[ad_1]

With costs shortly going up after the COVID-19 pandemic, inflation releases have hardly ever been as current within the public debate as in recent times. Nonetheless, since inflation estimates are often revised, how exact are the real-time knowledge releases? On this Liberty Road Economics submit, we examine the scale and nature of revisions to inflation. We discover that inflation estimates for a given month can change considerably as subsequent knowledge vintages are launched. For instance, contemplate March 2009. With the economic system contracting amid the International Monetary Disaster, the twelve-month inflation fee for private consumption expenditures (PCE) excluding meals and vitality dropped from an preliminary estimate of 1.8 p.c to 0.8 p.c within the present sequence. The distinction is dramatic and factors to the problem of monitoring inflation in actual time. Our outcomes recommend that there’s important uncertainty in measuring inflation, and the important thing options of the current spike and subsequent moderation of inflation could look fairly completely different in hindsight as soon as additional revisions have taken place.

Historic Revisions to the PCE Worth Index

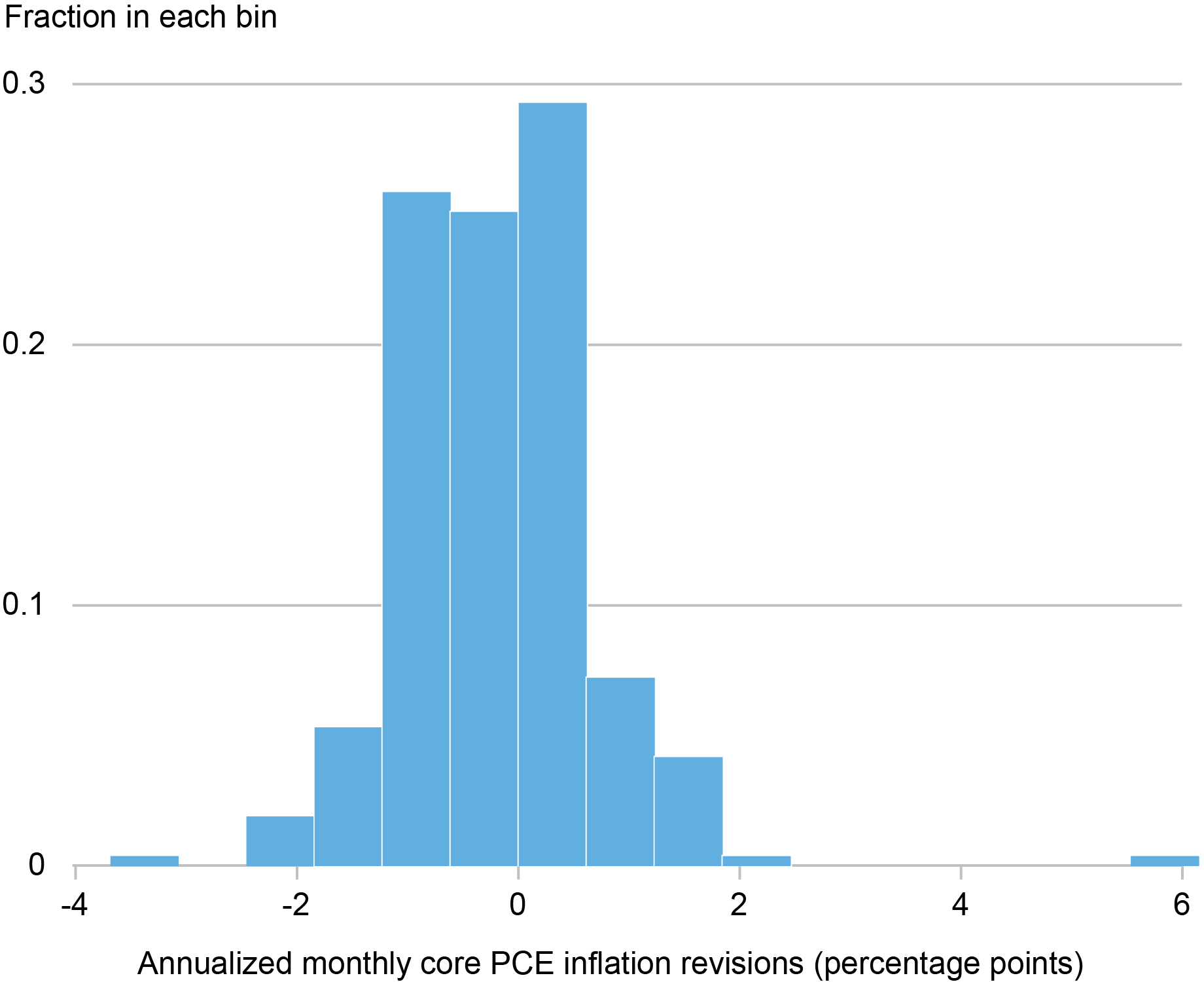

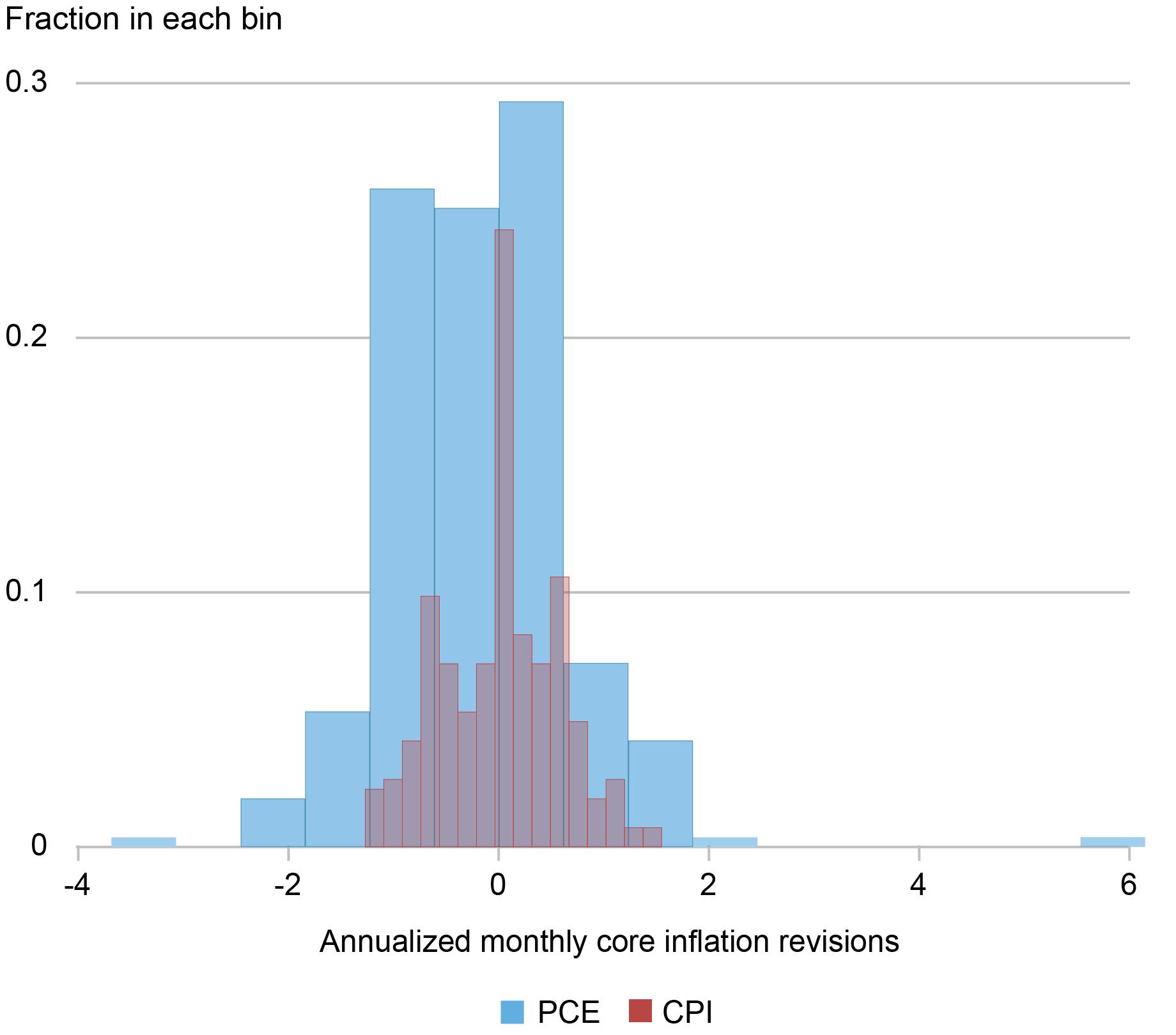

