[ad_1]

Tomas Key

Throughout the restoration from the Covid pandemic, the demand for employees rose to unprecedented ranges within the UK. The variety of jobs that companies had been trying to fill elevated to 1.3 million in the midst of 2022, 60% larger than the extent within the final three months of 2019. The quantity of job vacancies has fallen considerably over the previous 12 months, however stays at a excessive stage. This submit discusses how these modifications to the demand for employees have affected the unemployment fee. Particularly, it outlines how an equilibrium mannequin of the labour market might help to elucidate why there seems to have been a change to the connection between job vacancies and unemployment lately.

The Beveridge curve

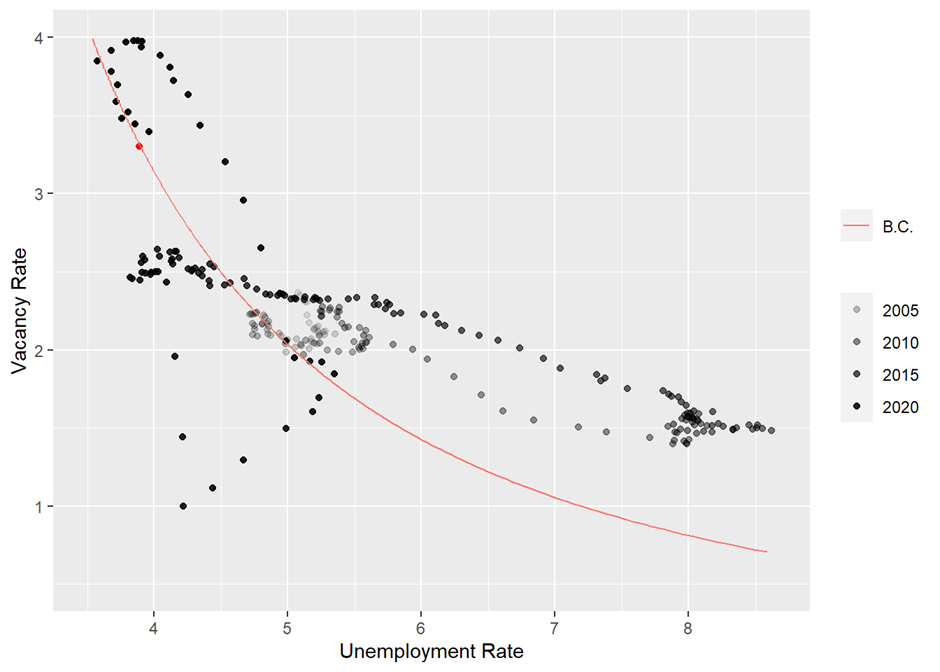

Earlier than turning to the mannequin, allow us to first check out the info. In Determine 1, I’ve plotted the emptiness and unemployment charges which were noticed over the previous 20 years or so. This exhibits the placing current improve within the emptiness fee that I discussed. It additionally exhibits that earlier than the pandemic, there was a fairly steady adverse relationship between the emptiness and unemployment charges. When companies want to fill extra positions, it’s simpler for unemployed employees to discover a job, and so there tends to be fewer of them. This relationship is called the Beveridge curve.

Determine 1: Emptiness and unemployment charges

Notes: Information is from the three months to June 2001 to the three months to April 2023: newest remark highlighted in pink. Emptiness and unemployment charges are as a proportion of the labour power. I exploit unemployment and labour power knowledge for these aged 16–64 to be per the inputs to the modelling train.

Supply: ONS.

Based mostly on that pre-pandemic relationship, it might have been affordable for an informal observer to count on that the very excessive emptiness fee in 2022 would have been accompanied by a a lot decrease unemployment fee than was the case. Beneath, I’ll define how a reasonably commonplace mannequin of the labour market might help to elucidate: (i) why the post-pandemic improve within the emptiness fee didn’t produce a decrease unemployment fee; (ii) why the substantial fall within the emptiness fee over the previous 12 months has solely been accompanied by a comparatively modest improve within the unemployment fee; and (iii) the affect {that a} additional decline within the emptiness fee is prone to have on the unemployment fee.

A mannequin of the labour market

The framework that can be utilized to interpret labour market developments is predicated on the transitions – or flows – between employment, unemployment and ‘inactivity’ – a catch-all time period for anybody that’s not at present working or actively trying to find work. Numerous folks expertise these transitions each quarter within the UK. For instance, round 1 / 4 of 1,000,000 folks moved from employment into unemployment in each quarter of 2022. Modifications to the speed at which persons are making these transitions are what generate actions within the employment, unemployment and inactivity charges.

On the coronary heart of the mannequin is an combination matching operate. It is a machine that’s helpful for summarising how the time that it takes to discover a job – or match – is decided by the variety of vacancies relative to the variety of job seekers in addition to the extent of ‘matching effectivity’ – the productiveness of the matching operate. It captures the truth that it takes appreciable effort and time for job seekers to discover a appropriate emptiness, and that that is affected by each the variety of alternatives which can be out there and what number of different persons are competing to fill them.

