[ad_1]

Money envelopes can really change the best way you work together together with your cash and funds. It’s no shock that the money envelope system has modified my husband and I’s funds in so some ways. It truly is a game-changing expertise!

However how on earth does it work? Can money envelopes really make it easier to with impulse spending and your funds? And the way do you purchase one thing on-line once you’re utilizing money?!

I’ve had these very same questions (plus some!). That’s why I’ve created this whole information on how the money envelope system works. Plus you’ll get free printable envelopes so you may get began as we speak.

What Is The Money Envelope System?

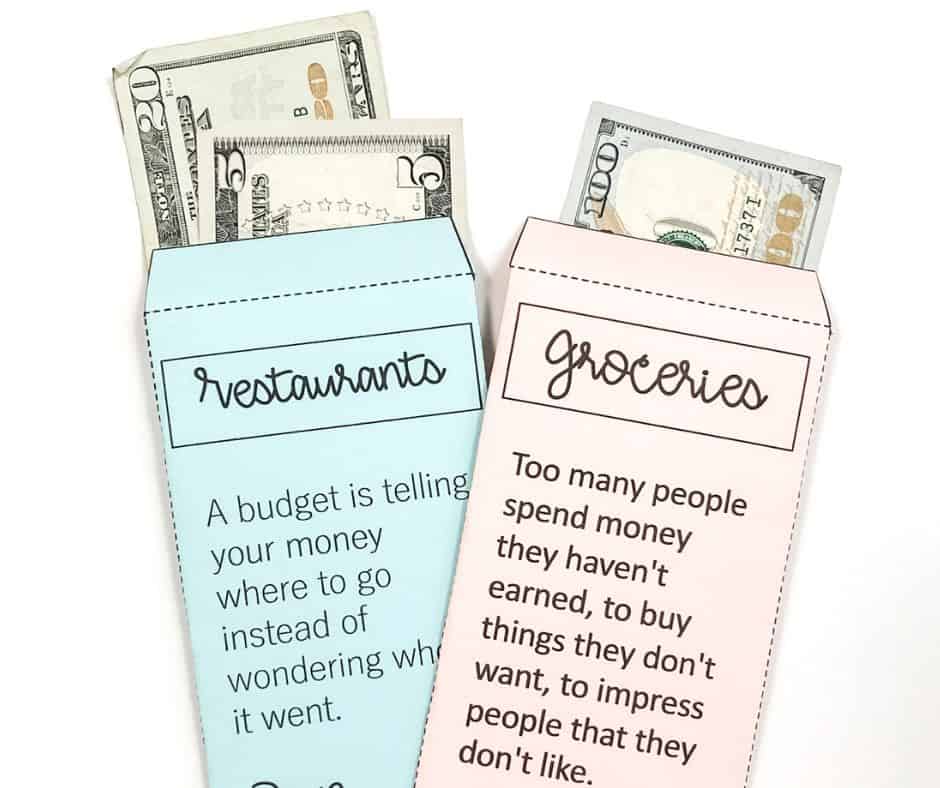

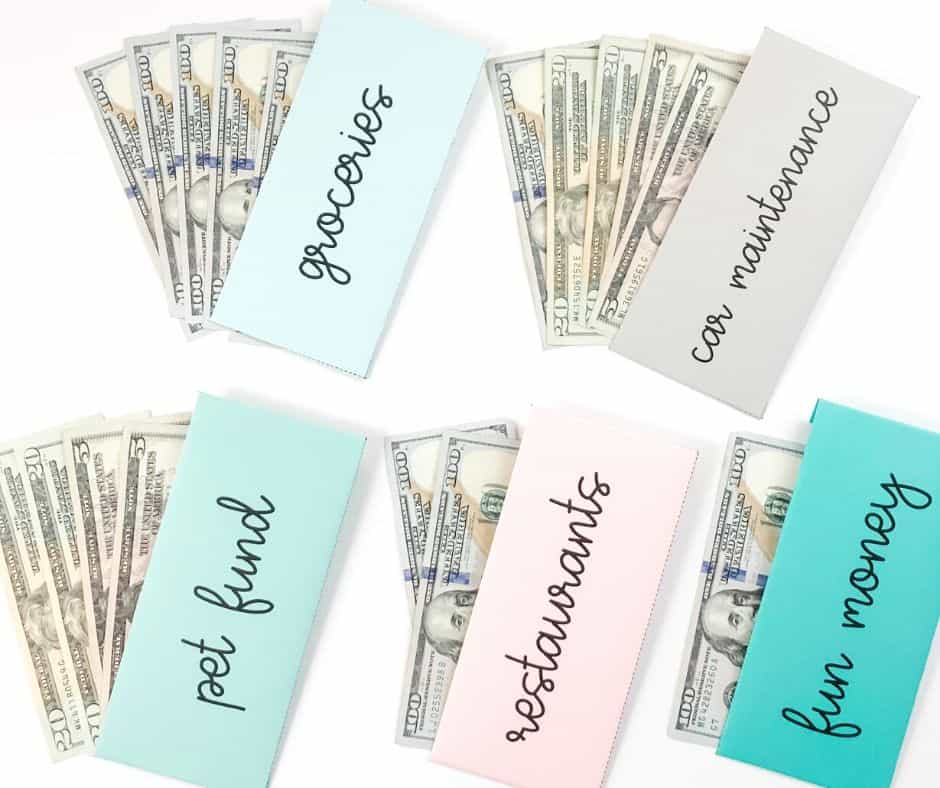

The money envelope system is a approach so that you can take again management and observe how a lot cash you’re spending on sure classes in your funds. As a substitute of utilizing a debit card or bank card, you’ll use money for areas in your funds the place you are inclined to overspend.

For those who wrestle with grabbing takeout or quick meals too typically, then you possibly can have a money envelope particularly for eating places. Use the cash you’ve put aside for eating places any time you exit to eat.

When you’ve used up your budgeted quantity, you received’t have any money left in your envelope! This helps maintain you on funds and never overspend every month.

Free Money Envelopes

To get your FREE money envelopes despatched straight to your inbox, join my Money Envelope Information. Then, merely print your freebies at residence on card inventory and begin utilizing them as we speak!

Not solely will you obtain printable money envelopes, however you’ll get entry to my Free Useful resource Library the place you’ll discover different budgeting and finance printables.

How Money Envelopes Work: 4 Easy Steps

As a result of I’m a Kind-An individual and completely love step-by-steps, I’m breaking this down for you in straightforward to comply with steps!

1. Know which classes you need in money.

I like to recommend going again by your spending and determining the place you are inclined to overspend. Additionally, determine when you’d like to make use of money envelopes for saving cash for future bills (learn extra about saving cash with sinking funds).