There are two essential measures of client value inflation in america: the PCE value index and the patron value index (CPI). Measuring inflation precisely is difficult as a result of it depends on intensive knowledge assortment, seasonal and different changes, and imputations. Consequently, each the PCE value index and the (seasonally adjusted) CPI are revised over time. We start by analyzing the PCE value index—the Federal Open Market Committee’s most well-liked inflation gauge—and doc that the magnitude of those revisions is usually substantial. This may be seen within the chart under which presents revisions to core PCE inflation, that’s, inflation in PCE excluding meals and vitality elements. On this submit we deal with core inflation to indicate that revisions should not confined to the extra risky elements.

Core PCE Inflation Revisions Can Be Sizable

Notes: The vertical axis is the fraction of inflation revisions falling in every bin. For instance, 25 p.c of inflation charges have been revised down between 0 and 0.6 share factors.

In different phrases, estimates of annualized month-to-month inflation in core PCE since 2001 have been revised by as a lot as 6 share factors and greater than 15 p.c of the revisions have been larger than one share level. Revisions should not solely sizable however happen repeatedly because the Bureau of Financial Evaluation (BEA) revises PCE as a part of the Nationwide Earnings and Product Accounts revision course of. For instance, the September 2018 quantity has been revised 5 instances following its preliminary launch: twice within the following months and 3 times additional in July 2019, July 2020, and July 2021.

