[ad_1]

When GXS Financial institution launched late final 12 months, there was little incentive to enroll as a result of the deposits have been restricted to solely $5,000. Nonetheless, now that GXS has raised the deposit cap to $75,000, is it value switching over?

The quick reply is – sure – particularly should you’re on the lookout for a financial savings account that has the next options:

- presents a lovely 3.48% p.a. rate of interest in your money

- no want to keep up a minimal steadiness

- no lock-in interval

- no hoops to leap by means of for increased curiosity i.e. no wage crediting / GIRO / invoice funds / bank card spend wanted

- no tiered curiosity

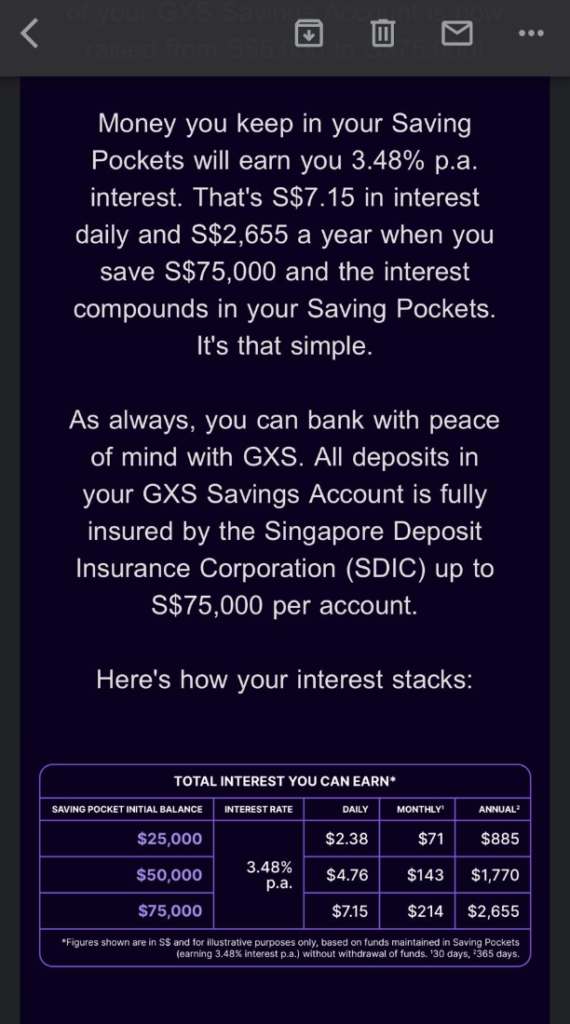

Be aware how the curiosity is utilized out of your very first greenback to the final, as a substitute of the same old tiered curiosity ranges that we’ve seen the native banks go for.

With the above options, these of you who’re uninterested in having to leap by means of hoops to earn your bonus curiosity can try GXS for a fuss-free different.

