[ad_1]

The world is shifting in direction of inexperienced, low-carbon growth. Inexperienced investments are rising continuously. In 2022, investments within the world power transition exceeded $1 trillion and, for the primary time ever, had been equal to fossil gas manufacturing prices. Renewable power sources attracted one of many largest shares of capital. Rising curiosity within the world inexperienced agenda might assist growing international locations entice worldwide assist by way of climate-related experience and financing.

Local weather change is a vital concern for Central Asia. The area is among the many most weak to local weather change. Central Asian economies face two sorts of climate-related dangers. Relating to bodily dangers, there are opposed local weather change penalties within the area such because the drying of the Aral Sea, a scarcity of water assets, meals safety dangers, and elevated frequency of utmost climate occasions. Local weather change is changing into an more and more extreme problem for the Central Asian agriculture sector. Transition dangers (associated to regulatory adjustments in world markets) are additionally vital for the area. After the imposition of the EU carbon border tax in 2026, Kazakhstan exporters might lose as much as $250 million in revenues per 12 months.

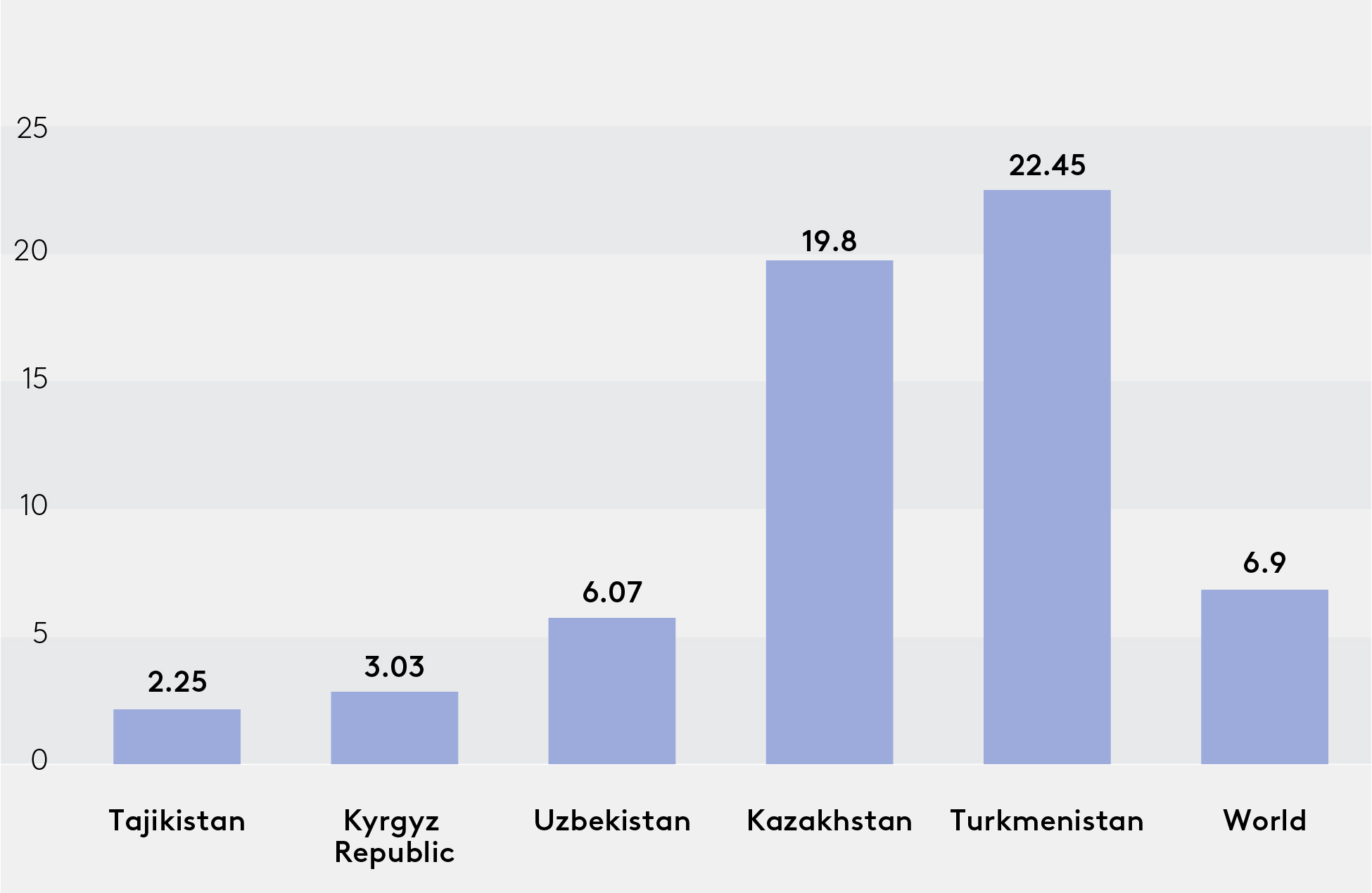

The degrees of greenhouse gasoline (GHG) emissions differ considerably amongst Central Asian international locations. The exports of Turkmenistan and Kazakhstan are extremely depending on hydrocarbons, and in consequence, they produce excessive GHG emissions (22.45 and 19.8 CO2 equal tonnes, respectively) by way of fugitive emissions. Conversely, the Kyrgyz Republic and Tajikistan exhibit the bottom ranges of GHG emissions (3.03 and a pair of.25, respectively) as a result of their substantial reliance on hydropower within the power sector.

Per-capita greenhouse gasoline emissions in CO2 equal, tonnes, 2021

Supply: Our World in Knowledge.

