[ad_1]

Jane and her husband Joe stay within the midwest with their two teenaged kids and one parrot. Lately, Jane retired from her 24-year-long profession as a university professor and loves the brand new life-style she’s carving out for herself. Joe works from dwelling and the household enjoys spending quite a lot of time collectively.

Jane’s query at this juncture is whether or not or not she must return to full or part-time work at any level, or, if the couple can stay on Joe’s revenue alone till he too retires in 9 years. She’s additionally questioning if their asset allocation is acceptable given their ages and projected retirement timeline.

What’s a Reader Case Examine?

Case Research handle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, pricey reader) learn via their scenario and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, try the final case examine. Case Research are up to date by contributors (on the finish of the publish) a number of months after the Case is featured. Go to this web page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Examine?

There are 4 choices for folk curious about receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Examine topic right here.

- Rent me for a non-public monetary session right here.

- Schedule an hourlong name with me right here.

- Schedule a 30 minute name with me right here.

→Undecided which possibility is best for you? Schedule a free 15-minute chat with me to be taught extra. Refer a good friend to me right here.

Please observe that area is proscribed for the entire above and most particularly for on-the-blog Case Research. I do my greatest to accommodate everybody who applies, however there are a restricted variety of slots accessible every month.

The Purpose Of Reader Case Research

Reader Case Research spotlight a various vary of monetary conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

The Case Examine collection started in 2016 and, thus far, there’ve been 98 Case Research. I’ve featured of us with annual incomes starting from $17k to $200k+ and internet worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous individuals. I’ve featured girls, non-binary of us and males. I’ve featured transgender and cisgender individuals. I’ve had cat individuals and canine individuals. I’ve featured of us from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured individuals with PhDs and other people with highschool diplomas. I’ve featured individuals of their early 20’s and other people of their late 60’s. I’ve featured of us who stay on farms and people who stay in New York Metropolis.

Reader Case Examine Pointers

I in all probability don’t must say the next since you all are the kindest, most well mannered commenters on the web, however please observe that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The aim is to create a supportive surroundings the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with constructive, proactive recommendations and concepts.

And a disclaimer that I’m not a educated monetary skilled and I encourage individuals to not make critical monetary selections primarily based solely on what one particular person on the web advises.

I encourage everybody to do their very own analysis to find out the perfect plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Jane, at present’s Case Examine topic, take it from right here!

Jane’s Story

Hello Frugalwoods–thanks upfront in your recommendation! I’m Jane, a 50-year-old retiree/stay-at-home-parent who was lucky to have the ability to go away my profession as a university professor this previous 12 months. My partner and faculty sweetheart, Joe, works a distant company job. We stay a beautiful Midwestern existence with our two youngsters (one in highschool, one post-high faculty) and one parrot.

Hello Frugalwoods–thanks upfront in your recommendation! I’m Jane, a 50-year-old retiree/stay-at-home-parent who was lucky to have the ability to go away my profession as a university professor this previous 12 months. My partner and faculty sweetheart, Joe, works a distant company job. We stay a beautiful Midwestern existence with our two youngsters (one in highschool, one post-high faculty) and one parrot.

What feels most urgent proper now? What brings you to submit a Case Examine?

We’ve adopted the fundamental rules of the FIRE (monetary independence, retire early) motion for a couple of decade now. We’re grateful to those that launched us to this motion and to content material creators like Frugalwoods who regularly train us to problem societal norms relating to the definition of a “good life.” I felt assured leaving my profession final 12 months once we had been approaching “Coast FI” territory and it was clear my job was making it tough for me to be the perfect guardian I may very well be to my youngsters, one in all whom has actually struggled.

Proper now, we’d like assist determining a plan for the following 10 years.

At that time, we are able to entry our retirement accounts and really feel comparatively assured with our skill to navigate our personal funds. However earlier than then, a fundamental query is: when will I want to hunt part- or full-time work, and the way a lot will I want to usher in?

What’s the perfect a part of your present life-style/routine?

I really feel “on high of” my life for the primary time. The home is clear, I’ve time to prepare dinner (which I LOVE) and take walks, and my stress degree is enormously decreased. I’m at the moment planning and beginning my vegetable backyard; I like to backyard and look ahead to an ever-improving vegetable backyard every year. I’m additionally taking over some dwelling enchancment tasks I’ve all the time needed to do and I’ve picked up a small quantity of volunteer work.

I get to be a stay-at-home-parent to my high-school-aged son and a greater help particular person to my 19-year-old daughter. Her stress degree, degree of functioning, and our relationship are markedly improved. I’m grateful that I can now give her the help she wants.

That is the primary time in our marriage that my partner’s profession has been prioritized over mine, and I really like watching him have this chance to develop. As a household unit, we spend most of our time collectively at dwelling, mountain climbing, taking part in video games or profiting from free leisure. I believe we spend far more time as a unit than most households with youngsters this age, and for that I’m grateful.

What’s the worst a part of your present life-style/routine?

I’ve had a tough time establishing a schedule that helps me really feel productive. My partner works from dwelling, my 19-year-old doesn’t drive and is a homebody, so there are normally three of us in the home always. It generally looks like Groundhog Day. I used to be by no means a giant spender, however as a result of I’m not bringing in an revenue, I really feel anxious about spending cash.

