[ad_1]

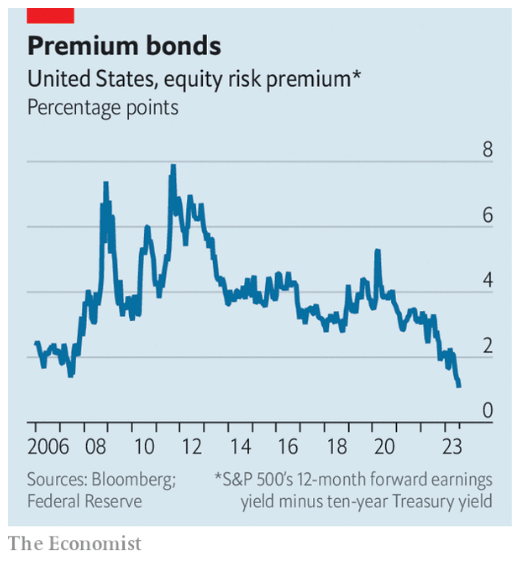

The Economist says by one measure shares are the costliest they’ve been in 5 a long time:

This chart exhibits the fairness threat premium which merely takes the ahead earnings yield (the inverse of the price-to-earnings ratio) and subtracts the ten 12 months treasury yield.

I requested final week if valuations nonetheless matter anymore for the inventory market however this one is sensible intuitively.

Rates of interest are up rather a lot prior to now couple of years. Shares have had a pleasant run. On a relative foundation, bonds are way more engaging now than they’ve been in a really very long time.

So why is the inventory market rising? Why are traders nonetheless allocating a lot cash to equities when the bond market is lastly providing respectable yields?

The easy reply is shares are up and bonds are down.

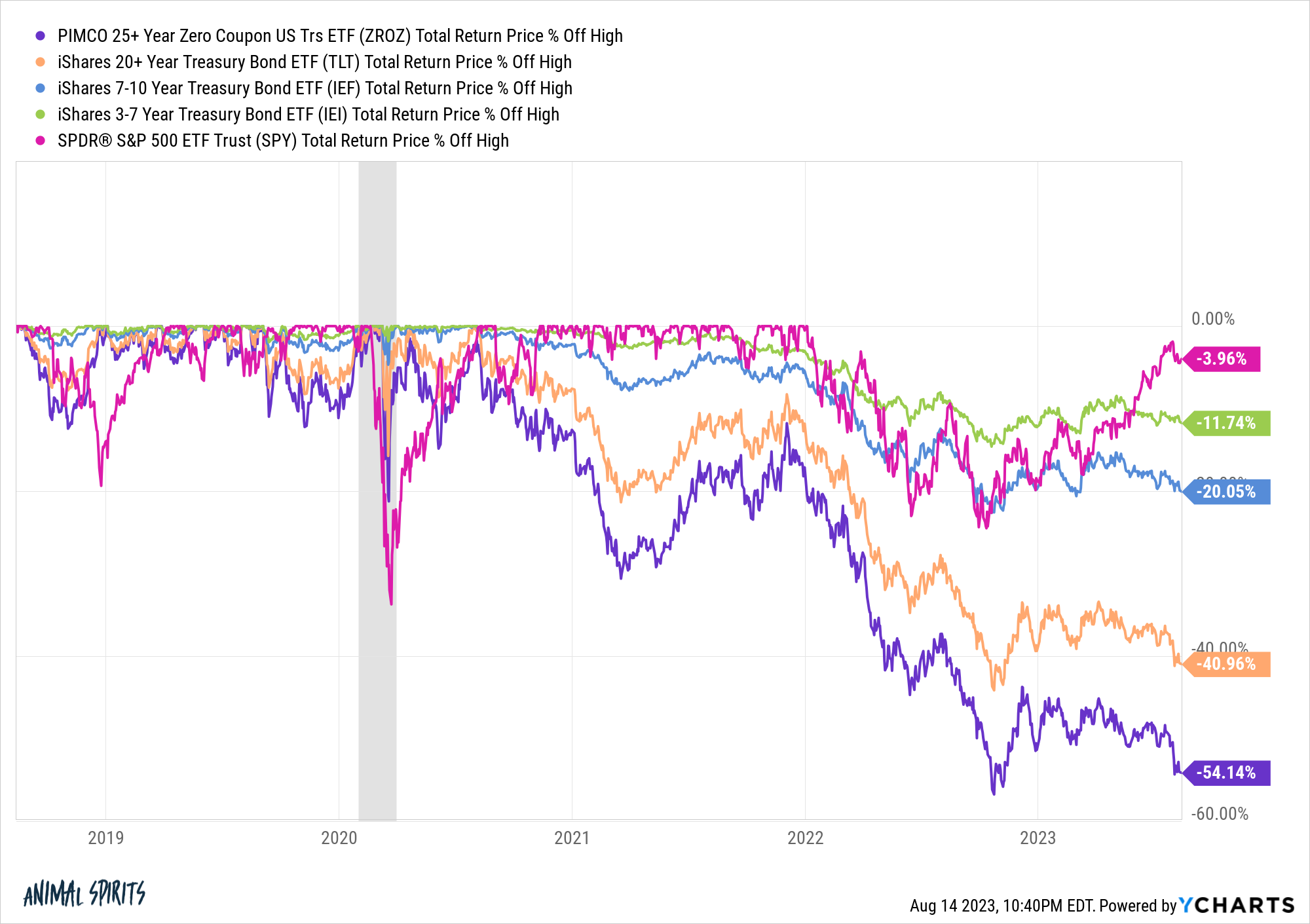

Right here’s a take a look at drawdowns for varied maturities within the bond market together with the S&P 500:

The S&P 500 has basically round-tripped from the bear market.

