[ad_1]

A reader asks:

Noob query right here…With the opportunity of rates of interest dropping in a 12 months or so, ought to a long run investor on the lookout for affordable yields plus capital beneficial properties be seeking to purchase some bonds proper now? And if that’s the case, what would you take a look at? Thanks!

Not a noob query within the slightest.

Most buyers don’t pay a lot consideration to the bond market however I believe bonds have been much more attention-grabbing than shares these previous few years. It’s all the time price revisiting the fundamentals in the case of fastened earnings as a result of bonds might be difficult at instances.

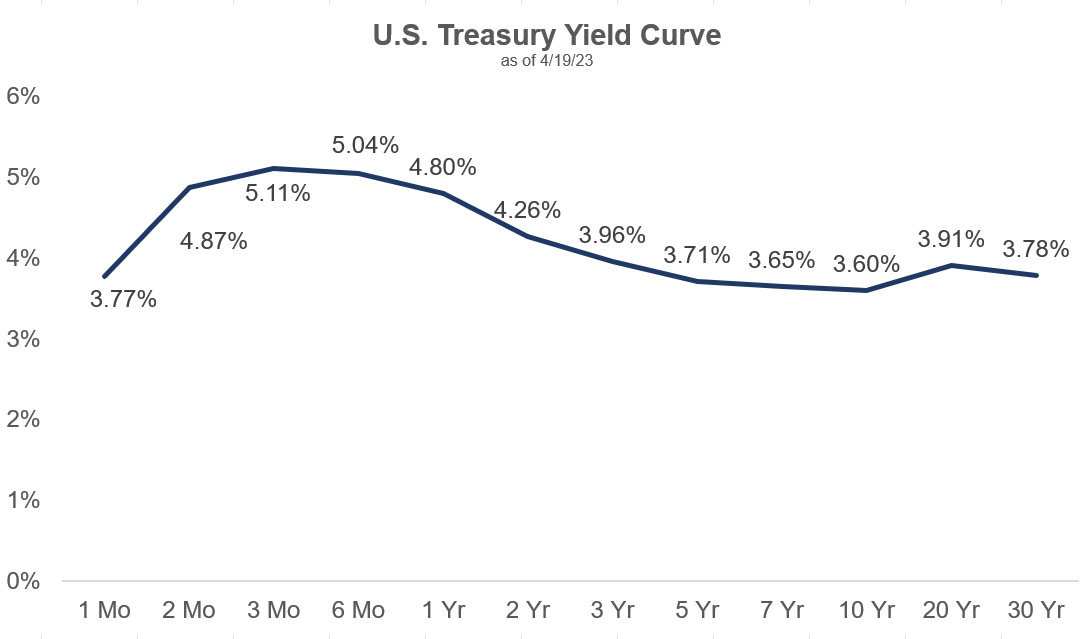

A number of months in the past I wrote about how T-bills have been the most important no-brainer funding to me with yields of round 5% and the yield curve wanting like this:

Whereas the Fed had pressured earnings buyers out on the danger curve for the reason that Nice Monetary Disaster, now buyers have been being punished for period threat in a rising charge atmosphere. Plus, short-term T-bills had a better yield in addition.

T-bills nonetheless look fairly darn enticing, as these yields are nonetheless above 5%. If the Fed raises charges once more, these yields will proceed to go up. However you do face reinvestment threat in T-bills for the reason that period is so brief.

If the Fed retains elevating charges and that throws the financial system right into a recession, they’re going to be pressured to chop rates of interest. Sadly, you may’t lock in these 5% comparatively protected T-bill yields for an prolonged time frame.1