The place Jane Desires to be in Ten Years:

- Have good medical health insurance.

- Perhaps working a part-time job that I like, however positively previous the accrual part of our lives.

- My husband wish to cease working at age 60 (in 9 years) if doable. Quite a bit will rely on our well being care scenario.

2) Way of life:

- I wish to be the place my youngsters are, and presumably within the higher Midwest the place my in-laws and husband’s household stay.

- Though we love our present home, I look ahead to a smaller dwelling. Ideally, in 3 years we are going to downsize to a house that we are able to buy outright with the fairness we now have on this dwelling.

- Each youngsters out of the home with jobs and medical health insurance.

- I need a easy life; a giant backyard, cooking most meals at dwelling, time with household.

- We wish to journey some, however are good at utilizing factors and minimizing journey prices.

3) Profession:

- I don’t consider I’ll ever re-enter academia. I may search a job that makes use of my tutorial experience sooner or later sooner or later, however it may require further coaching. I’m undecided I’m curious about doing that.

- I may also be completely happy working a part-time job right here and there, associated to my cooking/gardening/dwelling enchancment pursuits.

- I even have just a few concepts for small companies, however I don’t even know the place to start out with evaluating whether or not these are viable choices.

Jane and Joe’s Funds

Revenue

| Merchandise | Variety of paychecks per 12 months | Gross Revenue Per Pay Interval (complete BEFORE all deductions) |

Deductions Per Pay Interval (with quantities) | Internet Revenue Per Pay Interval (complete AFTER all deductions are taken out, equivalent to healthcare, taxes, worker parking, 401k, and so forth.) |

| Joe’s wage | 26 | $3,200 | $158 well being and dental; $290 401K contributions; $708 taxes | $2,044 |

| Joe’s added revenue as musician (approximate) | 1 | $2,500 | Taxes | $1,500 |

| Annual Gross complete: | $85,700 | Annual Internet complete: | $54,644 |

Mortgage Particulars

| Merchandise | Excellent mortgage stability (complete quantity you continue to owe) |

Curiosity Charge | Mortgage Interval and Phrases | Fairness (quantity you’ve paid off) | Buy value and 12 months |

| Mortgage | $174,679 | 2.63% | 15-year fixed-rate mortgage | Zestimate – owed = $250K ($425K-$175K) | $325; bought in 2017 |

Money owed: $0

Belongings

| Merchandise | Quantity | Notes | Curiosity/sort of securities held/Inventory ticker | Title of financial institution/brokerage | Expense Ratio (applies to funding accounts) | Account Kind |

| Jane’s 403b | $822,488 | By the job I left; accessible with no penalty at age 55 if wanted. | 60% giant cap fairness index, 19% world fairness index, 16% small-mid fairness, 1% core bond index | Voya | .02%, .09%, .03%, .02% | Retirement |

| Joe’s 403b | $158,013 | Rolled over from earlier jobs | 100% FNILX | Constancy | 0% | Retirement |

| Joe’s Roth IRA | $88,137 | 100% FNILX | Constancy | 0% | Retirement | |

| Jane’s rollover IRA from a earlier job | $76,243 | 97% FZROX; 3% SPAXX | Constancy | 0% (FZROX) .1% (SPAXX) | Retirement | |

| Jane’s 457b | $69,473 | By the job I left; accessible now with no penalty | 70% Massive US Caps; 15% Small-Mid US Caps; 15% Non-US Shares | Empower | .01%, .01%, .05% | Retirement |

| Financial savings Account | $46,308 | Our “cushion” or Emergency Fund | 100% FDRXX | Constancy | 0.34% | Money |

| Joe’s 401K | $14,894 | Present job; he shall be absolutely vested in August, and at the moment places in 5% with a 5% match | Prudential | Retirement | ||

| Jane’s Roth IRA | $13,900 | 100% FZROX | Constancy | 0% | Retirement | |

| Checking Account | $4,249 | Busey | Money | |||

| Whole: | $1,293,705 |

Autos

| Automobile make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| Toyota Highlander 2010 | $8,700 | 210,000 | sure |

| Honda Match 2007 | $2,500 | 199,000 | sure |

| Whole: | $11,200 |

Bills

| Merchandise | Quantity | Notes |

| Mortgage with Escrow (together with insurance coverage) | $2,265 | approaching $1K in precept per thirty days |

| Groceries | $700 | consists of family provides |

| Well being care prices (to get to deductible) | $400 | |

| Automotive bills | $375 | $200/mo for fuel and $175 for upkeep or saving for brand spanking new automobile |

| Water/Sewer/Trash | $250 | Avg per thirty days. One thing is unsuitable with our water payments; they’re exorbitant. We’re working to determine why. |

| Electrical (decreased fee b/c partially photo voltaic) & Gasoline | $214 | avg per thirty days |

| Consuming out | $200 | |

| Son’s Sports activities Staff | $169 | month-to-month |

| Photo voltaic (photo voltaic sharing via NexAmp) | $155 | avg per thirty days |

| Journey | $150 | journey bills not coated by rewards factors; home journey this 12 months |

| Clothes | $120 | |

| Items and Holidays | $100 | |

| Auto insurance coverage (State Farm) | $75 | 2 drivers solely at the moment, will add one driver in June. Full protection on each autos. $900/12 months |

