[ad_1]

Should you suppose your insurance coverage expertise job has been altering dramatically within the final three years, strive working in Human Assets!

Working in right this moment’s HR is sort of like attempting to maintain water in a colander. You try to hold helpful staff from quitting or retiring whereas on the identical time hiring sufficient individuals to maintain the colander full. You do that whereas attempting to maintain your worker inhabitants bodily and mentally wholesome, along with monitoring their efficiency and advantages. You additionally take care of HR disaster conditions, and you might be chargeable for upgrading HR expertise to satisfy the growing calls for of HR administration.

HR is so complicated! Good HR execs want interpersonal abilities, analytical experience, and a beneficiant dose of knowledge. In addition they want methods to extend their resilience as a result of HR groups are affected by burnout.

Evidently, HR is stressed.

It’s simple to see how we arrived right here. From attempting to arrange distant operations throughout Covid, overseeing hybrid work conditions now, combating for expertise, shifting worker demographics, and coping with their very own understaffed HR departments and an improve of their very own applied sciences — there’s an excessive amount of to do and too little time through which to do it.[i]

Insurers now have a possibility to alleviate a few of their buyer stressors. How? Serving to them with one of the vital essential points associated to worker retention and bettering advantages packages. New sorts of staff are persevering with to emerge, driving adjustments to product wants, eligibility, and choices.

However which means that Group and Voluntary insurers should deal with considered one of their most impactful stressors … their operational mannequin and expertise basis. It requires a deal with enterprise transformation.

Transformation begins with listening.

Assembly right this moment’s altering market want for advantages isn’t only a matter of straightforward conjecture and even market knowledge. It requires an understanding round right this moment’s actual product, service, and expertise points. The place are the stress factors? How can insurers rework to take away their very own stress and buyer stress?

At a latest roundtable dialogue, Majesco and Capgemini listened to insurance coverage executives as they mentioned the challenges of recent market dynamics in serving their Group & Voluntary insurance coverage clients. They lined each inside and exterior points. You’ll be able to learn the total report by downloading, Don’t Pull Again…Put the Pedal to the Metallic for L&AH Transformation. In right this moment’s weblog, we’ll share insights from our conversations relating to points equivalent to:

- Market drivers

- Buyer expectation gaps in a fancy buyer setting

- Product shifts (and worker expectations) that can require tech innovation

Every of those conversations resulted in lists of actual, on a regular basis points that insurers and their clients face. These lists change into the start line for understanding how firm stresses and buyer stresses may very well be solved with options that meet the wants of each.

Layers of stress relieved by next-gen tech options

In 2023, we see cost-of-living challenges, rising medical bills, decrease disposable incomes, inflation, rising expertise loss with projected retirements inside the business, the struggle to amass and hold new expertise, and the problem of legacy expertise.

On the within of the insurance coverage enterprise…

…insurers compete in a post-COVID market, the place they’re challenged with new worker expectations relating to work flexibility and the expertise wanted for his or her jobs. On the identical time, long-tenured employees are retiring and taking essential enterprise data with them, together with about their operational processes, merchandise, and legacy methods. The affect is new staff suppose in a different way and wish digital expertise to do their work.

On the surface of the enterprise…

Brokers are in dire want of recent applied sciences, searching for options from insurers that make it simple to do enterprise with them and applied sciences that present a customer-centric view. Clients led by their HR groups are desperate to embrace new applied sciences, merchandise, and strategies that can save them time and meet the rising worker range of wants and expectations.

Can insurers…

- enhance their very own enterprise consumer expertise,

- whereas their groups enhance the dealer expertise,

- whereas the dealer improves the employer expertise,

- whereas the employer improves the worker expertise?

“The youthful expertise, coming in by recruiters, ask for a digital profile of the corporate they’re making use of for as a result of they wish to know what sort of expertise they use. That’s a key level. The expertise side of the place we’ve been as an business versus the expectations of recent staff and associates coming in — there’s an enormous hole there.” – Roundtable Participant

One key and a rising layer of stress is the shifting demographics of insurer clients – each the enterprise proprietor and their staff. The “conventional” Group & Voluntary Advantages SMB clients – Gen X and Boomers – which have been loyal for years, are actually turning into extra digitally savvy and demanding larger worth from their insurance coverage suppliers due to their altering worker demographics.

On the identical time, there’s an growing dominance of SMB clients within the Gen Z and Millennial technology who’re extra in tune with right this moment’s altering worker wants and expectations as a result of they’re one. With the fluid state of employment that’s more and more frequent for the youthful technology and the rising retirement of the older technology — portability, personalization, new merchandise, and suppleness of advantages has change into crucial within the competitors for expertise to satisfy worker expectations.

However legacy expertise, legacy gross sales, and enrollment strategies can’t meet the shifting worker, dealer, and buyer calls for.

