[ad_1]

What you might want to know concerning the SIBOR to SORA transition, and what you might want to do when you’ve got an present dwelling mortgage pegged to SIBOR charges.

PSA: In case you have a SIBOR-based mortgage or property mortgage, you might want to know that SIBOR (Singapore Interbank Supplied Price) will likely be discontinued quickly. Instead, SORA (Singapore In a single day Price Common) will now be used as the principle benchmark for SGD-denominated loans.

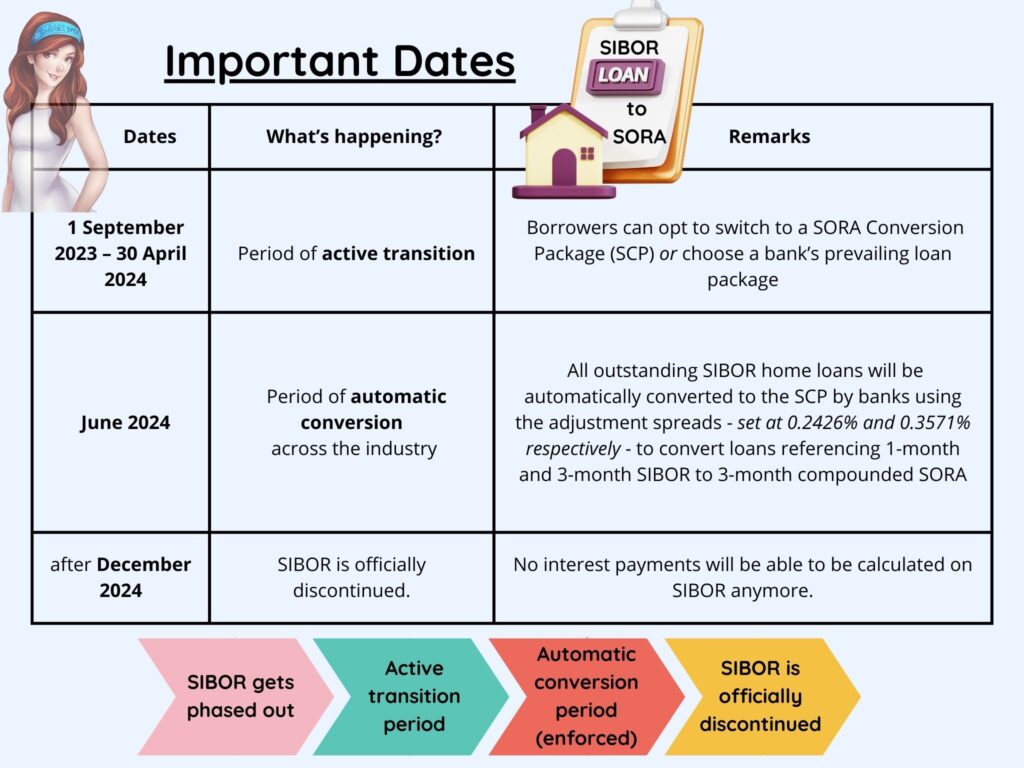

So should you’re an affected borrower, you possibly can both proactively swap now to a house mortgage of your selection i.e. convert your present SIBOR-based dwelling loans both to a SCP (SORA Conversion Bundle), or to one of many prevailing dwelling mortgage packages provided by your financial institution.

In any other case, should you select to do nothing throughout this era of energetic transition (till 30 April 2024), you’ll finally be robotically transformed by your financial institution in June 2024 at a hard and fast adjustment unfold of 0.2426% and 0.3571% respectively for loans referencing 1-month and 3-month SIBOR to 3-month Compounded SORA.

SIBOR will likely be formally discontinued after 31 December 2024.

Since curiosity funds can not be calculated for SIBOR-based loans after that and if no motion is taken by 30 April 2024, all excellent SIBOR dwelling loans will due to this fact be robotically transformed to the SORA Conversion Bundle in June 2024.

If you want a selection as to which dwelling mortgage bundle you like to change to, you then’re inspired to contact your financial institution throughout this energetic transition interval.