| Cell telephones (4 traces with Mint) | $65 | 4 traces with the MVNO Mint Cell |

| Haircuts | $60 | lower for Jane and Joe each different month, much less typically for teenagers, who put on their hair lengthy |

| Leisure | $50 | occasion tickets |

| sprinkler system | $19 | Month-to-month; activate and off as soon as per 12 months = $236 |

| Membership | $19 | botanical backyard ($225) |

| Pet bills | $18 | For the parrot |

| Subscription: Spotify | $10 | month-to-month |

| Month-to-month subtotal: | $5,414 | |

| Annual complete: | $64,965 |

Anticipated Social Safety

| Merchandise | Month-to-month Quantity | 12 months and age you’ll start taking SS |

| Joe’s anticipated Social Safety | $2,344 | at 67, in 2038 |

| Jane is not going to be eligible for SS as a result of she didn’t pay in for most up-to-date job (20 yrs) and because of the Windfall Elimination Provision (WEP) | $0 | Notice that that is actually complicated to lots of people, however I’ve executed quite a lot of analysis on it and talked to the SSA, and I’m fairly assured that is true. It’s uncommon for college college to not pay into SS, however that was the case in my college system. I don’t know the precise quantity, however I’d need to pay a considerable quantity into SS between now and retirement age with a view to not be topic to the WEP. |

| Annual complete: | $28,128 |

Credit score Card Technique

| Card Title | Rewards Kind? | Financial institution/card firm |

| Capital One Enterprise (Jane) | Journey | Capital One |

| Capital One Enterprise (Joe) | Journey | Capital One |

Jane’s Questions For You:

1) After I left my profession, I felt assured in our aim to “coast FI”; my husband would proceed to work and I’d keep dwelling for no less than a 12 months after which work out what was subsequent. However that one-year mark shall be upon us very quickly.

- How can I work out after I want to return to work and the way a lot I’d must make?

- To what extent will my age and employment hole be an issue as my time away from work lengthens?

- Notice that I in all probability can’t return to work full-time for no less than one other 12 months as my daughter wants extra time and a spotlight to get to a spot the place she’s thriving.

2) After finishing the worksheets for this Case Examine, I see some apparent locations for saving cash, however I’d love the readers’ concepts, too!

2) After finishing the worksheets for this Case Examine, I see some apparent locations for saving cash, however I’d love the readers’ concepts, too!

3) How does one start to discover self-employment?

- My concepts:

- Searching for out shoppers for whom I may prepare dinner (I already prepare dinner dinner each night time…why not prepare dinner the identical for an additional household or two?)

- Creating an internet site of homeschool-related content material

- Making an attempt to do some consulting associated to my tutorial areas of experience and… many different concepts!

4) How can we use what we find out about our monetary scenario to tell our alternative of insurance coverage?

- My husband has a ton of choices accessible via his employer and we went with the most cost effective possibility that features an HSA as a result of I believed that’s what FIRE of us did.

- Nevertheless, I’m undecided that is the precise alternative as we’re not in a spot to make the most of the HSA as an funding car and we now have a very giant deductible.

5) What can we do with our “cushion” of money that we’re planning to make use of to complement my partner’s revenue for us to stay on?

- It’s at the moment not incomes any curiosity.

- Notice that the cushion serves as our Emergency Fund, and we now have two different locations from which we are able to draw with out penalty (my 457 and each of our Roth IRA’s–principal solely).

6) Ought to our retirement accounts be shifting away from equities, given our age? I understand there are a lot of opinions on this, however I’d love to listen to yours and what the hive thoughts thinks.

Liz Frugalwoods’ Suggestions

I’m delighted to have Jane and Joe as at present’s Case Examine!

Jane’s Query #1: When do I want to return to work and the way a lot do I must earn?

This relies on how a lot Jane and Joe need/must spend each month. At current, their month-to-month spending outstrips their revenue; however, that’s one thing they may change in the event that they needed to. If Jane would like not to return to work–and to as a substitute dedicate her time to her youngsters and doubtlessly pursuing self-employment–all they should do is deliver their spending into alignment with Joe’s wage.

Present Annual Bills ($64,965) – Present Annual Revenue ($54,644) = $10,321 deficit

Let’s check out Jane and Joe’s bills to see if we are able to shut this hole. Anytime an individual needs to spend much less, I encourage them to outline all of their bills as Mounted, Reduceable or Discretionary:

- Mounted bills are stuff you can not change. Examples: your mortgage and debt funds.

- Reduceable bills are crucial for human survival, however you management how a lot you spend on them. Examples: groceries, utilities and fuel for the automobile.

- Discretionary bills are issues that may be eradicated solely. Examples: journey, haircuts, consuming out.

