[ad_1]

Rising up within the aftermath of the Nice Recession, Gen Z noticed their dad and mom and siblings battle financially. They’ve watched as rates of interest climbed,¹ housing costs soared,² and our financial system handled uncertainty. Regardless of these challenges, Gen Zers are blazing their very own path.

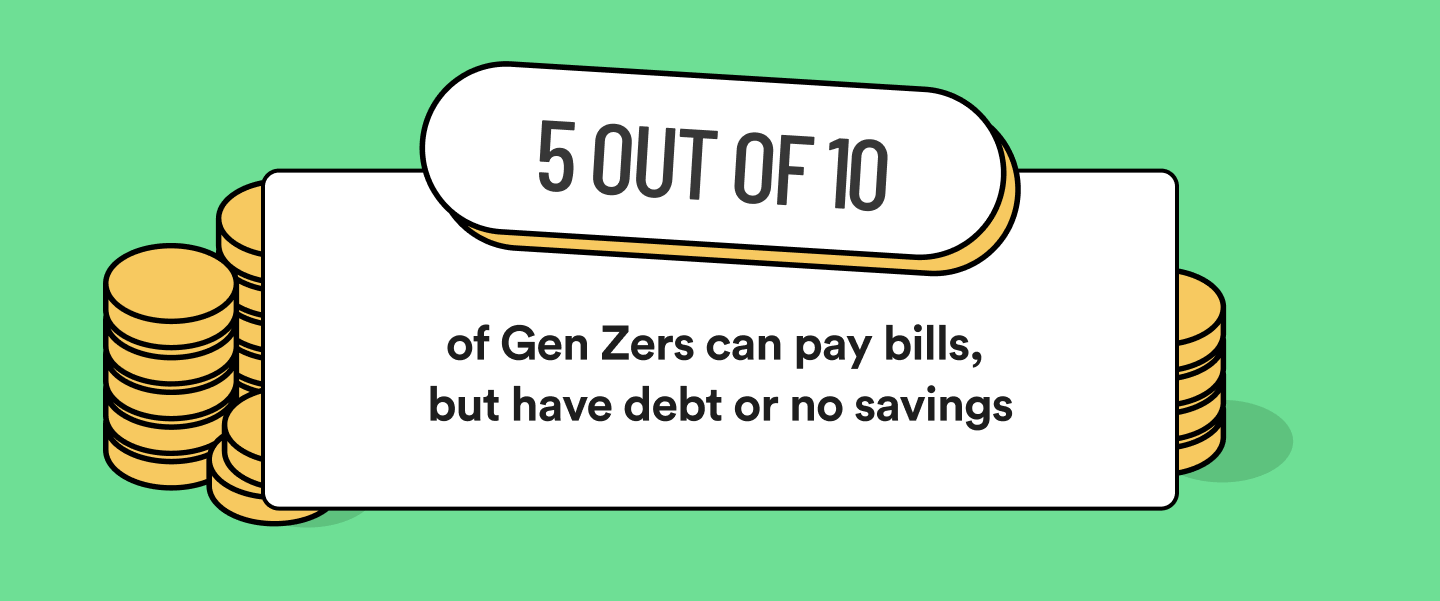

Our survey information highlights that greater than 50% of Gen Zers have a mixture of debt and financial savings or debt with none financial savings. Nevertheless, they actively handle their funds by paying their payments on time and overlaying important bills like groceries and requirements.

Inside this group, roughly 30% of surveyed Gen Zers will pay their payments however at the moment lack financial savings. They should discover new saving methods to start out constructing a monetary cushion for his or her future.

On a constructive notice, round 10% of these surveyed are debt-free and possess further financial savings. They reveal the potential for monetary independence.

What’s Gen Z’s common revenue?

Gen Zers are starting their skilled journeys or nonetheless pursuing schooling. They earn a mean revenue of $32,500 yearly.³ Whereas this appears low in contrast with extra established generations, as Gen Zers progress of their careers, their revenue ranges ought to improve.

But it surely’s not simply in regards to the revenue they bring about in. It’s about how they handle it. Gen Zers have proven they’re considering forward on the subject of managing cash. They’re budgeting, saving, and planning for his or her monetary futures. These habits, mixed with rising revenue over time, lay a powerful basis for rising wealth.

