[ad_1]

As life grows extra advanced and the advantages panorama will get even wider and likewise extra advanced, simplicity is now essential to staff and employers. Paradoxically, a part of that simplicity shall be offered by new and extra group and voluntary advantages. Simply as hospital indemnity helps to simplify the economics of an sudden hospital keep or pet insurance coverage serves to alleviate the stress of sick pets, up-and-coming advantages will simplify elements of life that have an effect on work/life steadiness and monetary wellness.

BenefitBump is an instance of a brand new, revolutionary group profit that simplifies worker lives through the beginning and adoption course of, the household depart interval, and the start of daycare. Many employers have realized that there’s a substantial amount of complexity round these essential timeframes in a household. Busy staff don’t naturally know learn how to navigate all the ins and outs of their advantages. It can lead to a excessive price of those that don’t return to work.

BenefitBump educates staff on the particular person degree, assigning a navigator who provides steerage, well being instruments, and emotional help. Their preliminary survey statistics are spectacular, with “98% of program members efficiently returned to work.” Group insurer, Securian, now provides BenefitBump as a value-added service, paired with their hospital indemnity insurance coverage.[i]

Expertise + Shift in Possession

Everybody has been speaking concerning the warfare for expertise, the brand new technology of staff, and the expectations that right now’s digital staff convey with them into the office. What they haven’t checked out as intently is the make-up of right now’s enterprise house owners and executives. At what level will their expectations and concepts on what is required for his or her companies and staff influence the whole group & voluntary panorama?

Effectively, that time has arrived. GenZ and Millennials are proudly owning and operating companies and they’re extremely perceptive about what advantages packages will encourage their worker friends. This leaves insurers trying to find new gaps to fill. In Majesco’s newest thought-leadership report, Bridging the Buyer Expectation Hole: Group & Voluntary Advantages, we study SMB buyer opinions and the way they align towards each worker expectations and insurer plans to satisfy these expectations.

At present’s buyer expectation hole

What’s the buyer expectation hole? The hole is the distinction between what prospects anticipate, need, and wish, as in comparison with what insurers are delivering. This hole must be as small as doable for insurers to create long-term buyer progress, worth, and loyalty. It calls for a customer-centric technique that understands the distinctive generational section variations in behaviors, life, and extra, that drive insurers’ choices about merchandise, providers, and buyer experiences.

“Conventional” SMB prospects – Gen X and Boomers – symbolize an enormous portion of insurers’ income and revenue right now. Many remained loyal to their insurer for years, even when they weren’t all the time 100% happy. Nonetheless, these “conventional” prospects are altering. They’re more and more digitally adept and are on the lookout for extra worth from insurers.

On the identical time, we’re seeing the rising dominance of SMB prospects from the Gen Z and Millennial section who seem like extra in tune with the altering wants and expectations of right now’s staff – particularly the youthful technology – and the worth of providing newer and revolutionary profit choices to draw and hold staff. They need new merchandise that can align with their wants, actions, and behaviors. And so they need it their means … personalised to them. With the fluid state of employment that’s more and more widespread for the youthful technology, portability and adaptability of advantages have change into crucial within the competitors for expertise.

The Gen Z and Millennial technology has the potential to reverse the rising safety hole for insurance coverage.

From a excessive within the mid-Nineteen Seventies, when 72% of adults and 90% of households with two-parent owned life insurance coverage,[ii] to a brand new 50-year low in 2010 when solely 44% of US households had particular person life insurance coverage, based mostly on LIMRA’s 2010 life insurance coverage research.[iii] A February 2017 LIMRA research famous that employment-based advantages (group and voluntary) life insurance coverage lined extra individuals than particular person life insurance coverage as of 2016. Encouragingly, a current evaluation discovered 50% of North American employers which can be at the moment not providing voluntary advantages are contemplating including them. Plus, 40% who do supply them need to add further advantages[iv] which might assist shut the safety hole.

