[ad_1]

We all know life insurance coverage isn’t a simple matter to debate. And should you’re studying this whereas making an attempt to navigate the life insurance coverage coverage of a beloved one who has handed away, you have got our deepest sympathy.

To make issues simpler, we talked with our associates from our Auto-Homeowners Life Insurance coverage Firm to reply your FAQ surrounding how life insurance coverage works. We hope it makes issues somewhat simpler for you.

- How does life insurance coverage work?

- How does life insurance coverage work upon loss of life?

- Does life insurance coverage really pay?

- How lengthy do you pay life insurance coverage earlier than it pays out?

- Can I money in my life insurance coverage earlier than I die?

How does life insurance coverage work?

Basically, you pay for a life insurance coverage coverage, and once you die, that coverage pays the designated people or organizations (beneficiaries) the greenback quantity specified (the loss of life profit) inside the provisions of your coverage.

The loss of life profit, for a private coverage, is commonly utilized by surviving relations to assist cowl funeral bills, repay money owed and assist change misplaced earnings. Relying on how the coverage was arrange, the funds might also assist pay for a dependent’s schooling and different legacy planning priorities specified of their belief.

Some necessary variables to contemplate when selecting a life insurance coverage coverage embrace:

- How lengthy it’s worthwhile to be insured

- The quantity of the loss of life profit

- Whether or not or not the coverage builds money worth

- How lengthy you might be required to pay for the coverage

Relying in your life stage, sure kinds of protection could also be extra interesting to you. So, discover the choices on the market, which embrace three kinds of protection:

Learn extra: Entire Life Insurance coverage vs. Time period: What You Must Know

How does life insurance coverage work upon loss of life?

After the person who is insured beneath the life insurance coverage coverage dies, a member of the family, or designated administrator, must name in a declare to the insurance coverage agent or insurance coverage firm. They’ll possible want a replica of the loss of life certificates and the life insurance coverage coverage quantity.

As soon as the declare is submitted, the designated people or entities can usually anticipate to listen to again from the insurance coverage firm inside a day or so with additional instruction. As soon as the funds are distributed, they will use the cash to cowl funeral bills, repay money owed, assist change earnings and different wants they could have.

If the deceased particular person wished sure funds put aside for particular wants, they could have designated their belief because the beneficiary of their coverage. On this scenario, their belief will present directions on how the funds are for use and you will want to consult with these paperwork to allocate the funds as specified.

Does life insurance coverage really pay?

Sure! Our life insurance coverage associates are keen about serving to households throughout tough occasions.

In fact, there are conditions when a life insurance coverage coverage might not pay the beneficiaries, which can embrace, however will not be restricted to:

- Dying from suicide, if inside the contestability interval

- Materials misrepresentations on the coverage’s software that have an effect on eligibility or charges

(For instance, should you say you don’t have a continual lung situation on the appliance however you’re really taking medicine for bronchial asthma.) - Required premiums weren’t paid to maintain the coverage in pressure

- The coverage was via an employer’s group plan and the person who is insured beneath the life insurance coverage coverage isn’t employed with that firm on the time of their loss of life

- The particular person insured beneath the life insurance coverage coverage died whereas taking part in unlawful actions

Overview the coverage fastidiously for full payout limitations and circumstances.

Learn extra: How A lot Life Insurance coverage Do I Want? [Free Calculator]

How lengthy do you pay life insurance coverage earlier than it pays out?

Brief reply: it is dependent upon your coverage.

Some life insurance coverage insurance policies help you select how lengthy you “pay in” to your coverage. For our entire life insurance coverage insurance policies, we provide Ten Pay and Single Pay choices, which let you pay a specified variety of funds to pay the coverage in full, faster.

So, let’s take a look at an instance.