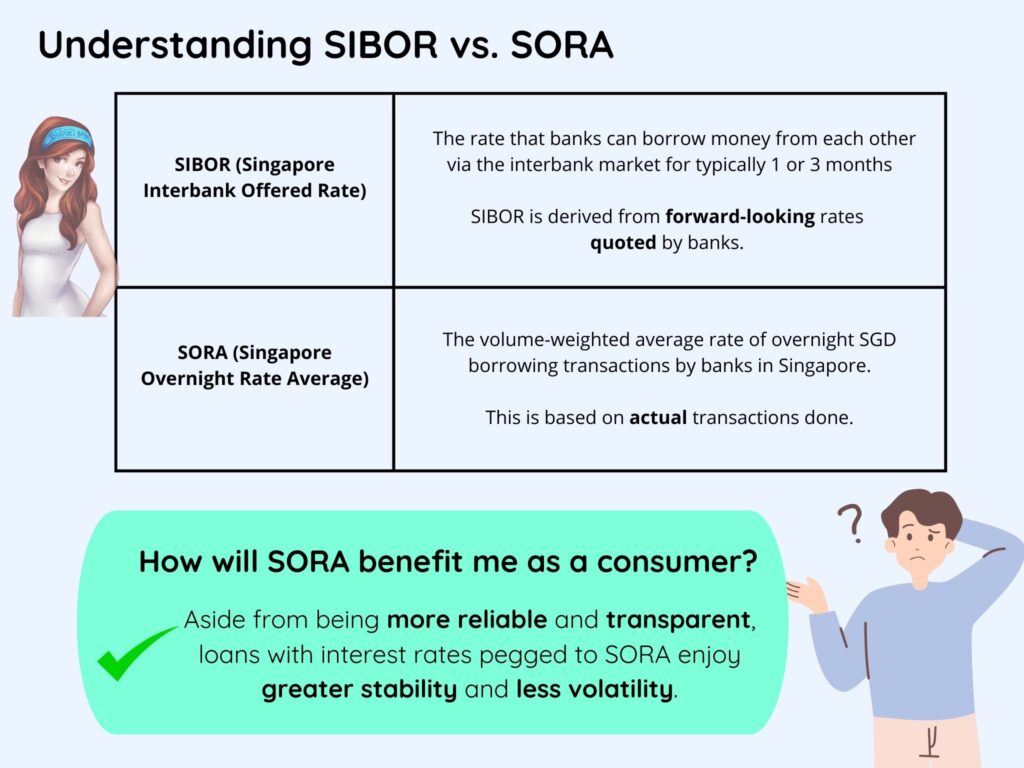

How will SORA profit me as a shopper?

Except for being extra dependable and clear, loans with rates of interest pegged to compounded SORA will get pleasure from higher stability and much less volatility.

SIBOR contracts usually use a single day’s studying of the benchmark for every curiosity fee interval. The draw back is that debtors are uncovered to market situations concentrated in a single single day. For example, some debtors could expertise increased curiosity fee for a whole three-month interval if the SIBOR spiked on specific day on account of a worldwide threat occasion.

In distinction, curiosity funds on SORA mortgage packages are based mostly on compounded SORA, which is computed as an common of particular person SORA readings over the inter-payment interval – e.g. month-to-month or quarterly, relying on how steadily your mortgage curiosity funds are calculated. Thus, the usage of compounded SORA leads to a fee that’s much less uncovered to sudden adjustments to rates of interest. As a result of averaging impact, rates of interest spiking increased on one or a number of days won’t affect your curiosity funds by as a lot as a result of averaging impact. It additionally signifies that any change in market situations will solely be step by step mirrored over time.

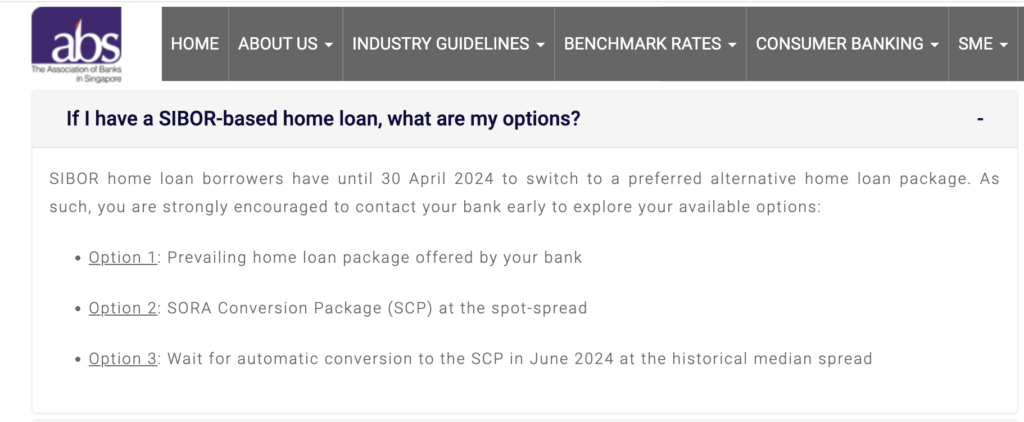

What are my choices if I’ve an present SIBOR mortgage?

