[ad_1]

Complete family debt balances elevated by $16 billion within the second quarter of 2023, in keeping with the newest Quarterly Report on Family Debt and Credit score from the New York Fed’s Heart for Microeconomic Knowledge. This displays a modest rise from the primary quarter. Bank card balances noticed the most important improve of all debt varieties—$45 billion—and now stand at $1.03 trillion, surpassing $1 trillion in nominal phrases for the primary time within the collection historical past. After a pointy contraction within the first 12 months of the pandemic, bank card balances have seen seven quarters of year-over-year development. The second quarter of 2023 noticed a brisk 16.2 % improve from the earlier 12 months, persevering with this robust development. With bank card balances at historic highs, we think about how lending and reimbursement have developed utilizing the New York Fed’s Client Credit score Panel (CCP), which is predicated on anonymized Equifax credit score report knowledge.

Credit score Card Issuance

Bank cards are essentially the most prevalent type of family debt and proceed to change into much more widespread. Contemplate that there are 70 million extra bank card accounts open now than there have been in 2019, earlier than the pandemic. What’s extra, about 69 % of Individuals had a bank card account within the second quarter of 2023, up from 65 % in December of 2019 and solely 59 % in December of 2013. And whereas lending did take a dip through the first 12 months of the pandemic, bank card issuances have been at considerably elevated ranges since.

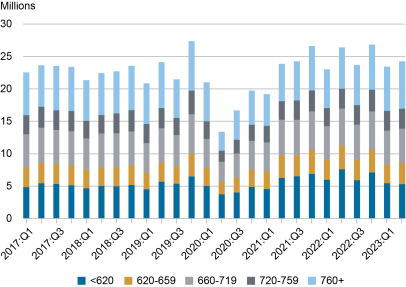

Within the chart beneath, we depict the opening of recent bank card accounts, damaged out by the debtors’ credit score scores. Bank card issuance had been pretty regular total, averaging about 23 million newly issued playing cards every quarter between 2017-19. The onset of the pandemic prompted a pointy retraction in new bank card issuance, with solely 13 million playing cards issued within the second quarter of 2020. However by the second quarter of 2021, lending returned throughout all credit-score teams.

Subprime debtors noticed a surge in card issuance in 2021 and 2022, though this seems to have softened within the first half of 2023. In contrast, card issuance to debtors with the best credit score scores— these over 760—expanded throughout first half of 2023. This relative tightening is according to different stories: The July 2023 Senior Mortgage Workplace Opinion Survey on Financial institution Lending Practices (SLOOS) described tightening requirements for all shopper mortgage requirements, and our June 2023 SCE Credit score Entry Survey confirmed a rise in credit score software rejection charges, particularly amongst these with decrease credit score scores.

Credit score Card Issuance by Credit score Rating

Credit score Card Delinquency

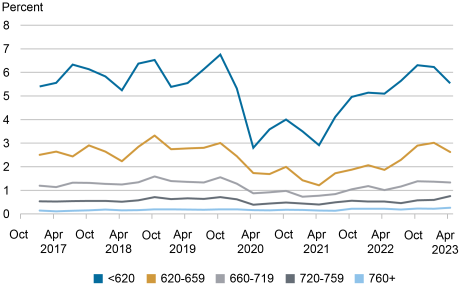

In February we wrote about rising delinquency charges and our plan to proceed to watch the state of affairs. Delinquency charges have now returned to pre-pandemic ranges. Within the chart beneath, we disaggregate transitions into delinquency by the borrower’s credit score rating at issuance. This image is according to a return to pre-COVID tendencies after a stretch of unusually low delinquency charges through the pandemic when forbearance, policy-boosts to revenue, and restricted consumption alternatives meant debtors had been higher positioned to repay their money owed. The 2 most up-to-date quarters additionally seem to indicate some stabilization. Be aware that these charges differ from the transition charge calculated in our Quarterly Report as a result of they’re unsmoothed and use extra detailed knowledge.

Delinquency Charges Degree Off

Transition into 30+ Days Delinquency

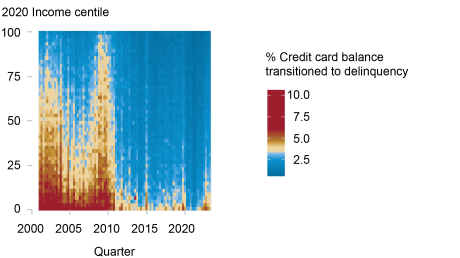

We lastly think about debt efficiency by revenue, to find out whether or not combination statistics could also be masking underlying financial challenges current in lower-income communities. We group debtors utilizing the typical adjusted gross revenue of their zip code as a proxy for revenue, utilizing knowledge from the IRS (zip code revenue). Within the warmth map model chart beneath, we depict bank card delinquency aggregated by zip code revenue, which is proven on the y-axis, with the share of delinquency indicated by the colour. Right here, we first see that decrease revenue areas have traditionally had increased delinquency charges, whereas increased revenue areas sometimes have higher debt efficiency. However, earlier than the Nice Monetary Disaster, bank card delinquencies had been significantly extra widespread, even in increased revenue areas, and rose much more between 2008-10. However now, after a quick interval of unusually low delinquency between 2020-22, delinquency charges have normalized at pre-pandemic ranges even in decrease revenue areas.

Credit score Card Delinquency by Zip Code Revenue

Regardless of the various headwinds American customers have confronted during the last 12 months—increased rates of interest, post-pandemic inflationary pressures, and the current banking failures—there’s little proof of widespread monetary misery for customers. American customers have up to now withstood the financial difficulties of the pandemic and post-pandemic durations with resilience. Nonetheless, rising balances might current challenges for some debtors, and the resumption of scholar mortgage funds this fall might add extra monetary pressure for a lot of scholar mortgage debtors. Even so, so far, family credit score reveals some early indicators of stabilizing at pre-pandemic well being, albeit with increased nominal balances.

Andrew F. Haughwout is interim director of analysis and head of Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donghoon Lee is an financial analysis advisor in Client Habits Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Daniel Mangrum is a analysis economist in Equitable Progress Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Joelle Scally is a regional financial principal within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Wilbert van der Klaauw is the financial analysis advisor for Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Tips on how to cite this publish:

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw, “Credit score Card Markets Head Again to Regular after Pandemic Pause,” Federal Reserve Financial institution of New York Liberty Avenue Economics, August 8, 2023, https://libertystreeteconomics.newyorkfed.org/2023/08/credit-card-markets-head-back-to-normal-after-pandemic-pause/.

Disclaimer

The views expressed on this publish are these of the writer(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the writer(s).

[ad_2]