[ad_1]

After almost two years of a inventory market that appeared to maneuver increased every day, buyers are actually experiencing a bout of volatility that has not been seen in fairly a while. So, will the second half of 2022 carry a return to the lackluster market surroundings that buyers grew accustomed to in 2020–2021 (apart from the novel coronavirus sell-off)? Or ought to we anticipate elevated volatility to turn into the norm shifting ahead?

What’s Modified?

Earlier than we reply these questions, let’s assess what’s modified out there and the financial system in such a short while. Getting into 2022, threat property (together with international equities) bought off dramatically on the heels of a surprising transfer increased in inflationary information. Costs for items and providers rose sharply as customers emerged en masse from Covid-19 lockdowns, wanting to resume their pre-pandemic spending and journey habits. Quick-forward to the center of the yr and an above-average inflation pattern has been exacerbated by rising power costs, tight labor markets, and provide chain disruptions—elevating the price of every part from child method to used vehicles. Russia’s invasion of Ukraine has additional prolonged the period—and implications—of the elevated inflationary backdrop for buyers.

Notably, sustained inflationary pressures precipitated the Fed to hike rates of interest, which have moved abruptly increased to date in 2022. Some readers might (accurately) assume that rising charges are extra impactful to fastened revenue investments. Whereas there’s actually some validity to that sentiment, as evidenced by the very actual carnage felt in fastened revenue markets year-to-date, fairness buyers should not completely proof against the opposed results of the Fed’s financial insurance policies. For fairness buyers, in periods of rising rates of interest coupled with inflation will increase, the market will typically low cost future money flows at the next rate of interest. In the end, the upper the low cost charge utilized to earnings, the decrease the worth of equities.

The place Do We Go from Right here?

Fairness and glued revenue buyers have skilled declining costs over the previous six months. However the important thing query shifting ahead is, the place will we go from right here? From my perspective, I imagine that inflation is more likely to stay elevated for the foreseeable future earlier than abating as we get nearer to the top of the yr. Whereas power and meals costs will doubtless stay unstable, we’re beginning to see different parts of inflation soften (e.g., housing and labor), which may end in a extra benign inflationary outlook as we get near the fourth quarter of 2022.

The general view for fairness markets is that elevated volatility needs to be anticipated in the course of the summer season and into the autumn because the market digests rate of interest coverage and assesses the Fed’s skill to generate a smooth touchdown for the financial system. That backdrop needs to be constructive for long-term buyers who wish to allocate capital in fairness markets. What sectors, types, and market caps needs to be favored is one other fascinating query, because the disparity in returns has been vital throughout the board to date in 2022.

Worth or Development?

Development-oriented sectors have skilled a notable pullback as of late, largely attributed to the mix of rising charges and extreme valuations. A further issue is the pandemic’s acceleration of demand for growth-oriented firms, which now face the aftermath of a “pull-forward” impact, as evidenced by current slowing demand. Some pockets of this development have resulted in adverse returns paying homage to the dot-com crash of the early 2000s.

What’s very completely different this time round, nonetheless, is the dearth of client and company leverage within the system, coupled with the truth that many of those shares are producing constructive earnings and money flows for buyers. Additional, we imagine that there are lots of longer-term secular developments in place, reminiscent of developments in medical sciences, a rising international reliance on digitization, and a transition to a extra service-based financial system—which ought to translate right into a extra constructive panorama for growth-oriented buyers shifting ahead.

Regardless of development’s current pullback, the backdrop for value-oriented shares stays constructive, even after notable outperformance in current months. The present financial surroundings is constructive for worth sectors like financials and industrials, and it’s tough to examine that dynamic materially altering within the close to time period. Plus, so long as oil costs stay firmly above $100, there’s apparent assist for the earnings prospects for a lot of shares within the power sector.

We imagine that U.S. fairness valuations are comparatively engaging at this level, if earnings don’t disappoint within the second half of the yr. When placing new capital to work, buyers might contemplate using a dollar-cost averaging method within the present surroundings (a method I’ll personally be wanting into over the approaching months). Whereas nobody has a crystal ball that may predict whether or not we’ve already seen the lows in markets this yr, buyers might take a stage of consolation within the long-term outlook for U.S. equities at present ranges.

Is There a Case for Overseas Equities?

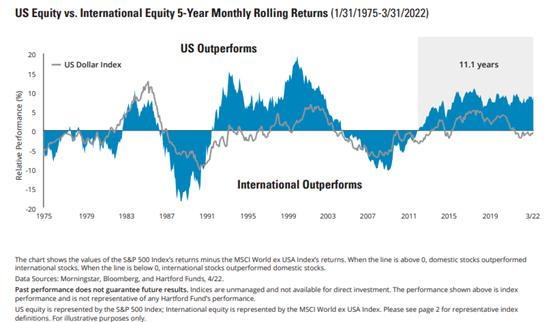

Developed worldwide and rising markets equities have underperformed U.S. equities for a chronic time frame, as evidenced by the chart under. In truth, the outperformance cycle for U.S. equities versus worldwide has lasted a median of seven.9 years since 1975, in accordance with information from Morningstar and Bloomberg. Slowing financial development, provide chain disruptions, a powerful U.S. greenback, and heightened geopolitical dangers have all served as headwinds for worldwide equities throughout this era.

Whereas investor sentiment is understandably fairly poor in mild of the efficiency disparity with U.S. equities, is the U.S. versus worldwide dynamic setting the stage for extra engaging relative returns in worldwide markets shifting ahead? Sentiment generally is a highly effective contrarian indicator, so I feel it is smart to have a wholesome respect for the truth that markets can rally when investor attitudes are, the truth is, pessimistic.