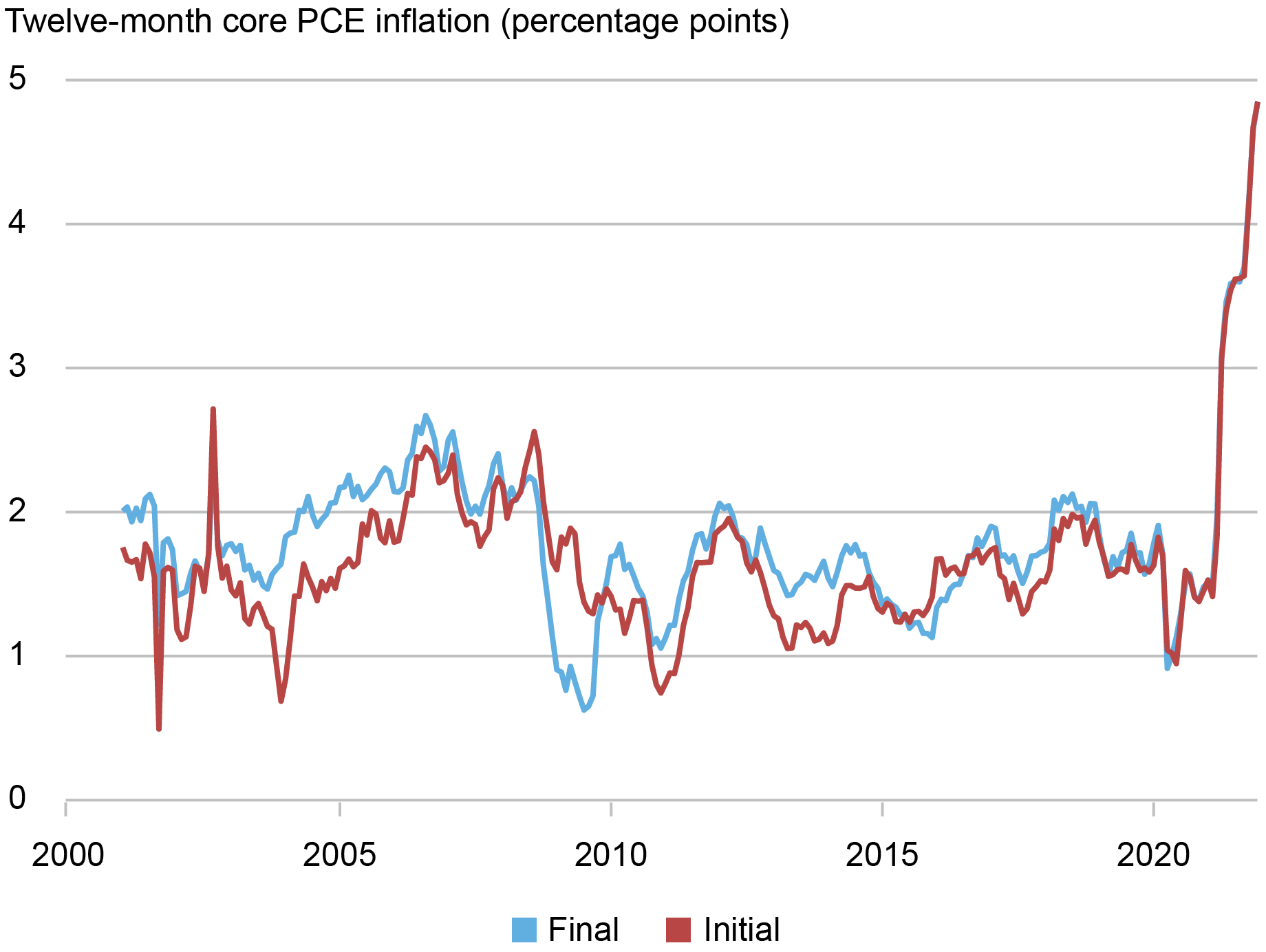

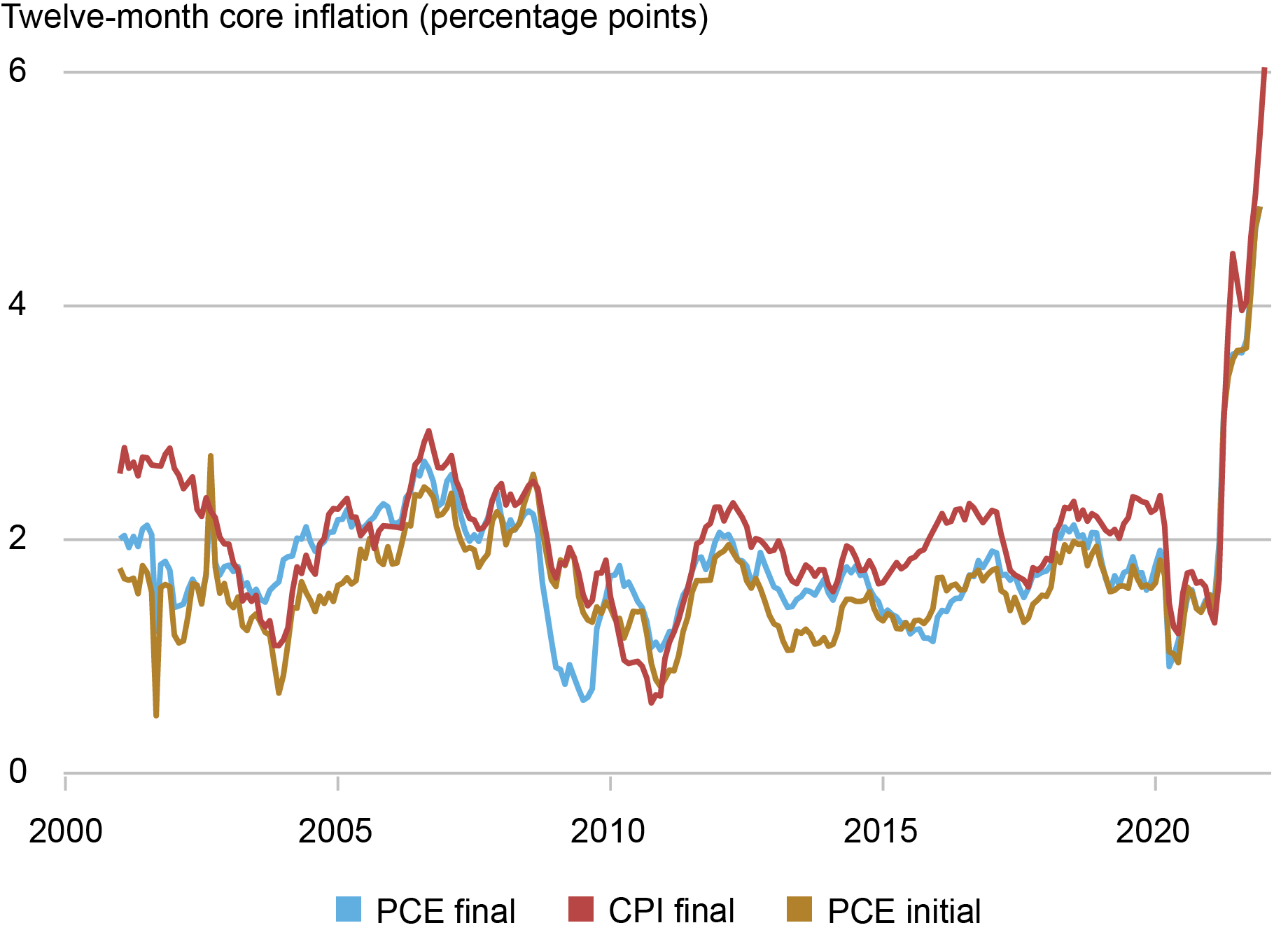

Our subsequent chart exhibits that the ultimate classic of core PCE inflation can diverge markedly from the extent of inflation implied by the preliminary one. We plot the year-over-year core PCE inflation fee on the time of the discharge in opposition to the present model of the sequence. Between 2004 and 2007, for instance, the hole between these two sequence was about 0.4 share level. An excellent bigger hole of about 1 share level opened late in 2008 and early in 2009 through the Nice Recession. The truth is, the preliminary estimates utterly missed the massive drop in inflation at the moment. Towards the tip of the pattern interval, the 2 sequence monitor each other extra carefully. That is possible as a result of most revisions are but to happen for the newest interval.

Core PCE Inflation’s Ultimate Estimate Can Differ Considerably from the Preliminary One

What Drives Revisions within the Core PCE Worth Index?