Okay, so how does this transformation have an effect on dwelling debtors?

In case your present housing mortgage is tied to the 1M or 3M SIBOR, you possibly can select between two choices now:

1. Change to the SORA conversion bundle (SCP), or

2. Go for every other mortgage bundle provided by your financial institution.

Alternatively, should you take no motion by 30 April 2024, your financial institution will auto-convert your SIBOR-based mortgage to the SCP in June 2024.

The excellent news is, changing your present SIBOR mortgage to the SCP or any of your financial institution’s prevailing mortgage packages with the identical financial institution now will NOT incur any further charges or lock-in interval. Sure, these are a part of a wider trade initiative to help prospects who swap out of their SIBOR retail loans throughout this energetic transition interval.

You’ll even be exempted from recomputing your Mortgage Servicing Ratio (MSR), Mortgage-To-Worth (LTV), and Complete Debt Servicing Ratio (TDSR), so long as the choice mortgage bundle you’ve opted for is together with your present financial institution.

Word: In the event you’re desiring to refinance your property mortgage and swap to a different financial institution, you’d need to examine if every other TDSR exemptions apply e.g. debtors who’re owner-occupiers are exempted from TDSR when refinancing your property loans.

Will this rely as a refinancing of my property mortgage?

No. MAS has beforehand confirmed that the taking on of the SCP and prevailing packages provided by the banks to prospects with present SIBOR property loans won’t be considered a refinancing of property loans below the regulator’s property mortgage guidelines.

Ought to I swap now or later?

There may be nonetheless time, so that you don’t need to rush into a call simply but. Nevertheless, this text is supposed to offer you a heads-up that in case you are an present SIBOR dwelling mortgage borrower, you’re inspired to talk to your financial institution early to discover the out there choices.

That manner, you’ll have extra time throughout this era to determine on what would be the finest transfer for you.

Do you have to select to do nothing for now till 30 April 2024, your SIBOR mortgage will likely be robotically transformed by the banks ranging from 1 June 2024. And no, you will be unable to maintain your SIBOR mortgage, as a result of curiosity funds based mostly on SIBOR can’t be computed anymore after SIBOR is discontinued.

| Dates | What’s taking place? | Remarks |

| 1 September 2023 – 30 April 2024 | Interval of energetic transition for debtors to change to a SORA conversion mortgage or a financial institution’s prevailing mortgage bundle | The SCP will likely be structured as: 3-month Compounded SORA + buyer’s present SIBOR margin + Adjustment Unfold (Retail). The Adjustment Unfold (spot-spread) will likely be decided as the typical distinction between the relevant SIBOR and 3-month Compounded SORA over the previous three-month interval. |

| June 2024 | Interval of automated conversion throughout the trade for all excellent SIBOR retail loans to SORA. | Your financial institution will apply the SCP with the Adjustment Unfold (historic median) set at 0.2426% and 0.3571% respectively to transform loans referencing 1-month and 3-month SIBOR to 3-month Compounded SORA. These signify the 5-year historic median spreads between the relevant SIBOR and 3-month Compounded SORA over the interval 30 June 2018 to 30 June 2023. |

As you possibly can see, it’s positively extra advantageous to begin desirous about whether or not you wish to swap to another dwelling mortgage once you can, and not once you have to.

Taking motion now to contact your financial institution to decide on a mortgage that’s appropriate for you earlier than SIBOR loans are fully phased out may be useful, since you’ll be minimising disruptions to your mortgage when SIBOR is discontinued.

You may as well keep away from scrambling to take up any mortgage bundle your financial institution provides you when the deadline comes, which can or will not be the perfect supply then.

What if I need to swap my dwelling mortgage to a different financial institution?

In case you are going with the SCP, which is a typical bundle that every one banks are providing, then there may be little purpose to change banks.

You’ll have to stick together with your present financial institution in an effort to get pleasure from the advantages (payment waiver, exemption of MSR, LTV and TDSR).