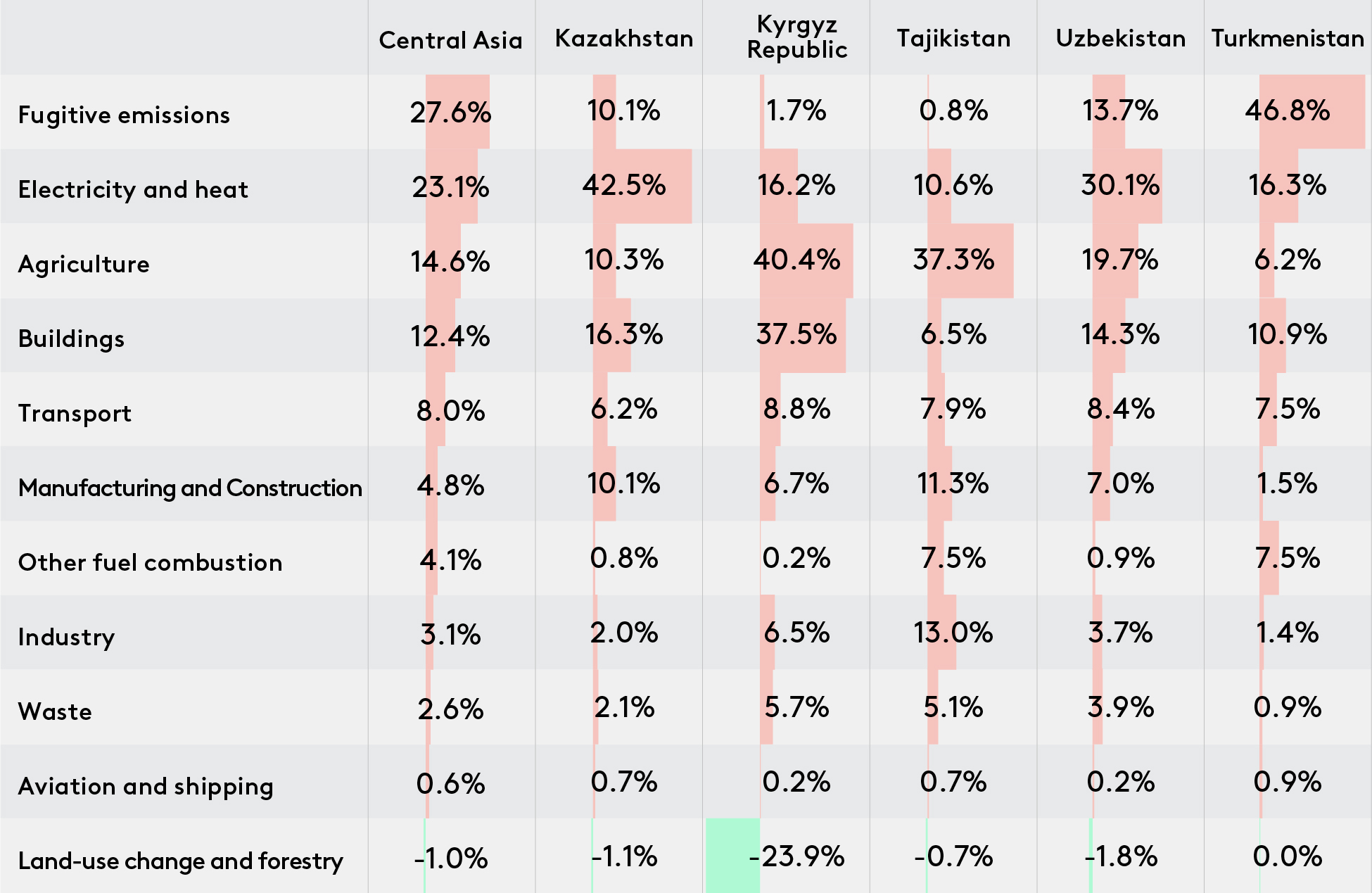

There are 4 key “ache factors” within the area’s sectoral construction that produce the best quantity of GHG emissions and needs to be in focus: fugitive emissions, electrical energy and warmth manufacturing, agriculture, and buildings. These sectors produce about 80 p.c of GHG emissions in Central Asia. Coal-fired energy technology continues to account for a major share of the area’s whole greenhouse gasoline emissions. It results in excessive emissions within the electrical energy and warmth manufacturing and buildings sectors. For instance, the electrical energy and warmth sector produces 42.5 p.c of GHG emissions in Kazakhstan, whereas buildings account for 37.5 p.c within the Kyrgyz Republic.

Greenhouse gasoline emissions by sector in CO2 equal, 2019

Supply: EDB calculations primarily based on Local weather Watch.

The area wants extra funding within the growth of recent technology capability, together with hydro energy vegetation, photo voltaic and wind energy vegetation, the development and improve of water remedy amenities, and so forth. Local weather finance devices offered by multilateral growth banks (MDBs) for adaptation and mitigation might additional enhance the low-carbon transformation of the area.

Apart from financing, the MDBs might also assist develop local weather initiatives and assess local weather dangers and alternatives. They will prepare syndicated loans, present technical help, share the experience required for feasibility research, mitigate dangers or provide ensures for his or her discount, and it will encourage non-public funding in inexperienced initiatives. Additionally they concentrate on methods to see whether or not local weather finance or ESG practices are efficient and create long-term impression. MDBs’ cooperation on these points can be necessary.