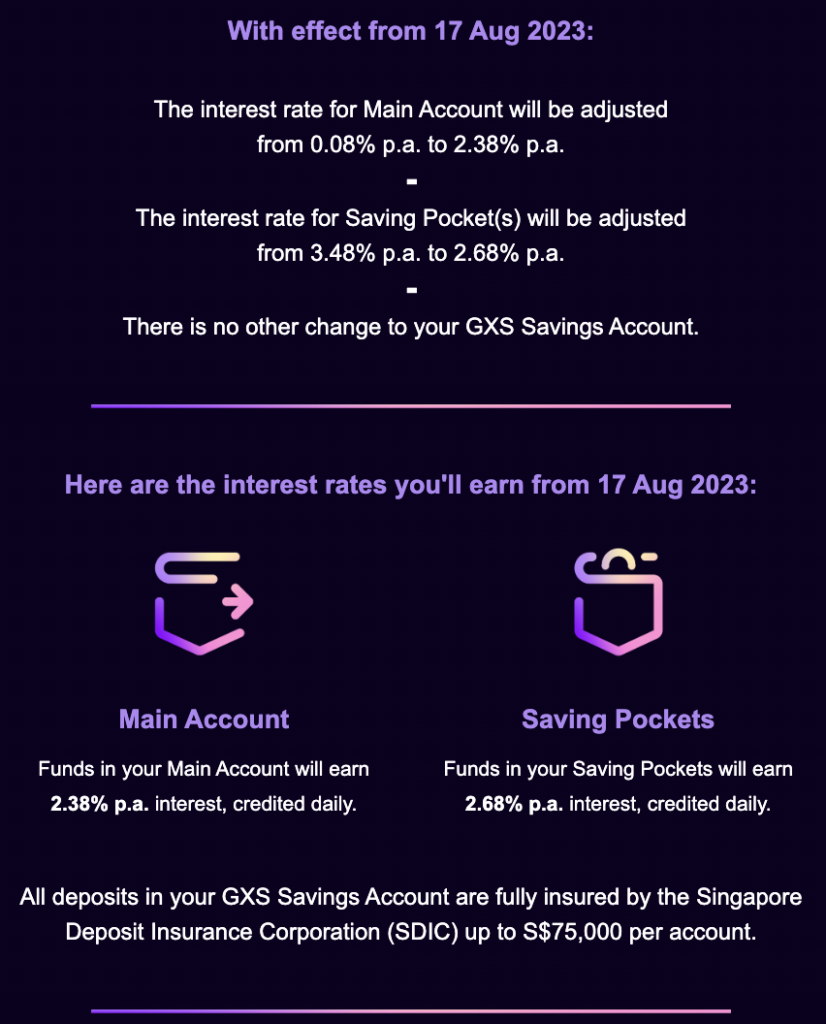

IMPORTANT UPDATE: Barely a month in, GXS has certainly chosen to slash their rates of interest i.e. efficient 17 August 2023 onwards, the rate of interest earned on Saving Pocket(s) funds have been adjusted from 3.48% p.a. to 2.68% p.a.

Background Context:

The article beneath was written for and printed on 30 July 2023, evaluating GXS as an possibility at a time when it provided shoppers a 3.48% p.a. rate of interest on their Financial savings Pocket(s) funds and had simply raised the sign-up funds restrict from S$5,000 to S$75,000.

Who’s GXS?

GXS is the brand new child on the block – a digital financial institution owned by Seize and Singtel – and acquired their license from the Financial Authority of Singapore (MAS) in December 2020. It launched its financial savings account late final 12 months, however as a result of GXS had a $50 million regulatory cap on retail deposits imposed by MAS through the lender’ first two years of operation to safeguard shoppers’ pursuits, it needed to restrict to solely chosen Seize / Singtel clients and a most of $5,000 per consumer.