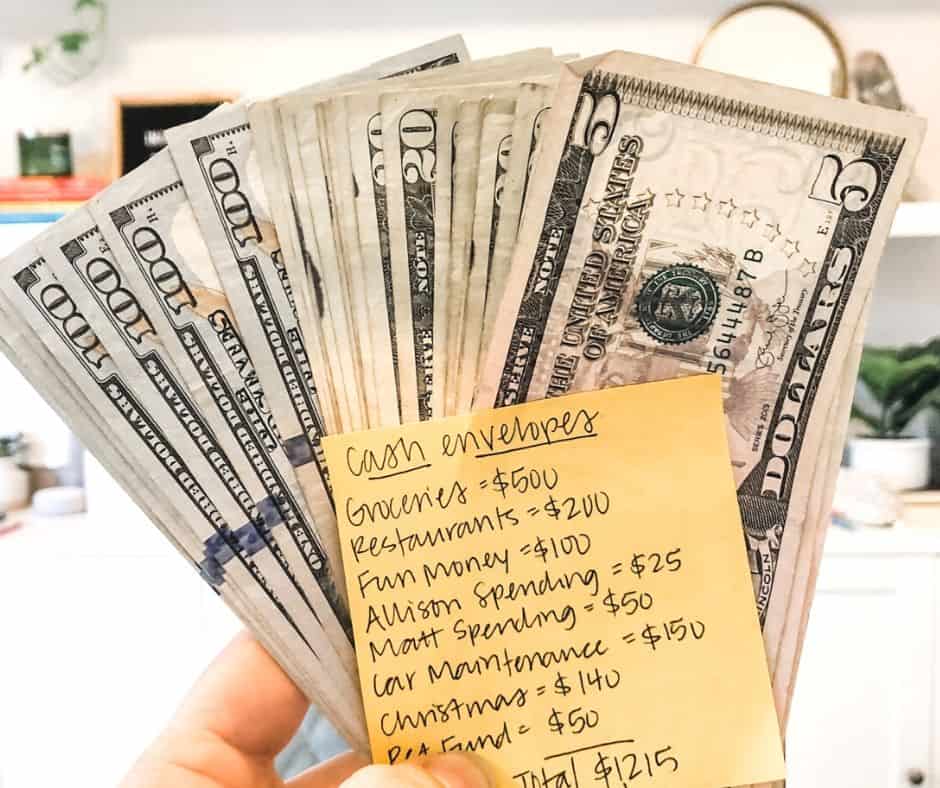

2. Go to the financial institution and pull out cash.

When you’ve made your funds, determine which denominations (a whole lot, twenties, tens, fives, ones) you need in your envelopes. Make a tally sheet so you know the way a lot of every invoice you wish to take out.

3. Arrange your cash into money envelopes.

After you’ve pulled money out from the financial institution, place your payments into your envelopes. As an illustration, when you plan to spend $600 this month on groceries, then plan on pulling out 6 100 greenback payments and place them in your envelope labeled “groceries.”

4. Use your money envelopes once you want them.

Take the envelopes with you once you want them. As soon as the cash is gone, it’s GONE. This forces you to watch out together with your spending and can make it easier to to remain inside your funds.

How Usually You Ought to Withdraw Money

How typically you might be paid will make it easier to decide how typically it is best to withdraw cash to your money envelopes. As an illustration, in case you are paid as soon as a month, you then’ll wish to withdraw your money envelopes month-to-month.

In case you are paid biweekly, you might need to take money out of the financial institution each different week.

The extra your cash and your funds, the better it is going to be to find out when to get your money out. For those who’re budgeting per paycheck, then it’s most likely greatest to tug out money each paycheck.

Our household is paid two instances every month, however we pull all our money out at first of the month. Because of the financial savings that we have now mechanically taken out of our account, it’s simpler for us to withdraw all our cash directly.