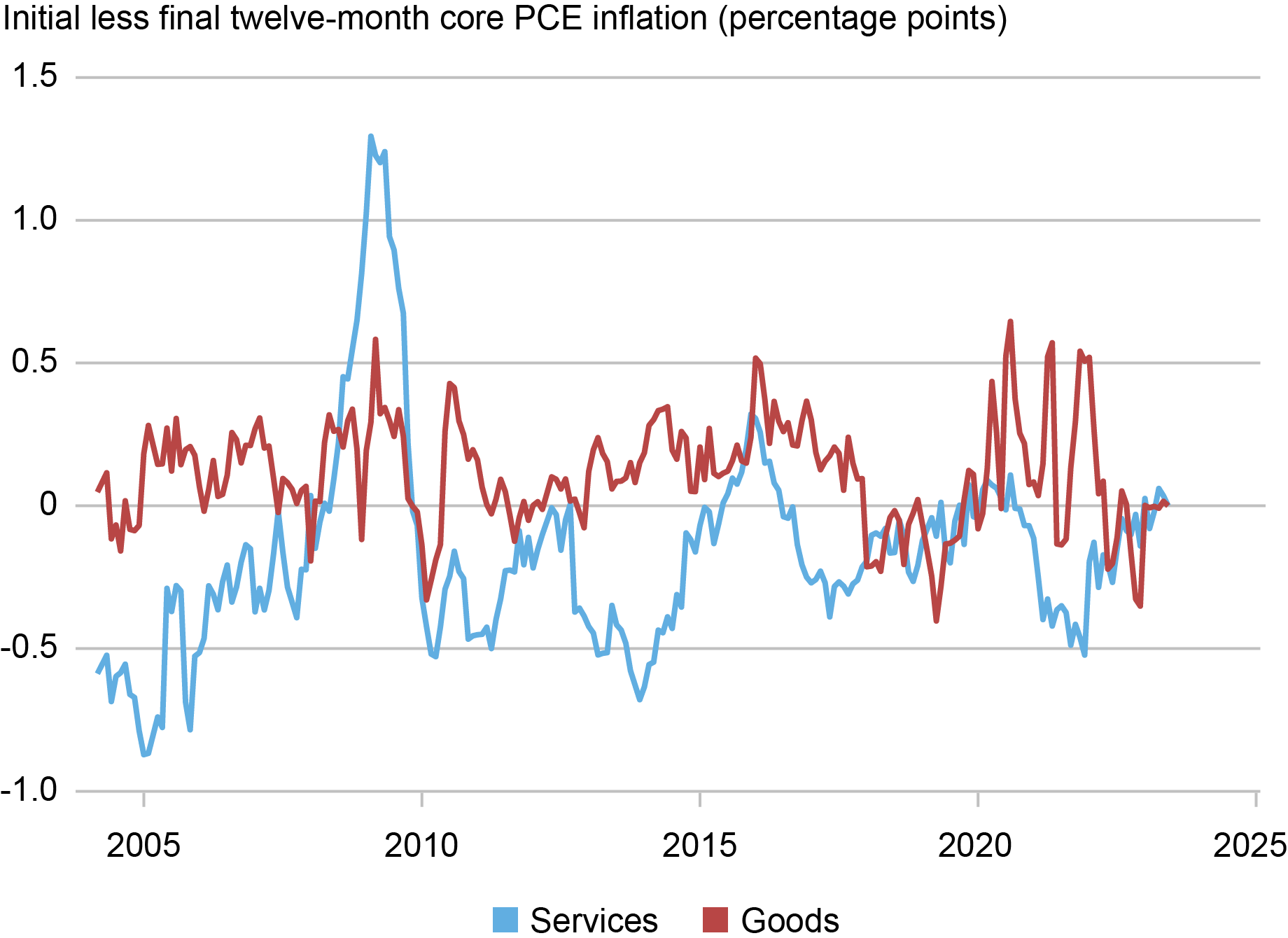

Are revisions bigger and extra frequent for some subcomponents of the index? Within the chart under, we present the distinction between the preliminary and newest launch of year-over-year inflation in core items (items inflation excluding meals and vitality) and core companies (companies inflation excluding vitality companies). We are able to see that each core items and core companies inflation are revised meaningfully though the magnitude of the revisions are usually bigger and extra persistent for core companies. The truth is, on common over our pattern, the magnitude of revisions to core companies is about double that of core items.

Revisions in Core Providers Inflation Are Typically Bigger than for Core Items Inflation