This altering market dynamic highlights progress alternatives for insurers who can supply advantages that meet a extra various worker base. Insurers have a chance to supply the fitting merchandise, value-added providers, and experiences to assist SMBs navigate these challenges and place their companies for progress.

Savvy, revolutionary firms are redefining insurance coverage from an outside-in perspective to adapt to what prospects – of any technology — need and anticipate, as an alternative of following the generations-long observe of an inside-out perspective that requires prospects to adapt to the way in which insurance coverage works. Consequently, these revolutionary firms are remodeling insurance coverage from a mysterious, complicated, and tough ordeal most would quite keep away from, to a extra clear, easy, and interesting expertise.

To grasp the client expectation hole, Majesco used the outcomes of our SMB, Shopper, and Insurer Strategic Priorities analysis to evaluate the variations between prospects and insurers with a three-pronged hole mannequin view that features personalised pricing with information/product, value-added providers, and distribution channels.

Expertise and Profit Choices

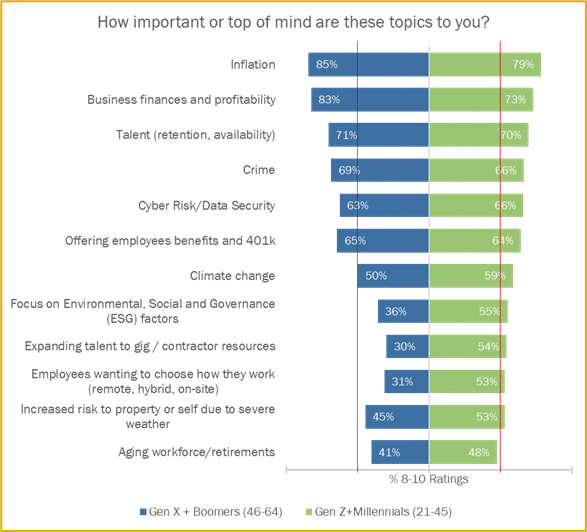

Majesco took a detailed have a look at enterprise house owners’ top-of-mind points. Expertise and profit choices are #3 and #6, respectively, as seen in Determine 1. Within the battle for expertise, a advantages plan that provides decisions based mostly on totally different demographics, together with generational teams and life-style, could make the distinction between attracting star performers or just lacking out, impacting the enterprise positively or negatively. This is the reason employers are more and more seeking to supply a wider vary of merchandise which can be related and stand out from the group, whatever the dimension of the enterprise.

Determine 1: SMBs’ prime of thoughts points

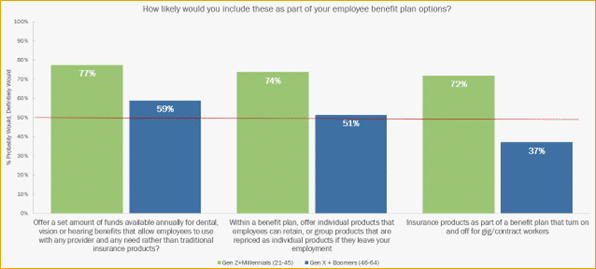

For insurers making the most of this chance, it isn’t with out its challenges. The everyday American now holds a mean of 12.3 jobs between the ages of 18 and 52, with roughly half of those occurring earlier than the age of 25.[v] Moreover, the Gig economic system now accounts for about 35% of the US workforce in some type (whether or not a full-time occupation or part-time) and rising, and demand for extra fractional protection linked to Gig employees’ itinerant careers presents a problem.[vi] As such, switching employers is occurring extra, leaving the necessity for insurance coverage a possible hole or alternative, relying on the product and portability. The demand for these capabilities is excessive, as mirrored in Determine 2 by each generational teams of SMB house owners.

