[ad_1]

Jio Monetary Providers, the monetary companies unit of Mukesh Ambani-run Indian conglomerate Reliance Industries, plans to broaden to service provider lending and insurance coverage, Ambani mentioned at Reliance’s annual normal assembly in a speech that’s prone to have a repercussions for numerous startups.

“JFS will massively improve monetary companies penetration by reworking and modernising them with a digital-first method that simplifies monetary merchandise, reduces value of service, and expands attain to each citizen by way of simply accessible digital channels,” he mentioned.

“For tens of hundreds of SMEs, retailers, and self-employed entrepreneurs, ease of doing enterprise should imply ease in borrowing, investments, and fee options. JFS plans to democratise monetary companies for 1.42 billion Indians, giving them entry to easy, inexpensive, progressive, and intuitive services.”

TechCrunch reported final week that Reliance was testing a sound field fee system at its campus. Analysts imagine that the actual attract of the sound field extends past its auditory alerts — it gives invaluable insights into service provider behaviors, facilitating the providing of loans based mostly on this knowledge.

The corporate may even enter the insurance coverage section, providing “easy, but good life, normal and medical insurance merchandise by way of a seamless digital interface.” Jio Monetary Providers will discover partnerships with world gamers, he mentioned.

“It’s going to use predictive knowledge analytics to co-create contextual merchandise with companions and cater to buyer necessities in a really distinctive approach,” he mentioned.

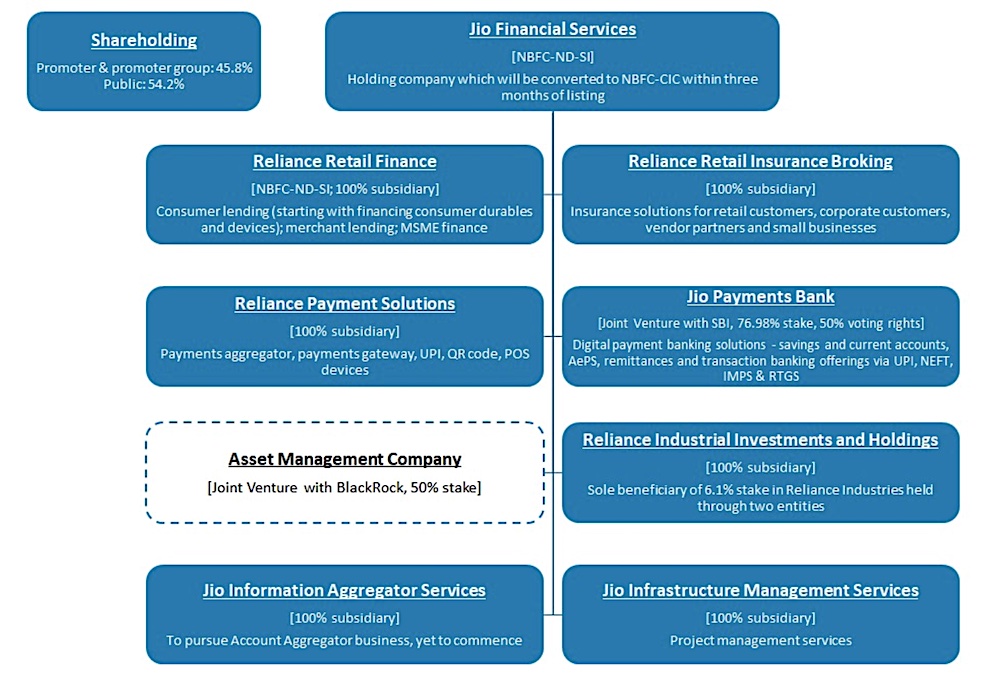

Ambani’s feedback supply peek into the strategic trajectory of Jio Monetary Providers, mere days subsequent to the lackluster inauguration of the monetary entity onto the general public market. Reliance’s dialogue concerning the future plans of Jio Monetary Providers has been considerably restricted to this point, apart from its earlier announcement of a three way partnership with BlackRock.

Jio Monetary Providers firm construction (Picture: Morgan Stanley)

Jio Monetary Providers owns 6.1% in Reliance. Ambani mentioned JFS operates in a sector that could be very capital intensive, and Reliance has made it one of many “world’s highest capitalised monetary service platforms at inception.”

“There’s unprecedented alternative to rework the asset administration trade by introducing a full-service tech-enabled asset supervisor with inexpensive and clear funding merchandise to satisfy the wants of each section of society,” mentioned Larry Fink, Chairman and chief government of BlackRock, at Reliance’s occasion on Monday.

Jio Monetary Providers may even discover blockchain-based platforms and participation in central financial institution digital forex, he mentioned.

Ambani added:

I’ve three causes to be completely assured about JFS attaining super success over the subsequent few years.

1. The digital-first structure of JFS will give it an unmatched head begin to attain thousands and thousands of Indians.

2. It is a extremely capital-intensive enterprise. Your Firm has supplied JFS with a powerful capital basis to construct a best-in-class, trusted monetary companies enterprise and obtain speedy development. Reliance has capitalised JFS with a internet price of Rs 1,20,000 crore to create one of many world’s highest capitalised monetary service platforms at inception.

3. JFS is blessed with a really sturdy board, led by Shri Ok.V. Kamath, a veteran and most revered banker. A extremely motivated management crew is being constructed with a mixture of monetary trade specialists and younger leaders who’re desperate to tackle huge challenges.

[ad_2]