Nevertheless, should you intend to change to a different mortgage bundle provided by a totally different financial institution as an alternative (e.g. to make the most of a limited-time promotional fee), then do word that will probably be the similar as the standard course of concerned in refinancing your mortgage(s) i.e. you’ll have to pay all the standard administrative / authorized charges, and be topic to MSR and TDSR evaluations (except you’ve gotten exemptions from these for different causes, e.g. debtors who’re owner-occupiers are exempted from TDSR when refinancing your property loans).

What are the prevailing packages out there available in the market?

The prevailing packages provided by your financial institution might embody

- floating fee packages, usually based mostly on compounded SORA or financial institution board charges, and/or

- fastened fee loans.

Please strategy your financial institution to seek out out what are the prevailing packages they provide.

In the event you’re contemplating SORA-based loans, its key profit lies in its transparency, because the SORA fee is revealed on MAS web site on every enterprise day at 9am. Because the unfold that every financial institution costs over compounded SORA is obvious to see, it turns into simpler for us as debtors to check dwelling loans towards one other financial institution!

One other various is to go for a floating mortgage pegged to the financial institution’s board fee, which is fastened internally by the financial institution. Nevertheless, these board charges have hardly any transparency as they’re decided solely on the financial institution’s discretion, making it a lot more durable to check mortgage packages.

Ought to I select a hard and fast or floating fee dwelling mortgage?

Within the final decade, floating-rate dwelling loans have typically been cheaper than fastened fee loans as a result of low rate of interest surroundings then. The draw back is that these loans are topic to rate of interest fluctuations, which may trigger financing points for debtors who don’t have spare money to take care of the adjustments when rates of interest rise. With the unsure rate of interest outlook right this moment, it’s anybody’s guess whether or not most of these loans will stay reasonably priced within the quick to medium time period.

In case you are risk-averse, a fixed-rate dwelling mortgage could also be extra acceptable in your threat urge for food as there will likely be no must panic even when rates of interest rise immediately, because you’ll nonetheless be paying the identical quantity no matter any fluctuations in rates of interest. At occasions, you’ll even get to avoid wasting extra on the month-to-month instalments throughout spikes in rates of interest.

The trade-off? Mounted-rate mortgage charges are sometimes increased than floating charges, though some individuals don’t thoughts paying increased mortgage rates of interest in alternate for stability and a peace of thoughts.

Tip: Plan based mostly in your threat urge for food and financing skill, slightly than purely based mostly on prevailing rate of interest provides. In the event you don't have the spare money or emotional bandwidth to take care of sharp fluctuations in rates of interest, then a fixed-rate mortgage could also be higher for you. Converse to your financial institution early, who will be capable to present additional recommendation in your choices.

What’s the finest mortgage mortgage rate of interest?

Given {that a} mortgage is prone to be one’s best monetary legal responsibility, we want to ensure we proactively handle our dwelling loans, particularly on this interval of financial uncertainties and international rate of interest adjustments. Whether or not you’re planning to refinance otherwise you’ve set your eyes on a brand new dwelling, you might face a dilemma when deciding which is the “finest” mortgage mortgage bundle.

In the event you’re uncertain, you might be inspired to contact your financial institution to hunt recommendation from their mortgage specialist, as proactively managing your mortgage is a vital step in constructing a sound monetary plan.

You may even put any curiosity financial savings to good use, corresponding to leveraging increased interest-yielding financial savings instruments to inflation-proof your emergency funds.

Conclusion

The energetic transition interval for debtors to transform their present SIBOR-based loans to another mortgage bundle is going on now until 30 April 2024, and you’re going to get to get pleasure from the next advantages when changing your mortgage together with your financial institution:

- A one-time payment waiver

- with no further lock-in interval

- you’ll be exempted from recomputing your Mortgage Servicing Ratio (MSR), Mortgage-To-Worth (LTV) and Complete Debt Servicing Ratio (TDSR)

Extra importantly, you’ve gotten the power to decide on a house mortgage bundle that you just favor now, slightly than scrambling round when the deadline arrives. It’s thus price exploring your choices right this moment to see what is going to swimsuit you finest.

For subsequent steps, you possibly can both strategy your financial institution or a mortgage specialist to seek out out what choices can be found to you.

Disclosure: This text is written in collaboration with The Affiliation of Banks in Singapore (ABS), as a part of their instructional outreach efforts to boost public consciousness about with the ability to swap to SORA or different dwelling mortgage packages throughout this energetic transition interval earlier than SIBOR is formally phased out. The contents and slant mirror each the creator's views and ABS' inputs for factual accuracy.

[ad_2]