[ad_1]

By Nadia Stovicek and JoAnn Volk

A current examine from the Authorities Accountability Workplace (GAO) sheds new gentle on well being care sharing ministries (HCSMs). The GAO interviewed officers from 5 HCSMs on plan options, enrollment, and advertising and marketing. The report consists of, for instance, details about HCSM use of paid gross sales representatives, administrative prices (one HCSM directs as much as 40 p.c of members’ contributions to administrative prices) and membership (one HCSM mentioned a survey of their members discovered 42 p.c had earnings underneath 200 p.c of the poverty degree, which might make them eligible for substantial subsidies for a Market plan). However the report affords solely a snapshot of a handful of HCSMs.

Regardless of a historical past of fraud and unpaid payments, HCSMs are largely a black field for insurance coverage regulators and most of the people. Trinity, an HCSM administered by the corporate Aliera, not too long ago went bankrupt; a minimum of 14 states have taken motion to close down Aliera due to their malfeasance. Members suing Aliera are solely anticipated to recoup one to 5 p.c of the cash they’re owed, which may quantity to a whole lot of 1000’s of {dollars}. Extra not too long ago, the North Dakota Lawyer Basic settled a lawsuit with HCSM Jericho Share for creating “a misunderstanding that its merchandise are medical insurance” and utilizing that misunderstanding to promote memberships. Past the info within the GAO report, little is understood concerning the operations or funds of HCSMs. A client contemplating changing into a member of a well being care sharing ministry—with an expectation that their well being care payments can be paid—could wish to know, for instance, if the HCSM has a historical past of steady income or retains in reserve sufficient funds to cowl members’ well being care payments. To raised perceive what data is accessible, we reviewed publicly accessible audits and income experiences to the IRS to see what data an bold client may acquire about an HCSM earlier than enrolling.

What are HCSMs?

HCSMs’ members conform to observe a standard set of non secular or moral beliefs and contribute common funds to assist pay the qualifying medical bills of different members. HCSMs have many options which can be much like these of insurance coverage. For instance, members’ funds are sometimes required on a month-to-month foundation and will range relying on age and degree of protection, very like a premium. Members should pay some prices out-of-pocket earlier than they will submit payments to the HCSM for cost, akin to a deductible; member tips for protection typically require members to pay co-insurance and use a community supplier when getting care. Even the advertising and marketing depends closely on the similarity to insurance coverage, which may mislead shoppers into considering they’re getting extra from a membership than an HCSM gives.

Regardless of these similarities, most states don’t contemplate HCSMs to be medical insurance issuers, and don’t topic them to the requirements that insurance coverage firms should meet. This may depart members financially weak. HCSMs make no assure that they are going to cowl any well being care declare, even people who meet tips for sharing, and so they don’t have to fulfill monetary requirements to make sure they’ve sufficient funds to pay claims. In addition they wouldn’t have to adjust to the buyer protections of the Reasonably priced Care Act (ACA). For instance, HCSMs wouldn’t have to cowl important well being advantages, which embody hospitalization, maternity care, psychological well being and substance use dysfunction companies, prescribed drugs, and preventative companies. In actual fact, HCSMs sometimes exclude protection for preexisting situations, behavioral well being, and maternity care besides in restricted circumstances, and restrict protection for prescribed drugs.

What knowledge is publicly accessible?

State regulators want knowledge to grasp how HCSMs function and market memberships to shoppers, however most states don’t gather such data. Solely Colorado requires knowledge from all HCSMs promoting memberships in-state; Massachusetts collects knowledge from these HCSMs whose members can declare credit score for protection underneath the state’s particular person protection requirement. The federal authorities doesn’t gather or present to the general public actionable knowledge about HCSMs both.

