[ad_1]

Activist shareholders play a central function in fashionable companies, influencing the capital construction, enterprise technique, and governance of corporations. Such “blockholders” vary from traders who actively jawbone or break up corporations to index funds which are largely passive in that they restrict themselves to voting. In between, nevertheless, is a key group of blockholders which have traditionally targeted on buying and selling however have embraced activism as a longtime enterprise technique up to now few a long time. Campaigns involving such “buying and selling” blockholders have turn out to be ubiquitous, more and more concentrating on large-capitalization corporations; additional, their assaults characteristic a number of activists, every with particular person stakes that, in isolation, are unable to regulate targets. On this put up, we ask three questions: (1) How do buying and selling activists construct stakes earlier than an assault, whereas anticipating that different traders could have related incentives? (2) Does the character of strategic buying and selling change relative to settings the place activism is unlikely to happen? (3) Are there trade-offs between buying and selling and the agency’s long-term worth?

A Chief-Follower Tackle the “Free-Rider” Drawback

Activism is a expensive exercise on the whole: planning and executing large adjustments in firms requires analysis, consultants, and authorized charges, all of which may add as much as hundreds of thousands of {dollars} in bills. A traditional “free-rider drawback” is at play: because the good points related to any given marketing campaign profit all shareholders, there’s an incentive to let others spend their very own sources. All else equal (particularly, absent institutional variations throughout traders), shareholders with bigger blocks have a better incentive to incur these prices, as the additional worth generated is utilized to extra shares. “Video games of affect” naturally emerge: with many activists inserting their eyes on the identical targets, and block dimension figuring out their willingness to intervene in a agency, an activist would possibly wish to steer others so as to add worth by affecting the profitability of block accumulation.

In a latest paper, we develop a mannequin through which two activists resolve what number of shares to build up in a setting the place (i) activists’ preliminary blocks are their personal data (that’s, positions haven’t been disclosed); and (ii) activists can make investments to enhance agency worth. We contemplate the case through which preliminary blocks exhibit correlation, whereas buying and selling is sequential: within the first interval, a frontrunner activist (she) submits a market order on the agency’s inventory (alongside retail traders, who successfully camouflage her commerce), whereas within the second interval a follower activist (he) performs the function of the chief. Within the third (and final) interval, each activists take expensive actions that decide agency worth. Our chief should then consider how her buying and selling will have an effect on the agency’s worth by influencing the follower’s subsequent buying and selling alternatives. Thus, our steering dynamics are market-based, and therefore much less relevant to traders with portfolios in mounted proportions (for instance, index funds); additional, we summary from environmental, social, and governance points affecting corporations’ values.

Buying and selling Dynamics with Steering Motives

In a landmark paper, Kyle (1985) examined the query of how a dealer with superior data relating to a agency’s true worth strategically transmits her data to the market by way of her trades. Two key insights emerge from the prolific literature that adopted. First, the dealer’s value influence units limits on arbitrage, in a scientific approach: whereas extra responsive costs naturally induce much less aggressive trades, the general responsiveness of costs should be in keeping with the data conveyed by the dealer’s market orders—say, if the dealer makes an attempt to arbitrage an underpriced agency extra aggressively by shopping for extra shares, costs ought to reply extra to order flows, and vice-versa. Second, the dealer behaves in an “unpredictable” method in equilibrium: the dealer is at all times equally more likely to be lengthy or quick relative to cost quoted by market makers in any interval—thus, the anticipated path of her commerce is impartial always.