Lengthy-duration bonds will not be solely nonetheless down — they’re squarely in market crash territory. Even 7-10 12 months treasuries are nonetheless in a bear market.

Traders are used to bear markets for shares. We had one final 12 months, in March 2020, in 2008, in the beginning of this century from the dot-com implosion, to not point out the entire corrections alongside the best way.

Traders have change into conditioned to purchase, or at the least maintain shares, after they’ve fallen. Not everybody has the flexibility to drag this off however historical past has taught inventory market traders that shares at all times come again. Purchase when there’s blood within the streets and so forth.

However we’ve by no means seen something like this within the bond market. Whereas it’s true that increased yields ought to result in increased anticipated returns in mounted revenue, there’s a psychological toll from these losses.

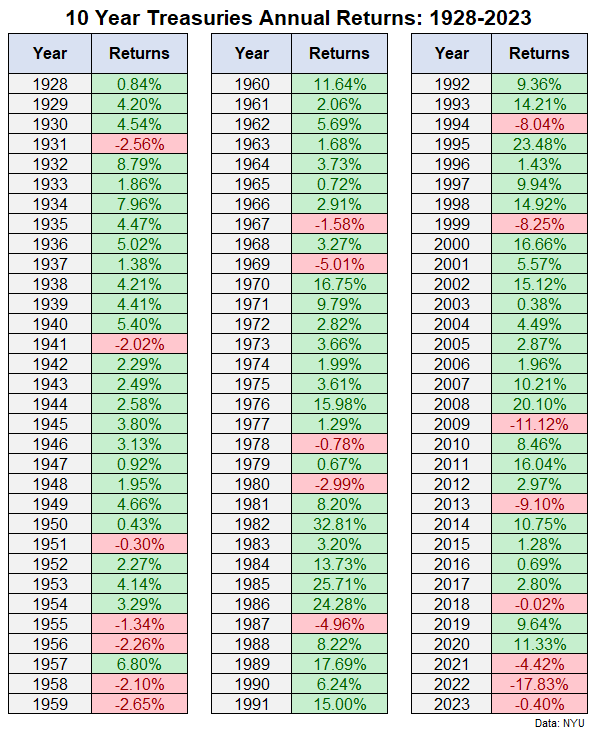

If rates of interest hold rising we might be an unprecedented run of losses within the bond market:

Clearly, 2023 will not be over but however we’re the opportunity of three years in a row of losses within the benchmark U.S. authorities bond.

There was a stretch within the Nineteen Fifties with 4 losses in 5 years however these losses had been all lower than 3%. The cumulative return from 1955-1959 was -1.8%, hardly a cause for alarm.

Aside from that, there hasn’t been one other occasion of back-t0-back losses for 10 12 months treasuries till the previous two years.

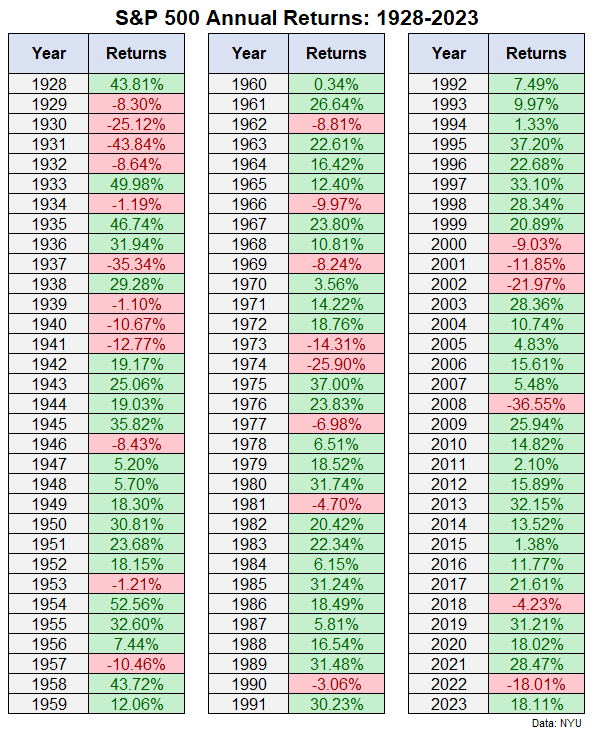

Three down years in a row doesn’t even occur within the inventory market all that always:

The U.S. inventory market fell 4 years in a row from 1929-1932. It was additionally down three years in a row from 1939-1941. The newest back-to-back-to-back losses had been from 2000-2002.