Determine 2: SMBs’ curiosity in providing new worker profit plan choices

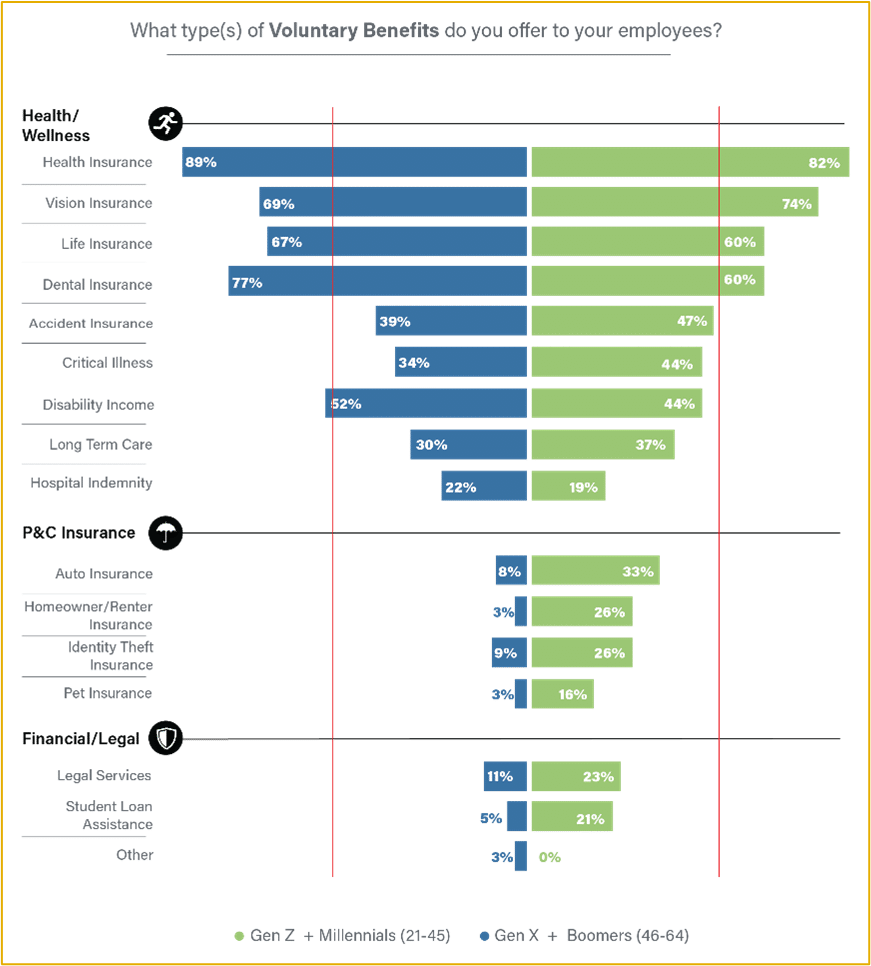

The voluntary advantages market is strong with exercise as accountability has shifted from employer to worker for a lot of nonmedical, health-related insurance coverage merchandise, with sturdy curiosity mirrored in rising gross sales.

Nonetheless, right now’s merchandise nonetheless pattern towards the normal — centered on life, accident, incapacity, medical, dental, and A&H, missing innovation and solutions for brand spanking new wants and expectations, significantly for Millennials and Gen Z.

Insurers who can supply choices past conventional product boundaries have a chance to seize new prospects extra cost-effectively and develop the connection as they evolve alongside their life journey. Creating, partnering, and providing merchandise that meet the worker’s distinctive rapid wants, whereas engaging them to remain as a buyer in the event that they depart their employer, is a rising technique amongst main insurers. That is mirrored in Determine 3 the place the youthful technology of SMB house owners has a powerful, rising curiosity in different merchandise.

Determine 3: Voluntary advantages supplied by SMBs

It follows that any new or revolutionary choices that improve staff’ safety and help employer struggle for expertise would supply progress alternatives for insurers. The problem for conventional group and advantages insurers is knowing what new choices and plans can place them because the supplier with selection, to drive extra engagement, enrollment, and shopping for of particular merchandise.

That is the place next-gen clever core and enrollment programs can assist personalize and drive this progress alternative.