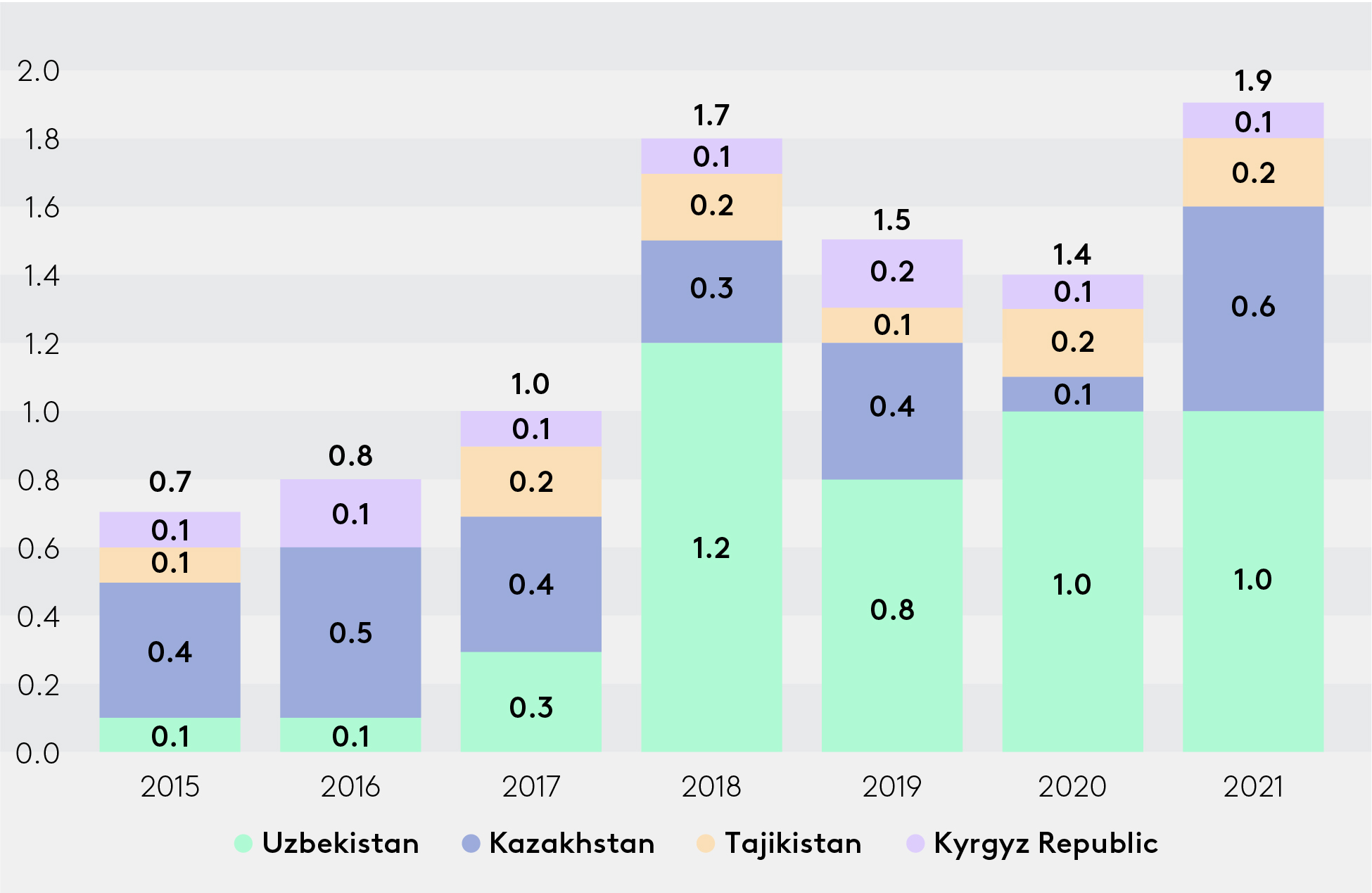

In 2021, main MDBs offered greater than $81.7 billion in local weather finance worldwide, of which $50.7 billion was channeled to low- and middle-income international locations. In 2021, Central Asian international locations acquired $1.9 billion in local weather finance, or 2.2 p.c of the entire quantity, as compared with Central Asia’s 0.4 p.c share of world GDP. From 2015 to 2021, Central Asia obtained $8.9 billion from MDBs as inexperienced finance. Particularly, Uzbekistan acquired virtually half of the entire quantity – $4.4 billion (49.1 p.c). Reforms initiated in Uzbekistan in 2017 (foreign money and worth liberalization, customs and tax reforms, and many others.) drove up the incoming flows of local weather finance. Kazakhstan acquired $2.6 billion (29.4 p.c), Tajikistan acquired $1.1 billion (12.1 p.c), and the Kyrgyz Republic acquired $0.8 billion (9.2 p.c). Turkmenistan acquired virtually nothing (0.2 p.c).

Central Asian international locations might entice extra exterior local weather finance as a result of area’s excessive bodily local weather danger. With out exterior sources, the inexperienced transformation of Central Asia can be a burden for nationwide budgets. Implementing inexperienced initiatives, low carbon applied sciences, and digital options to stop local weather change and defend the surroundings are extremely capital-intensive measures. For instance, estimates recommend that the international locations of the area might face prices starting from one hundred pc of nationwide GDP (Kyrgyz Republic) to 300 p.c (Kazakhstan) with the intention to obtain carbon neutrality. There are some methods, nevertheless, to draw inexperienced finance to the area for its low-carbon transformation.

First, the international locations might present extra high-quality bankable initiatives and develop connections with MDBs working within the area. For instance, Turkmenistan has huge potential to develop ties with MDBs, specifically for upgrading the extractive business and decreasing fugitive emissions. Uzbekistan might function a profitable instance of how Central Asian international locations work with MDBs.