Insurers can enhance their skill to develop, make capital extra environment friendly, and scale back prices whereas assembly rising buyer expectations together with new threat and product calls for. It’ll require insurers to rethink their enterprise technique, together with their operational mannequin and expertise platform, however that’s the sort of rethinking that can maximize outcomes.

Stressors require a shift from product to buyer focus.

Till extra just lately, the Group and Voluntary enterprise have been product- and broker-centric, relying on the dealer to satisfy the wants of the client with the proper merchandise and plans. However that doesn’t work for all clients – notably smaller ones who could not have entry to a dealer. If insurers shift from a product to a buyer focus, they obtain a fringe profit — a greater understanding of buyer wants and expectations that may be invaluable.

In right this moment’s L&AH market, each group and particular person, clients wish to do enterprise when, the place, and the way they need. A customer-first focus is way tougher to attain due to the breadth of buyer varieties and demographics insurers are trying to serve.

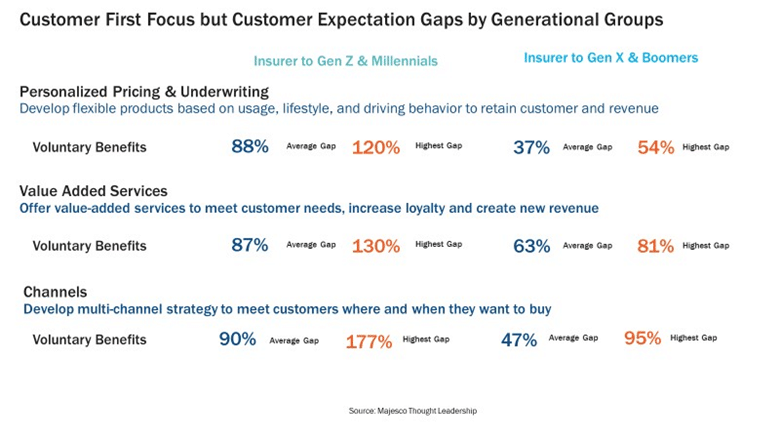

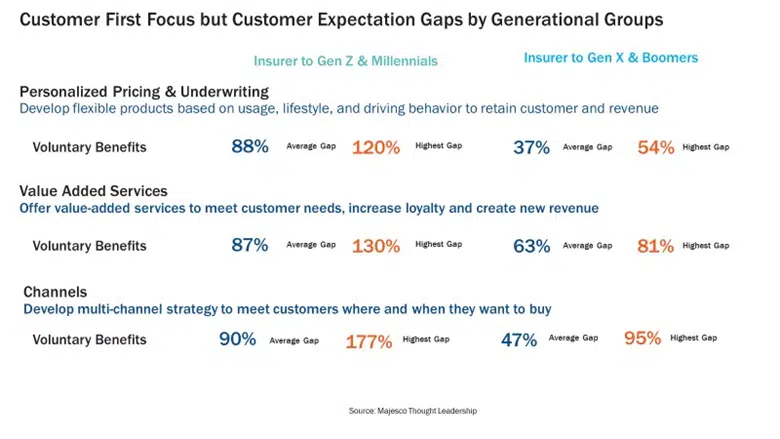

Employers want to have the ability to attraction to 4 vastly completely different generations within the office, which requires the right combination of merchandise inside profit plans. Protection gaps for personalised merchandise and value-added providers inside a profit plan (see Determine 1) can’t be closed with out the event of and supply of recent merchandise that meet the wants of the youthful generations. Employers want the proper advantages bundle to draw and retain expertise throughout a number of generational and demographic teams. It’s complicated and getting extra so.

Determine 1

This identical state of affairs, from the provider perspective, is analogous, however extra technology-based. As Child Boomers and a few Millennials are retiring in rising numbers, recruiting has change into a significant subject. Youthful generations anticipate to make use of next-gen expertise of their jobs – whether or not as an IT or enterprise particular person. If not, many don’t come or actually depart inside just a few weeks of becoming a member of. The youthful technology has no need, nor incentive to work on antiquated expertise.

“It proved to be actually difficult to get these Gen Z’s and the millennials on top of things on our tech and our course of.” – Roundtable Participant

Fixing these generational issues inside insurers will finally assist clear up the challenges they’ve in filling the product, expertise, and channel gaps for his or her clients – each the employer and their staff. It will likely be an enormous step in turning into actually customer-centric and assembly the wants of product and digital experiences.

How does your product decrease EVERYONE’s stress?

It’s fascinating. If an insurer redefines “product,” to be all-inclusive of the danger product, value-added providers, and the client expertise, then they immediately change into a customer-focused and never a product-focused firm. Immediately, merchandise change into the instruments that can improve experiences and add worth to life and work.

The voluntary advantages market should present these sorts of value-driven merchandise with the growing shift in price accountability from employer to worker for many nonmedical, health-related insurance coverage merchandise and the demand for newer merchandise that align with completely different wants. Nevertheless, most of right this moment’s merchandise stay principally conventional — centered on life, accident, incapacity, medical, dental, and A&H, missing innovation and solutions for brand new wants and expectations, notably for Millennials and Gen Z.

