[ad_1]

At the moment’s Animal Spirits is dropped at you by YCharts:

Submit your e mail right here to obtain 20% off a YCharts subscription for brand spanking new purchasers and right here for YCharts Worth vs. Progress Tendencies Report

On at this time’s present, we talk about:

Tropical Bros Shirts:

- See right here for Animal Spirits x Tropical Bros shirts and right here for more information on No Child Hungry

Hear Right here:

Suggestions:

Charts:

Tweets:

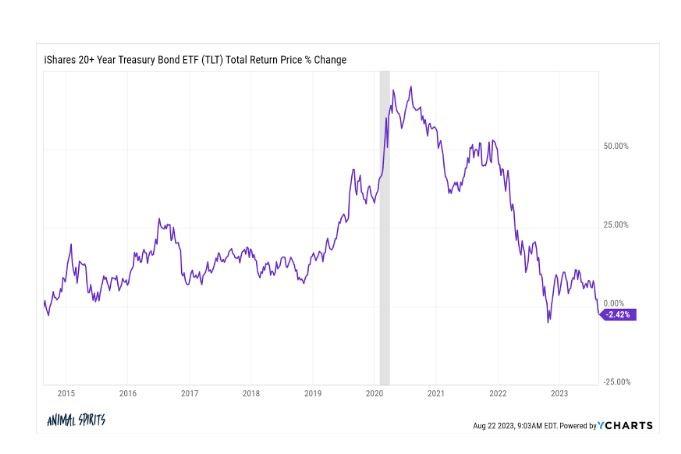

Since 2/19/20 — the height for the market earlier than COVID hit — the 20+ Yr Treasury ETF has posted a complete return of -31.9% versus ARK Innovation’s $ARKK drop of 30.7%. pic.twitter.com/flFRsaJzn6

— Bespoke (@bespokeinvest) August 21, 2023

A take a look at all of Michael Burry’s current predictions.

In 2005, Predicted the collapse of the subprime mortgage market

-> Housing market crashes in 2008, International Monetary Disaster.On Dec 2015, he predicted that the inventory market would crash throughout the subsequent few months.

-> SPX +11%… pic.twitter.com/fpBj9V2Shq— Adam Khoo (@adamkhootrader) August 15, 2023

It is not daily you see a method go virtually all the way in which to zero in lower than two years. However this hashish ETF–which is slated for liquidation–has practically accomplished it. It is down ~90% since its Oct. 2021 inception. Leverage and weed shares, unhealthy combo. pic.twitter.com/h4KEuEUJzD

— Jeffrey Ptak (@syouth1) August 20, 2023

US bonds attracted $1.7bn within the week ending Aug 16 for the thirty third straight week of inflows.

through TD Securities pic.twitter.com/jDLT2kHzMm

— Each day Chartbook (@dailychartbook) August 19, 2023

Cash-market funds have dominated YTD flows throughout asset lessons.

through Barclays pic.twitter.com/Nus7ozgqwN

— Each day Chartbook (@dailychartbook) August 19, 2023

All of those are affordable takes:

-inflation continues to be too excessive

-fast progress is suitable with cooling inflation resulting from provide chain enchancment

-growth continues to be too quick to be in line with 2% inflation

-over time the economic system can’t deal with 5%+ Fed Funds— Conor Sen (@conorsen) August 18, 2023

U.S. shoppers are nonetheless tremendous wholesome

Shopper debt as a % of GDP is at 2001 ranges–Bofa pic.twitter.com/k0aMtQv2Lk

— Gunjan Banerji (@GunjanJS) August 14, 2023

Reminder that some persons are paying mortgage funds for fancy vehicles.

These are actual, lively automobile leases in 5 states: pic.twitter.com/kZwSl0LIbW

— CarDealershipGuy (@GuyDealership) August 17, 2023

Extreme delinquency for auto loans is highest since not less than 2006. But, the roles market is robust.

So mainly, nobody has any thought what is going on on.

[via Wall Street Journal] pic.twitter.com/i0SvkjCrvB

— CarDealershipGuy (@GuyDealership) August 21, 2023

Closing my week pondering ideas from an AI professor @Wharton who thinks productiveness acceleration from AI will take 10-year bond yield as much as 6%.

Is bond sentiment too bullish or bearish – @biancoresearch and @dailydirtnap been debating.

Speak about a 🔥take.

— Jeremy Schwartz (@JeremyDSchwartz) August 18, 2023

2% of mortgaged properties have adverse fairness, down from 25% in 2011 pic.twitter.com/3GZjXYDrGp

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) August 16, 2023

Extra leverage and actual property hypothesis?

Solely 0.88% of dwelling fairness is being utilized in HELOCs presently

The bottom stage since 1988!

It peaked at 6.57% pic.twitter.com/nFKLIx86tI

— TheHappyHawaiian (@ThHappyHawaiian) August 21, 2023

What a month-to-month mortgage cost would appear like for a brand new dwelling purchaser within the US, based mostly on the median present dwelling worth and the typical 30Y fixed-rate mortgage, assuming a 20% down cost: pic.twitter.com/GITXvCvI2f

— Michael McDonough (@M_McDonough) August 22, 2023

Macy’s is difficult to take severely.

Hikes shrink allowance after bodily depend… which raises quite a lot of questions.

Searching for -7% FY comps. Takes bank card delinquencies up.

*This* is what rubbish retail accounting appears like. A lot gibberish for a $4b mkt cap co. $M

— Jeff Macke (@JeffMacke) August 22, 2023

Contact us at [email protected] with any suggestions, suggestions, or questions.

Comply with us on Fb, Instagram, and YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities entails the chance of loss. Nothing on this web site ought to be construed as, and might not be utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product.

[ad_2]