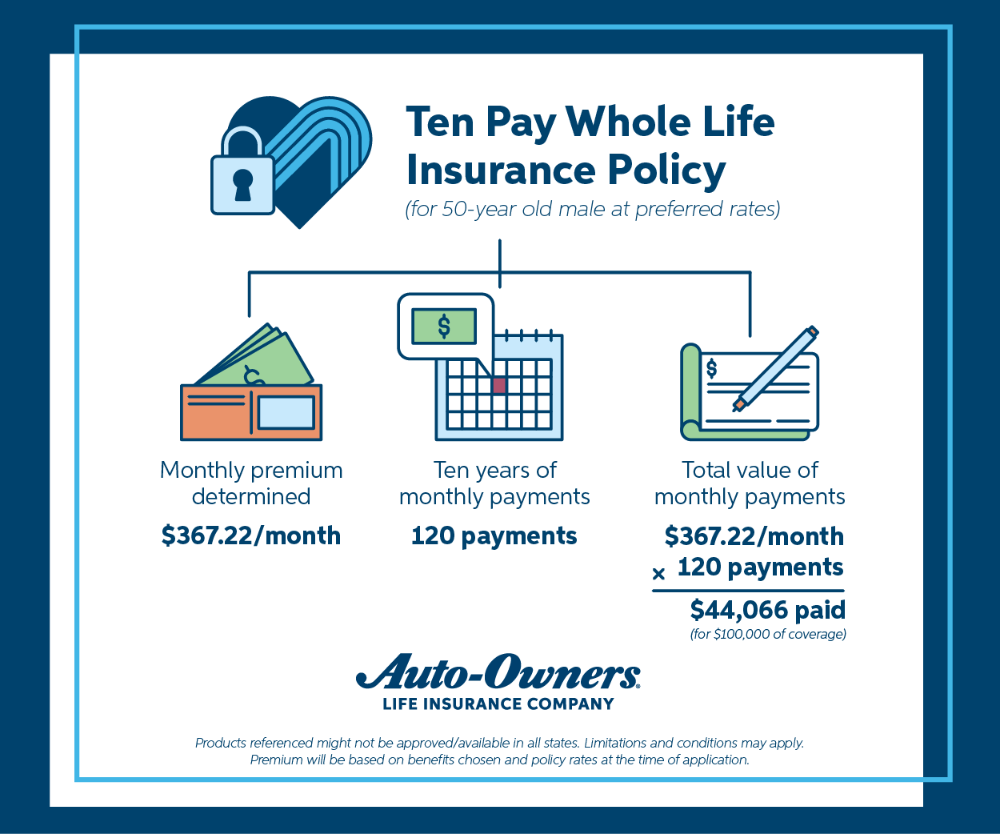

Jack simply turned 50 and determined he wants a life insurance coverage coverage. He purchases an Auto-Homeowners $100,000 Ten Pay entire life coverage at most popular charges, and has a month-to-month premium of about $367.22. *

Jack simply turned 50 and determined he wants a life insurance coverage coverage. He purchases an Auto-Homeowners $100,000 Ten Pay entire life coverage at most popular charges, and has a month-to-month premium of about $367.22. *

Since he selected a Ten Pay coverage, he pays his month-to-month premium ($367.22) for 10 years. That equates to 120 funds (12 month-to-month funds x 10 years = 120 funds).

After he makes his month-to-month funds for 10 years, he’s executed and his coverage is taken into account “paid up.” This implies he can have the $100,000 loss of life profit out there for his beneficiaries upon his loss of life (as much as age 110) and can now not be billed for it.

Time period life insurance coverage insurance policies are related in that you just pay for the time period your coverage gives you protection, which is often 10, 20 or 30 years. These funds are usually smaller than the Ten Pay and Single Pay choices, since you might be getting protection for a shorter specified time frame and making funds on the coverage for the whole time period. Please notice: If the particular person coated by the time period life coverage lives previous the protection interval, the coverage is not going to pay out the loss of life profit because it’s previous the time period.

Can I money in my life insurance coverage earlier than I die?