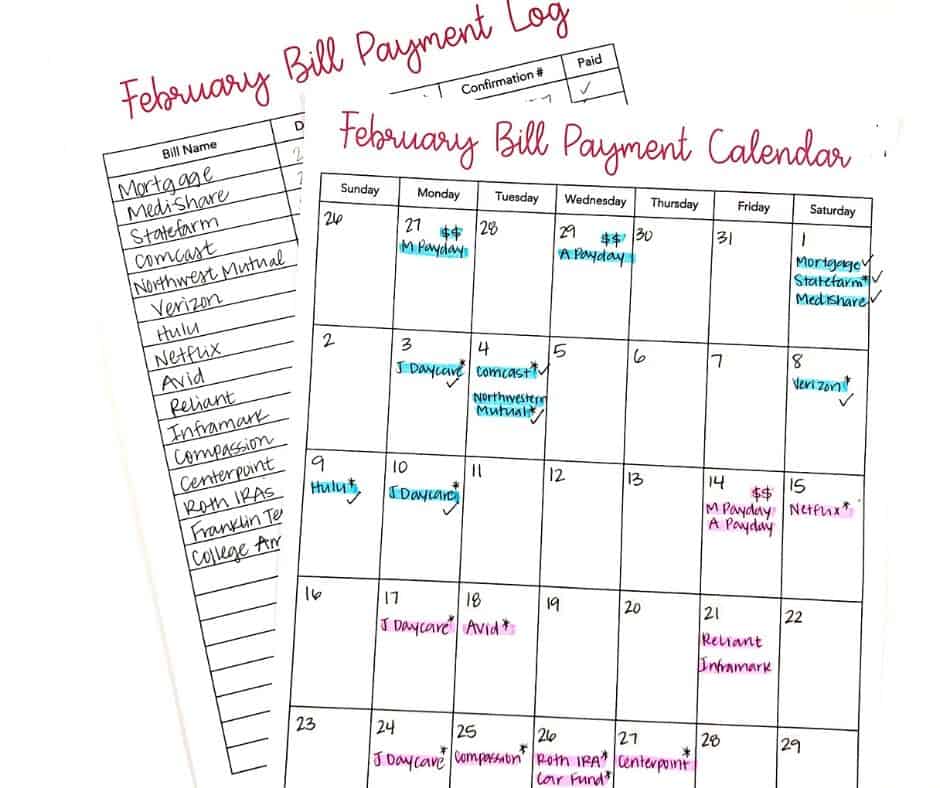

The best technique to decide that is to know the way to write a funds. I personally use a funds calendar to assist me know which paycheck will cowl which bills. You may be taught extra about writing a funds right here.

Why Money Envelopes Assist Individuals Spend Much less

Money envelopes usually are not new. They’ve been utilized by individuals for years, and there’s a cause why increasingly more persons are utilizing money envelopes every day.

Analysis exhibits that folks overspend by $7,400 every year. Clearly, individuals are inclined to spend with out pondering (I do know I do!). It’s a lot simpler to spend cash once you’re utilizing a debit card or bank card.

Handing over money is tougher. Individuals have an emotional connection to bodily cash. It’s tougher to half with a $20 invoice than it’s to spend $20 on a debit card.

The primary cause why money envelopes work is that they make it easier to keep on observe together with your funds. Money envelopes practice you to take again management of your funds and cease spending once you run out of cash.