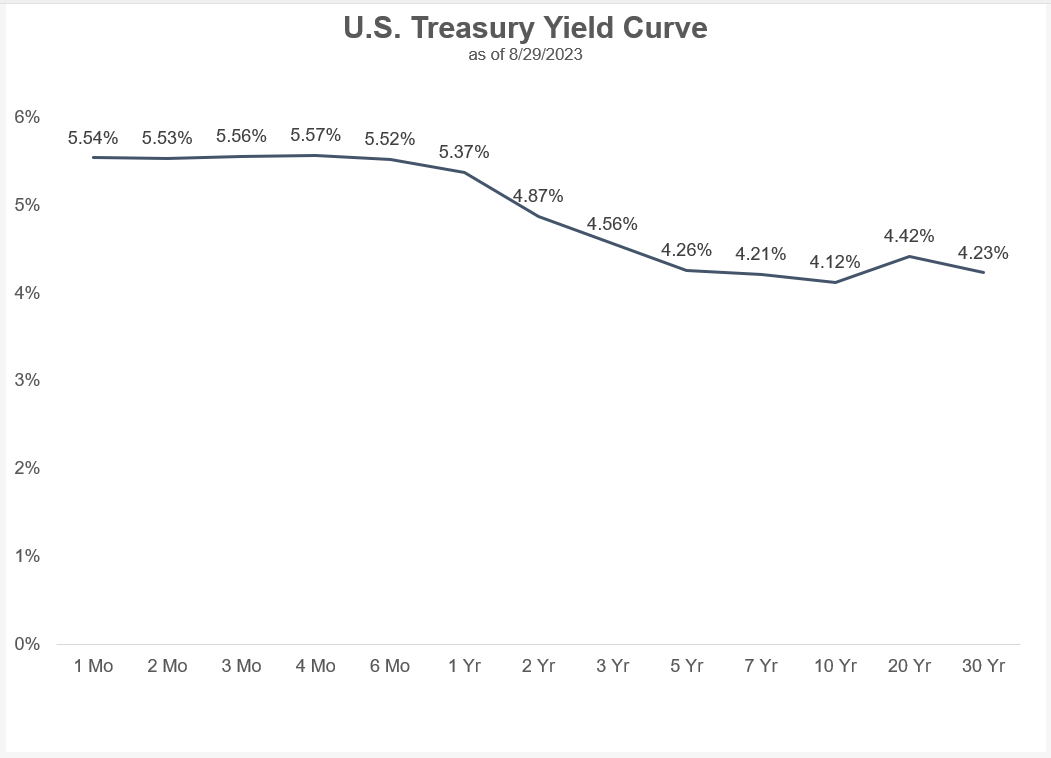

Now check out the up to date yield curve by means of this week:

The lengthy finish of the curve has caught up a bit of bit. You’ll be able to nonetheless earn a premium in T-bills however the hole has narrowed.

Intermediate-term bonds are wanting extra attention-grabbing from a mix of upper yields and falling inflation.

I’m not a bond dealer however let’s take a look at the case for including some period right here.

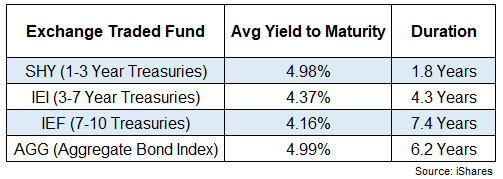

Listed here are the period and common yields to maturity for varied bond ETFs:

A complete bond index fund (AGG) now yields about the identical as 1-3 12 months Treasuries (SHY). That’s nonetheless decrease than T-bill yields however significantly better than the place issues stood only a few brief years in the past.

As a reminder, period is a measure of rate of interest sensitivity on bond costs. A very good rule of thumb is each 1% transfer in charges will trigger an inverse transfer in share phrases of the period determine.

For instance, IEI has an efficient period of 4.3 years. If charges fell 1%, you’ll count on that fund to rise round 4.3%. Conversely, if charges rose 1%, you’ll count on the fund to drop 4.3%.

However that’s simply costs.

Now that yields are a bit of greater than 4.3%, you’ll count on to interrupt even from that rise in charges in a 12 months from the yield. In 2020, 2021 and 2022 the beginning yields on bonds have been a lot decrease. You didn’t have that in-built cushion from larger beginning yields.

So whereas bonds may expertise additional draw back threat in costs if charges proceed to go up, there’s now a much bigger margin of security since yields have already risen a lot.