To remain inside Joe’s wage, they’d must restrict their spending to a most of $4,553.66 per thirty days. I categorized Jane and Joe’s bills and got here up with the under proposed plan of how they may accomplish this:

| Merchandise | Quantity | Notes | Class | Proposed New Quantity |

| Mortgage with Escrow (together with insurance coverage) | $2,265 | approaching $1K in precept per thirty days | Mounted | $2,265 |

| Groceries | $700 | consists of family provides | Reduceable | $600 |

| Well being care prices (to get to deductible) | $400 | Mounted (I assume?) | $400 | |

| Automotive bills | $375 | $200/mo for fuel and $175 for upkeep or saving for brand spanking new automobile | Reduceable | $275 |

| Water/Sewer/Trash | $250 | Avg per thirty days. One thing is unsuitable with our water payments; they’re exorbitant. We’re working to determine why. | Reduceable | $175 |

| Electrical (decreased fee b/c partially photo voltaic) & Gasoline | $214 | avg per thirty days | Reduceable | $200 |

| Consuming out | $200 | Discretionary | $50 | |

| Son’s Sports activities Staff | $169 | month-to-month | Discretionary | $169 |

| Photo voltaic (photo voltaic sharing via NexAmp) | $155 | avg per thirty days | Reduceable (I assume?) | $100 |

| Journey | $150 | journey bills not coated by rewards factors; home journey this 12 months | Discretionary | $25 |

| Clothes | $120 | Discretionary | $20 | |

| Items and Holidays | $100 | Discretionary | $10 | |

| Auto insurance coverage (State Farm) | $75 | 2 drivers solely at the moment, will add one driver in June. Full protection on each autos. $900/12 months | Reduceable | $75 |

| Cell telephones (4 traces with Mint) | $65 | 4 traces with the MVNO Mint Cell | Mounted. Option to go on utilizing an inexpensive MVNO!!!! | $65 |

| Haircuts | $60 | Minimize for Jane and Joe each different month, much less typically for teenagers, who put on their hair lengthy | Discretionary | $10 |

| Leisure | $50 | occasion tickets | Discretionary | $10 |

| sprinkler system | $19 | Month-to-month; activate and off as soon as per 12 months = $236 | Mounted (I assume?) | $19 |

| Membership | $19 | botanical backyard ($225) | Discretionary | $19 |

| Pet bills | $18 | For the parrot | Mounted | $18 |

| Subscription: Spotify | $10 | month-to-month | Discretionary | $10 |

| Month-to-month subtotal: | $5,414 | Month-to-month subtotal: | $4,515 | |

| Annual complete: | $64,965 | Annual complete: | $54,180 |

Fortunately, Jane and Joe have comparatively low Mounted bills, which implies it’s absolutely inside their energy to cut back the Reduceable and Discretionary objects to suit inside Joe’s take-home pay. Woohoo! Whether or not they wish to scale back/remove these things is completely as much as them, however it’s technically doable for them to stay on Joe’s wage alone–and to stay properly!

Moreover, Jane famous that they intend to downsize houses in ~3 years and doubtlessly purchase a smaller dwelling outright. That will be a serious game-changer since their largest expense–by far–is their $2,265 mortgage fee.

Thus, it turns into a query of private desire and priorities:

- Would Jane reasonably return to work with a view to preserve their present spending degree?

- Would Jane reasonably scale back the household’s bills with a view to stay on Joe’s wage alone and thus not must go ever again to work?

After all there are additionally loads of in-between choices–equivalent to part-time work or partial expense reductions–that the household must also contemplate.

However Wait, This Price range Wouldn’t Embrace Any Financial savings!

Nicely, truly it does as a result of Joe continues to be placing a pre-tax wage deduction into his 401k each pay interval! Woohoo once more! Jane and Joe have executed such an incredible job of saving and investing over time that they’ll be completely nice if they only proceed Joe’s 401k contributions and spend the remainder of his wage. They’d basically be doing a type of reverse model of Coast FIRE.

Nicely, truly it does as a result of Joe continues to be placing a pre-tax wage deduction into his 401k each pay interval! Woohoo once more! Jane and Joe have executed such an incredible job of saving and investing over time that they’ll be completely nice if they only proceed Joe’s 401k contributions and spend the remainder of his wage. They’d basically be doing a type of reverse model of Coast FIRE.

Let’s check out the remainder of their belongings to make sure they’ll be okay not saving something past Joe’s 401k contributions.

Asset Rundown

1) Money: $50,557

Between their two money accounts, the couple has $50,557 in money. Nicely executed! The one draw back is that that is technically an overbalance of money. What do I imply by that? Isn’t extra cash all the time higher?!? Nicely, yay and nay.

→The largest draw back to preserving a lot cash in money is the chance price.

Having this a lot money solely is smart if:

- You plan to give up your jobs and never instantly discover one other;

- You could have main bills deliberate for the near-term, equivalent to: shopping for a home, shopping for a automobile, a big HOA evaluation, and so forth.

Outdoors of those two eventualities, it turns into an enormous alternative price linked with the truth that your money is dropping worth day-after-day since it’s not maintaining with inflation.

Whereas is can really feel instinctively “protected” to carry onto quite a lot of money, there’s a hazard to doing so. Once you’re overbalanced on money, you’re lacking out on the potential funding returns you’d take pleasure in in case your cash was as a substitute invested in, for instance, the inventory market.

How A lot Ought to They Preserve In Money?

Your money equals your emergency fund and your emergency fund is your buffer from debt:

- An emergency fund ought to cowl (at minimal) 3 to six months’ price of your spending.

- At Jane and Joe’s present month-to-month spend fee of $5,414, they need to goal having an emergency fund of $16,242 to $32,484.

- In the event that they determine to cut back their spending to stay on Joe’s wage, their emergency fund can commensurately scale back to someplace between $13,545 and $27,090.

