[ad_1]

Bounce to winners | Bounce to methodology

Life within the quick lane

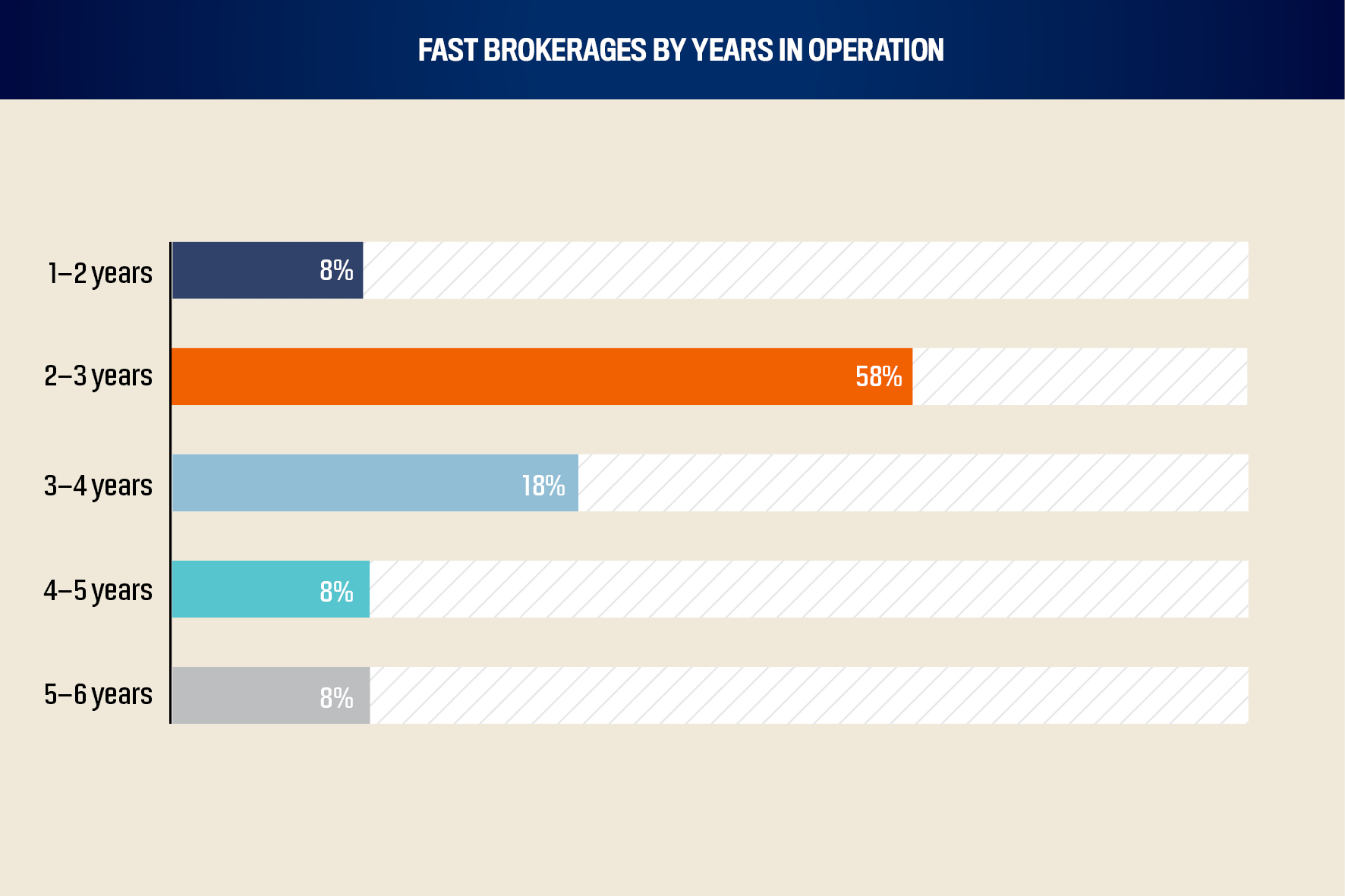

Attaining 20% development in a 12 months is not any imply feat, particularly within the present financial local weather, however that’s what all 12 of AB’s Quick Brokerages have achieved. Much more spectacular, eight of these cohort members have been in enterprise for 3 years or much less and have earned the supplementary honour of being topped Quick Starters.

Business skilled Stephen Michaels, managing director of Catalyst Advisers, showcases why these brokerages deserve reward for delivering such eye-catching outcomes.