Second, the Central Asian governments might concentrate on investments in renewable power sources. Central Asia has nice potential for hydro, photo voltaic, and wind energy technology. On the identical time, the international locations ought to proceed to develop balancing energy capacities akin to gasoline and nuclear technology. Particularly, Central Asia has large potential to develop nuclear energy technology, inasmuch as Kazakhstan is the world’s largest producer of pure uranium and a serious producer of nuclear gas parts.

Third, exterior assist might work along with home policymaking. Nationwide regulation is equally necessary, akin to inexperienced taxonomies. For instance, Kazakhstan has already adopted its personal taxonomy of inexperienced initiatives, whereas Kyrgyzstan is within the technique of growing taxonomies for inexperienced finance.

Fourth, supranational assist from multilateral establishments could possibly be helpful for enhancing regional competencies. As an illustration, the international locations might share regional expertise and efficiently carried out measures, in addition to spreading energy-efficient applied sciences within the area. Enchancment of power effectivity is vital to decreasing carbon depth and needs to be a part of the inexperienced transformation methods of the agriculture, business, and buildings sectors.

Fifth, shifting in direction of a extra regional ESG (environmental, social, and governance) finance market could possibly be useful to draw non-public capital to inexperienced initiatives, in addition to for issuing ESG bonds. The Astana Worldwide Monetary Middle might guarantee the event of inexperienced finance coverage and inexperienced financing devices each in Kazakhstan and the Central Asian area as an entire.

Lastly, governments, worldwide growth establishments and the non-public sector have to work collectively in combating local weather change. Taking management of local weather dangers would take extra monetary assets, simpler nationwide insurance policies, and extra cooperation. Then it might turn out to be a useful issue for long-term sustainable financial development.

MDBs’ whole local weather finance of Central Asian international locations, $ billion

[ad_2]