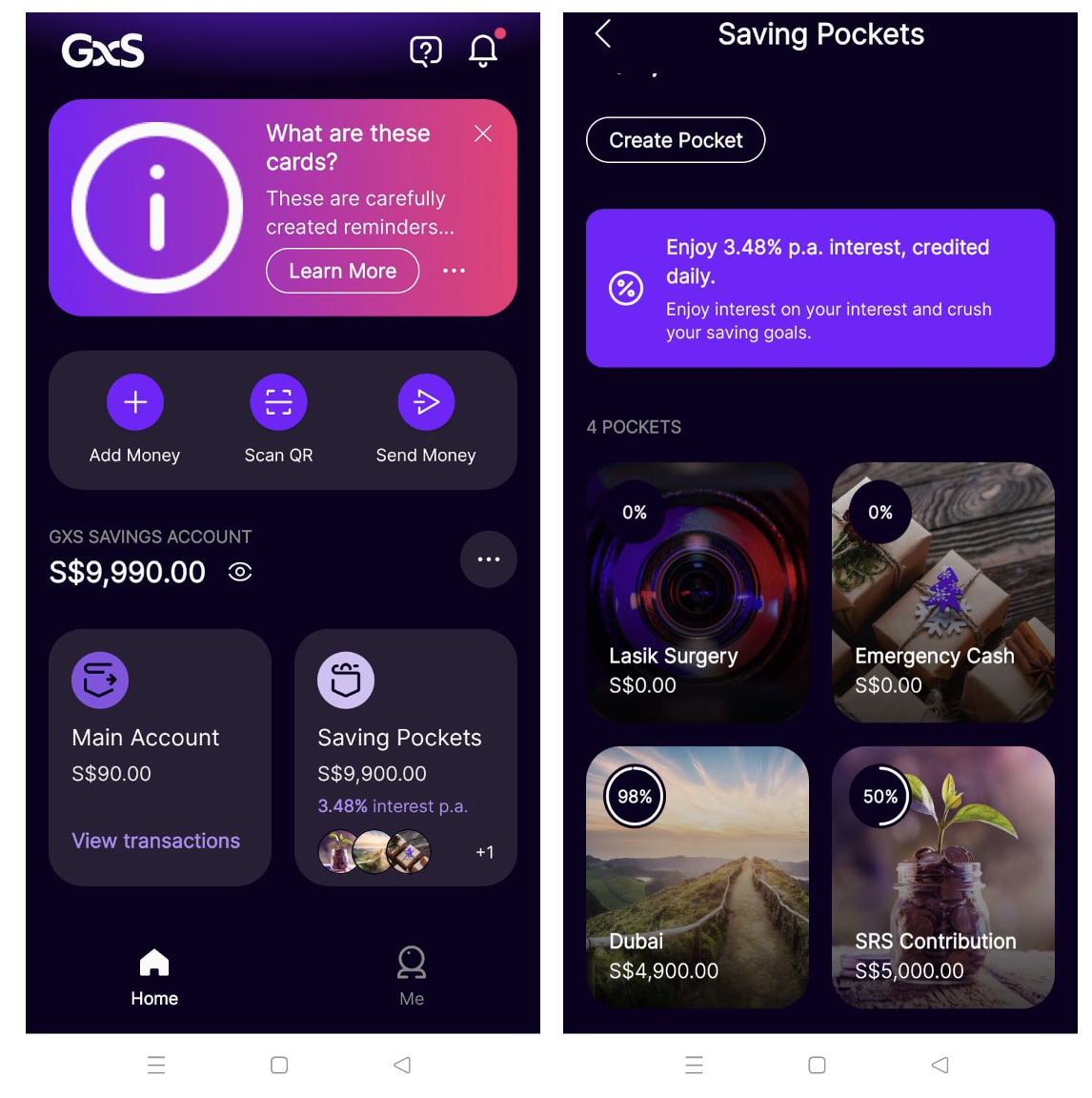

The GXS’ financial savings account at the moment presents an rate of interest of three.48% a 12 months on “Financial savings Pockets” (a function that jogs my memory of Hugo’s Cash Pots). Whereas I think about this could possibly be decreased in time to return – particularly if the Fed begins ceasing its rate of interest hikes – , it nonetheless doesn’t cease us from milking the nice charges whereas it lasts.

What’s extra, one other game-changer is that GXS credit your curiosity each day, as in comparison with each month. This lets us profit from an excellent increased (and sooner) fee of compounding because you’re incomes curiosity on curiosity – plus, you possibly can really feel shiok every single day if you log in and see “free cash” being credited into your account 😛

Within the coming months, GXS has stated they can even be launching a debit card with rewards and cashback to entice clients to spend through their financial savings account. Those that spend with GXS on Seize and Singtel (contains Singtel Sprint) can even get bonus factors, though the main points on GXS reward program continues to be scarce at this level.

Learn how to get entry?

Should you’re questioning how to enroll, all you should do is to obtain the GXS app and register. Slots are on a first-come-first-served foundation, and there’s no referral code for now.

Be aware that you simply’ll need to be at the least 16 years previous to be eligible, and signing up is a mere matter of minutes (you’ll want your cellular quantity, SingPass and electronic mail).

