[ad_1]

The Nice British Holidaymaker is a fairly hardy and decided species – however they’ve actually not been immune from the price of dwelling disaster.

3-in-5 of us have both booked or are planning to e book a visit overseas within the subsequent 12 months, in response to our survey of 1,000 adults throughout the UK. One other 20% will take a break within the UK whereas 1-in-5 mentioned they simply couldn’t afford to go away in any respect this yr.

Supply: 979 adults who journey exterior the UK. On-line analysis by Client Intelligence carried out March 2023

Supply: 979 adults who journey exterior the UK. On-line analysis by Client Intelligence carried out March 2023

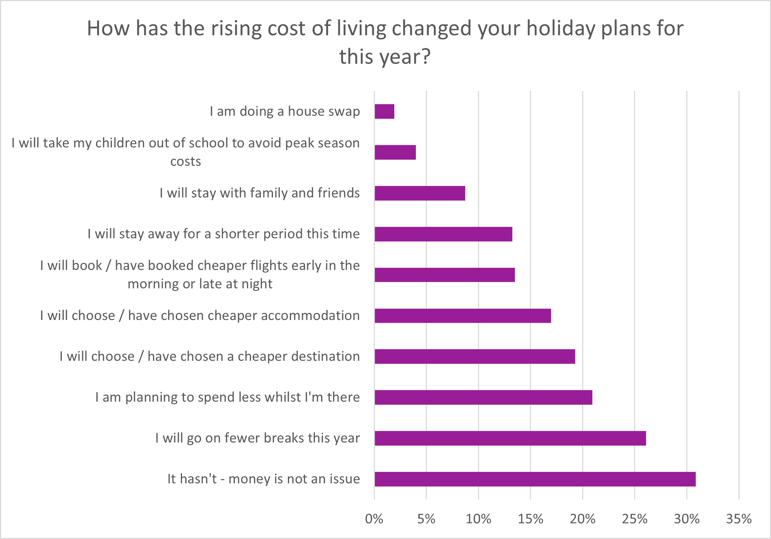

Moreover, the price of dwelling crunch has modified the plans of 70% of those that are planning to go on vacation this yr.

1 in 5 are giving up issues like excursions and meals out, 19% are heading to cheaper locations, 17% are reserving cheaper lodging, and 13% are even going for red-eye flights to make vacation budgets go additional.

1 / 4 of these planning to journey will take fewer breaks this yr, and 13% will keep away for fewer days/nights.

As many as 7% of adults aged 25-54 admitted that they have been planning to take their kids out of college to keep away from peak season prices.

Solely 3 out of 10 mentioned cash was no object to their journey plans.

Supply: 778 adults who’ve booked or are planning to e book a vacation within the subsequent 12 months. On-line analysis by Client Intelligence carried out March 2023.

Supply: 778 adults who’ve booked or are planning to e book a vacation within the subsequent 12 months. On-line analysis by Client Intelligence carried out March 2023.

Journey insurance coverage recognition

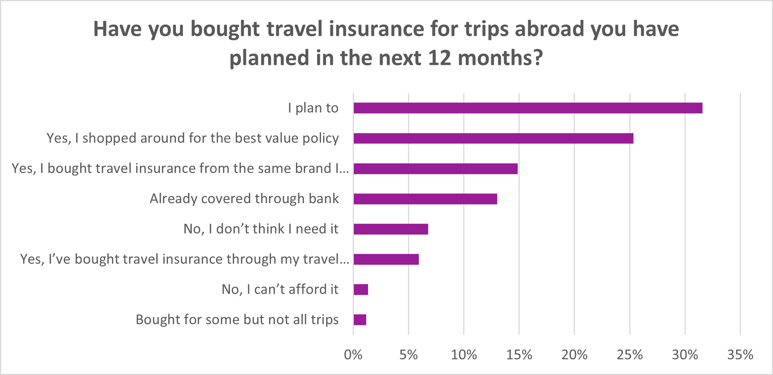

In excellent news for journey insurers, it seems that the one factor individuals aren’t going to be skimping on is insurance coverage.

Put up pandemic, individuals aren’t taking any possibilities with their well being – or their hard-earned holidays – and journey insurance coverage is nearly universally valued.

Practically 60% already have some form of journey insurance coverage in place for his or her deliberate journeys, with one other 32% planning on getting cowl earlier than they go. Solely 7% of travellers felt they didn’t want journey insurance coverage, and only one% felt they couldn’t afford it.

