[ad_1]

Saleem Bahaj, Robert Czech, Sitong Ding and Ricardo Reis

Few matters captivate our consideration just like the enigma of inflation. Understanding the place the market thinks inflation is headed is essential for policymakers, buyers, and anybody who desires to maintain their monetary geese in a row. And that’s the place inflation swaps come into play. They’re just like the crystal ball of inflation expectations, permitting merchants to hedge towards inflation threat and giving us a peek into the minds of market contributors. In a current paper, we delve into this thriving market to uncover the who, what, and why behind the costs of those swaps to make clear the dynamics of inflation expectations.

Why, you may ask, are these swaps gathering such consideration? Properly, their significance lies of their capacity to supply a complementary perspective on inflation expectations. Whereas conventional measures similar to breakeven inflation from index-linked authorities bonds have their deserves, inflation swaps present a complementary canvas for market contributors to precise their views on future worth dynamics. By analysing these swaps, economists can refine their understanding of market sentiment and calibrate their choices accordingly. Regardless of the market’s significance, not a lot is thought in regards to the related gamers and portions behind the costs.

Inflation swap fundamentals

However first, let’s return to fundamentals. Inflation swaps are by-product contracts that enable two events to change a stream of funds at a hard and fast fee for an additional at a floating fee pegged to an inflation index (for instance the UK Retail Value Index (RPI)). Most inflation swap contracts take the type of zero coupon swaps, the place money adjustments palms on the finish of the contract. The vast majority of these contracts are likely to mature at comparatively brief horizons (eg one to 3 years) or at lengthy horizons of ten years or extra.

The customer of an inflation swap pays the mounted fee, which displays the anticipated inflation on the contract’s finish date. If inflation matches the mounted fee, no cash adjustments palms, and each events break even. The vendor of an inflation swap pays the floating inflation fee. Because the precise inflation fee is unsure, the vendor’s legal responsibility is decided solely on the finish of the contract. When the realised inflation fee deviates from the mounted fee, one occasion has to compensate the opposite. For instance, if realised inflation is increased than the mounted fee, the vendor will owe the customer on the finish of the contract, and vice versa if realised inflation is decrease than the mounted fee.

Unsurprisingly, the inflation swap market just isn’t with out its complexities. Market contributors have totally different bargaining powers and risk-bearing capacities, and infrequently demand further compensation for buying and selling such a dangerous by-product. Which means the swap breakeven fee not solely displays the markets’ pure inflation expectations, however can also be probably contaminated by a liquidity premium – a catch-all time period for market imperfections that may be massive and differ over time. Given so, how helpful are these swap breakeven charges as a measure of anticipated inflation?

Stylised information in the marketplace for inflation swaps

To carry the lid on this market, we harness the regulatory DTCC EMIR Commerce Repository Knowledge to acquire detailed trade-level experiences on over-the-counter inflation swap contracts. The inflation measure for the UK inflation swap market is the RPI, which dominates practically all (round 99%) swap contracts traded on UK inflation – per the RPI’s position because the index used for inflation-linked gilts. Taking a more in-depth have a look at the UK RPI swaps, one of many key information that we doc is the segmentation throughout the market. Pension funds and LDI funds emerge as the first consumers of inflation safety, holding substantial optimistic web positions (predominantly at longer horizons of greater than 10 years). Seller banks, who’re on the opposite aspect of the commerce, actively promote inflation safety past their holdings of inflation-linked gilts. Hedge funds actively have interaction in short-horizon buying and selling (≤ three years), resulting in every day fluctuations of their web positions. This market segmentation sheds gentle on the methods and buying and selling motives of market contributors throughout totally different buying and selling horizons: hedge funds appear to interact in knowledgeable arbitrage buying and selling within the short-horizon market, whereas pension funds search to hedge their long-dated liabilities by shopping for inflation safety within the long-horizon market. Consequently, vendor banks find yourself as substantial web sellers of inflation safety (as proven in Chart 1).

Chart 1: Web notional positions within the UK RPI inflation swap market

Supply: DTCC Commerce Repository OTC rate of interest commerce state information, from January 2019 to February 2023.

Our identification methods

Backed by a theoretical mannequin, we decompose swap costs into two elements: (i) a liquidity premium; and (ii) a ‘basic’ part of inflation expectations. To estimate these elements, we make use of three totally different identification methods, every leveraging totally different options of the information.

First, we reap the benefits of the high-frequency nature of our information and assume that hedge funds reply extra to basic shocks than vendor banks inside a buying and selling day. Seller banks, in flip, react greater than pension funds to those shocks. Which means a basic shock resembles a requirement shock within the short-horizon market (each costs and portions rise) and a provide shock within the long-horizon market (costs rise however portions fall). We additionally assume that demand shocks to the short-horizon market don’t spill over to the long-horizon market inside a buying and selling day, and vice versa. Importantly, we’re capable of confirm these assumptions within the information. Utilizing a signal restriction strategy, we’re then capable of establish provide, demand and basic shocks by observing fluctuations of costs and portions within the swap market.

Second, we leverage the variation throughout market contributors to assemble granular instrumental variables, utilizing investor-level shocks as devices for the combination demand of every sector.

Lastly, we exploit the truth that inflation swap charges exhibit bigger fluctuations on inflation launch dates. Assuming that these dates are dominated by basic shocks, we are able to use worth actions over time to establish these shocks. For all three identification methods, we then estimate vector autoregressions.

