[ad_1]

Morgan Housel’s newest ebook is a gem into human behaviour and the way we are able to be taught from historical past and patterns to know the longer term, in addition to place our investments to learn from it. Listed below are my greatest takeaways.

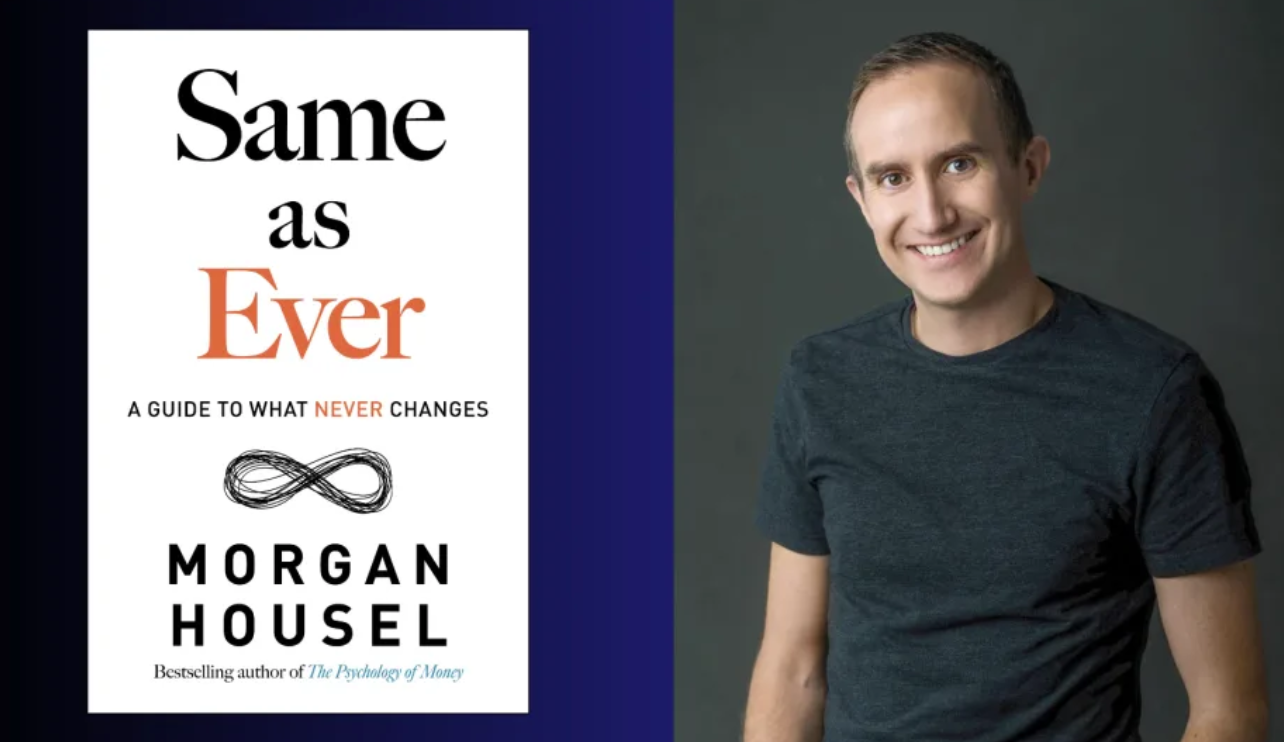

I lately completed studying Morgan Housel’s second ebook, “Similar as Ever: A Information to What By no means Modifications” on the lengthy drive again from Cameron Highlands with my household. For these of you who discover the identify unfamiliar, Housel is without doubt one of the greatest finance writers of our time, with a knack for distilling complicated monetary info into easy, comprehensible ideas. He’s one in every of my favorite finance writers, and one who vastly conjures up me in my finance work as nicely.

Launched solely lately in November 2023, his newest ebook is about mankind’s behavioural patterns and methods of pondering that oddly sufficient, don’t appear to vary over time. Housel dives into these patterns, after which persistently brings his narrative again to what we are able to be taught from distinct patterns of human habits. He posits that if we are able to perceive these issues that by no means change, Housel posits, we’ll have higher perception to what the longer term holds.

And that can make us higher buyers, too.

The ebook opens with a thought-provoking quote:

“I very steadily get the query: “What’s going to vary within the subsequent 10 years?”

It’s a quite common one. I virtually by no means get the query: “What’s not going to vary within the subsequent 10 years?”

That second query is definitely the extra necessary of the 2 — as a result of you possibly can construct a enterprise technique across the issues which are steady in time.

Jeff Bezos, Amazon’s founder

Certainly, Bezos constructed Amazon’s retail enterprise by specializing in the one factor he knew that clients would all the time need: low costs and quick supply.

What’s going to NOT change within the subsequent 10 years, and the way are your investments positioned for it?