“It’s simple to bury your head within the sand and suppose, ‘The market’s down. Capability is down 30%. Individuals can’t borrow as a lot, and nobody’s shopping for,’” he says. “We are able to both sit again and suppose, ‘I’m simply going to attend,’ or begin sharpening our instruments.”

Michaels recommends contenders for the title of Quick Brokerage ought to:

-

preserve glorious relations with a number of banks to seize superb rates of interest, processes, threat appetites and credit score insurance policies

-

grasp the ins and outs of advanced credit score insurance policies

-

sustain with altering instances, problem themselves and stay related

“Australians want trusted mortgage brokers greater than ever”

Rocky LimRL Monetary Group

Peter White, managing director of the FBAA, underlines how powerful it’s been for the 2023 Quick Brokerages to push by means of.

He says, “The fixed rise of rates of interest over the past 12 months or so means you suppose you’ve acquired the deal one minute, then probably the following you do not. That may be a reasonably difficult atmosphere for anybody to truly work in, so it’s good to be tenacious, preserve going and don’t get despondent.”

Quick-growing mortgage corporations

“Only one financial institution may not minimize it,” states Rocky Lim, the proprietor of Quick Brokerage RL Monetary Group. “We provide options from 30, 40 or 50 completely different lenders if it must be proper and you aren’t locked into one answer. Versatility is necessary to all Australians, whether or not they’re upgrading, investing or refinancing.”

Along with partnering with scores of banks, RL Monetary Group outshines the competitors by:

-

inserting purchasers’ finest pursuits at coronary heart

-

constructing rapport and long-term relationships with purchasers

-

establishing clear shopper expectations upfront

The corporate noticed a discount of about 10% within the common mortgage measurement from the fiscal 12 months ending 2022/23; nevertheless, it achieved an roughly 25% acquire in complete settlement worth.

Fellow Quick Brokerage 10X Dwelling Lending is an education-based lending service dedicated to serving to purchasers strategically navigate the method and helping them on each step of their property-buying journey.

“I’m pushed by how many individuals I’m able to assist and serve,” says Michael Wu, mortgage dealer at 10X Dwelling Lending.

The corporate stands out by:

-

specializing in individuals’s wants and understanding each short- and long-term targets

-

regularly bettering its lending data to optimise suggestions

-

making itself out there after hours and on weekends

Over the previous 18 months, 10X Dwelling Lending has:

-

helped 132 purchasers discover options to reaching their monetary targets

-

settled greater than $50 million in loans

-

achieved a 35% improve 12 months by 12 months

-

garnered over 100 5-Star Google evaluations

In the meantime, Quick Brokerage Cinch Loans targets professionals in authorized, medical, consulting and IT.

“I’m an entrepreneurial, trusted adviser with a robust monetary companies background who will get his power from serving to individuals personal their houses quicker,” says founder and CEO Suvidh Arora.

Cinch Loans shines by:

-

leveraging know-how and innovation

-

delivering distinctive options

-

providing a private contact

“My ardour is to assist purchasers enlarge their property success by providing them tailor-made lending options”

Michael Wu10X Dwelling Lending

“We personally know every certainly one of our purchasers and join with them at a private stage,” says Arora. “Nothing can beat the human contact.”

Over the previous 18 months, Cinch Loans has:

-

been nominated for over 75 completely different trade awards

-

gained a number of Elite Dealer awards and CEO’s Selection awards

-

garnered monetary brokerage of the 12 months on the MFAA state awards

-

been named in MPA’s High Brokerages and High Dealer lists

The suitable aspect of the digital divide

Quick-growing brokerages embrace and leverage know-how to their profit, one thing that Cinch Loans has pioneered by:

-

digitising most of their in-house and customer-facing processes

-

implementing a digital brokerage delivering real-time options

-

making certain their in-house CRM platform consolidates all their tech

-

utilizing machine studying, analytics and AI to complement information and shopper outcomes and supply purchasers with distinctive options

“By doing this, we’ve been capable of scale considerably,” says Arora. “Workers numbers are up 250% over the previous 18 months. Enterprise volumes have elevated by over 140%, and we’re on a development spurt that’s being fueled by scalable use of know-how – all whereas offering a private contact to our purchasers, the place every member of our crew is a ‘relationship supervisor.’

“Of late, we’ve began utilizing our tech experience and shopper base to diversify into different streams, together with however not restricted to business finance, asset finance and improvement finance. We’re already seeing some big volumes come by means of.”

The brokerage has seen tangible advantages within the general buyer expertise and effectivity as a result of their use of know-how.