Outcomes and coverage implications

Our empirical evaluation yields a number of strong findings throughout the three identification methods. First, we discover that every one swap charges stabilize inside two to 3 buying and selling days after a basic shock. In different phrases, the inflation swap market appears to include new basic info moderately rapidly. Second, the availability of inflation safety by vendor banks to pension funds at lengthy horizons could be very elastic, in contrast to their provide to hedge funds at brief horizons. Which means shocks to the demand of pension funds decide the traded portions within the long-horizon market, however are unlikely to have a major impression on costs. Third, a lot of the actions in short-horizon swap costs are pushed by liquidity frictions, notably by shocks to the demand of hedge funds. Our outcomes due to this fact counsel that short-horizon swap charges are comparatively unreliable measures of anticipated inflation. In distinction, basic elements dominate worth actions within the long-horizon market. This implies that adjustments within the 10-year inflation swap fee are a greater measure of basic anticipated inflation.

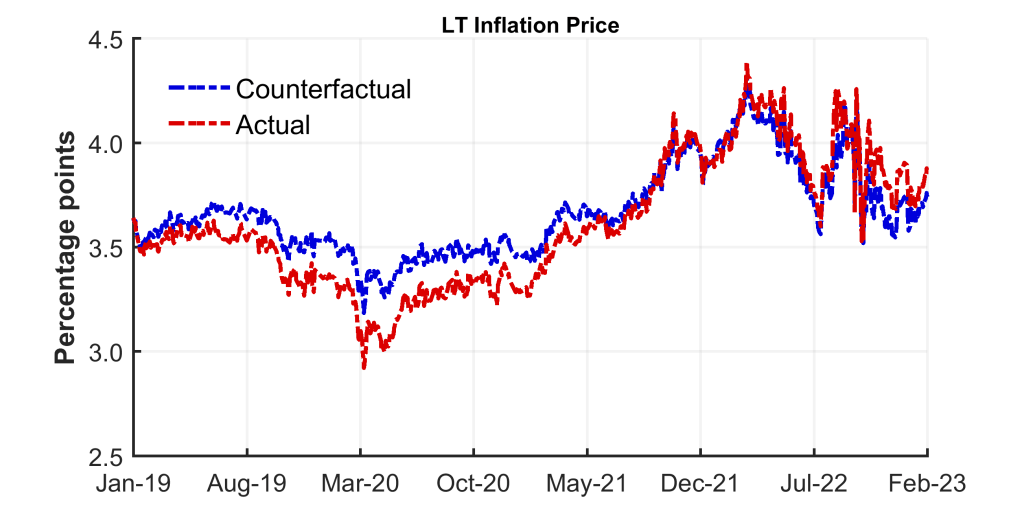

Furthermore, we offer a novel time collection for long-horizon basic anticipated inflation that’s cleaned of liquidity frictions (see Chart 2). Our counterfactual estimates of anticipated long-term inflation counsel that an unfiltered studying of precise inflation swap costs will result in an overstatement of actions in anticipated inflation. For instance, precise measures overstated the chance of deflation throughout the pandemic, they usually equally overstated the chance of sustained inflation throughout the power disaster. In reality, our counterfactual measure of anticipated basic inflation has been decrease and declining extra quickly than precise swap charges since Autumn 2022. Our counterfactual measure due to this fact means that long-run expectations of inflation are extra secure than implied by precise swap charges alone.

Chart 2: Elementary anticipated inflation

Lastly, we discover a important dispersion within the beliefs about inflation amongst vendor banks and hedge funds. Within the short-horizon market, we present {that a} handful of establishments reply to basic adjustments in inflation expectations by taking far bigger positions out there. This means that their buying and selling behaviour is prone to decide swap costs. Within the long-horizon market, in distinction, pension funds are likely to have extra uniform beliefs and their worth impression is extra evenly distributed. Intriguingly, the inflation beliefs of particular person vendor banks inferred from buying and selling exercise additionally line up remarkably properly with their one-year inflation forecasts: the vendor banks that submit increased inflation forecasts are likely to promote much less inflation safety to hedge funds within the short-horizon market.

Conclusion

Understanding the dynamics of the inflation swap market is beneficial for policymakers and market contributors alike. By shedding gentle on the important thing gamers, market dynamics, and expectations, we reveal the swift reactions of market contributors to new info, the position of various establishments in buying and selling inflation safety, and the impression of liquidity frictions and basic elements on worth actions. These insights present helpful steering for understanding inflation expectations and making knowledgeable choices in a quickly altering financial panorama.

Saleem Bahaj works within the Financial institution’s Analysis Hub division and is an Affiliate Professor of Finance and Economics at College School London. Robert Czech works within the Financial institution’s Analysis Hub. Sitong Ding is a PhD scholar on the London Faculty of Economics and Ricardo Reis is the A. W. Phillips Professor of Economics on the London Faculty of Economics.

If you wish to get in contact, please e-mail us at [email protected] or go away a remark under

Feedback will solely seem as soon as authorized by a moderator, and are solely printed the place a full identify is provided. Financial institution Underground is a weblog for Financial institution of England employees to share views that problem – or help – prevailing coverage orthodoxies. The views expressed listed below are these of the authors, and aren’t essentially these of the Financial institution of England, or its coverage committees.

Share the put up “Decoding the marketplace for inflation threat”

[ad_2]