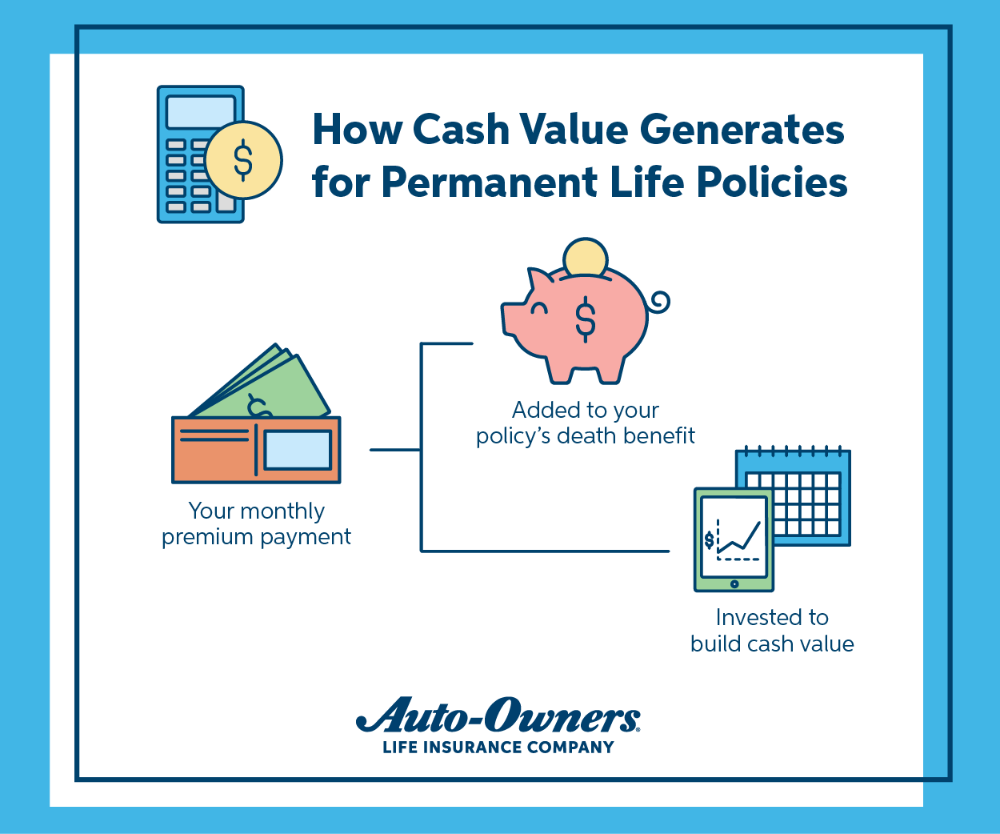

Sure life insurance coverage insurance policies construct a money worth. Everlasting life insurance coverage insurance policies, like our entire life and common life insurance coverage insurance policies, supply this however time period life insurance coverage insurance policies don’t. As you make funds in your entire life or common life insurance coverage coverage, a part of your cost goes towards constructing your money worth. For entire life insurance policies, your money worth builds at a assured rate of interest that’s assigned once you buy your coverage.

You’ll be able to withdraw the money worth or take a mortgage in opposition to your coverage’s money worth to pay for faculty, a home, and many others., whereas the coverage continues to be in pressure. Each of those choices will lower the lump sum your beneficiary receives. With the mortgage choice, you can be charged curiosity on the mortgage. Different fees might also apply when withdrawing coverage money worth.

The money worth is admittedly alleged to operate as a legacy planning account, not a private mortgage, however it may be used that method if wanted.

Learn extra: Is Life Insurance coverage Taxable? Right here’s What You Must Know

Auto-Homeowners Entire Life insurance policies and our Common Life insurance policies supply the flexibility to construct money worth. Moreover, our common life merchandise, Perma Time period® 2 and Perma Time period® 3, give you the flexibility to construction the coverage as a everlasting protection or as a time period!

Every of those merchandise have their very own eligibility necessities, coverages and charges, so speak to your agent about what may match greatest for you.

We’re keen about serving to you present for your loved ones’s future. We all know it’s not a simple matter to debate, which is why we’re right here that will help you navigate it. In case you have questions on an present life insurance coverage coverage or are excited about discovering a coverage, contact your native Bolder Insurance coverage Advisor.

This text offered by Auto-Homeowners Insurance coverage, a Bolder Insurance coverage Accomplice

*Merchandise referenced is probably not authorized/out there in all states. Limitations and circumstances might apply. Premium can be primarily based on advantages chosen and coverage charges out there at time of software.

Disclaimer: This text isn’t knowledgeable recommendation. The evaluation of protection is normally phrases and is outmoded in all respects by the Insuring Agreements, Endorsements, Exclusions, Phrases and Circumstances of the Coverage. Among the protection talked about on this materials is probably not relevant in all states or might need to be modified to adapt to relevant state regulation. Some coverages might have been eradicated or modified for the reason that publishing of this materials. Reductions is probably not out there in all states. Limitations and circumstances might apply. Premiums can be primarily based on advantages chosen. Please verify together with your native Unbiased Auto-Homeowners Insurance coverage Agent for particulars.”

[ad_2]