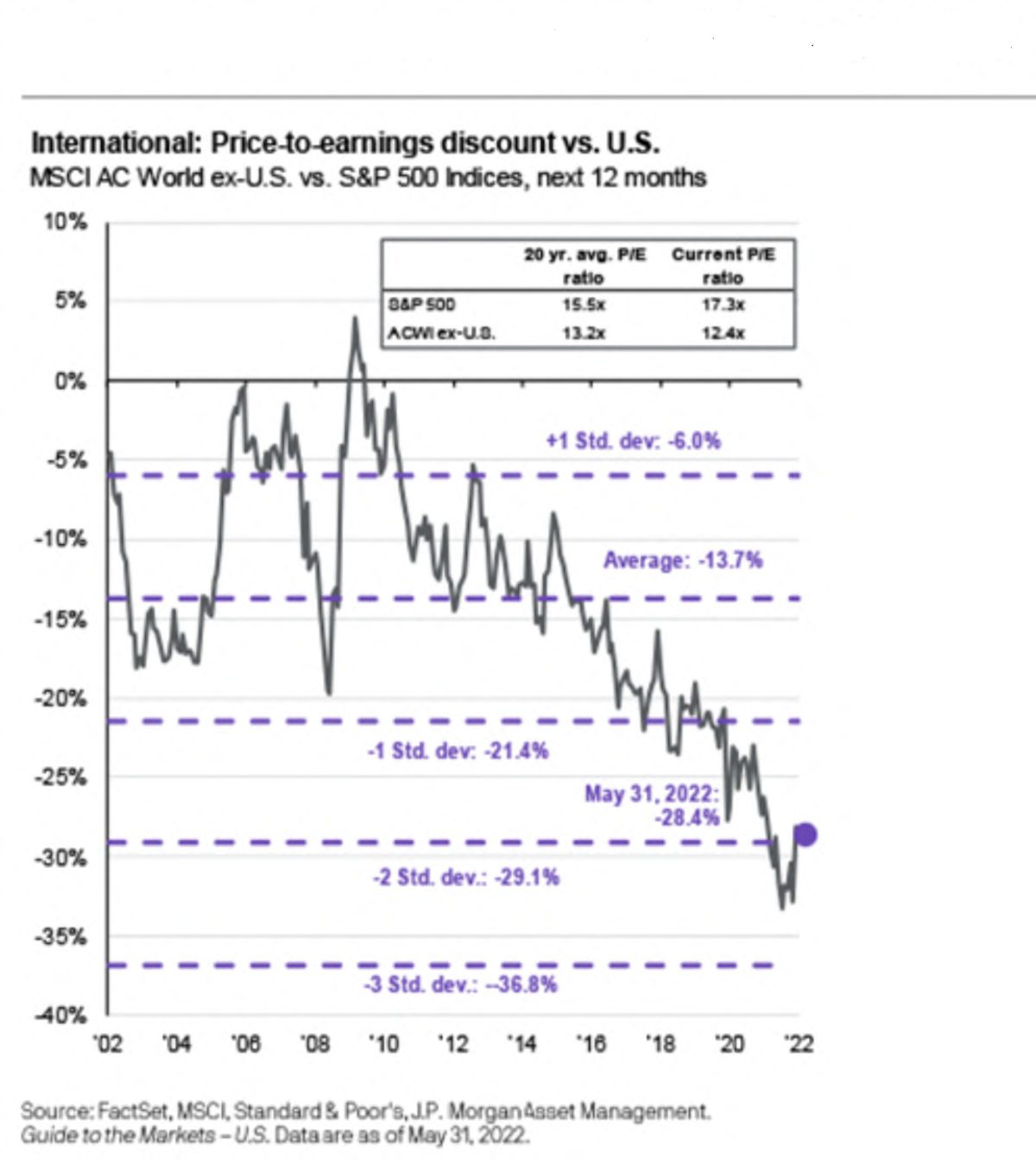

One other issue supporting the forward-looking case for worldwide equities is valuations. The MSCI ACWI ex USA Index was buying and selling at a price-to-earnings (P/E) ratio of 12.4x as of Could 31, 2022, which is under the 20-year common of 13.2x. The notable disparity in valuations between the U.S. and developed international equities is highlighted within the chart under.

The bear case for international equities within the close to time period, nonetheless, is that fundamentals are more likely to stay difficult resulting from heightened geopolitical dangers and till we begin to see constructive developments with the battle in Ukraine emerge. Within the close to time period, it’s cheap to anticipate that international equities might battle to outperform within the present surroundings.

A Tough Needle to Thread

With no scarcity of near-term challenges for threat property, and equities specifically, buyers are more likely to expertise spurts of volatility over the following few months. The market will proceed to judge the Fed’s skill to carry inflation underneath management with out triggering a recession—a tough needle to string, although one that’s actually doable. If profitable, I imagine the stage is about for engaging risk-adjusted returns for fairness buyers over the following three to 5 years.

Greenback-cost averaging is the apply of investing a hard and fast greenback quantity frequently, whatever the share value. Markets will fluctuate, and purchasers should contemplate their skill to proceed investing in periods of low value ranges.

The MSCI ACWI ex USA is a free float-adjusted market capitalization-weighted index that’s designed to measure the fairness market efficiency of developed and rising markets. It doesn’t embrace the U.S.

[ad_2]