All that being mentioned, if they’d reasonably preserve this cash in money (and perceive the dangers to doing so), they will. Level right here is that they don’t want to save lots of up any extra cash, which is why I’m comfy suggesting the above finances that entails them spending all of Joe’s wage.

What To Do With This Money

No matter what the couple decides about Jane remaining retired, they should do one thing with this money that’ll leverage it indirectly.

No matter what the couple decides about Jane remaining retired, they should do one thing with this money that’ll leverage it indirectly.

→On the very, very least, they need to transfer this money right into a high-yield financial savings account that’ll earn them curiosity. There are various accounts on the market providing nice rates of interest proper now.

For instance, as of this writing, the American Categorical Private Financial savings account earns a whopping 3.90% in curiosity (affiliate hyperlink). Because of this in a single 12 months, their $50,557 would earn $1,972 in curiosity!

Relying on what they determine to do by way of Jane’s retirement, they will additionally contemplate brief to medium time period funding choices, equivalent to CDs, Cash Market Accounts, and Authorities Bonds. With all kinds of investments, you’re trying to maximize your return, however be certain that the time horizon works in your plans. It’s type of like a ladder or hierarchy of choices:

- On the most accessible finish are high-yield financial savings accounts as a result of you’ll be able to withdraw your cash at any time, in any quantity and with no penalty.

- In any case accessible finish are retirement investments as a result of you must be age 59.5 earlier than you’ll be able to withdraw your cash with out penalty.

- Within the center are brief and medium-term funding choices, which may make quite a lot of sense when you anticipate needing this cash in, say, three years with a view to purchase a brand new automobile.

2) Retirement: $1,243,148

Jane and Joe have a grand complete of $1.2M between their varied retirement accounts, which is implausible.

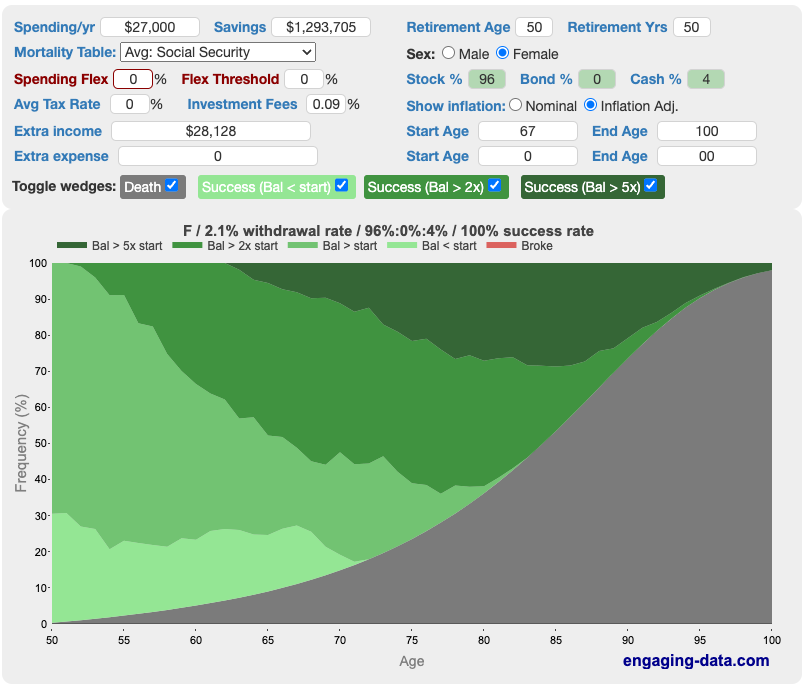

For enjoyable, I ran a calculation via Partaking Knowledge’s Wealthy, Broke or Lifeless calculator to see what would occur if Joe additionally absolutely retired tomorrow:

What we see right here is that if Joe had been to hitch Jane in retirement tomorrow, the couple has a 96% probability of success (in different phrases, of not working out of cash earlier than they die). That’s a fairly good probability of success!

This success fee is predicated on the variables of:

- Joe and Jane decreasing their annual spending to a most of $54,180.

- Each of them retiring at age 50 and residing to age 100

- Their present asset allocation of 96% shares and 4% money

- Joe starting to take Social Safety at age 67 at (an inflation-adjusted) $28,128 per 12 months

- Jane not receiving any Social Safety

- Neither of them working one other day of their lives

In mild of that, I’d say they’re in nice form! There are some caveats to this calculation, however it ought to give them the arrogance that they’ve loads of cash invested for retirement and that, in the event that they’re keen to cut back their spending, Jane doesn’t want to return to work (and neither does Joe!).

