[ad_1]

Leaders elevate lid on main acquisition

Graham Firm was one of many largest unbiased insurance coverage companies in the US, however the prime 100 company not too long ago ushered the beginning of a brand new period after being acquired by Marsh McLennan Company (MMA), a subsidiary of Marsh and one of the lively mergers and acquisitions companions available in the market.

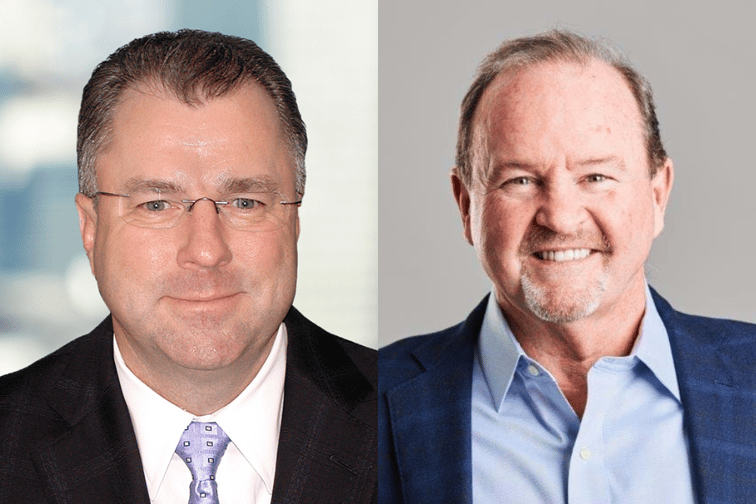

“It was fairly a journey,” mentioned Ken Ewell (pictured proper), president and chief working officer of Graham Firm. “I might say proper up entrance, if it wasn’t for Marsh McLennan Company, we in all probability wouldn’t be having this interview.”

Promoting to a a lot bigger agency was by no means a part of the imaginative and prescient for Graham Firm, Ewell mentioned. However becoming a member of MMA has unlocked larger assets for the agency, permitting it to face a “tsunami” of expertise modifications within the trade.

“We have been nicely on our solution to over six a long time of constructing a powerful tradition from the inside-out, attracting one of the best folks, and coaching and persevering with to develop them,” mentioned Ewell. “Merely put, we don’t have the dimensions, on a standalone foundation, to face the tsunami of expertise modifications coming our method.”

The deal between MMA and Graham firm closed on August 1, 2023. Phrases of the acquisition weren’t disclosed.

The large query

Graham Firm offers enterprise insurance coverage, worker advantages, and surety brokerage providers to firms in high-risk industries, together with building, actual property, manufacturing and distribution, well being and human providers, and monetary {and professional} providers.

Based in 1960 by William Graham III, the Philadelphia-based agency now instructions greater than $75 million in annual income following vital investments in expertise to gasoline its nationwide progress.

It has 215 staff throughout its Philadelphia, New York and Washington DC places of work, all of whom shall be retained after the acquisition.

The choice to affix MMA additionally permits Graham Firm to supply shoppers a wider array of capabilities and entry to extremely specialised, superior applied sciences, whereas preserving and strengthening its tradition and values whereas offering new profession improvement alternatives for workers.

“We have been considering 18 months forward, three years forward, [about] what would drive shopper selection,” Ewell continued. “That was an enormous query we requested. Our shoppers need expertise options that enhance their choice making, and what our shoppers need is what we would like.”

Fulfilment of a legacy

Graham Firm got here into the only possession of William “Invoice” Graham IV, within the Seventies. Invoice served as president from 1970 to 1999, and at the moment serves as chairman.

In 2017, the brokerage transformed to an employee-owned enterprise by means of an Worker Inventory Possession Plan (ESOP), a transfer that aligned with Invoice’s philosophy of investing in his folks.

“Invoice’s all the time been about what drives shopper selection,” mentioned Ewell. “How can we develop a enterprise? How can we maintain a high-performance tradition? The ESOP was a fulfilment of his imaginative and prescient.”

However as Graham Firm noticed modifications within the trade starting to speed up, it shortly realized that it wanted to evolve with it.

“We got here collectively, and Invoice mentioned, we have now to take a look at this and plan for the longer term,” Ewell mentioned. “Invoice feels that whereas the ESOP was an excellent completion of his imaginative and prescient for his staff, our partnership with Marsh McLennan Company is the fulfilment of his legacy to his staff, and to our shoppers and future shoppers.”

‘An easy choice’ for MMA

The acquisition additionally has vital private {and professional} that means for David Eslick (pictured left), chairman & CEO of MMA.

“Graham has been one of the extremely revered corporations within the insurance coverage brokerage trade for many years,” Eslick advised Insurance coverage Enterprise. “Invoice Graham is an icon and what he began with Graham has been one of many best successes in in our trade.

“Ken and I sat on the board of the Council of Insurance coverage Brokers & Brokers for a few a long time collectively. We now have been capable of construct each our private {and professional} relationship [during that time], particularly within the final 14 years since I began Marsh McLennan Company.”

The CEO mentioned MMA had been seeking to construct out its worker advantages experience after it acquired Trion Group, a gaggle incapacity and life advantages brokerage in 2010.

“We needed to search out the correct companion for them as a result of they’re middle-market to higher middle-market on advantages. We knew that Graham [Company] can be the correct companion as a result of Graham is within the middle-market to higher center market area within the property and casualty space.”

“During the last two years, Ken and I grew to become extra engaged and we each determined that every one among us can be higher collectively than aside.”

White Plains, New York-headquartered MMA is the nation’s eighth-largest insurance coverage dealer, with greater than 10,000 staff in 170 places of work.

Share your ideas on MMA and Graham Firm’s partnership under.

Associated Tales

Sustain with the most recent information and occasions

Be part of our mailing record, it’s free!

[ad_2]