey, schooling, or house enhancements.

- High quality of Life Objectives – Classes for hobbies, well being and wellness, and leisure.

Right here’s what that starter price range would possibly’ve appeared like:

And whereas this set of default classes and teams work nice for a few of us, we would like you to know that they’re not your solely possibility. You might need variable earnings, you is likely to be aggressively breaking the paycheck to paycheck cycle, or possibly you wish to save up for a selected enjoyable factor like a trip and even a blanket ladder.

Altering your classes isn’t mistaken. Actually, there’s no mistaken strategy to set up your price range. We will set up our budgets primarily based on the class construction that most closely fits our lives proper now. If we modify our minds later, that’s okay and we are able to restructure once more then too.

Right here’s an instance of classes arrange round once you receives a commission:

And right here’s one damaged out by theme:

Use any of these as a template to arrange your personal YNAB classes or customise your personal!

Save in Particular Classes,

Spend in Basic Ones.

Saving cash is thrilling. There, I mentioned it. As one YNABer, Carsen, put it, “Giving {dollars} jobs is like attending to spend the cash earlier than you spend the cash (and who doesn’t take pleasure in spending cash?).”

And the roles that you simply give your {dollars} might be paying on your subsequent new cellular phone, a home undertaking, a brand new fridge or a trip. No matter you’re saving for, it’s motivating to know that you simply’re chipping in for a future buy that may make your life higher—and the specificity is what’s so motivating!

However what occurs after we pay for the brand new fridge or go on that trip? Do you actually need a class referred to as ‘Whirlpool WRB322DMBB’ or ‘Woohoo! Costa Rica, 2017, Child!’ floating round in your price range? It’s a private alternative, however my guess is “No.”

Even in the event you disguise these outdated classes once you’re completed with them, it’s simply additional litter. So how are you going to save for specifics (that vacay class title is fairly motivating!), with out the class remnant muddling your spending experiences? Straightforward! You want a Want Farm.

With a Want Farm, you may plant particular seeds in new classes (Costa Rica, 2017!) however, once you harvest your crop (Costa Rica, 2017!), you file the expense beneath a extra basic class (Journey). Then you definately delete your outdated Costa Rica class and your experiences stay clutter-free. Make sure you learn that weblog publish to develop into a Grade-A Want Farmer.

Revisit and Revise.

Final, however not least, do not forget that your price range is a dwelling, respiratory factor. Life modifications, and budgets ought to, too. Don’t really feel like you must get it good proper now—these aren’t everlasting selections. Play with it!

Attempt a separate class on your espresso purchases for some time—possibly you want a bit of extra focus there. However, once you’re in management, possibly you wrap that again into your ‘Consuming Out’ or ‘Enjoyable Cash’ class. Your name.

Perhaps you merely outgrow a class. Did you simply make your final month value of automobile funds? Congrats! Go forward and hit “delete” on that automobile fee class and begin subsequent month with a clear(er) slate. You’ll be prompted to reassign the previous exercise to a special class in order that your spending experiences stay correct—one thing extra basic like “Transportation” covers a number of potentialities.

The purpose is, maintain it easy (the place you may!), and all the time return to our unique query: “Will including this class truly change my conduct?” (Taking a look at you, middle-of-the-night Amazon purchases.)

Feeling impressed about altering up your YNAB classes? Take a look at these 5 price range classes that you simply want proper now!

Need to begin spending and saving in a method that may change your relationship with cash…and your life? Attempt YNAB without cost for 34 days—no dedication or bank card required.

[ad_2]

%20(1).png)