Gen Z’s method to incomes cash goes past conventional jobs. Many are exploring facet hustles and turning into entrepreneurs.4 This has enabled them to determine a number of cash streams and acquire invaluable expertise in cash administration and enterprise, higher positioning them to extend their wealth over time.

How Gen Z handles their cash

Gen Z, being on the early levels of their monetary journeys, sometimes have decrease internet worths than different generations.5 However their proactive cash administration habits and deal with constructing wealth point out their willpower to enhance their monetary standing over time.

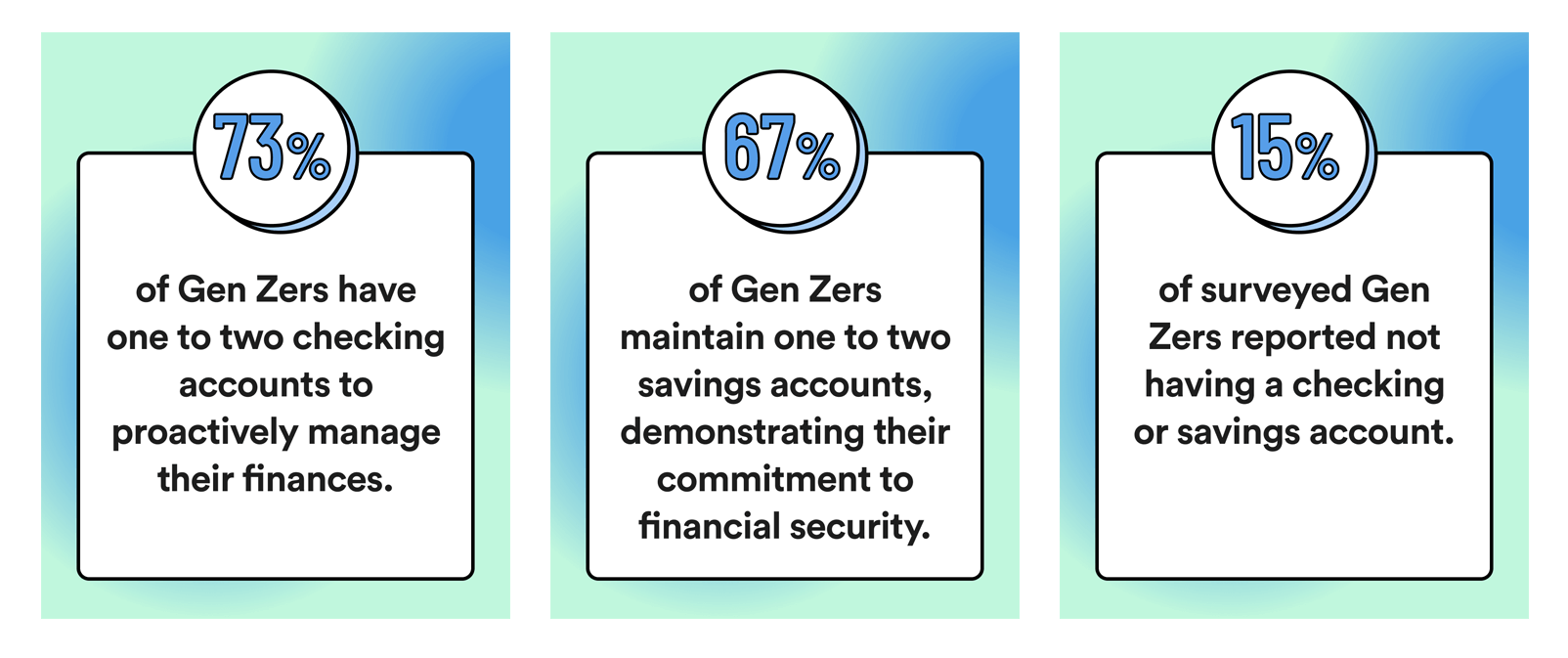

Gen Z’s method to cash administration displays a mixture of warning and foresight. Right here’s a breakdown of how Gen Z handles their cash, in line with our survey outcomes:

Gen Z’s monetary habits showcase their considerate method to managing their cash, with a deal with sustaining checking and financial savings accounts to help their monetary targets

Gen Z’s monetary habits showcase their considerate method to managing their cash, with a deal with sustaining checking and financial savings accounts to help their monetary targets

[ad_2]