[ad_1]

With inflation now a lot decrease than it was a 12 months in the past, many pundits are contemplating the place the Federal Reserve ought to go from right here. Nick Timiraos surveys three choices within the Wall Road Journal:

Choice 1: Fed officers can elevate charges increased to deliver inflation right down to 2 p.c shortly.

Choice 2: Fed officers can maintain charges at their present stage (and think about trimming charges later subsequent 12 months) to deliver inflation right down to 2 p.c slowly.

Choice 3: Fed officers can substitute their 2 p.c goal with a 3 p.c goal and declare victory.

Let me provide a fourth choice: maintain charges the place they’re and declare victory now.

The Fed doesn’t want to lift charges additional. And stopping now doesn’t quantity to stopping quick as a result of inflation is already at or round 2 p.c.

As famous in its Assertion on Longer-Run Targets and Financial Coverage Technique, the Fed judges “that inflation on the fee of two p.c, as measured by the annual change within the value index for private consumption expenditures, is most constant over the longer run with the Federal Reserve’s statutory mandate.” And, though it says “acceptable financial coverage will possible goal to attain inflation reasonably above 2 p.c for a while” when “inflation has been working persistently under 2 p.c,” it doesn’t point out that it’ll let inflation run under 2 p.c following intervals when costs have grown extra quickly. In different phrases, the Fed has an uneven common inflation goal and—since inflation has been comparatively excessive over the past three years—ought to solely be anticipated to deliver inflation again right down to 2 p.c.

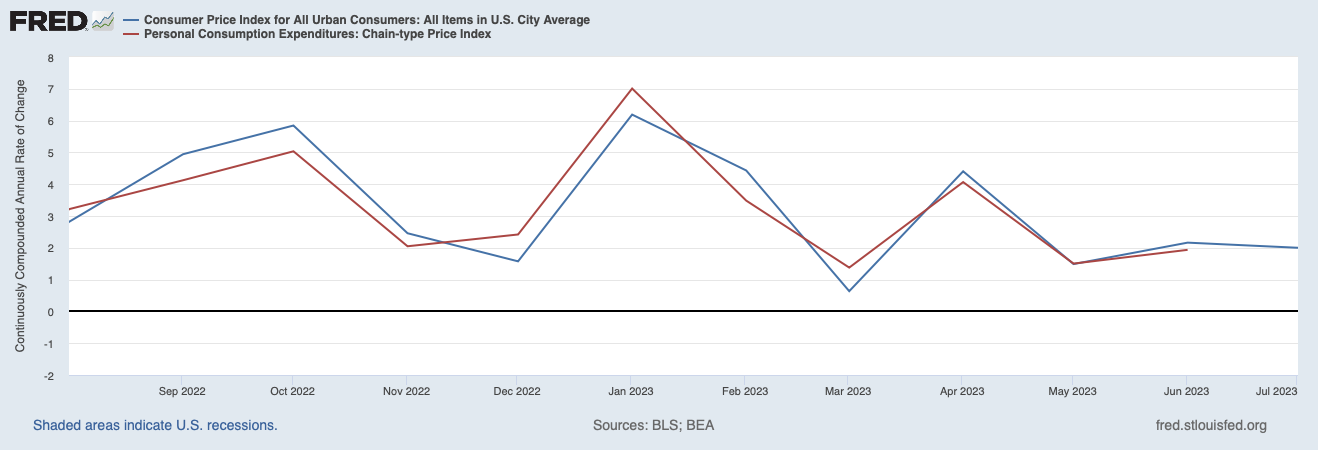

Inflation is usually reported over a 12-month interval. Over the 12-month interval ending in July 2022, the private consumption expenditures value index (PCEPI) grew 6.38 p.c whereas the buyer value index (CPI) grew 8.41 p.c. The CPI grew 3.30 p.c over the 12-month interval ending July 2023. The PCEPI for July has not but been launched, nevertheless it grew 2.97 p.c over the 12-month interval ending June 2023. Taken collectively, these numbers appear to indicate that the Fed has extra work to do whether it is to get inflation again right down to 2 p.c.

Not so quick! The 12-month fee tells us how a lot costs have risen over the past 12 months. However what actually issues for figuring out the suitable course of financial coverage is (i) how a lot costs have been rising lately and (ii) how a lot they’re prone to rise going ahead given the present state of coverage.

During the last three months, the CPI has grown at an annualized fee of simply 1.88 p.c. It grew at an annualized fee of 1.49 p.c in Might, 2.16 p.c in June, and a couple of.00 p.c in July. The PCEPI grew at an annualized fee of 1.50 p.c in Might and 1.94 p.c in June. It would possible are available in at or round 2 p.c in July.

An annualized month-to-month fee tells us how a lot costs will rise over the subsequent 12 months if costs proceed to rise on the similar fee. That’s not fairly the identical as how a lot costs are prone to rise going ahead given the present state of coverage, however it’s a good place to begin. To estimate how a lot costs are prone to rise going ahead given the present state of coverage, one should additionally think about whether or not financial coverage is unfastened, tight, or impartial at current (and is predicted to stay so into the not-so-distant future).

One frequent solution to gauge the stance of financial coverage is to see whether or not the Fed’s actual (inflation-adjusted) coverage fee is larger than (tight), lower than (unfastened), or equal to (impartial) the pure fee of curiosity, which is usually denoted R* or r-star. The New York Fed affords two estimates of the pure fee. Its Holston-Laubach-Williams estimate is 0.58, whereas its Laubach-Williams estimate is 1.14 p.c. The Richmond Fed presents its personal estimate, referred to as the Lubik-Matthes pure fee, which is 2.16 p.c.

The Fed’s nominal coverage fee vary is 5.25 to five.5 p.c. Since inflation is round 2 p.c, the actual coverage fee vary is roughly 3.25 to three.5 p.c. Given the aforementioned estimates of the pure fee, that implies that coverage is reasonably to extraordinarily tight. In different phrases, one ought to anticipate inflation to fall even additional (i.e., under 2 p.c) if the Fed holds charges the place they’re.

The battle for two p.c inflation has already been gained. Fed officers ought to acknowledge and have a good time the victory. Additional fee hikes danger pointless casualties.

[ad_2]