Our mannequin presents a brand new perspective on these insights. On the ‘limits to arbitrage’ dimension, value influence can also be naturally at play, because it determines the bills incurred whereas buying and selling. However it’s not the one drive. Assume that the preliminary blocks are positively correlated—that’s, leaders holding bigger blocks initially are statistically indicative of followers having bigger blocks too—and suppose that the chief accumulates a smaller block than anticipated by market makers who set costs. A surprisingly low order stream would induce the market maker to deduce that the chief’s place—and that of the follower, as a result of correlation is constructive—are smaller than anticipated. From the attitude of the chief, due to this fact, such a transfer implies that the follower will face a decrease quoted value when it’s his flip to commerce, successfully making block accumulation extra enticing. Because the follower acquires extra shares, he essentially makes a bigger funding resolution too, which the chief enjoys. In different phrases, the power to affect agency worth via the actions of different activists is a second drive that influences the magnitude of market orders.

Extra formally, we assemble an equilibrium through which the chief sells on common if positions are positively correlated initially, whereas she buys on common in any other case: within the latter case, a excessive quantity is indicative of a giant block by the chief, which now’s synonym of a smaller place by the follower, and the identical mechanism ensues. However this means that the chief ceases to commerce in an unpredictable approach, as order flows acquire non-trivial momentum in our equilibrium. Returning to our questions, the steering motive induces a frontrunner activist to attempt to switch prices to their followers by making their arbitrage alternatives extra enticing (query 1): as followers purchase extra inventory, they develop extra pores and skin within the sport. However to realize this purpose, the chief should commerce in a approach that departs from the standard view on strategic buying and selling that the chief trades in an unpredictable approach (query 2).

