[ad_1]

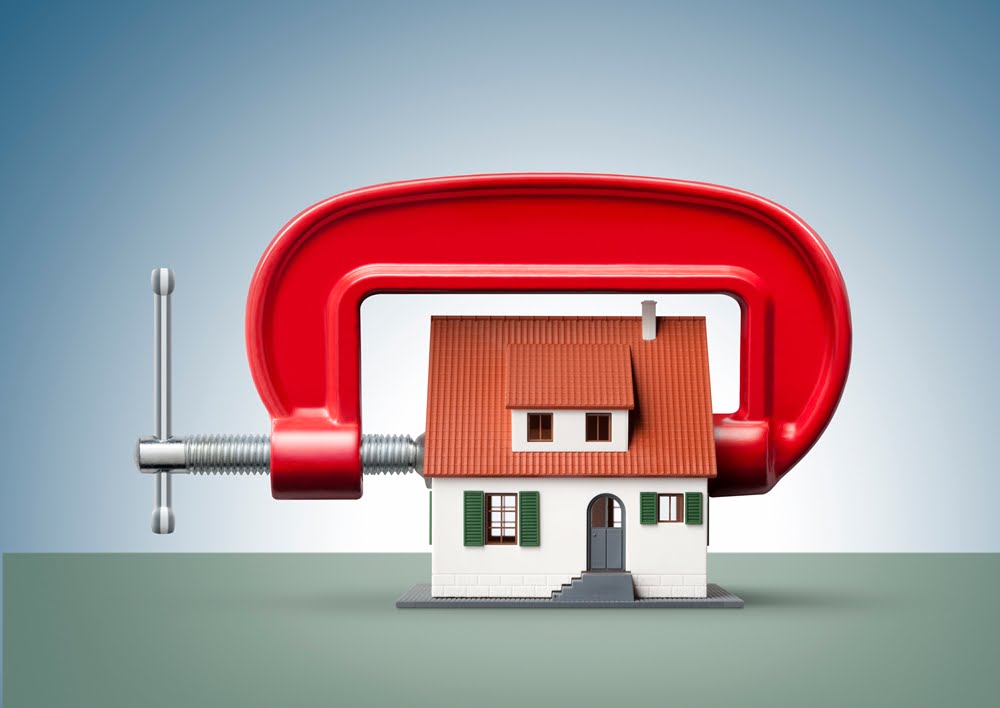

Initially launched to mitigate borrower default dangers within the occasion of rising rates of interest, some brokers now argue that Canada’s mortgage stress check is not wanted with rates of interest presumably close to their peak.

Others, nonetheless, say it’s a instrument that’s finest left in place in the intervening time.

Again in 2016, the federal authorities rolled out the stress check as a strategy to curb dangers related to lending in occasions of low rates of interest and excessive market costs. The check acts as a buffer, making certain that potential homebuyers with a 20% or higher down fee are in a position to afford month-to-month mortgage funds at a charge of 5.25% or 2% over their contracted charge—whichever is larger.

Two years later, the Workplace of the Superintendent of Monetary Establishments (OSFI) prolonged the check to use to insured mortgages as properly, or these with down fee of lower than 20%.

As rates of interest at present stand, this implies at present’s debtors are having to qualify for mortgages at charges between 7% and 9%.

Is the stress check nonetheless vital?

Although the stress check remains to be serving its function as a buffer for brand spanking new homebuyers and buyers, at present’s financial and rate of interest surroundings is kind of completely different in comparison with when the stress exams had been put in place.

That’s why some mortgage professionals say it’s time to take a tough have a look at the stress check.

“I might say that possibly the stress check making use of 2% above what present charges are is exceeding what the dangers are,” says Matt Albinati, a mortgage dealer with TMG The Mortgage Group. “I’m all for constructing a buffer for individuals’s monetary scenario, however the stress check limits the quantity individuals can borrow.”

Albinati thinks that this modification of surroundings does represent a assessment of the stress check, one thing that OSFI does with its pointers every year.

“You look again a yr, the stress check was doing a fairly good job. This time—or close to sooner or later—it is likely to be a superb time to take a better have a look at it,” he instructed CMT.

Others, nonetheless, like Tribe Monetary CEO Frances Hinojosa, assume the stress check needs to be left as is, at the very least for now.

“I don’t assume we needs to be so fast to vary the stress check till we’re out of the present financial storm that we’re in at present,” she instructed CMT in an interview.

“On the finish of the day, it’s there to additionally defend the patron [in addition to financial institutions] to make sure that they’re not over-leveraging themselves in a mortgage that they might doubtlessly not be capable of afford down the highway,” she added.

Hinojosa thinks that the stress check proved its value through the current run-up in rates of interest, the influence of which was felt instantly by adjustable-rate mortgage holders.

“What I observed with a whole lot of these shoppers when the charges had been ratcheting up was that it wasn’t a query of whether or not they couldn’t afford it,” she stated. “It was simply uncomfortable as a result of they needed to readjust the price range.”

With out the stress check in place when these debtors had been qualifying for his or her mortgages, they might have doubtlessly over-leveraged themselves and doubtlessly put themselves susceptible to default if charges rose excessive sufficient, Hinojosa added.

Different lenders

Whereas all federally regulated monetary establishments are required to comply with stress check pointers, there are nonetheless different choices for customers.

Some provincial credit score unions, for instance, can situation mortgages with a qualifying charge equal to the contract charge or simply 1% larger, giving stretched debtors extra leeway.

However, are they utilizing credit score unions?

Albinati and Gert Martens, a dealer with Dominion Lending HT Mortgage Group based mostly out of Grande Prairie, AB, say that their shoppers are usually not sometimes turning to credit score unions.

Albinati famous that to ensure that his shoppers to obtain insurance coverage for his or her mortgage—which makes up about two-thirds of his buy information—they might want to comply with federal pointers and qualify below the stress check.

Hinojosa, nonetheless, stated she has seen the stress check push debtors to different lending channels, together with the personal mortgage sector. “I believe the opposite a part of that is the unintended penalties of getting such a excessive stress check,” she stated. “It’s not solely pushing shoppers essentially to credit score unions, [but] additionally rising the quantity of enterprise that’s been going into different lenders.”

Though these different channels have seen a spike in exercise, Hinojosa notes that it isn’t as a result of these establishments don’t stress check, however as a result of in addition they have the flexibility to approve shoppers with prolonged debt-to-income ratios that the banks can’t essentially do.

Albinati stated he’s additionally beginning to ship enterprise to lenders aside from the large banks. “We’re doing a whole lot of renewals [and] pulling enterprise away from the chartered banks, as they aren’t being aggressive,” he stated. “[With] file mortgage lending in 2020-2021, they’re scaling again as mortgages are fairly aggressive by way of revenue margins.”

[ad_2]