[ad_1]

It’s exhausting to reap the benefits of what everybody already is aware of. That is considered one of many causes that index returns can’t be defined by valuations, particularly within the quick time period. If everyone is conscious of one thing, it’s exhausting to derive an edge from it. It’s what you possibly can’t predict that drives extra returns.

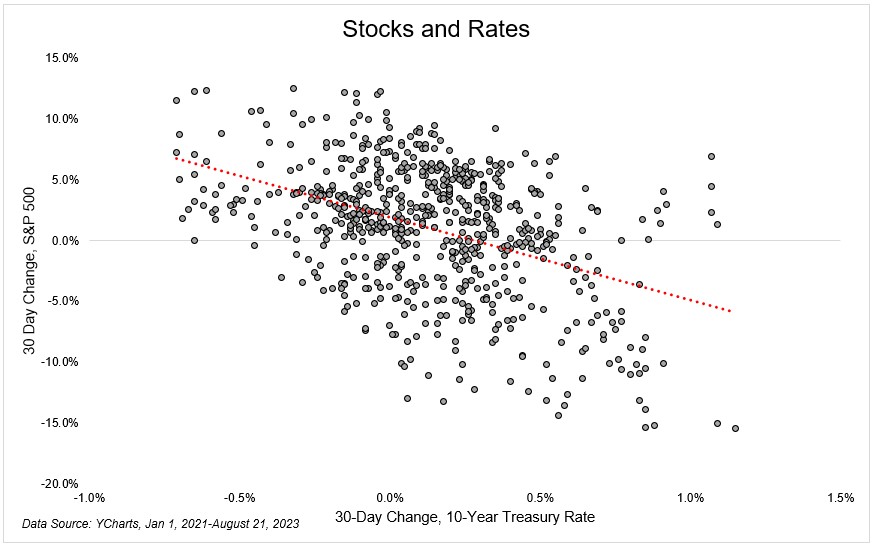

One of the crucial vital issues to the inventory market proper now’s rates of interest. In case you knew the place rates of interest would go, you’d have a great likelihood of beating the market. This chart exhibits the 30-day change within the 10-year treasury fee and the way shares carried out over the identical time. From 2021-today, if the 10-year treasury fee was up, which it was 64% of the time, shares fell 0.15% on common over the identical time. If 10-year charges have been down over a 30-day interval, the S&P 500 gained 3.1% over the identical time.

In case you knew that charges would rise, you’d have sat in money. In case you knew that charges would fall, you’d have levered up. However in fact you couldn’t know what charges would do, which will get again to the purpose of what drives alpha; stuff you can not persistently predict.

This relationship gained’t maintain ceaselessly, but it surely’s been considered one of if not a very powerful variables which have pushed inventory market returns because the fee mountaineering cycle started.

Josh and I are going to cowl this and rather more on tonight’s What Are Your Ideas?

[ad_2]