“Sooner or later, I see extra companies utilizing information and AI to not solely acquire a aggressive benefit but additionally proceed to offer distinctive and environment friendly options to their purchasers,” says Arora.

Going above and past

With an abundance of merchandise in the marketplace, the buyer can’t sustain. That is the place 10X Dwelling Lending comes into its personal.

Wu says, “I seen that that is my actual secret weapon, and I’ve gained a variety of enterprise from it.”

He has led the brokerage in its potential to ship for individuals who seem to don’t have any viable choices.

“I’ve acquired some nice purchasers who have been initially declined by their very own banks and even declined by Lendi brokers,” he says. “After consulting with me, I efficiently helped them discover the best lending options to realize their property and monetary targets.”

And he provides, “If I actually can’t discover the best options now, I all the time present them with an actionable plan with a particular timeframe, in order that they are often prepared for the best options within the subsequent three, six or 12 months.”

Proving that, Wu explains how his ingenuity is important for purchasers within the present financial local weather.

“I additionally seen that folks’s budgeting and way of life are a giant focus, as many debtors roll off their mounted charges. I’ve carried out a variety of pricing request actions from banks to make it possible for my purchasers are on a aggressive price. This can be a nice time to remain in contact with my purchasers, construct sturdy relationships and get by means of this troublesome time collectively.”

“We personally know every certainly one of our purchasers and join with them at a private stage. Nothing can beat the human contact”

Suvidh AroraCinch Loans

Eyes on the prize

White particulars how a typical Quick Brokerage must be proactive in promotion.

He says, “They often have a really sturdy profile. It’s not all the time about branding, however very often it’s, they usually have a robust enterprise and private model that may very a lot be a part of it. They’re out within the market, in entrance of shoppers and are very busy participating with the market.”

That’s a theme that chimes with Lim. He’s on the entrance foot to drive RL Monetary Group ahead and has set a goal to extend settlement quantity by 66%.

“We efficiently expanded our personal shopper database, attracting new prospects by means of referrals, advertising and networking. By way of buyer satisfaction, that’s a excessive indicator of job by receiving constructive suggestions from the purchasers,” he says. “We’re increasing the crew, having employed a full-time onshore employees and probably including one other dealer within the subsequent 12 months or two – that’s within the pipeline.”

From the Sponsor

Liberty takes nice satisfaction in sponsoring Australian Dealer’s Quick Brokerages 2023 particular report.

The dealer channel is pivotal in serving to Australians get and keep financially steady. It’s the lifeblood of the mortgage and finance industries and has all the time been on the core of our decision-making at Liberty.

We perceive the wants of brokers and recognise the work concerned in constructing a profitable enterprise. That’s why our merchandise cater to a various vary of consumers, to assist brokers construct sturdy, sustainable companies.

On behalf of Liberty, I congratulate the free-thinking quick brokerages recognised on this report, who achieved standout development over the 2022/23 monetary 12 months. Their tales are significantly inspiring, contemplating the challenges confronted over the previous 12 months. Their potential to adapt and thrive displays a promising future for the trade.

Liberty proudly supplies brokers and prospects with higher selection, providing free-thinking options at aggressive costs. Our revolutionary method has seen greater than 700,000 prospects get monetary assist throughout our vary of dwelling, automobile, private and enterprise loans, in addition to LRBA lending. The Liberty Group has additionally protected over 247,000 prospects with insurance coverage merchandise.

As all the time, we’re dedicated to persevering with our unwavering assist of the dealer channel.

