[ad_1]

Earlier than answering

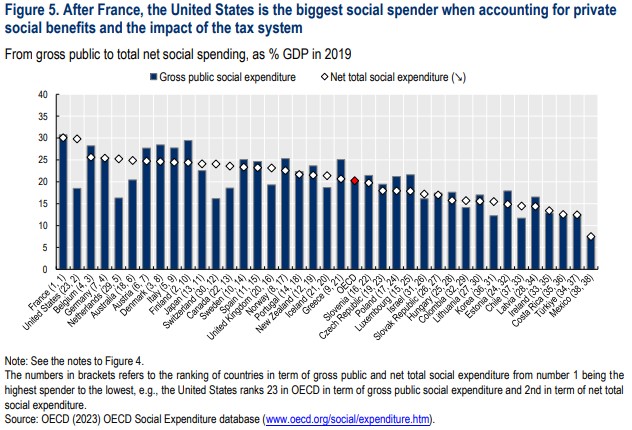

this query, we have to outline what the OECD counts as social expenditure.

It’s primarily a mix of what we name

welfare spending (together with pensions) and well being spending, but it surely

additionally consists of incapacity-related advantages, lively labour market

programmes, in addition to unemployment and housing advantages. What it’s

not is simply public social spending. In all OECD nations people

spend a few of their very own cash (both straight or via their

employer) on social expenditure. Within the UK, for instance, personal

social expenditure exceeded 6% of GDP in 2019 in keeping with the OECD,

primarily within the type of pension contributions.

The reply to the query posed by the title, utilizing this knowledge, comes from the

diamonds within the chart under.

That France is high

might be not an enormous shock , however that the US is

second (slightly below France) may. The blue columns signify public

(state) social spending, and the US is certainly pretty low right here, however

the US has the second highest personal sector social spending amongst

OECD nations. France is on the high partly as a result of it has a really

beneficiant pension system (see this

current publish), whereas the US is so excessive partly as a result of it has a really

costly (and inefficient) well being system.

Given what number of hits

of the keyboard are spent discussing public spending on well being,

pensions and different gadgets, combining private and non-private spending in

this manner is usually a helpful corrective. What issues to most individuals is

how massive their pension is, or the standard and accessibility healthcare

is, somewhat than the shape through which they pay for it.

The OECD splits

personal social expenditure into two varieties: necessary and voluntary.

In nations the place

personal social spending is excessive, in each Switzerland and Iceland it

is essentially necessary, in Canada and the UK it’s nearly all

voluntary, whereas the Netherlands and the US it’s blended. The final two

contain necessary well being funds (Obamacare within the US). Necessary

funds may give shoppers some selection over suppliers, however

in any other case necessary funds are just like a tax. Within the UK the

largest element of voluntary social expenditure entails personal

pensions. Once more this offers shoppers extra selection than any state

pension would, however for people the choice of not shopping for is hardly

advisable, which suggests they don’t have extra cash to spend on

different issues. The large benefit of a state pension over personal

pensions is that the latter exposes people to rate of interest threat

on the time their pensions must be changed into an annuity.

So whereas the selection

between public, necessary personal and voluntary personal provision is

essential, the quantity of social expenditure from no matter supply is

at the very least as essential. Of the G7 nations, which spent the least on

social expenditure in 2019? Within the chart above it’s the UK. This has

not at all times been the case, as the next chart exhibits [1].

Key: In 2010 from high France,US,UK,Germany,Italy,Japan,Canada

In 2010 the UK had

the third highest social spending within the G7, however the pattern over the

following decade has been persistently downwards. As a result of our

Conservative authorities has been obsessive about chopping taxes and

squeezing the state, with out a lot try at decreasing the scope of

what the state offers within the UK, we find yourself having much less spent in

many areas (together with social expenditure) than most individuals need. [2]

It is a essential

reality to remember the following time somebody moans about how a lot the

state spends on well being, pensions or another merchandise of welfare

spending. It’s a level I attempt to emphasise at any time when I focus on public

spending on well being or pensions, or combination public spending figures.

An emphasis on complete social spending can be essential when taking a look at

knowledge on tax.

Based on OECD

figures for 2020 for the G7, the nation with the

highest complete tax as a share of GDP is France at 45%, adopted by

Italy at 43%. Germany is considerably decrease at 38%, after which Canada

and Japan decrease nonetheless at 34% and 33% respectively. The UK is at 32%,

whereas the US is lowest at 26%. The UK is a low tax nation, with solely

the US decrease among the many G7. However because the figures above present, these

variations replicate the type of financing of social spending at the very least

as a lot as the full quantity of social spending. Those that counsel

that low taxes within the US imply that folks there have more cash to

spend are being disingenuous, as a result of US residents have to pay, both

straight or not directly, for social items which can be offered free in

different nations.

Because of this a lot

of the general public debate in regards to the measurement of the state misses key points.

What needs to be central to this debate is how forms of spending,

together with social spending, are financed somewhat than the quantity that

is spent. For instance, is it higher for the state to offer most

pensions (as in France) or is it higher for people to pay for

their very own pension schemes? Is a well being service privately funded through

insurance coverage firms (both voluntarily or via mandated funds)

much less environment friendly than one thing just like the NHS. How a lot tax individuals pay

will comply with from that dialogue, but tax is all too typically how such

discussions begin.

[1] Knowledge for 2019

in 4 of the G7 nations will not be proven right here, maybe as a result of knowledge

within the earlier chart is partially estimated.

[2] Those that can

afford it may try to make up the distinction by, for instance, shopping for

personal medical insurance coverage, however the high quality of personal sector well being

care when it comes to medical outcomes is very depending on the NHS.

[ad_2]