Clients expect extra area of interest, personalised merchandise, providers, and experiences that align with their particular wants, dangers, life, and behaviors. From an elevated curiosity in life, important sickness, and incapacity insurance coverage, to portability, scholar mortgage compensation, pet insurance coverage, or gig worker on-demand insurance coverage, right this moment’s clients anticipate a greater variety of insurance coverage merchandise provided in profit plans.

“… you may’t compete on wage alone. Profit packages have now change into increasingly more strong, and we’re including in issues like pet insurance coverage or journey and wellness, and mortgage insurance coverage. We’re taking a look at scholar mortgage compensation and caregiver assist. And it’s not even simply concerning the product anymore. It’s additionally about providers. The teaching, wellness, and help, — monetary help and retire, [teaching] staff how to consider retirement and funding.” – Roundtable Participant

Insurers who provide new choices along with conventional merchandise have a possibility to satisfy the broadening range of shoppers with elevated gross sales and the flexibility to develop the connection as they evolve alongside their employment and life journey. This consists of going past the standard L&AH merchandise to increase into P&C merchandise like auto and householders’ insurance coverage, and pet or journey insurance coverage. Growing or partnering with different insurers to supply the merchandise demanded by altering worker demographics is extra essential than ever for each the insurer and their buyer the employer.

Savvy, progressive corporations are redefining insurance coverage from an outside-in perspective to adapt to what clients – of any technology — need and anticipate, as an alternative of following the generations-long follow of an inside-out perspective that requires clients to adapt to the way in which insurance coverage works.

A part of the innovation includes bettering experiences with out including dramatically to employer and worker advantages prices. In some instances, which means increasing buy channels or guiding staff to pick out the merchandise utilizing AI-driven capabilities which are most related to them, their demographics, and their life. It means utilizing expertise to drive efficiencies and effectiveness and actually innovating with new merchandise.

“HR budgets aren’t rising; they’re shrinking in lots of instances. We’re seeing a number of pricing pressures on the dental plans, imaginative and prescient, listening to, and scholar mortgage compensation plans. A whole lot of employers are saying, “Pay attention, I’m going to place a primary healthcare price in a few of the first preliminary ancillary advantages after which I’m going to chop the worker a examine. I simply want a platform that claims, ‘Decide from considered one of these 10-12 issues which are significant to you and related to you.” That is forcing us to consider completely different advantages, completely different partnerships we want. Do you go in with one other provider who’s bought a distinct providing and strategy?” – Roundtable Participant

The transformation that can relieve the pressures upon all stakeholders relies upon next-gen clever core options and digital applied sciences as a brand new basis for a brand new period of group and voluntary advantages. These options have a distinct structure, one primarily based on the native cloud. APIs, Microservices & containerization, headless, and most significantly embedded analytics with BI, AI/ML, and Generative AI. These options allow insurers to suppose massive, act quick, create rapidly, and innovate when concepts and partnerships come up.

“Now we have to be prepared to alter in order that we are able to take full benefit of the expertise with out customizing it in order that we don’t proceed to bear these prices of customization and we are able to deploy our individuals to our clients and let our merchandise stand on their very own. What’s most essential are the those that we serve and the way we serve them.” – Roundtable Participant

After all, there’s extra to transformation than simply expertise change. It requires forward-thinking management and a tradition that’s prepared to alter. Majesco and Capgemini have been collectively main these sorts of transformation efforts, with nice outcomes, positioning Group & Voluntary Advantages insurers for a profitable future.

“I used to be conscious of the partnership earlier than I bought right here (to Capgemini), mentioned Samantha Chow, Capgemini, Life and Annuity Sector Chief. “It’s a fairly robust relationship on the market within the business, that Majesco and Capgemini have had. And never simply on the methods, integration, and alliances facet, however on that strategic partnership, supporting the life and advantages business, with a deal with legacy modernization and claims, and the way they’ll higher match the wants of our evolving clients.” – Samantha Chow, Capgemini, Life and Annuity Sector Chief

The time is correct for Group & Voluntary leaders to make these choices and step into this new period of advantages with the instruments to make alternatives into income. Majesco’s L&AH Clever Core, Majesco World IQX Gross sales & Underwriting Workbench, Digital Enroll360 for L&AH, and ClaimVantage Connect360 for L&AH present insurers with the next-gen cloud platforms they should make the right choices on positioning their group for fulfillment.

For a deeper take a look at government opinions and extra concepts about capturing the Group & Voluntary market, you’ll want to learn the Majesco/Capgemini thought-leadership report, Don’t Pull Again…Put the Pedal to the Metallic for L&AH Transformation right this moment.

In the present day’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Kelly Reisling, Senior Director, Capgemini

[i] Ladika, Susan, Burnout Is a Drawback for HR Professionals, HR Journal, March 14, 2022

[ad_2]