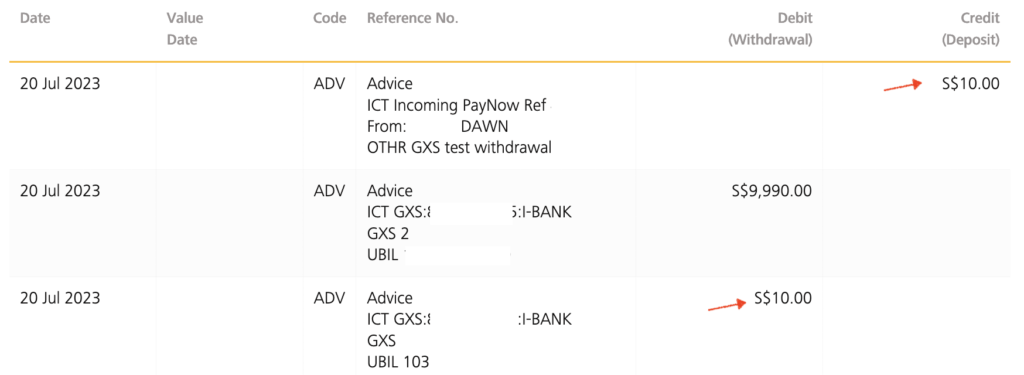

You possibly can then fund your account both through PayNow (every individual can solely have 2 financial institution accounts for PayNow – 1 linked to your NRIC/FIN and one other linked to your cellular quantity) or by direct financial institution switch. I opted for the latter, and acquired the cash throughout the identical minute.

Be sure to transfer your cash out of your Essential Account and into your Financial savings Pockets with a view to get the three.48% p.a. curiosity!

Is it value switching to GXS?

I can hardly consider of us who would not profit from GXS proper now.

Since most of us have already got greater than 1 financial institution financial savings account, there’s actually nothing stopping you from signing up for an additional one – until you discover it too troublesome to handle your money in a number of totally different locations.

In any other case, 3.48% p.a. credited day by day is an actual game-changer. Right here’s the way it stacks up in opposition to the opposite choices I might in any other case take into account for placing my money in proper now:

- vs. different digital banks: GXS 3.48% p.a. is increased than Belief Financial institution’s 2% (non-union members) and a pair of.5% (union members) p.a. rate of interest

- vs. fastened deposits: at 3.48% with zero lock-up interval, this beats all the opposite fastened deposits proper now (whose charges vary from 2.9% – 3.88% with minimal sums and lock-in durations). In fact, with no lock-up enforced, there’s no stopping GXS from chopping their rates of interest any time they need – though that additionally means we’re free to maneuver funds out if we deem it inadequate then.

- vs. MAS T-bills: the newest tranche got here in at 3.85% p.a. for six months. Should you missed that, otherwise you’re not a fan of locking your cash up for six months, then GXS’ could be a extra preferable possibility.

- vs. money administration accounts: the charges are comparable or barely decrease, however the distinction is that your deposits at GXS are insured by SDIC (whereas money administration accounts are NOT insured by SDIC). Money administration merchandise like MoneyOwl’s Smart Saver (4%) or POEMS (>4%) are nonetheless a legitimate consideration for folk with money to spare, so I embrace them right here although it isn’t an apple-to-apple comparability or an equal product.

As a skeptic, I examined out by transferring $10 first to ensure the quantity went by means of appropriately, earlier than transferring the entire supposed sum. I additionally examined out the withdrawal operate, as a result of the very last thing any of us would need (whereas pursuing excessive curiosity) is to have our cash caught, is not it!

What ought to I exploit GXS for?

With the enticing 3.48% p.a. curiosity proper now and the dearth of hoops to leap by means of, I might say GXS is amongst the best option for contemporary graduates and younger working adults proper now – particularly for folk who battle to hit the minimal spend requirement on their playing cards.

By way of funds, you can even park your short-term emergency funds right here (e.g. 3-6 months) for liquidity with out sacrificing curiosity, and even your funding war-chest whereas ready for alternatives within the inventory or choices market.

Don’t neglect, GXS Financial savings Pockets function additionally makes it an ideal match so that you can put your short-term financial savings right here, reminiscent of funds that you simply’re saving up for an upcoming buy e.g. marriage ceremony, residence renovation, a brand new furnishings, and many others.

However earlier than you rush to open a GXS account to your aged mother and father, do be aware that GXS continues to be a comparatively new financial institution in spite of everything, and since transactions are largely on-line, chances are you’ll not wish to be further diligent for scams and malware that might achieve entry to your telephone and liquidate your funds. On this sense, the native banks have stricter rip-off controls in place.

Will YOU be placing your cash into GXS?

The battle is on – let’s see how the native banks reply from right here!

[ad_2]