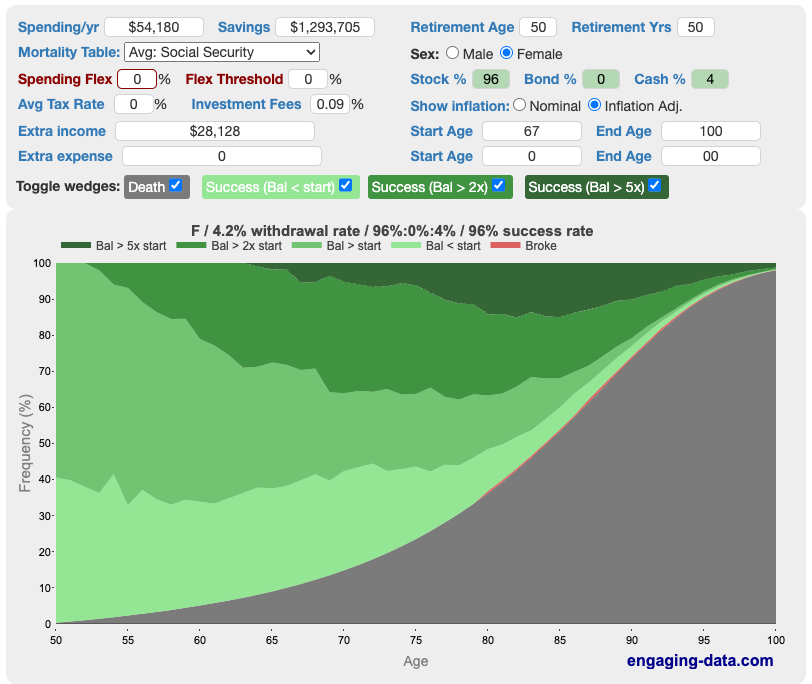

I’ll additionally level out that, in the event that they scale back their spending even additional–for instance after they draw back and remove their giant mortgage fee–their success fee will increase to 100%:

-

- They at the moment spend 27180 yearly on their mortgage fee

- With out that, their annual spending may dip to a meagre $27,000!!!

Right here’s the chart:

However Wait, Isn’t Most of Their Cash Tied Up In Retirement Accounts?!?

Nicely, sure and in addition no. Jane and Joe have a beautiful medley of accounts and so they’re all ruled by barely totally different guidelines.

1) Jane’s 457b: $69,473

In 457b plans, you’re allowed to withdraw cash penalty-free earlier than age 59.5, after you allow the employer who sponsors the plan. Therefore, if an individual plans to retire sooner than age 59.5, there’s an actual benefit to having a 457b. Resulting from this reality, this $69k might be spent by Jane and Joe at any time, with out penalty. In mild of that, from right here on out, they will contemplate this in the identical class as every other non-retirement (aka taxable) funding.

In 457b plans, you’re allowed to withdraw cash penalty-free earlier than age 59.5, after you allow the employer who sponsors the plan. Therefore, if an individual plans to retire sooner than age 59.5, there’s an actual benefit to having a 457b. Resulting from this reality, this $69k might be spent by Jane and Joe at any time, with out penalty. In mild of that, from right here on out, they will contemplate this in the identical class as every other non-retirement (aka taxable) funding.

Notice that you simply do pay taxes in your withdrawals, however that is normally nice as a result of–presumably–by the point you’re withdrawing the cash, you’re retired and thus, your revenue and tax fee are decrease.

2) Jane and Joe’s mixed Roth IRAs: $102,037

In accordance with Charles Schwab, listed below are the principles for withdrawing previous to age 59.5:

You’ll be able to withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. Nevertheless, you will have to pay taxes and penalties on earnings in your Roth IRA.

Thus, Jane and Joe may withdraw the contributions they’ve made to their Roth IRAs, with out penalty, at any time.

3) Jane’s IRA: $76,243

If extra cash is required, Jane can contemplate a backdoor Roth IRA technique whereby you exchange a standard IRA right into a Roth. This is usually a very excessive tax occasion, so tread rigorously.

How Would This Work?

Based mostly on the low annual expense estimates above, this could carry them via to age 59.5, at which period they will start withdrawing from their 401k and 403bs with out penalties.

- Let’s say they look ahead to Joe to retire till they’ve downsized and eradicated their mortgage fee, bringing their annual bills to $27k.

- They first spend down their extra $50,557 in money (above their emergency fund, which at that time would have to be within the vary of $6,750 to $13,500, which leaves $37,057), which’ll cowl their bills for 1.37 years.

- Then, they start spending down Jane’s $69,473 457b, which’ll cowl their bills for one more 2.57 years.

- We’re now at ~4 years, which implies the couple is no less than 54 (doubtlessly older relying on when Joe retires).

- They’ll now take a look at withdrawing their contributions to their $178,280 in IRAs.

- And this quantity will truly be much more since Jane ought to rollover her outdated 403b (which has $822,488 in it) into an IRA.

→I wish to be clear that that is very “again of the envelope” math since we’re not taking quite a lot of variable elements under consideration. However, I hope that this factors Jane and Joe in the precise path for future analysis if that is one thing they wish to contemplate.

The Significance Of Diversifying Your Belongings

One thing I wish to spotlight is the dearth of diversification in Jane and Joe’s asset portfolio.

One thing I wish to spotlight is the dearth of diversification in Jane and Joe’s asset portfolio.

- They at the moment have all of their investments in retirement-specific autos.

- 100% of those are invested in equities (except 1% of Jane’s 403b in bonds)

Each of those are good issues to do–and to be clear, Jane and Joe have executed an A+ job of choosing funds with very low expense ratios!

Nevertheless, this falls underneath a “placing your whole eggs in a single basket” funding strategy. As with most issues in life, diversification is an efficient factor. The best and most easy method for them to diversify can be to place cash right into a taxable funding account, which is invested within the inventory market, however is just not retirement-specific. With a taxable account, you’re not beholden to the principles governing retirement accounts.

