[ad_1]

The Diplomat writer Mercy Kuo usually engages subject-matter specialists, coverage practitioners, and strategic thinkers throughout the globe for his or her numerous insights into U.S. Asia coverage. This dialog with Lotta Danielsson – vice chairman of the U.S.-Taiwan Enterprise Council and editor of the report “U.S., Taiwan and Semiconductors: A Essential Provide Chain Partnership” – is the 377th in “The Trans-Pacific View Perception Collection.”

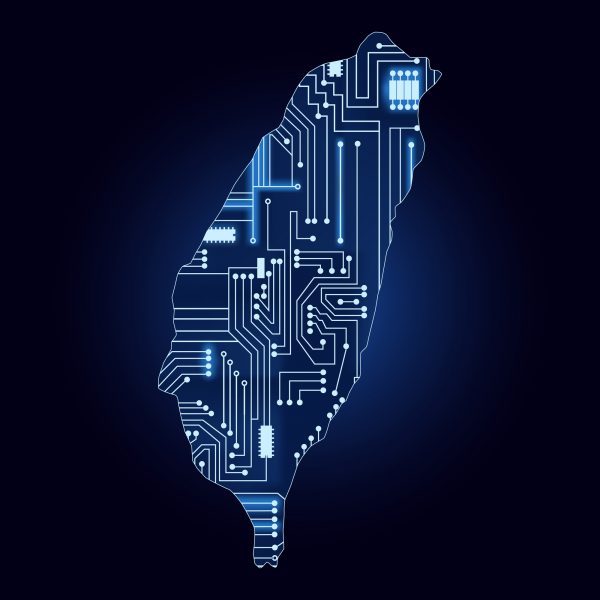

Clarify Taiwan’s essential position within the semiconductor provide chain.

Taiwan spent the final 40 years bolstering its semiconductor trade. The Taiwan authorities, home corporations, and overseas corporations have all invested within the sector. A clustering impact has led to Taiwan constructing substantial capability throughout a large spectrum of applied sciences, the place 1000’s of suppliers and producers have coalesced into a strong semiconductor ecosystem.

Taiwan is a vital provider and associate not just for main U.S. know-how companies like Apple, Nvidia, Texas Devices, and Qualcomm but additionally for outstanding know-how corporations throughout the globe. 4 Taiwan corporations – TSMC, UMC, Vanguard, and Powerchip – collectively held a foundry market share of 69 % within the first quarter of 2023. Spearheaded by TSMC, Taiwan foundry corporations account for a majority of total international capability, particularly for modern know-how on the smallest course of nodes and on 300-mm wafers.

On the <10 nm course of node, the island holds by far the biggest manufacturing capability at 63 %, with South Korea at 37 %. Taiwan produces 92 % of chips at 7 nm and 5 nm, and solely two corporations – Taiwan’s TSMC and South Korea’s Samsung – are mass-producing chips at 5 nm or much less. TSMC continues to take a position, pushing in the direction of increased utilization of its main 3 nm course of whereas additionally creating future applied sciences. In the meantime, competing semiconductor foundries are scrambling to catch up technology-wise.

Whereas Taiwan’s dominance on the innovative makes headlines, Taiwan additionally has a considerable presence in trailing-edge chips that go into automobiles, home equipment, and so forth. Taiwan’s ASE is the main international outsourced meeting and testing (OSAT) agency, and Taiwan’s MediaTek is the fourth largest fabless firm on this planet. As well as, Taiwan was the second-largest vacation spot for semiconductor tools spending in 2022.

Taiwan holds a focus of each capability and know-how. It’s a key marketplace for U.S. semiconductor tools producers and a important associate for U.S. tech corporations. The complexity of the semiconductor trade, and the extraordinary price of constructing new manufacturing capability, signifies that it will be unimaginable to interchange Taiwan-made chips in a single day – and even over a couple of years.