And if charges did rise one other 1%, certain, you’ll expertise some loss in value with a better period however now your beginning yield is 5.3% and also you’re going to make up for these losses a lot sooner.

Beginning yield explains roughly 90-95% of returns for high-quality bonds going out 5-10 years into the longer term. So that you don’t actually need yields to fall to earn a good return in bonds.

It is best to really need charges to remain the place they’re or transfer a bit larger from right here so you may lock in larger yields for longer.

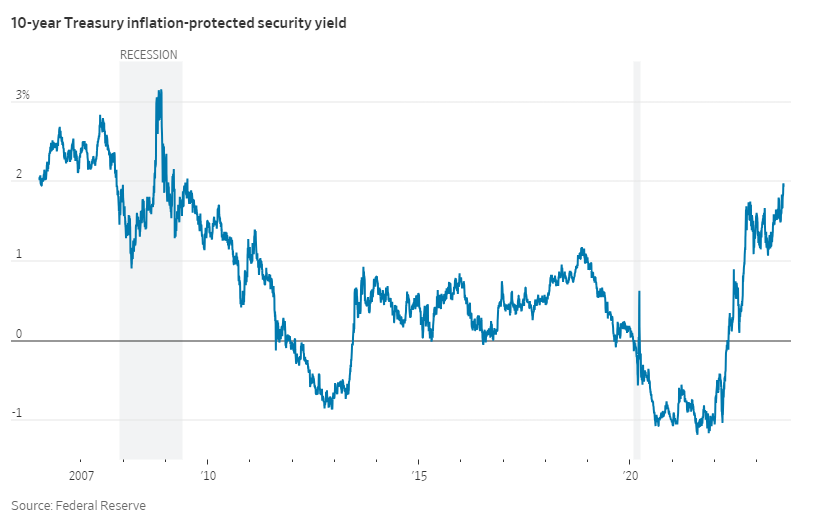

One other optimistic growth for bond buyers is optimistic TIPS yields:

I used to be taught early in my profession that something within the 2-3% vary for yields on Treasury Inflation-Protected Securities is an effective deal. You’ll be able to see on this chart that TIPS yields have been unfavorable for a lot of 2020, 2021 and 2022.

Now you get 2% on 10 12 months TIPS plus the inflation kicker. Not a nasty deal.

I don’t faux to have the flexibility to foretell the place rates of interest or inflation go from right here. I choose to have a look at the bond market when it comes to threat and reward.

I used to be scared of the bond market in 2020 when charges dropped to their lowest ranges in historical past. The dangers outweighed the rewards by a large margin.2

Now you’ve got choices galore as a fixed-income investor.

For those who’re nervous about rising charges or inflation, T-bill yields are the best we’ve seen in 20 years or so. The Fed is gifting you 5%+ in your protected belongings.

For those who’re nervous about deflation, falling rates of interest, a recession or the Fed chopping short-term charges, you may really lock in yields within the 4-5% vary on intermediate-term bonds.

And for those who’re nervous about your buying energy, you may earn 2% yields plus inflation on TIPS.

Every of those bond devices has its personal dangers.

For T-bills it’s reinvestment threat. For intermediate-term bonds it’s rising charges and inflation. For TIPS it’s rising charges and deflation.

There aren’t any free lunches.

It took some ache to get right here however fixed-income buyers lastly have some choices after years of paltry bond yields.

We spoke about this query on the most recent version of Ask the Compound:

Jonathan Novy, one in all our advisors and insurance coverage consultants at Ritholtz Wealth, joined me this week to debate questions on emergency funds, investing while you don’t have a 401k, annuity yields and long-term care insurance coverage.

Additional Studying:

Why I’m Extra Apprehensive In regards to the Bond Market Than the Inventory Market

1The identical is true of CDs. I checked out 5 12 months CD yields at Marcus at the moment. They’re 3.8%.

2Though I actually did’t foresee a 12 months like 2022 the place yields would rise as rapidly as they did.

[ad_2]