If charges hold rising issues are going to worsen for the bond market earlier than they get higher.

I don’t have the flexibility to foretell the place rates of interest go from right here. There’s a good case to be made that charges may hold shifting increased if the financial acceleration in progress continues.

The excellent news for bond traders in that scenario is that anticipated returns hold proper on rising with even increased yields. The unhealthy information is you’re going to expertise extra losses within the meantime.

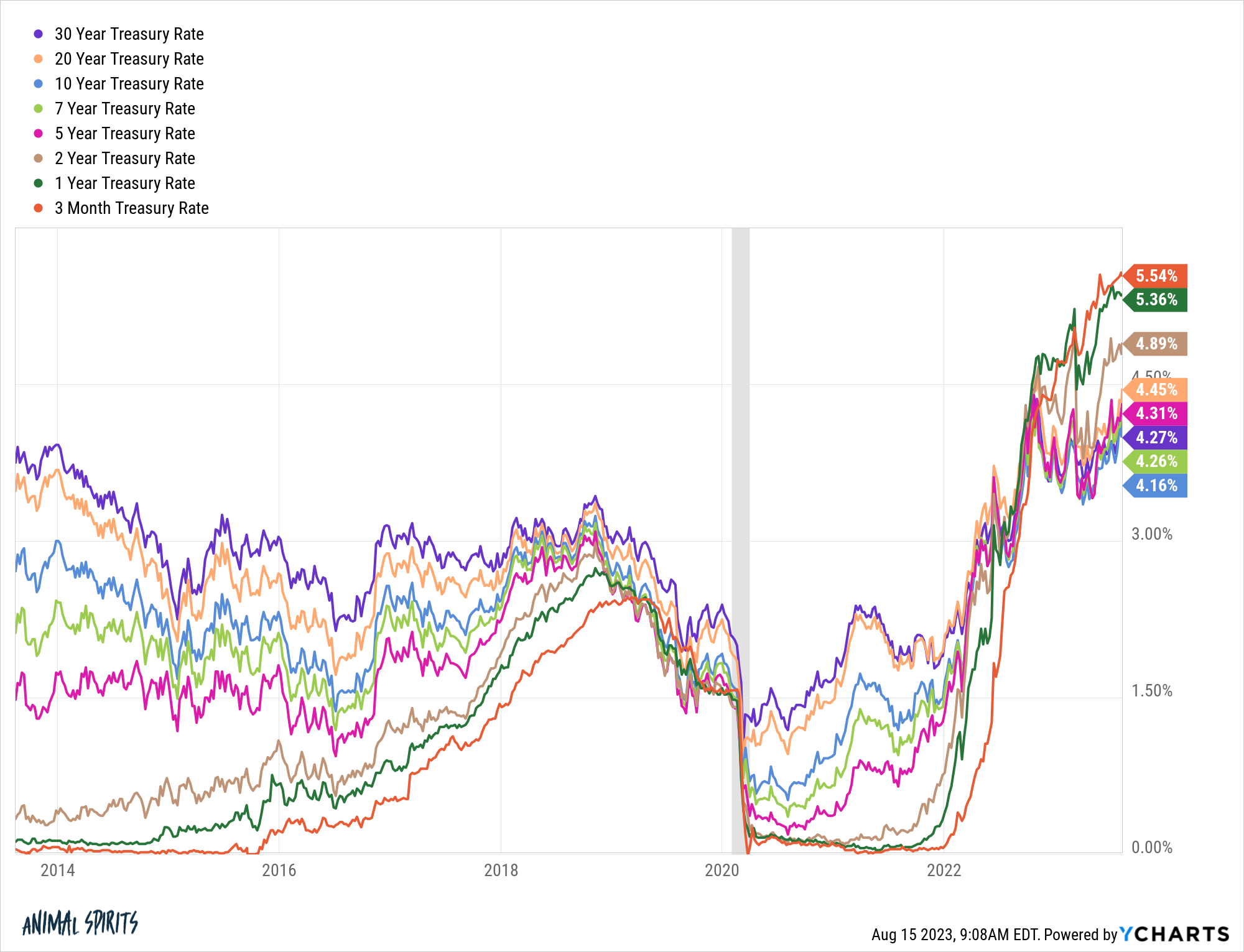

Bond yields throughout the board are at their highest ranges in years:

It is a good factor for these on the lookout for common revenue and better yields than the inventory market.

However it is perhaps tough for traders to return round to the thought of shifting a considerable piece of their portfolio from shares to bonds when bond losses proceed to pile up and the inventory market is shifting increased.1

Within the tug-of-war between fundamentals and the ache of shedding, it’s the ache that wins out more often than not within the markets.

Additional Studying:

Market Timing & Curiosity Charges

1Perhaps if the inventory market rolls over but once more traders will change their tune.

[ad_2]