A lack of entry to Taiwan-made chips may imply a 5-10 % hit to U.S. GDP, probably bigger than the estimated adverse impression of seven.5 % from the COVID pandemic. U.S. intelligence estimates present that shedding Taiwan’s chip manufacturing may imply erasing as much as $1 trillion per yr from the worldwide financial system for the primary few years. It may even have extreme repercussions for U.S. nationwide safety, as entry to semiconductors is a key driver for superior weapons capabilities.

Determine key dangers to Taiwan’s operate within the semiconductor trade.

Expertise shortages, mental property and commerce secrets and techniques theft, pure disasters, uncooked materials and tools shortages, industrial accidents, provide/demand gaps, and infrastructure issues all symbolize dangers affecting the semiconductor provide chain. Some key dangers for Taiwan embody ongoing expertise shortages and potential disruptions to amenities and infrastructure from extreme climate or earthquakes. Such partial disruptions are the most certainly to happen however would even be shorter time period and have much less extreme penalties.

For Taiwan, two extra however much less possible situations stem from aggressive actions by China. One state of affairs is an financial blockade whereby Beijing may try to limit the move of products and companies to/from Taiwan, probably inflicting a big, medium-term disruption to the Taiwan semiconductor trade.

Lastly, a China-Taiwan battle may imply a complete disruption in Taiwan for a yr or extra. Nevertheless, there is no such thing as a consensus on what damages an tried invasion would trigger or how a protracted battle would have an effect on Taiwan semiconductors. It is usually debatable whether or not Beijing intends to invade Taiwan anytime quickly, and what the worldwide response to that may entail, significantly as China’s financial system additionally relies upon closely on semiconductor output from Taiwan.

How are corporations within the international semiconductor provide chain making ready for potential disruptions?

Chip manufacturing, significantly foundries, is turning into extra geographically numerous, and new capability is coming on-line, as exemplified by the Arizona funding by TSMC. Semiconductor corporations in Taiwan have already made vital investments to resist pure disasters and are rising water recycling and securing energy entry. The federal government and firms are funding college packages to make sure entry to expertise. They’re establishing danger administration groups to organize for potential disruptions and are diversifying and constructing redundancy into their provide chains. Firms are working nearer with suppliers to construct bigger inventories, even at elevated prices, and are bettering monitoring and making ready different routes for deliveries. Many chip corporations are making resiliency a prime precedence.

Consider the effectiveness of Taipei’s measures to safeguard the worldwide semiconductor trade ecosystem from geopolitical dangers.

Taipei has to stability the potential for “hollowing out” the essential Taiwan chip trade with being a workforce participant within the international ecosystem. Taiwan has supported varied U.S.-led initiatives within the semiconductor sector, together with observing U.S. restrictions on gross sales to Huawei, complying with export controls, and becoming a member of the Chip 4 alliance as a key member. There’s solely a lot that Taiwan can do by itself, however they’ve constantly partnered with the U.S. and its allies of their makes an attempt to counteract China. Taiwan desires to be a part of the answer, regardless of anxiousness at residence over a possible erosion of Taiwan’s star trade.

Assess Washington’s technique for participating allies in defending the way forward for Taiwan’s important contributions to the semiconductor provide chain within the worldwide enviornment.

It’s encouraging that Washington is specializing in this essential sector and Taiwan’s essential position. Permitting Taiwan corporations to benefit from CHIPS and Science Act incentives and together with Taiwan within the Chip 4 alliance are each optimistic steps ahead. Taiwan ought to have a seat on the desk, and the U.S. management bringing Taiwan into the fold is heartening.

It’s regarding, nonetheless, that the dialogue on friend-shoring within the semiconductor provide chain seems to exclude Taiwan. The U.S. wants to incorporate Taiwan on this dialogue, permitting others to benefit from their abilities and expertise. Taiwan will stay a important semiconductor associate for the foreseeable future, and the U.S. should do the whole lot it may to assist make sure that Taiwan stays shut – not simply to the US however to our allies as properly.

[ad_2]