[ad_1]

Nvidia is likely one of the costliest shares within the S&P 500.

Nvidia is just not the primary large tech firm to commerce at a wealthy valuation. The one that individuals typically examine it to is Cisco, one of many darlings from the dot com period. We are able to’t examine issues to the long run, so we glance to the previous.

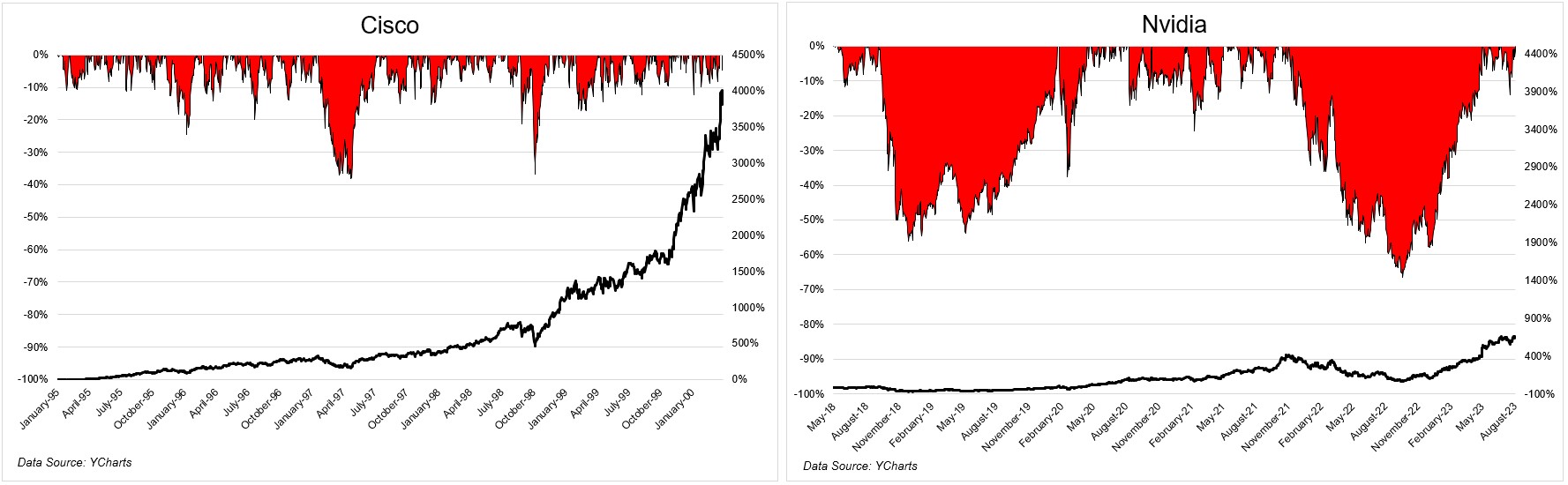

Cisco sported an $8.9 billion market cap on the opening day of 1995. At its peak simply over 5 years later, it was $556 billion. The 4,000% enhance over a five-plus yr interval was remarkably clean contemplating the insane enhance. These kinds of positive factors are oftentimes a bucking bronco, making it nearly inconceivable to carry on.

The deepest drawdown from the start of 1995 to the highest in March 2000 was 38%, and traders have been made entire simply 49 days after the underside. The common distance from an all-time excessive over this era was simply 6%. Actually unbelievable for a inventory that compounded at 101% a yr over that point.

Nvidia traders have earned 660% over the past five-plus years. Whereas nonetheless glorious, it’s nowhere close to the 4,000% return Cisco delivered on its strategy to the highest. As well as, Nvidia traders have had a a lot rockier journey, seeing two crashes of greater than 55%. The common distance from an all-time excessive over this time for Nvidia was -23%. When you held on, you deserve each penny.

For traders who have been late to the dotcom celebration, the opposite facet of this journey was gut-wrenching. From its peak in March 2000 to the underside in September 2001, Cisco misplaced 86% of its worth. Even right now, greater than 20 years later, the inventory remains to be 30% beneath its highs.*

I’ve seen information saying that Cisco has grown its high line at 20% a yr since its peak in 2000. The purpose being that companies can have magnificent development, however traders can have a special expertise in the event that they dramatically overpay for that development.

At 39 occasions gross sales in 2000, clearly Cisco traders have been paying up for future development. The issue is that the 20% quantity I’ve seen didn’t materialize. From 2001 by 2022, Cisco grew its high line at 4.5% a yr. With the good thing about hindsight, that was hardly value paying by the nostril for. Its income was much less in ’01 than it was in ’00, much less in ’02 than it was in ’01, and fewer in ’03 than it was in ’02.