That is an attention-grabbing strategy to reverse your thought course of on the subject of evaluating companies, shares and investments. As a substitute of fretting over whether or not rates of interest will rise or fall within the subsequent quarter, or whether or not the S&P will crash, it may be higher value our time to ask the perennial query of:

“What’s going to NOT change within the subsequent 10 years as an alternative, and the way is that this firm (that I’m enthusiastic about) positioning itself to ship this?”

SG Funds Babe, as impressed by Jeff Bezos’ quote

Certainly, after I utilized this to the shares that I’ve been shopping for up these days, the reply gave me large readability into WHY these companies made sense earlier than shifting onto their valuations subsequent.

Attempt it on your subsequent funding train – you may be stunned.

The ebook is filled with knowledge and insights into human psychology, behaviour and historical past, so I encourage you to choose up a duplicate of the ebook and skim all of it for your self. As for private finance takeaways, right here’s one other one from the ebook that I cherished and needed to share:

Volatility is inevitable in capitalist economies and the inventory market

Housel references a thesis put ahead by famed economist Hyman Minsky within the Nineteen Sixties, who got here up with this concept that he known as the monetary instability speculation:

When the financial system is steady, folks get optimistic. And once they get optimistic, they go into debt. And once they go into debt, the financial system turns into unstable. So the rationale the financial system turns into unstable is as a result of it was once steady. Subsequently, he mentioned, you possibly can by no means think about a world through which there are not any recessions, no booms and busts, as a result of the absence of recessions is definitely what creates recessions.

Apparently, it’s the similar in inventory markets too.

Sounds acquainted? We noticed this play out throughout the COVID inventory market growth, the place valuations rose to sky-high ranges till they may not be sustained…then the bubble popped.

Embrace inefficiencies in your monetary plan

The issue with people is that all of us attempt an excessive amount of for effectivity and maximization of sources, together with on the subject of our cash.

We really feel unsettled when we have now an excessive amount of money within the financial institution, particularly when your banker or insurance coverage agent tells you that your money is being eroded by inflation and you should make investments it as an alternative of sitting on money!

For all that’s value, I echo the identical phrases right here on the weblog – besides that I’m not your banker or agent and have completely nothing to promote you, nor will I earn any commissions on any funding that you just make together with your money.

However nonetheless, I typically obtain DMs from involved readers asking whether or not hanging on to an excessive amount of money is an inefficient drag on their portfolios.

I get it – there are occasions when even I query myself whether or not my warchest is simply too large. It occurs even to one of the best of us however the factor is, there isn’t a good reply, nor any reply that’s sure.

As Housel superbly describes it, money is an inefficient drag throughout bull markets, however as necessary as oxygen throughout bear markets.

With the markets rallying these few weeks after a complete yr of bearish sentiment – I hope you’ve been shopping for, as a result of I actually have. For those who’re a paid subscriber on my Patreon, you’d have been capable of see what I purchased through the years, and why, right here – this sentence turns into much more related at this time than earlier than.

Be taught to embrace inefficiencies even in your monetary plan.

One other nice piece of economic recommendation from Housel is:

Leverage is probably the most environment friendly strategy to maximize ur stability sheet and the best strategy to lose all the things.

Like the remainder of you, I’ve additionally been served the identical advertisements for funding programs that declare to show you the best way to use leverage to maximise your returns and earn extra from a restricted capital base.

I even know a number of people who use this methodology, and have been making good cash with leverage thus far – be it in shares, choices or crypto.

And identical to you guys, I’ve additionally gone by way of intervals the place I used to be left questioning, may I be mistaken? Am I just too narrow-minded to simply accept that leverage may really be an honest technique?

However I caught to my weapons, as a result of the basic fact about leverage doesn’t change.

Leverage is a double-edged sword.

If I had used leverage on my shares this yr, I might most actually have been burnt, as many went down as a lot as 60% earlier than recovering in latest months as a result of market rally.

A rising tide lifts all boats.

However as a result of I didn’t, I used to be capable of maintain the journey and stayed the course. By no means as soon as did I really feel the necessity to liquidate even when a inventory was dropping, or to borrow cash due to margin calls. As a result of I didn’t use leverage, the utmost I may lose was 100% of my capital and nothing extra.

I capped my draw back dangers and my upside returns are limitless.

In fact, this isn’t to say that simply because leverage isn’t for me, then it isn’t for you both.

However I, like Morgan Housel, stay satisfied that the overwhelming majority of individuals should not fitted to leverage and can be higher off with out it.

So whereas leverage stands out as the most effective strategy to maximize your stability sheet and (potential) returns, be taught to embrace inefficiencies in your monetary plan by forgoing it as an alternative.

P.S. Morgan Housel has already began writing his third ebook, “The Artwork of Spending Cash”. Have you ever learn his newest ebook but, and what had been your greatest takeaways from it? Share with me within the feedback beneath!

With love,

Funds Babe

[ad_2]