John Mohnacheff

John Mohnacheff

Group Supervisor – Gross sales

Liberty

Quick Brokerages

- 10X Dwelling Lending

- Birdie Wealth

- Cinch Loans

- Mortgage Market Canberra

- Marquee Group

- Marquette Monetary

- Protego Finance

- Reservoir Finance

- RL Monetary Group

- Savvy Finance Group

- Sheel Capital

- Two Birds One Mortgage

Quick Starters

- 10X Dwelling Lending

- Cinch Loans

- Marquee Group

- Marquette Monetary

- Protego Finance

- Reservoir Finance

- RL Monetary Group

- Sheel Capital

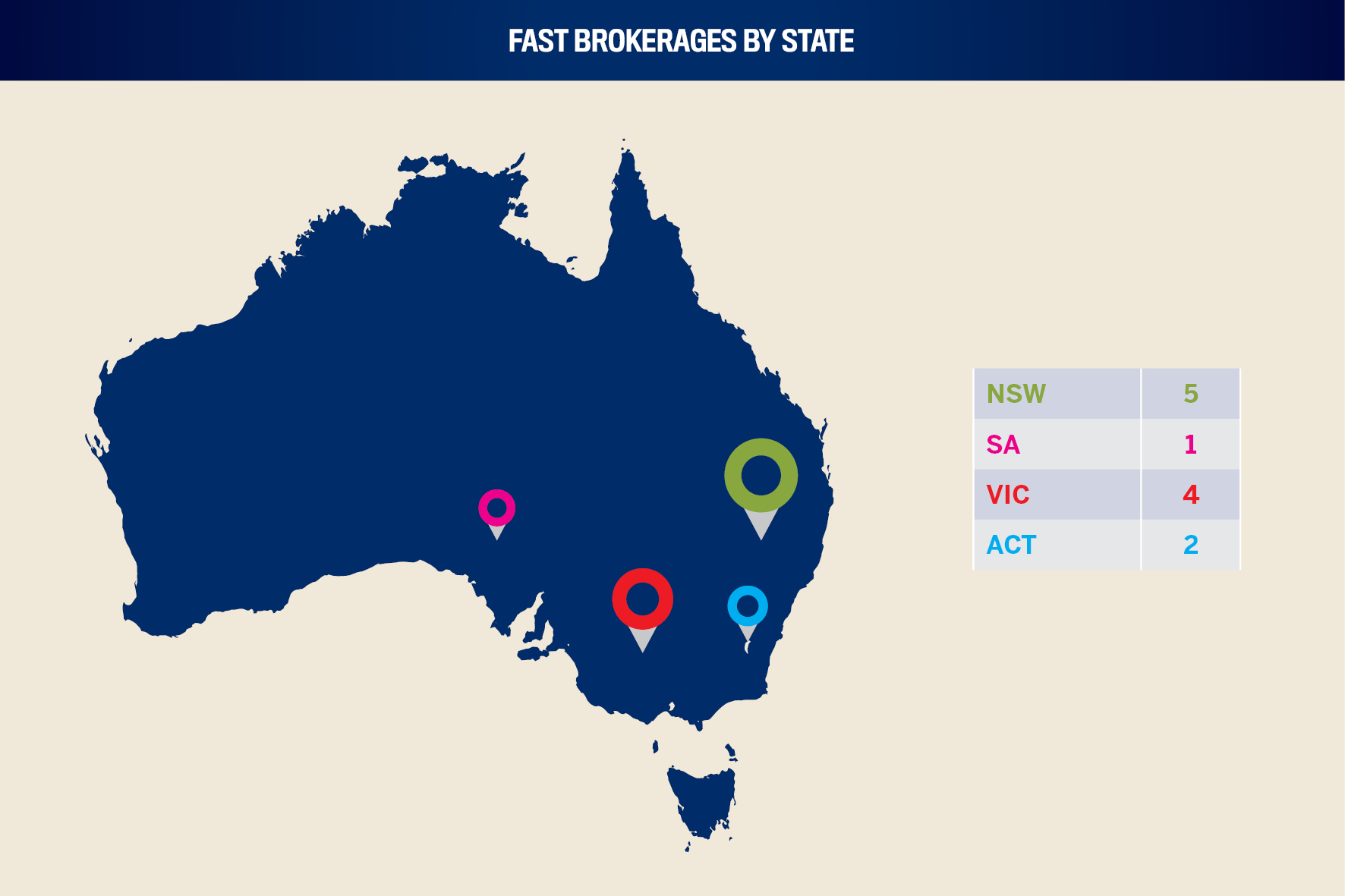

Australian Dealer invited submissions for its third annual Quick Brokerages awards on 17 Could 2023 because the publication sought to recognise Australia’s fastest-growing mortgage brokerages.

The analysis crew requested brokerages to record their income totals and settlement volumes for the 2021/22 and 2022/23 monetary years, along with different development milestones they wished to spotlight. They then evaluated the nominations acquired to find out which brokerages skilled standout development.

The 2023 Quick Brokerages awards are given to brokerages that achieved greater than 20% development in mixed income and settlement quantity.

A complete of 12 brokerages made the ultimate record of Quick Brokerages this 12 months. Australian Dealer additionally highlights eight brokerages as Quick Starters which have been in enterprise for 3 years or much less and are making their mark on the mortgage panorama. These brokerages confirmed their resilience and cemented their sturdy positions within the Australian mortgage trade.

This particular report is proudly sponsored by Liberty.

[ad_2]