Progressive Advantages and Monetary Wellness Merchandise

At present’s prospects desire a threat product, value-added providers, and an expertise that gives them with what they should handle their lives and humanize the whole buyer lifecycle. Conventional merchandise can handicap insurers. From an elevated curiosity in life, vital sickness, and incapacity insurance coverage to telematic and Gig advantages and extra, prospects need revolutionary merchandise that assess their private threat, life-style, and behaviors.

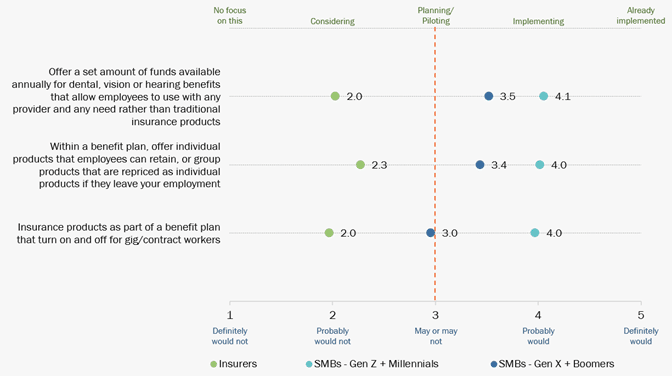

This demand for revolutionary merchandise is seen in Determine 4 with each generational SMB teams having a excessive demand for them. Employers of all ages have gotten more proficient and understanding worker wants and becoming these wants into the group’s profit choices.

Sadly, most insurers, nonetheless, haven’t but responded to this want. Providing particular person merchandise which can be each moveable and cost-effective, and merchandise that may activate and off for Gig employees is anticipated, but in addition wanted, given the shift within the worker market. With extra companies turning to Gig employees and needing merchandise extra aligned with the truth of worker expectations, insurers have an enormous alternative to distinguish and drive progress because the office continues to quickly change.

Determine 4: Curiosity gaps between SMB and Insurers in new profit plan choices

Monetary wellness is about adopting new practices and options to guide a extra wholesome and financially safe life. Practising monetary wellness ranges throughout budgeting, defending property like houses and automobiles, saving, investing, and using insurance coverage to satisfy short- and long-term monetary objectives.

Rising buyer curiosity in monetary wellness could be attributed to many components. Actually, the COVID pandemic performed a job. The expanded use of wearable gadgets that observe coronary heart price, sleep cycles, and health exercise has motivated many people to stay more healthy lives. And a booming wellness economic system demonstrates that individuals are prepared to put money into their wellness. For SMBs, managing the monetary and operational elements that hold the enterprise operating and wholesome – the SMB’s monetary wellness – has been difficult because of the macroeconomic components post-COVID.

In response to a CNBC+ survey, solely 57% of adults in the USA are financially literate, which means that 43% will not be utilizing the fitting instruments or lack the information to funds or make investments.[vii] Moreover, as said in a current LendingClub press launch, 63% of People reside paycheck-to-paycheck and haven’t been in a position to attain a degree of monetary wellness.[viii] And for companies, the rising inflation and provide chain challenges, not to mention the struggle for expertise, are straining their quick and long-term monetary outcomes. This is the reason it has risen as a top-of-mind challenge.

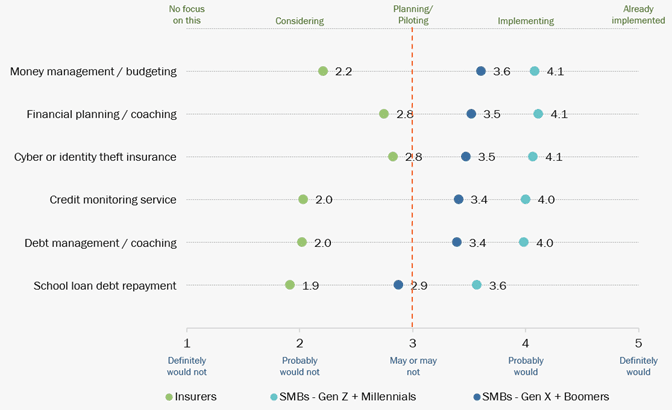

On condition that insurance coverage is a serious element of monetary wellness, it will replicate an incredible alternative for insurers to supply options. Nonetheless, as seen in Determine 5, there’s a main buyer expectation hole in what insurers are providing. This displays a seamless enterprise mannequin and tradition of product- versus customer-driven methods inside insurers that won’t reach a customer-driven market.