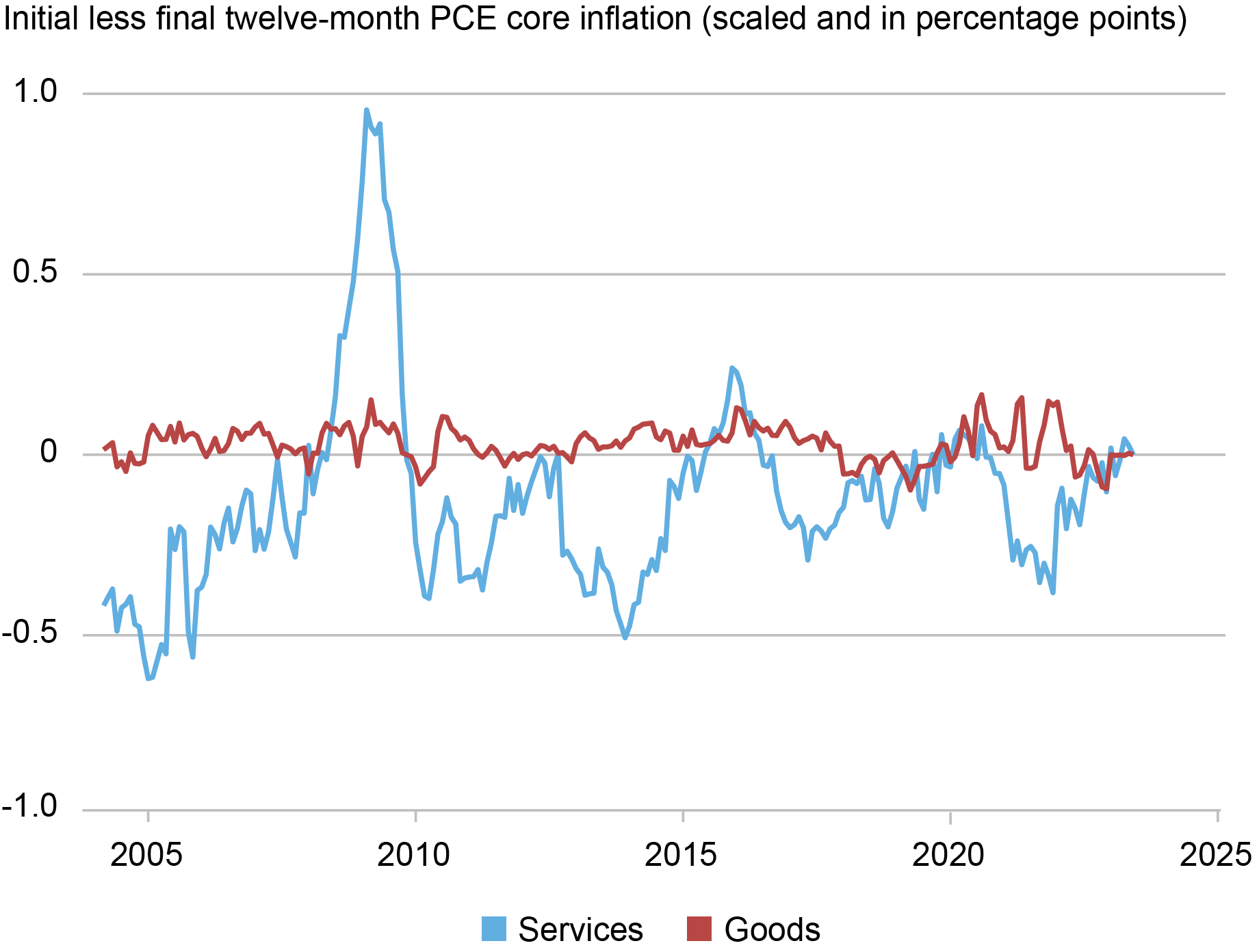

The impression of revisions to those subcomponents onto revisions to core inflation are ruled by the share of expenditures in these two subcategories. During the last twenty years or so, the share of core companies expenditures relative to core expenditures (all expenditures much less expenditures on meals and vitality) is about 75 p.c. Consequently, the dominant supply of revisions to core inflation emerges from revisions to core companies inflation. Within the subsequent chart we rescale the revisions of those two subcomponents primarily based on their contribution to core inflation. As soon as they’ve been rescaled, we observe that the majority the revisions to core inflation originate from core companies inflation.

Revisions in Core Providers Are the Lion’s Share of Revisions to Core Inflation

The PCE Worth Index and the CPI

The buyer value index, the opposite key measure of inflation in america, can be revised on a yearly foundation. These revisions are usually smaller than for the PCE value index, since revisions within the CPI come totally from updates within the seasonal adjustment elements. As could be seen within the chart under, revisions to month-to-month CPI inflation have a mass level at zero and they’re virtually by no means larger than 1 share level in annualized phrases.

Core CPI Revisions Are Smaller than Core PCE Revisions

Notes: The vertical axis is the fraction of inflation revisions falling in every bin. For instance, 25 p.c of inflation charges have been revised down between 0 and 0.6 share factors.

Importantly, since revisions to CPI inflation come up solely from modifications to the seasonal adjustment elements, year-over-year CPI inflation is (primarily) by no means revised. A pure query is whether or not the preliminary or ultimate launch of PCE inflation is nearer to CPI inflation. The chart under exhibits that no clear sample stands out. There are intervals when revisions in PCE inflation make the ultimate sequence nearer to CPI inflation, comparable to over the intervals 2005-07 and 2013-15. There are additionally intervals when revisions in PCE inflation trigger it to diverge from CPI inflation, as was the case through the Nice Recession.