In distinction to retirement autos (equivalent to 401k, 403bs, IRAs, and so forth), taxable accounts:

- Don’t have any restrict on how a lot you’ll be able to put into them

- Don’t have any restrictions on when you’ll be able to withdraw the cash

- Are taxed (therefore their identify)

- Since they’re not via an employer, you’ll be able to make investments them in no matter you need (inventory, bonds, ETFs)

- Do not need any required minimal distributions (RMDs), which implies you’ll be able to go away your cash invested for so long as you need

→Since there are benefits and drawbacks to retirement and taxable accounts, it’s a good suggestion to have each.

They function in several methods and thus can serve you in several methods and totally different conditions. Forbes has this easy-to-understand article on taxable funding accounts when you’d wish to be taught extra

When do you have to open a taxable funding accounts?

In case you’ve already:

- Paid off all high-interest debt

- Saved up a fully-funded emergency fund (held in a checking or financial savings account)

- Maxed out all doable retirement accounts

- Don’t want this money within the close to future for a serious buy (equivalent to a home)

Then… you’ll be able to contemplate opening a taxable funding account!

I outlined above why you don’t wish to preserve large quantities of money available, and our final Case Examine detailed brief and medium-term investments to contemplate, equivalent to: CDs, Treasury Bonds and Cash Market Accounts. So at present, let’s speak about this different, longer-term funding possibility: the taxable account. I can really feel your enthusiasm already!!!

The place and How Do I Open A Taxable Funding Account?

Fortunately, you are able to do this by yourself by way of the world large net!

Fortunately, you are able to do this by yourself by way of the world large net!

- Select a brokerage:

- That is the place via which you make investments your cash. For instance: Constancy, Vanguard and Charles Schwab are all brokerages.

- If you have already got accounts (equivalent to your 401k) with a brokerage, it’ll be best to open a taxable funding account with them.

- Nevertheless, you wish to first be certain that the brokerage you choose provides low-fee funds.

- Select what you wish to make investments your cash in:

- Issues to contemplate when selecting what to spend money on:

- Your threat tolerance. Investing within the inventory market is inherently dangerous. Would you be extra comfy with lower-risk, lower-reward choices, equivalent to bonds? Or higher-risk, higher-reward choices, equivalent to shares?

- Your age. How quickly are you anticipating withdrawing a share this cash? As mentioned on this Case Examine, many consultants contemplate 4% to be a protected fee of withdrawal.

- The charges related to the funds you’re contemplating. Excessive charges (referred to as “expense ratios”) will eat away at your cash over time. DO NOT do this to your self! For reference, the next three brokerages and funds are thought-about to be low-fee funding choices:

- Constancy’s Whole Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Whole Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Whole Market Index Fund (VTSAX) has an expense ratio of 0.04%

- Questioning the right way to discover a fund’s expense ratio? Try the tutorial on this Case Examine.

- Issues to contemplate when selecting what to spend money on:

Ought to I spend money on particular person shares or complete market index funds?

For me personally, I choose a complete market, low-fee index fund that matches my asset allocation wants and threat tolerance. The reason being that, typically, investing in a complete market index fund offers you the broadest doable publicity to the inventory market (in addition to the bottom charges).

→In a complete market index fund, you’re basically invested in a teensy bit of each single firm within the inventory market, which supplies you a ton of range.

If one firm–and even one sector–tanks, your total portfolio isn’t toast. It’s the “not placing your whole eggs in a single basket” model of investing. It’s what I do, it’s what the overwhelming majority of FIRE of us do and, better of all, it’s very, very straightforward to implement and preserve.

Along with complete market index funds, many people wish to have a few of their portfolio in one thing like a complete bond ETF, as a result of bonds are a lower-risk (though additionally lower-reward) funding car.

Is it Clever to Spend money on Particular person Shares?

For my part, completely not. Why? as a result of if that one firm goes down, your funding plummets. If Apple or Amazon or Netflix or whoever has a foul quarter, you have a foul quarter. If you’re as a substitute invested throughout the complete inventory market, firms can go bankrupt and your portfolio will nonetheless bob together with the broader inventory market. Investing in a person inventory is “placing your whole eggs in a single basket.”

I contemplate investing in particular person shares to be a interest, not a monetary technique. In case you actually take pleasure in day buying and selling and wish to do it for enjoyable, go proper forward! However I wouldn’t do it with cash I want. For my part, it’s not a lot safer than going to a on line casino.

When Ought to You Use Your Taxable Investments?

Ideally, you’ll preserve this cash invested till you retire. Once you retire, you’ll be able to start to drawdown a share of those funds every year to cowl your residing bills. As you close to retirement, you’ll wish to scale back the chance publicity of those investments so that you simply’re buffered from any main market downturns within the run-up to your retirement. Folks solely “lose all of it” within the inventory market after they promote their shares at a loss and take a success.

Ideally, you’ll preserve this cash invested till you retire. Once you retire, you’ll be able to start to drawdown a share of those funds every year to cowl your residing bills. As you close to retirement, you’ll wish to scale back the chance publicity of those investments so that you simply’re buffered from any main market downturns within the run-up to your retirement. Folks solely “lose all of it” within the inventory market after they promote their shares at a loss and take a success.