Determine 5: SMB-Insurer gaps in monetary wellness value-added providers

The Group and Voluntary alternative x 10

Group and Voluntary insurance coverage services and products have all the time been about multiplication. “How can we place giant volumes of enterprise on the books unexpectedly?” With right now’s applied sciences, that dynamic is becoming, “How can we place new, revolutionary merchandise that resonate with the variety of life and desires of staff whereas serving to employers to develop loyalty and entice one of the best expertise?” It’s nonetheless a matter of multiplication, however in right now’s state of affairs, it’s additionally about retention, flexibility, and treating the worker as the middle of the advantages relationship. It’s a strategic shift that will lead to far better outcomes.

As firms try to distinguish themselves with potential staff, they’re operating a race that wants assist. Group and voluntary insurers want to arrange themselves to help correctly by using applied sciences and processes that may make all of it occur.

Is your organization able to serve the following technology of employers? Majesco has created options for group and voluntary advantages that won’t solely convey insurers into the digital age however will even put together to offer the info and analytic suggestions insurers and employers must optimize their choices. We’re working with a number of insurers who’re bringing revolutionary group and advantages merchandise to market, together with value-added providers to satisfy the calls for of a quickly altering employer and worker market.

Discover out extra about Majesco’s market-leading options that convey what you want for the long run right now together with L&AH Clever Core Suite, ClaimVantage IDAM, International IQX Gross sales and Underwriting, and Enroll360 options[DG1] which can be serving to Group and Voluntary insurers meet the rising calls for of employers and their staff.

For extra on this matter, be sure you learn, Wished: Group and Voluntary Merchandise to Enhance Worker Engagement & Loyalty, and obtain, Bridging the Buyer Expectation Hole: Group & Voluntary Advantages.

[i] “Securian Monetary collaborates with “BenefitBump” to boost training amongst expectant mother and father,” Press launch, Securian.com, September 29, 2022.

[ii] Dahl, Corey, “A short historical past of life insurance coverage,” ThinkAdvisor, September 9, 2013, https://www.thinkadvisor.com/2013/09/09/a-brief-history-of-life-insurance/

[iii] Ibid.

[iv] Howe, Barbara, “A Contemporary Take a look at Voluntary Advantages,” Company Wellness Journal.com, https://www.corporatewellnessmagazine.com/article/a-fresh-look-at-voluntary-benefits

[v] “Variety of Jobs, Labor Market Expertise, Marital Standing, and Well being: Outcomes from a Nationwide Longitudinal Survey,” Bureau of Labor Statistics, August 31, 2021, https://www.bls.gov/information.launch/pdf/nlsoy.pdf

[vi] Henderson, Rebecca, “How COVID-19 Has Remodeled The Gig Economic system,” Forbes, December 10, 2020, https://www.forbes.com/websites/rebeccahenderson/2020/12/10/how-covid-19-has-transformed-the-gig-economy/?sh=42b329d16c99

[vii] Lorsch, Emily, “This is the reason People can’t handle their cash,” CNBC, April 8, 2022, https://www.cnbc.com/video/2022/04/08/financial-literacy-in-america.html

[viii] “Wages Have Didn’t Match Inflation, 65% of Employed Shoppers are Residing Paycheck to Paycheck,” LendingClub press launch, October 24, 2022, https://ir.lendingclub.com/information/news-details/2022/Wages-Have-Failed-to-Match-Inflation-65-of-Employed-Shoppers-are-Residing-Paycheck-to-Paycheck/default.aspx

[ad_2]