[ad_1]

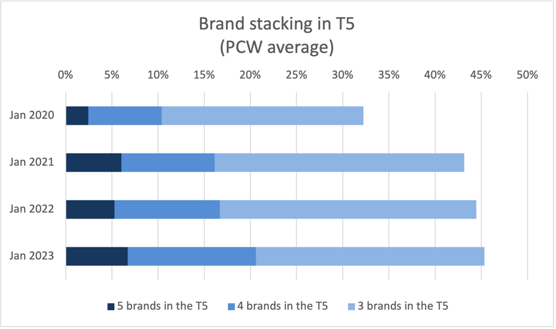

In January 2020 practically a 3rd (32.2%) of shoppers in search of new automobile insurance coverage quotes noticed no less than three manufacturers from the identical group in Prime 5 positions. By January 2023 this determine had risen to 45.3%. Inside that, the proportion of teams getting a clear sweep of Prime 5 positions has greater than doubled from 2.4% to six.7% in three years.

It’s partly prompted by pricing reforms placing an finish to ‘free’ add-ons like authorized bills or breakdown cowl to new prospects (with these further covers making their means into totally different ranges of canopy as an alternative), partly a response to the price of dwelling disaster to supply a alternative of canopy ranges, and partly a tactic to hit extra of the highest pricing spots for desired prospects.

Both means, they’re by now widespread to a lot of the huge teams.

However lots of these teams have an issue in curating the burgeoning suite of merchandise.

Specializing in the highest 10 best teams, our Marketview instrument has recognized that half (3-in-6) of dwelling insurance coverage teams and 2-in-7 of the highest 10 automobile insurance coverage teams have been providing cheaper costs for his or her extra premium tiers.

The cases are uncommon, accounting for lower than 1% of all group quotes. Nonetheless, they’re persistent in doing so.

This instance from an actual threat in January 2023 illustrates the issue – a buyer receives a less expensive quote for a product with extra options than the decrease tiers are provided for – all from the identical model.

There are many different examples. One insurer, for example, quoted £15 much less for a better tier coverage with larger contents cowl and residential emergency cowl included than the tier under.

No correlation is clear. Typically the manufacturers are stacked subsequent to one another with minimal worth distinction, typically they’re actually far aside. A few of our actual dangers obtained the identical topsy-turvy outcomes persistently for 3 months in a row, others noticed it some months however not others. Neither is it restricted to some components of the market – we see it throughout age teams and property measurement.

The low prevalence suggests accident over conspiracy. However these inconsistencies might trigger concern. Is it a mistake in pricing or a mapping error? And from a product governance perspective, how is it honest worth?

Regardless of the trigger, and possibly it’s a deliberate experiment in nudging insurance coverage consumers in direction of a unique product, it’s more likely to confuse prospects and that may’t be good for anybody.

The query for manufacturers whether or not they would have the ability to defend, or determine and proper any pricing anomalies like this.

Perceive and optimise your aggressive place.

Market View is an insurance coverage market benchmarking answer that gives a uniquely complete understanding of market dynamics, competitor behaviour and model positioning inside the normal insurance coverage trade.

[ad_2]

.png#keepProtocol)