[ad_1]

In August 2023 the AIER On a regular basis Worth Index (EPI) rose 0.87 p.c, lifting the index from 285.2 to 287.7. This was the biggest month-to-month p.c enhance since January 2023 (0.93 p.c). Moreover, 287.7 is the best recorded index worth, besting the earlier EPI excessive of 287.1 registered in June 2022.

AIER On a regular basis Worth Index vs. US Client Worth Index (NSA, 1987 = 100)

(Supply: Bloomberg Finance, LP)

Throughout the EPI, the biggest month-to-month worth will increase had been seen in motor gas, housing gas and utilities, and meals away from house. Pet merchandise, housekeeping provides, and costs for classes and instruction noticed the biggest declines in worth, month-to-month.

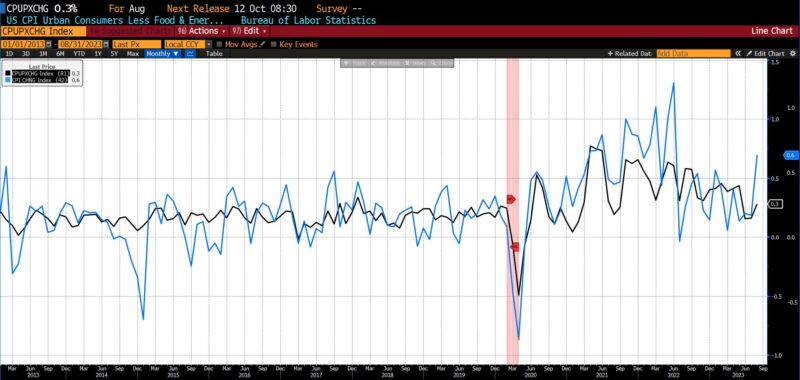

On September 13 the Bureau of Labor Statistics (BLS) launched Client Worth Index (CPI) knowledge for August 2023. The month-to-month headline CPI quantity rose 0.6 p.c versus an 0.2 p.c seen the earlier month. The rise was in step with surveys, and was the biggest enhance in 14 months. Core (excluding meals and vitality) month-to-month CPI rose 0.3 p.c versus an anticipated rise of 0.2 p.c.

The most important contributor to the rise within the month-to-month headline CPI was gasoline, which accounted for over 50 p.c of the rise. Shelter, which has now risen for 40 consecutive months, additionally performed a task within the August acceleration of US costs. Within the core index, the month-to-month rise was accounted for by rents, motorcar insurance coverage, medical, and private care. Costs for used vehicles and vans and recreation declined essentially the most in August.

August 2023 US CPI headline & core, month-over-month (2013 – current)

(Supply: Bloomberg Finance, LP)

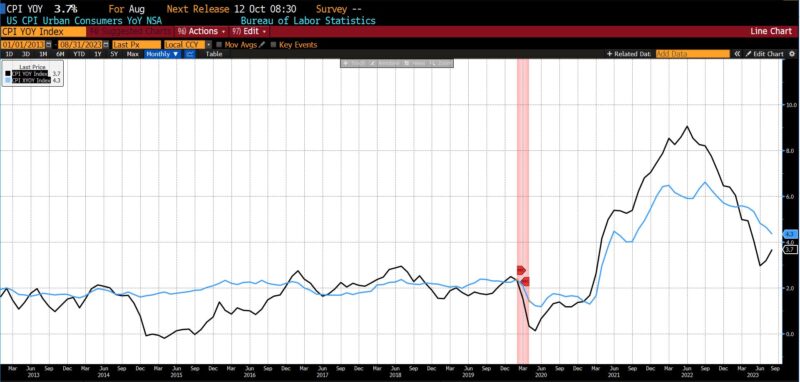

On a yearly (August 2022 by means of August 2023) foundation, headline CPI rose 3.7 p.c versus an anticipated 3.6 p.c enhance, in contrast with a 3.2 p.c enhance in July 2023. The rise within the year-over-year numbers is accounted for largely in vitality and meals worth will increase. Yr-to-year core CPI fell from 4.7 p.c in July 2023 to 4.3 p.c in August 2023. Once more, shelter was a significant (over 70 p.c) contributor to the will increase, as had been motorcar insurance coverage (up 19.1 p.c), private care (5.8 p.c), and new autos (2.9 p.c). The core CPI enhance was in step with expectations.

August 2023 US CPI headline & core, year-over-year (2013 – current)

(Supply: Bloomberg Finance, LP)

The core month-to-month CPI enhance of 0.3 p.c was the primary enhance since February, and comes at a time the place possible Federal Reserve coverage strikes for the rest of 2023 are being intently thought-about. From July 4th weekend till yesterday, the typical US gasoline worth per gallon has risen from $3.89 to $4.29, a ten.3 p.c enhance and the best worth since November 2022. However whereas the rise in gasoline costs was pushed extra by refining hindrances (owing to the summer season heatwave and certain non permanent), worth will increase in air journey, motor insurance coverage, and several other different classes had been detrimental surprises. Grocery costs elevated, however on the slowest tempo (annualized) in over two years.

With the discharge of the information, market-implied coverage charges ticked up within the three- to six-month vary, indicating increased expectations of one other 25 foundation level Fed Funds enhance towards the tip of 2023. Regardless of some enhancements for the reason that obvious peak 13 months in the past, shoppers and companies are nonetheless contending with 31 months of above-trend rising costs.

[ad_2]