[ad_1]

What You Must Know

- The Fed is kidding itself on avoiding a recession, Grantham says.

- Investor fervor surrounding AI has been one thing Grantham has been warning towards.

The slow-moving affect of rising rates of interest will find yourself torpedoing the financial system, dashing Federal Reserve expectations {that a} recession could be averted, based on famend Wall Road curmudgeon Jeremy Grantham.

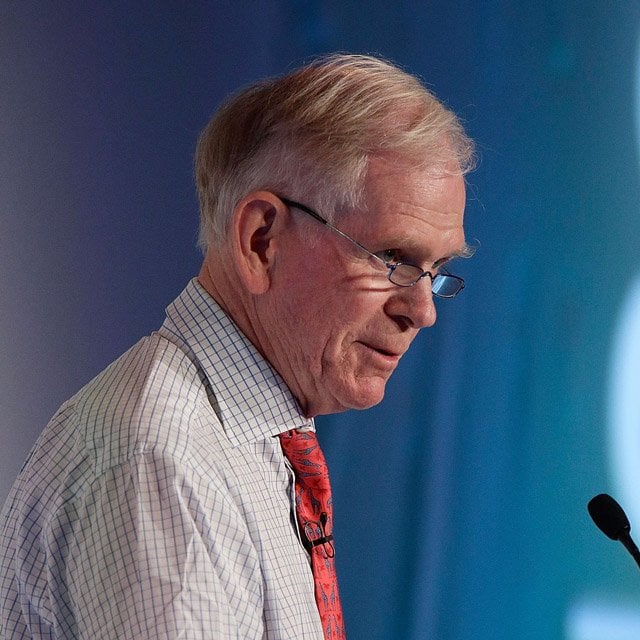

Grantham, whose personal forecast for a brutal market reckoning has taken lumps on this yr’s tech revival, doubled down on the gloom prophesy in an interview taped for an upcoming episode of Bloomberg Wealth with David Rubenstein.

“The Fed’s report on these items is fantastic. It’s virtually assured to be mistaken,” stated the co-founder of the Boston-based funding agency Grantham Mayo Van Otterloo, in response to a query about Chair Jerome Powell’s view {that a} downturn is avoidable. “They’ve by no means known as a recession, and notably not those following the nice bubbles.”

Grantham, 84, is well-known for gloomy forecasts which have sometimes presaged main market dislocations, resembling in 2000 and 2008. He known as the post-pandemic surge in equities “in some ways about equal to the 2000 tech bubble,” however stated its deflation has been interrupted by hypothesis on synthetic intelligence and financial stimulus that he linked to subsequent yr’s presidential election.

“All the pieces and its canine appears to have intruded,” he stated. “It’s made life extremely difficult. Personally I believe AI is essential,” he stated. “However I believe it’s maybe too little too late to avoid wasting us from a recession.”

Volatility within the financial system for the reason that outbreak of Covid-19 has made depressing the lives of just about everybody attempting to forecast the path of markets. Grantham’s warnings round 2021’s unbridled bullishness — “we had among the craziest investor conduct of all time,” he informed Rubenstein — appeared prescient when shares have been walloped final yr. This yr, with the Nasdaq 100 Index up greater than 30%, they’ve sometimes appeared overblown.

Investor fervor surrounding AI, loosely outlined as problem-solving utilizing computer systems and massive datasets that’s pushed tech shares to lofty valuations, has been one thing Grantham has been warning towards. And whereas pleasure round it might be propelling equities for now, he stated, it gained’t hold the US financial system from contracting.

Recession in 2024

The deflationary impression of final yr’s fall in tech shares is “too massive,” he stated. As increased charges proceed to depress different corners of the market, notably actual property, the U.S. financial system will see “a recession operating maybe deep into subsequent yr and an accompanying decline in inventory costs.”

In January, he projected the trendline worth of the S&P 500 at about 3,200 by the tip of the yr, greater than 1,000 factors beneath its present degree.

[ad_2]