Core CPI Inflation Is Not a Constant Sign of the Instructions of Revisions to Core PCE Inflation

Conclusion

We’ve proven that variations between PCE inflation for all vintages and CPI inflation could be substantial. For instance, over the interval from 2001-18 the variations between year-over-year core PCE inflation primarily based on the preliminary launch versus the ultimate sequence have been massive. The hole ranged from -1 to 1.6 share level and 90 p.c of the time was between -0.5 and 0.5 share level. Taken plainly, these gaps would recommend a believable vary for the present year-over-year core PCE inflation fee of as excessive as about 4.7 p.c and as little as round 3.7 p.c. Our outcomes present the numerous uncertainty surrounding the measurement of inflation in actual time, which provides to the challenges confronted by policymakers, analysts and most of the people in analyzing inflation.

Inflation Revisions Information

Richard Audoly is a analysis economist in Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Martín Almuzara is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Richard Ok. Crump is a monetary analysis advisor in Macrofinance Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Davide Melcangi is a analysis economist in Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Roshie Xing is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Learn how to cite this submit:

Richard Audoly, Martín Almuzara, Richard Crump, Davide Melcangi, and Roshie Xing, “How Giant Are Inflation Revisions? The Issue of Monitoring Costs in Actual Time,” Federal Reserve Financial institution of New York Liberty Road Economics, September 7, 2023, https://libertystreeteconomics.newyorkfed.org/2023/09/how-large-are-inflation-revisions-the-difficulty-of-monitoring-prices-in-real-time/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).

[ad_2]