The measure of job seekers that I exploit when estimating the matching operate consists of unemployed employees in addition to some employed and inactive people. Within the case of inactive folks, that may appear odd as I discussed above that these are people who report that they aren’t actively trying to find work. Nonetheless, lots of them do transfer into employment over a three-month interval, maybe as a result of their circumstances change or they’re fortunate sufficient to discover a job with out having to seek for one. Accounting for these ‘passive’ job seekers among the many inactive, in addition to an estimate of the variety of employed people trying to find work, has been proven to be essential in current analysis.

After estimating the parameters of the matching operate, I can use it to explain how the extent of the emptiness fee impacts the speed at which individuals transition into employment. When mixed with values for the opposite move charges – such because the charges at which people are getting into unemployment from employment and inactivity – this provides a framework that can be utilized to hint out the affect of modifications to the emptiness fee on the steady-state, or equilibrium, unemployment fee. That’s the fee that’s obtained as soon as the system has totally adjusted to the modifications within the move charges.

Determine 2: Simulated relationships between the emptiness and unemployment charges

Supply: Creator’s calculations.

Two illustrations of this are proven in Determine 2. The mannequin produces the adverse relationship between the emptiness and unemployment charges seen within the knowledge. That’s because of the affect of the emptiness fee on the pace with which unemployed employees discover jobs – their ‘job-finding fee’. Holding the opposite transition charges fixed, a better emptiness fee will increase the job-finding fee of unemployed employees, and so cut back unemployment. This determine additionally demonstrates that, on this framework, modifications to the opposite move charges or to matching effectivity will result in a shift within the place of the simulated Beveridge curve. They may change the extent of the unemployment fee that’s produced by any stage of the emptiness fee.

One other essential characteristic of the simulated relationship between the emptiness and unemployment charges produced by the mannequin is that it’s non-linear, or convex. This displays the truth that because the variety of vacancies will increase relative to the variety of unemployed, it turns into more and more troublesome for companies to fill them. That’s one thing that many firms within the UK have turn out to be aware of lately.

Explaining current labour market dynamics

It’s now time to carry collectively the simulated relationship between the emptiness and unemployment charges produced by the mannequin and the info. I’ve executed that in Determine 3. The simulated Beveridge curve on this plot is produced by the framework I described when calibrated with move fee estimates from the previous 12 months – it isn’t an try to suit a curve utilizing the entire knowledge proven on the chart. The truth that the simulated Beveridge curve doesn’t match by the entire knowledge makes clear that the modifications within the unemployment fee which were seen over time haven’t solely been because of the affect of modifications within the emptiness fee. They’ve additionally been because of modifications to different move charges, reminiscent of the speed at which persons are transferring from employment to unemployment, and to matching effectivity – elements that act to shift the place of the curve produced by the framework that I’ve described.

Determine 3: Simulated Beveridge curve and emptiness and unemployment charges

Notes: Information is from the three months to June 2001 to the three months to April 2023: newest remark highlighted in pink. Emptiness and unemployment charges are as a proportion of the labour power. Simulated Beveridge curve is produced utilizing knowledge from 2022 Q1 to 2023 Q1. Information on labour market shares and flows is for these aged 16–64.

Sources: Creator’s calculations and ONS.

So how can this assist to elucidate current developments? Nicely, over the previous 12 months or so, modifications within the emptiness fee have been the principle issue producing modifications within the unemployment fee. That implies that the info have moved down the simulated Beveridge curve. Because the emptiness fee is at present very excessive relative to the unemployment fee, the portion of the curve alongside which the info have moved is comparatively steep. That’s the reason the substantial fall within the emptiness fee over the previous 12 months has solely been accompanied by a reasonably modest improve within the unemployment fee.

The rationale that the very excessive stage of the emptiness fee in 2022 didn’t produce a decrease unemployment fee displays two elements. First, the steepness of the curve that I simply talked about. Second, the truth that the simulated Beveridge curve has ‘shifted out’ from its place earlier than the pandemic. The rationale for that shift is that there was each a rise in flows from inactivity into unemployment, which act to extend unemployment for any stage of the emptiness fee, and a discount in matching effectivity.

The affect of additional falls within the emptiness fee will rely on whether or not the info proceed to maneuver down a steady Beveridge curve, or the curve shifts place as soon as extra. The present place of the curve means that the unemployment fee may settle at a stage larger than instantly earlier than the pandemic, as soon as the demand for employees has returned to a extra regular stage.

Conclusion

Though some current actions within the UK emptiness and unemployment charges seem odd at first look, they are often well-explained by a normal mannequin of the labour market. That framework additionally gives some steerage concerning the future path of the labour market – concerning the affect of additional falls within the emptiness fee on the unemployment fee. That affect will rely on whether or not the info proceed to maneuver down a steady Beveridge curve, or whether or not modifications to matching effectivity or to different options of the labour market result in a deviation from that path.

Tomas Key works within the Financial institution’s Structural Economics Division.

If you wish to get in contact, please e mail us at [email protected] or depart a remark under.

Feedback will solely seem as soon as authorized by a moderator, and are solely revealed the place a full identify is provided. Financial institution Underground is a weblog for Financial institution of England employees to share views that problem – or assist – prevailing coverage orthodoxies. The views expressed listed here are these of the authors, and usually are not essentially these of the Financial institution of England, or its coverage committees.

Share the submit “How have current modifications to the demand for employees affected the unemployment fee?”

[ad_2]