So, how does right now’s premier development inventory examine to Cisco? When you modify for inflation, the income that Cisco generated in 2000 is much like the place Nvidia is right now. Over the trailing twelve months, Nvidia is a bit behind the place Cisco was in 2000, however for those who embody estimates for the following quarter, we’re taking a look at $40 billion in income for 2023. The P/S ratio is in line, however the huge distinction is profitability and development. Buyers are paying 113 occasions TTM earnings, however simply ~43 occasions subsequent yr’s estimates.

So, how does right now’s premier development inventory examine to Cisco? When you modify for inflation, the income that Cisco generated in 2000 is much like the place Nvidia is right now. Over the trailing twelve months, Nvidia is a bit behind the place Cisco was in 2000, however for those who embody estimates for the following quarter, we’re taking a look at $40 billion in income for 2023. The P/S ratio is in line, however the huge distinction is profitability and development. Buyers are paying 113 occasions TTM earnings, however simply ~43 occasions subsequent yr’s estimates.

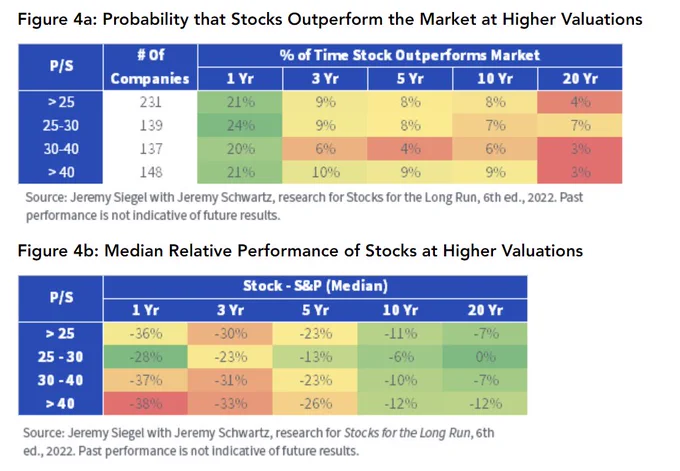

The trillion-dollar query is, how a lot are traders paying for Nvidia’s vivid future, and what does historical past say about corporations buying and selling at lofty valuations?

231 corporations have reached the same a number of over the past 50+ years, in keeping with Jeremy Schwartz. Solely 20% of shares buying and selling with a P/S ratio between 30-40 outperformed the market over the following 12 months. The extra you lengthen your time horizon, the more severe the outcomes get. Over a 10-year interval, that quantity drops down to six%.

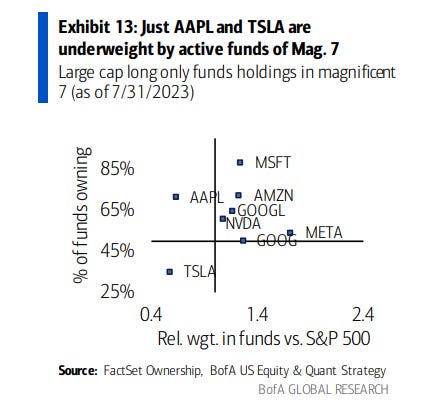

Whereas Cisco versus Nvidia is likely to be a enjoyable thought train, we’ve to grasp the variations between the place the previous was in 2000 and the place the latter is right now. In 2000, the dot com bubble had been working scorching for greater than 5 years. Because of this, practically everybody was all-in, or at the least in on the tech commerce. The AI period solely started a few months in the past. Whereas there aren’t any underperform or promote suggestions on Nvidia, lively managers are extra chubby Google, Amazon, Microsoft, and Meta.

It is smart that Nvidia is buying and selling wealthy, contemplating its latest earnings revisions and the insatiable demand for its GPUs. Adam Parker stated, “Over the past six months, the consensus expectations for calendar 2024 (NVDA’s CY 2024 closes in Jan ’25) income has risen from roughly $35 billion to $75 billion, the results of their Might earnings–which yielded the biggest upward gross sales revisions of any mega cap firm ever.”

If Nvidia delivers greater than what’s priced into the inventory, it is going to proceed to work. If it doesn’t, it’s going to get smashed. Everybody is aware of this. What no one is aware of is whether or not it is going to or it received’t.

It’s useful to have a look at base charges like Jeremy Schwartz did, however you’re not going to become profitable for those who’re evaluating a inventory of this period to a inventory from a earlier one and suppose that the story will mirror each other. It’s a psychological shortcut, and that’s normally not rewarded. If I’m writing a submit asking if Nvidia is the following Cisco, the reply might be no.

Josh and I are going to cowl Nvidia and rather more on tonight’s What Are Your Ideas?

*On a complete return foundation, the inventory bought again to new highs in August 2021.

[ad_2]