[ad_1]

Obtain free Eurozone inflation updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the newest Eurozone inflation information each morning.

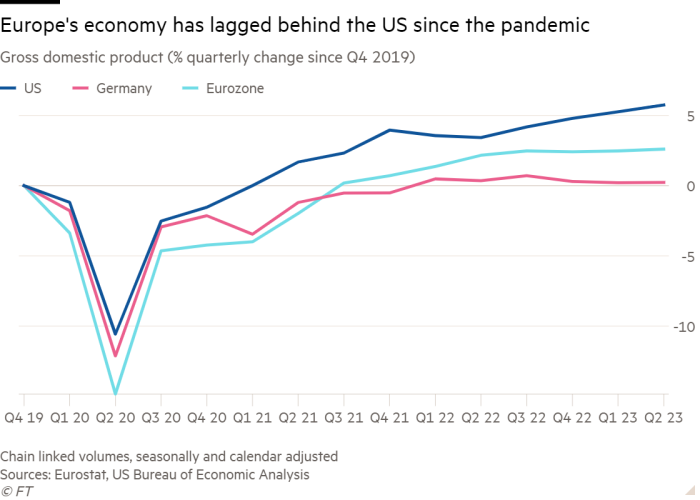

The EU financial system is forecast to develop simply 0.8 per cent in 2023 and 1.4 per cent in 2024, in contrast with predictions of 1 per cent and 1.7 per cent in Could, in response to figures printed by the European Fee on Monday.

The fee additionally inched up its predictions for inflation subsequent 12 months, as excessive and nonetheless growing costs hit client spending throughout the bloc.

Whereas inflation will fall to six.5 per cent in 2023, in contrast with a earlier forecast of 6.7 per cent, it would stay at 3.2 per cent in 2024, 0.1 share factors larger than beforehand anticipated.

“The EU financial system has misplaced momentum since spring,” mentioned Paolo Gentiloni, the European commissioner for the financial system. “Financial exercise stalled within the second quarter and survey indicators level to additional weakening within the coming months.”

The expansion revision comes because the European Central Financial institution prepares for a pivotal resolution on Thursday on whether or not to boost charges to include excessive inflation in Europe, or to maintain charges on maintain to forestall worsening the downturn.

Europe’s financial outlook has weakened in current months due to a downturn in manufacturing, faltering commerce with China, a discount of presidency assist measures and squeezed client spending as a consequence of excessive inflation and rising borrowing prices.

“Excessive and nonetheless growing client costs for many items and providers are taking a heavier toll than anticipated” in earlier forecasts, the fee mentioned.

The deteriorating prospects for the area’s financial system, underlined by a downward revision to the official eurozone progress determine for the second quarter from 0.3 per cent to 0.1 per cent, has elevated expectations that the ECB will pause its rate of interest rises on Thursday.

Nonetheless, there stays concern in regards to the excessive stage of eurozone inflation, which is nicely above the ECB’s 2 per cent goal, though it has halved from an all-time excessive of 10.6 per cent final October to five.3 per cent in August.

Upward strain on inflation is coming from rising oil costs and a weakening euro that pushes up import prices, which means one other fee rise by the ECB continues to be on the playing cards.

The brand new figures predict a contraction in German actual gross home product of 0.4 per cent, in contrast with a beforehand forecast rise of 0.2 per cent. The German financial system will nonetheless develop by 1.1 per cent in 2024 however at a slower than anticipated fee in its spring forecast.

Italy has additionally suffered a 0.3 share level downward revision in each 2023 and 2024, resulting in 0.9 per cent and 0.8 per cent progress in annually.

The largely unchanged outlook for world progress and commerce signifies that the EU can’t depend on demand from different international locations to assist its financial system, the fee added.

[ad_2]