[ad_1]

Obtain free International Economic system updates

We’ll ship you a myFT Each day Digest e-mail rounding up the most recent International Economic system information each morning.

Good morning. Shares in Nation Backyard slumped to a file low on Monday after the Chinese language developer suspended buying and selling in not less than 10 of its mainland bonds, spurring a wider sell-off in property-linked shares.

The corporate, previously the biggest developer in China by gross sales, missed worldwide bond funds final week in an indication {that a} two-year liquidity disaster throughout the true property sector was threatening to escalate.

Shares within the group fell as a lot as 18.4 per cent in Hong Kong following an announcement launched over the weekend that mentioned a number of bonds issued by the corporate and its subsidiaries could be suspended from buying and selling this week.

Shares in developer Jinmao Holdings additionally fell as a lot as 9.8 per cent after the corporate issued a revenue warning late on Friday. A Hong Kong index monitoring the mainland property sector dropped as a lot as 4.8 per cent, whereas the broader Grasp Seng index fell 2.5 per cent and China’s CSI 300 shed 1.3 per cent.

Till lately Nation Backyard was seen as a safer prospect than lots of its extremely leveraged friends. Its battle to outlive is an important check of the well being of China’s property sector, and Beijing’s insurance policies in the direction of it, as homebuyer confidence dips.

On Monday analysts at Morgan Stanley downgraded Nation Backyard to underweight, warning that the corporate’s “worsening liquidity might result in larger likelihood of default within the close to time period”. Chinese language officers have stepped up their supportive rhetoric about the true property sector in latest weeks amid considerations over widespread defaults.

Nation Backyard on Friday mentioned it could “spare no effort in self-rescue”. Learn the total story.

-

FT Alphaville: Even when Nation Backyard makes the late fee, it could solely be delaying what seems to be inevitable.

-

Associated: Entities linked to Chinese language conglomerate Zhongzhi have didn’t make funds, sparking concern over the nation’s wealth administration business and its publicity to a troubled property market.

Right here’s what else I’m retaining tabs on in the present day:

-

Financial knowledge: China releases nationwide retail gross sales, industrial output, overseas direct funding, whereas second-quarter GDP figures are due from Japan. Japan’s economic system seemingly grew an annualised 3.1 per cent within the interval from April to June. (Reuters)

-

Outcomes: China Airways and Nationwide Australia Financial institution report earnings.

-

Holidays and anniversaries: Monetary markets in India and South Korea will likely be closed, as each international locations have independence day holidays. As we speak can also be the seventy fifth anniversary of the partition that created the states of Pakistan and India.

-

Ladies’s World Cup: The semi-finals start with Spain vs Sweden. The victor advances to the ultimate on Sunday, the place they’ll play the winner of Wednesday’s Australia vs England match.

5 extra high tales

1. Russia’s central financial institution will maintain an emergency rate of interest assembly on Tuesday after the rouble fell under Rbs100 to the greenback, prompting a squabble amongst policymakers over methods to take care of the financial fallout from the invasion of Ukraine. The extraordinary assembly will happen after the central financial institution mentioned it’d improve its key rate of interest, presently at 8.5 per cent. Learn extra on the rouble’s precipitous slide.

-

Struggle in Ukraine: Russian air strikes triggered a collection of explosions and fires within the Black Sea port metropolis of Odesa, marking the most recent bombardment in a weeks-long marketing campaign aimed toward choking Ukraine’s grain exports to world markets.

2. Saudi Arabia and the United Arab Emirates are shopping for up hundreds of the high-performance Nvidia chips essential for constructing synthetic intelligence software program. The Gulf states’ purchases through state-owned teams come because the world’s main tech corporations rush to acquire the scarce chips. Learn extra on the worldwide AI arms race.

3. Donald Trump is ready to face a possible fourth legal indictment as quickly as this week. A grand jury in Georgia is listening to proof of alleged meddling within the 2020 presidential election and is nearing a last determination, as native authorities have arrange barricades exterior the county’s courthouse in Atlanta. Right here’s extra on the potential new expenses.

4. Markets in Argentina reeled on Monday after the shock victory of Javier Milei, a radical libertarian economist and outsider candidate, within the nation’s major ballot forward of its presidential election in October. Milei received greater than 30 per cent of the vote on pledges to dollarise the nation’s economic system and dramatically reduce spending. Learn extra on Argentina’s “political earthquake”.

5. Big inflows over the previous two weeks to only 4 change traded funds monitoring China’s blue-chip CSI 300 index have prompted hypothesis that Beijing’s “nationwide workforce” is at work attempting to assist the economic system. The hypothesis has been fuelled by a latest pledge from China’s leaders to spice up the economic system and “develop consumption by growing residents’ revenue”. Learn the total story.

The Large Learn

Two types of lithium-ion battery expertise are vying to dominate an business destined to be value tons of of billions of {dollars}. The alternatives of shoppers, politicians and carmakers will play an important position in both cementing China’s grip over the worldwide electrical car market or loosening it and risking a slower, extra pricey vitality transition.

We’re additionally studying . . .

Chart of the day

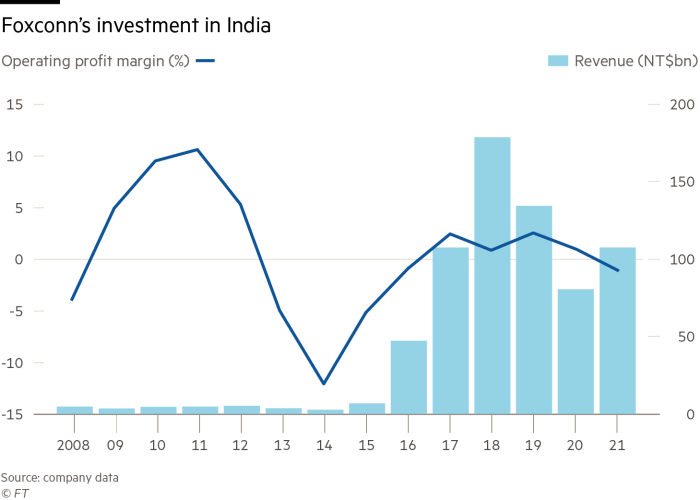

Multinationals’ need for a “China plus one” technique, following provide chain disruptions and geopolitical tensions between Washington and Beijing, is driving iPhone producer Foxconn right into a renewed push into India. However the pivot to India can also be revealing limits to Foxconn’s willingness and talent to diversify.

Take a break from the information

Books tackling the challenges of synthetic intelligence, the race for pure sources and the rise (and fall) of billionaires make the longlist for this yr’s Monetary Occasions and Schroders Enterprise E-book of the Yr Award. Learn the total checklist.

Extra contributions by Grace Ramos and Gordon Smith

Really helpful newsletters for you

Asset Administration — Discover out the within story of the movers and shakers behind a multitrillion-dollar business. Enroll right here

The Week Forward — Begin each week with a preview of what’s on the agenda. Enroll right here

[ad_2]