Nevertheless, some states require HCSMs that search an exemption from state insurance coverage necessities to make accessible an annual audit upon request. The ACA definition of HCSMs whose members are exempt from the person mandate additionally consists of that requirement. Primarily based on these annual audit reporting necessities, we contacted seven HCSMs, representing the biggest HCSMs working throughout states to request a duplicate of their annual audit: Altrua, Christian Healthcare Ministries (CHM), Medi-share, Samaritan, Sedera Well being, Solidarity, and Liberty HealthShare.

These audits are sometimes carried out by an accounting agency and supply an summary of the monetary solvency of a company, together with statements of monetary positions, actions, practical bills, and money flows. Of the 7 HCSMs we contacted, solely 3 supplied us with an audit when requested. (See Desk 1.) One HCSM, Medi-Share, solely supplied a transient doc with extra restricted knowledge than could be required in an official audit.

Desk 1.

| HSCM | Audit supplied? |

| Altrua | No |

| Christian Healthcare Ministries | Sure |

| Medi-Share Christian Care Ministry | No |

| Samaritan Ministries | Sure |

| Sedera Well being | No |

| Solidarity HealthShare | No |

| Liberty HealthShare | Sure |

Supply: Authors’ communication with the listed ministries

As a result of we had been unable to acquire an annual audit from all seven HCSMs, we additionally reviewed their publicly accessible 990 varieties to investigate monetary knowledge. Non-profit organizations should yearly file a Type 990 with the Inside Income Service (IRS). With this manner, non-profits report required knowledge on the group’s actions, funds, governance, and compensation paid to sure workers and people in management positions. We obtained a number of years of 990 varieties by way of ProPublica, a information website, and the IRS web site for the entire HCSMs we reviewed besides Sedera. It’s unclear why Sedera, which claims to be a non-profit on its web site, wouldn’t have submitted a 990. As a result of the IRS has not but revealed 2021-2022 990s, we couldn’t evaluation the latest knowledge.

What the Knowledge Reveal

Audits, the place accessible, present higher element than a 990. For instance, audits present data on “practical bills,” which embody spending on public relations, worker advantages and taxes, amongst different bills. Two audits additionally reported loans acquired underneath the Paycheck Safety Program: $3 million to Liberty HealthShare and $2.5 million to Christian Healthcare Ministries, each of which had been forgiven.

However audit knowledge aren’t reported in a constant manner. For instance, Samaritan Ministries and Christian Healthcare Ministries listing members’ presents and dues as income; Liberty HealthShare doesn’t depend member contributions as income as a result of they’re held in members’ sharing accounts, which aren’t mirrored within the audit. In one other instance, Samaritan Ministries experiences spending on promoting, Christian Healthcare Ministries experiences spending on “member improvement charges,” which is claimed to mirror spending on promoting, and Liberty HealthShare experiences “member improvement charges” and “promoting” prices individually, which suggests member improvement charges could embody commissions to brokers. HCSMs that pay dealer commissions typically pay considerably increased commissions than these paid to brokers who enroll individuals in ACA protection, which may drive higher enrollment.