I understand it is a lot to attempt to cowl in a single publish, so I extremely advocate the e book, The Easy Path to Wealth: Your Street Map to Monetary Independence And a Wealthy, Free Life, by: JL Collins, for anybody curious about deepening their information round investing. It’s well-written and straightforward to grasp.

This leads us very properly (virtually like I deliberate it… ) into:

Jane’s Query #6: Ought to our retirement accounts be shifting away from equities, given our age? I understand there are a lot of opinions on this, however I’d love to listen to yours and what the hive thoughts thinks.

Let’s start on the very starting

What’s An Fairness?

Equities, on this context, are the identical as shares. In case you personal shares/equities, you personal a bit of an organization. As I famous above, shares are typically thought-about to be extra aggressive, however extra rewarding. Conversely, bonds are thought-about to be much less aggressive, however much less rewarding.

It’s like a sliding scale of threat vs. reward. You, the investor, need to determine the place you wish to be on this scale.

Portray with a VERY broad brush; typically:

Portray with a VERY broad brush; typically:

- Once you’re younger and have a few years earlier than retirement, you wish to be very aggressive in your investing. The thought being that you simply’ll be capable to trip out the inevitable ups and downs of the inventory market because it’ll be many many years earlier than it is advisable withdraw any of this cash.

- Then, as you close to retirement, you wish to titrate your threat/aggression to make sure that you don’t lose cash if the market experiences a dip simply previous to your retirement.

HOWEVER, as with all issues, there are differing opinions on the knowledge of decreasing threat (and consequently reward) in a portfolio as you age.

Vanguard has this good chart, which lets you search all of their funds in accordance with threat degree. As you’ll see, there are a variety of various bonds and cash market accounts one can select from.

Equally, Constancy has this very useful web site outlining their varied funds by threat degree. It allows you to take a look at totally different constructions of funds in a pattern portfolio in accordance with their threat degree. As I famous above, diversification is sweet, which you’ll see mirrored in Constancy’s mannequin portfolios. Probably the most conservative portfolio they mannequin consists of quite a lot of bonds and their most aggressive has all shares and no bonds. Then, there are a bunch of pattern portfolios in between.

What Ought to Jane Do?

I’ll reiterate that range is an efficient factor. I personally am not 100% in home index funds as a result of I wish to play the sphere. I’ve obtained some worldwide index funds (which you should purchase proper via your helpful, dandy brokerage), I’ve obtained some bonds, I’ve obtained all of it–even one solitary Bitcoin! The thought, right here once more, is to unfold out the chance and never rely solely on one supply or sector.

Rollover The Previous 403b

Jane must also look into rolling over her outdated 403b into an IRA in order that she will have full management over the funds she’s invested in.

Right here’s how to try this:

- Name the brokerage (or do it on-line) that at the moment holds the 403b to ask about doing a “direct rollover” into a standard IRA at one other brokerage. Since Jane and Joe have already got quite a lot of accounts with Constancy, I assume that’s the place she’ll wish to put it.

- You’re seemingly not going to wish to roll this right into a Roth IRA since you’d then need to pay taxes on the total quantity all on this calendar 12 months (assuming that this 403b is just not a Roth). If it’s a Roth, it may possibly solely be rolled right into a Roth.

- The brand new brokerage (Constancy) will wish to know what you wish to make investments your rollover IRA in.

I like this text explaining rollovers: Your Information to 401(okay) and IRA Rollovers.

Abstract:

- Decide their high precedence:

- If Jane needs to stay retired, she completely can. The household can scale back their spending to permit them to stay simply on Joe’s wage.

- If Jane needs to return to work, she completely ought to.

- If Joe additionally needs to retire proper now, he may!

- On this occasion, the household would wish to cut back their spending and in addition analysis among the retirement vehicle-to-cash conversions I outlined above.

- This math will get even simpler after they downsize and remove their giant mortgage fee.

- They’d additionally must analysis what their state provides for medical health insurance via the Reasonably priced Care Act. The ACA is just not a boogeyman and it’s a very nice solution to get your medical health insurance. It’s, in spite of everything, what I do for my household. The problem is that it’s ruled by every state and, as such, the prices and subsidies fluctuate wildly by state. They’ll analysis this via their state’s ACA web site.

- Look into diversifying their investments, doubtlessly to lower-risk, decrease reward avenues, equivalent to bonds. Additionally contemplate opening a taxable funding account to offer them extra flexibility.

- Determine what to do with their monumental money cushion:

- If Joe needs to retire now, they may use this to cowl residing bills for awhile (and thus keep away from withdrawing something from their investments). In the event that they go this route, they need to transfer this cash right into a high-yield financial savings account in order that they’re no less than incomes curiosity on it.

- In the event that they don’t intend to make use of this cash within the close to future, they need to look right into a extra worthwhile possibility for all the things above their emergency fund, equivalent to:

- Opening a taxable funding account

- Opening a short-term funding car, equivalent to a CD

Okay Frugalwoods nation, what recommendation do you will have for Jane? We’ll each reply to feedback, so please be at liberty to ask questions!

Would you want your personal Case Examine to seem right here on Frugalwoods? Apply to be an on-the-blog Case Examine topic right here. Rent me for a non-public monetary session right here. Schedule an hourlong or 30-minute name with me right here, refer a good friend to me right here, or e mail me with questions ([email protected]).

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e mail inbox.

[ad_2]