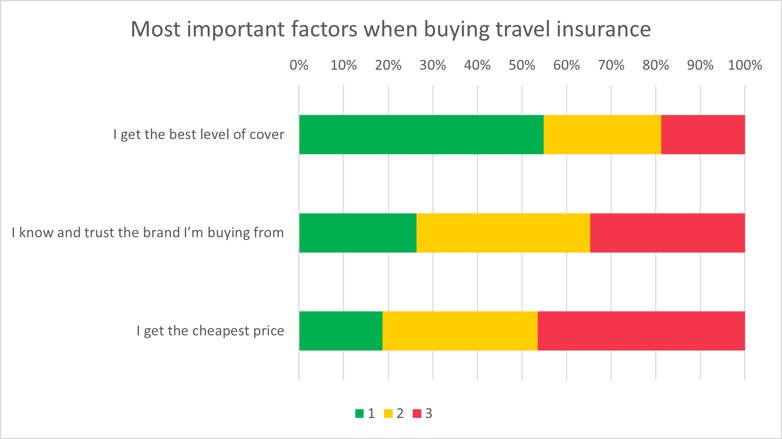

In truth, regardless of ongoing and deepening price of dwelling struggles, value shouldn’t be the principle consideration for many journey insurance coverage prospects. Greater than half make getting the perfect degree of canopy high their high precedence. Most then prioritise a high quality model they recognise, with value coming in a paltry third of their checklist of concerns.

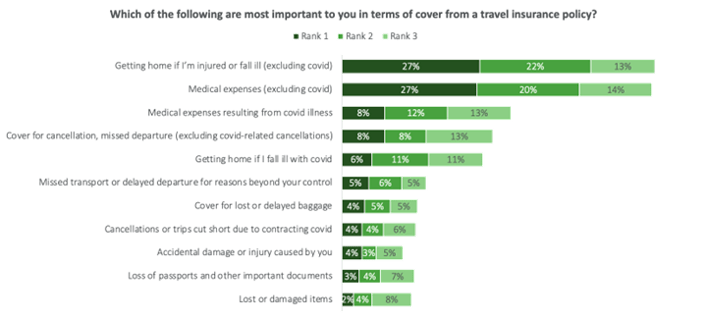

Once we requested individuals to rank an important coverage options, medical bills and repatriation have been an important issues individuals need from their journey insurance coverage.

And once they have purchased a coverage, belief in journey insurance coverage is comparatively buoyant. 87% consider the extent of canopy supplied by their coverage is truthful in relation to what they paid, and 81% belief their supplier to pay out within the occasion of a declare.

And once they have purchased a coverage, belief in journey insurance coverage is comparatively buoyant. 87% consider the extent of canopy supplied by their coverage is truthful in relation to what they paid, and 81% belief their supplier to pay out within the occasion of a declare.

Nonetheless, it’s value noting belief is decrease for youthful customers. Solely 70% of 18-24 yr olds mentioned they belief their journey insurer to pay out in the event that they made a declare, in comparison with 93% of these aged 65+.

Confusion reigns

Understanding of precisely what’s and isn’t lined continues to differ.

- Practically half of policyholders aren’t sure in the event that they’re lined for unintended harm or damage they trigger themselves

- 43% are uncertain in the event that they’ll be lined to get dwelling if they fall ill with Covid

- 38% aren’t certain if their coverage would pay out if Covid lower their journey brief

- 35% weren’t certain if covid associated medical bills could be lined.

In truth general, solely 37% have been ‘fairly certain’ they have been lined for Covid associated issues, and 43% admitted they hadn’t learn the small print of their coverage in any element.

For journey insurers and brokers, the Client Obligation-fuelled mission is obvious: schooling and communication is required to spice up client understanding.

Folks wish to journey.

They need insurance coverage.

They need worth, not a cut price basement coverage.

The problem for suppliers is to verify prospects perceive what they’re getting, to allow them to handle expectations, show truthful worth, and construct that every one vital belief even additional.

Viewsbank is our in-house client analysis panel. It’s a big, responsive and group pushed panel that conducts each quantitative and qualitative analysis.

Our Viewsbank panel helps our prospects with all kinds of initiatives starting from detailed thriller procuring to demographically focused analysis surveys. The analysis helps our shoppers make knowledgeable selections primarily based on true understanding of the patron’s voice.

[ad_2]