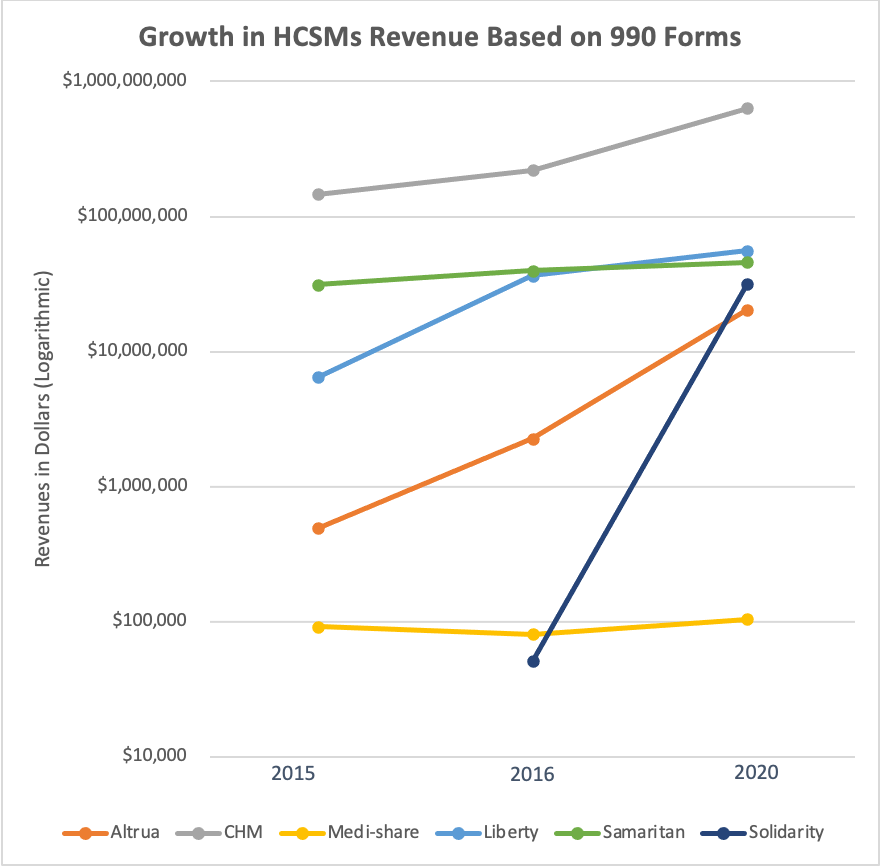

As a result of we had been in a position to acquire a number of years of 990s, we had been in a position to evaluate income modifications over time. HCSMs report whole income on 990s primarily based on contributions, program companies, or each. The 990s lack element but it surely’s seemingly the income a minimum of roughly displays rising membership. Most HCSMs’ 990s that we reviewed noticed big income development between the years we may evaluation. (See Graph 1). For instance, Solidarity HealthShare’s reported income grew a whopping 62,143% in 4 years, and Altrua grew about 4,010% in 5 years. Medi-Share was a notable exception to this pattern; it reported little or no income and development between 2011 and 2020. It’s not clear why, as Medi-Share is likely one of the oldest and largest HCSMs within the nation.

Graph 1.

Supply: authors’ evaluation of 990 filings

A majority of the HCSM 990 varieties we reviewed (Solidarity, Samaritan, Christian Healthcare Ministries, Medi-share, and Altrua) indicated spending in extra of revenues in some years and substantial income fluctuations year-to-year. This raises questions concerning the adequacy and stability of funding accessible to cowl members’ well being care prices. One HCSM, Liberty HealthShare, has come underneath current scrutiny for his or her historical past of not paying their members’ claims.

One problem with the info accessible on the 990s is that every HCSM experiences its knowledge in a different way, making it troublesome to make comparisons between them. In distinction, well being insurers should use a standardized template to report monetary knowledge to state regulators, making it doable to grasp and evaluate insurers primarily based on premium income, accessible reserves, and bills paid for administrative prices and members’ well being care claims.

Conclusion

The dramatic development in income for almost all of HCSMs we checked out suggests substantial development in enrollment. Nevertheless, the numerous income fluctuations from year-to-year, coupled with some HCSMs exhibiting bills that exceed revenues, elevate questions on whether or not shoppers who select an HCSM as an alternative choice to complete protection can depend on their well being care payments getting paid. Regulators searching for to grasp the rising function of HCSMs of their markets—and the dangers to shoppers who’re persuaded, typically by deceptive advertising and marketing, to purchase memberships—want extra full knowledge reported frequently. Guaranteeing HCSMs adjust to the requirement to make accessible an annual audit is a spot to begin in states the place that applies, however even that knowledge is restricted and all states ought to have an curiosity in acquiring extra full knowledge to higher perceive this rising section of protection.

[ad_2]