Predictions and Correlation in Observe

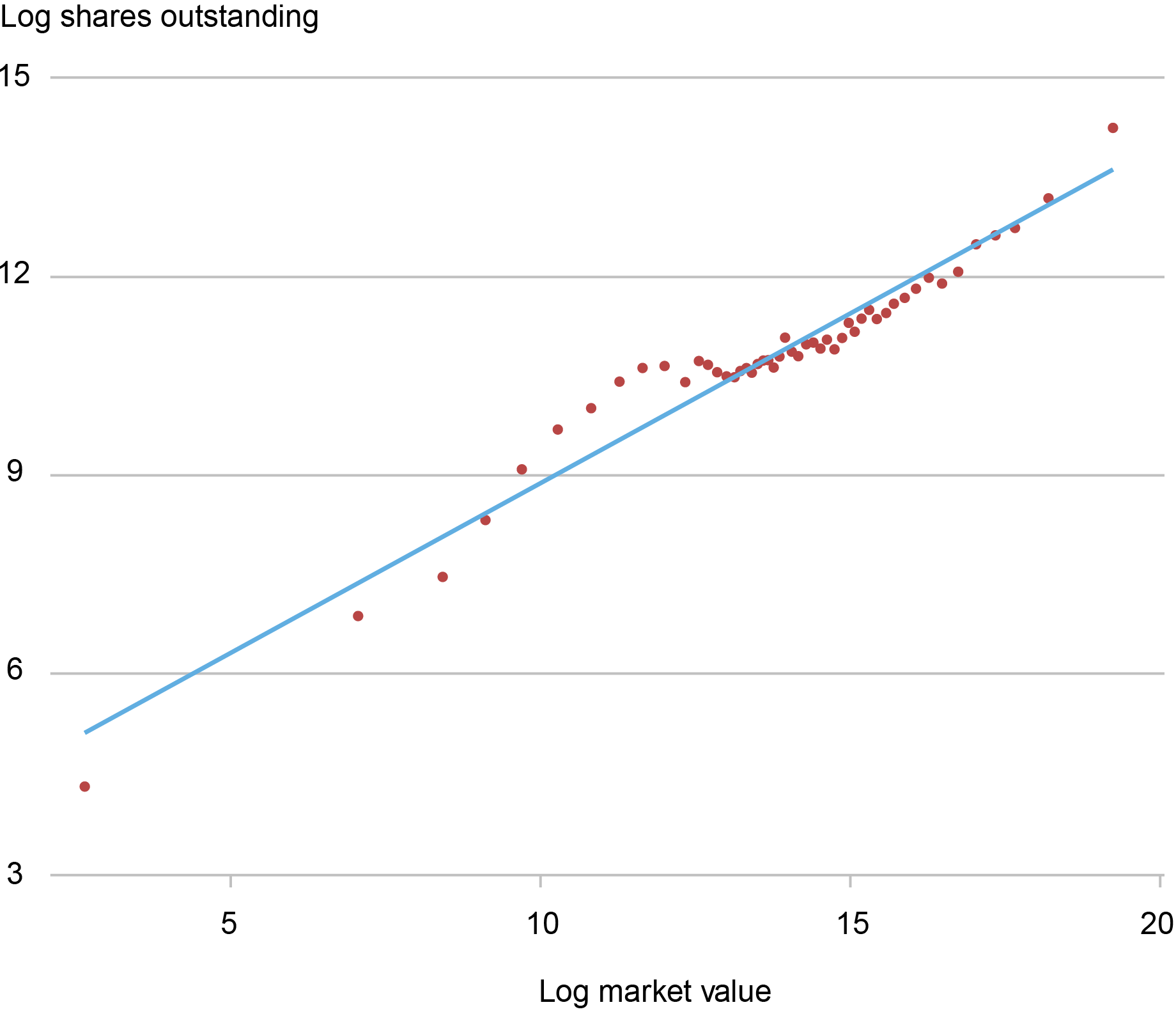

In our mannequin, massive terminal blocks—that’s, put up buying and selling positions—are synonymous with excessive share values. As a result of the chief decreases/will increase her terminal place when correlation is constructive/damaging, corporations’ share values are decrease/increased than if buying and selling was not allowed, or activism was not at play. Thus, whether or not the steering motive exacerbates conventional free-rider motives, thereby lowering values (query 3), relies on the signal of the correlation. The latter may be linked with observable agency traits, permitting us to guage our findings. As an illustration, a mixture of activists with lengthy and quick positions is extra possible with damaging correlation in our mannequin: the upper share values that we predict are in keeping with extra inventory appreciation arising for corporations that includes traders with massive quick positions on its inventory, as documented by some research. Equally, our work predicts that the extra worth that activism brings ought to decline when shifting from damaging to constructive correlation: that is in step with inventory appreciation reducing as market valuation transitions from low to high-cap corporations—certainly, large-cap corporations provide extra scope for constructive correlation as a result of they have an inclination to have extra shares excellent, as depicted within the chart beneath.

Shares Excellent (Logs) and Market Values (Logs) for a Giant Pattern of Companies within the U.S. Inventory Market

Supply: Doruk Cetemen, Gonzalo Cisternas, Aaron Kolb, and S. Viswanathan (2023): “Activist Buying and selling Dynamics,” Federal Reserve Financial institution of New York Workers Reviews 1030, September 2022, Revised February 2023.

That mentioned, we present that the presence of a frontrunner at all times will increase agency values relative to the case through which the follower acts in isolation, in step with proof documenting that multiplayer engagements carry out higher than single-player counterparts: a doubtlessly exacerbated free-rider motive doesn’t offset the presence of a further strategic chief investor who has vested pursuits in a agency.

Doruk Cetemen is an assistant professor of economics on the Metropolis, College of London.

Gonzalo Cisternas is a monetary analysis advisor in Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Aaron Kolb is an affiliate professor of enterprise economics and public coverage at Indiana College Kelley Faculty of Enterprise.

S. “Vish” Viswanathan is the F.M. Kirby Professor of Finance on the Fuqua Faculty of Enterprise, Duke College

Learn how to cite this put up:

Doruk Cetemen, Gonzalo Cisternas, Aaron Kolb, and S. “Vish” Viswanathan, “Chief-Follower Dynamics in Shareholder Activism,” Federal Reserve Financial institution of New York Liberty Road Economics, September 6, 2023, https://libertystreeteconomics.newyorkfed.org/2023/09/leader-follower-dynamics-in-shareholder-activism/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).

[ad_2]