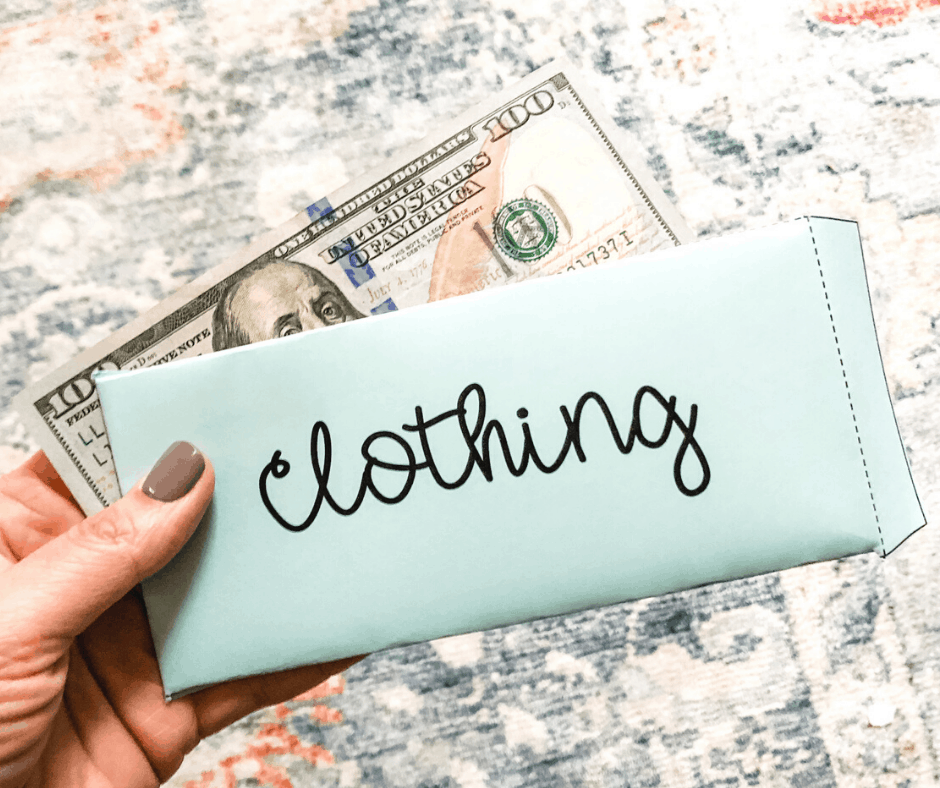

It’s fairly easy. When you have $50 to spend on garments, and you find yourself on the register with $57 value of clothes, one thing needs to be put again. Utilizing money helps you develop higher boundaries together with your cash.

For those who keep dedicated to solely utilizing the cash that you simply budgeted for every money envelope, then you’ll, certainly, keep on observe every month financially.

Have A Finances In Place

For money envelopes to work successfully, it’s vital that you’ve a funds in place. You must solely be pulling cash out of the financial institution to your envelopes AFTER you’ve written your funds!

Need assistance on the way to write a funds? Don’t fear! I’ve acquired you coated. Head on over to The Best Manner To Write A Finances to learn to write a funds that really is sensible!

Frequent Money Envelope Classes

I don’t advocate pulling money out to pay your hire or electrical energy invoice. These are each bills the place you aren’t more likely to overspend every month.

As a substitute, pull money out for areas in your funds the place you are inclined to spend an excessive amount of cash.

Unsure the place you might be spending an excessive amount of cash? That’s okay! I like to recommend printing off your financial institution statements from final month. Undergo every transaction and categorize it.

Spotlight all of the transactions the place you went out to eat in a single shade. Then use a unique shade highlighter for all of the instances you ran to the grocery retailer.

When you’ve categorized your transactions, add up how a lot you’re spending in every space. For those who’re spending greater than you had budgeted, then likelihood is you want a money envelope for that class!

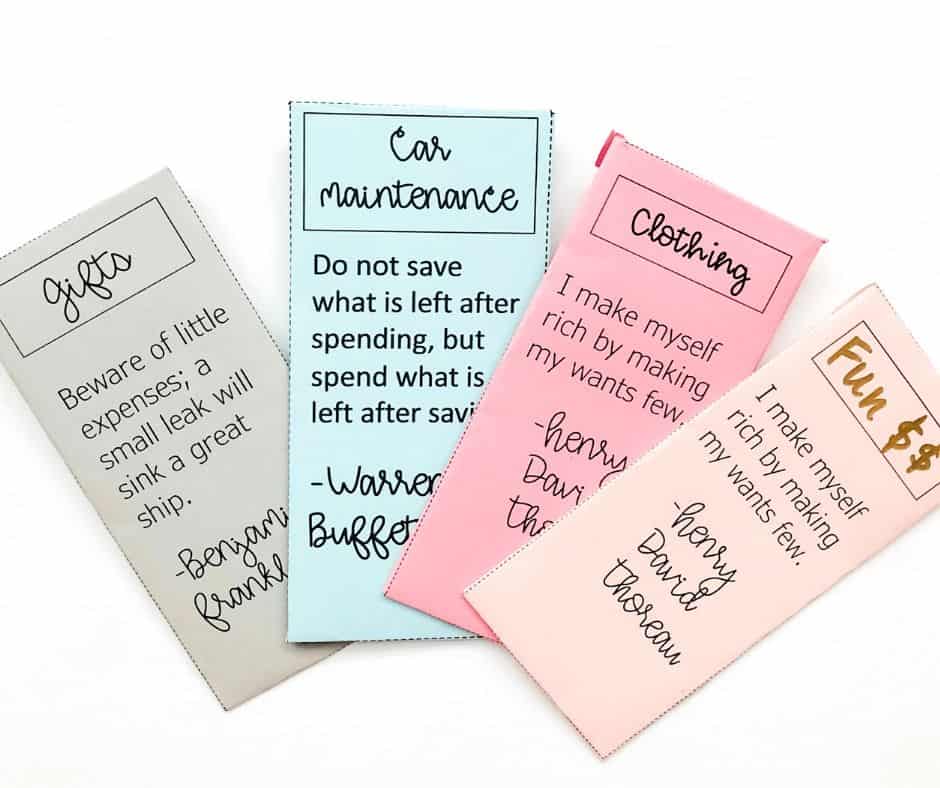

Under are frequent money envelope classes:

- Meals: Groceries

- Meals: Eating places

- Haircuts

- Enjoyable Cash

- Leisure

- Clothes

- Automotive Upkeep (sinking fund)

- Residence Repairs (sinking fund)

- Christmas (sinking fund)

In the end, discover what works for you in the case of utilizing money envelopes.

And my largest tip: don’t begin off with 8 totally different envelopes. You’ll get overwhelmed immediately. As a substitute, select 1 or 2 classes in your funds the place you know you are inclined to overspend. Attempt utilizing money envelopes for a couple of months in these classes.

What To Do When You Pay Payments On-line

“However I pay my payments on-line. Do I must take money out for these payments?”

The quick reply: No.

The lengthy reply: Completely not!

You shouldn’t take out money for payments. The aim of the money envelope system is that will help you develop higher habits and cease overspending. I’m guessing you aren’t paying additional to your web invoice every month.

Proceed paying your payments like regular. Take money out for areas in your funds which might be variable bills resembling meals, gasoline, or spending cash.

What To Do When You Purchase One thing On-line

Simply since you store on-line doesn’t imply you possibly can’t use the money envelope system! While you purchase one thing on-line, merely make a visit to the financial institution and deposit the cash you spent out of your money envelopes.

From time to time I order my groceries on-line as a substitute of going to the shop myself. They cost my debit card and I instantly run by the financial institution to deposit my money into my account after I seize my groceries.

Though this does take an additional 5 minutes, I nonetheless use money envelopes as a result of they’ve helped me stick with my funds! I’d a lot relatively spend a couple of additional minutes operating by the financial institution than really feel like I’ve no management over my cash.

What To Do With Your Cash

One of the vital frequent questions individuals ask in regards to the money envelope system is what they need to do with the change they obtain. I personally don’t like placing cash in my money envelopes. The additional weight causes my envelopes to change into heavy and it looks like cash are all the time spilling out into the underside of my purse.

As a substitute, I’ve discovered that 3 choices for coping with change and money envelopes:

- Possibility 1: Maintain the additional change in your pockets. Chances are high you’ve gotten a zippered part in your pockets particularly made for cash. Merely put your change in your pockets and subsequent time you pay with money, attempt to make precise change. As an illustration, if the full is $20.07, then seek for 7 cents in your pockets. This manner you’re utilizing your cash as you want them.

- Possibility 2: Gather your change in a jar at residence. I like accumulating additional change in a jar we maintain in our home. As soon as the jar is full, I carry it by my financial institution and deposit all of the cash into our trip financial savings account. It is a wonderful means to save cash for one thing particular!

- Possibility 3: My husband personally retains additional change and cash in his automotive. He has a particular spot in his console the place he stashes this cash. If he’s driving and desires to purchase himself a coke, he stops and makes use of his additional cash to purchase his caffeine.

How To Deal with Leftover Cash

When you have more money leftover on the finish of the month, then let me be the primary one to congratulate you!

Give your self a pat on the again and do a celebration dance. Clearly, you’re doing one thing proper!

However what must you do with that additional money?

Fortunately, you’ve gotten a couple of choices on the way to deal with leftover cash.

- Possibility 1: Depart the additional cash in your envelope. When you have any more money in your restaurant envelope, one choice is to depart it in your envelope and have ever extra cash to spend the following month.

- Possibility 2: Depart the additional cash in your envelope, however funds much less the following month. Let’s say you’ve gotten $50 left in your restaurant envelope. For those who usually funds $200 every month for consuming out, this month you solely need to funds $150 as a result of you have already got $50 in your money envelope.

- Possibility 3: Ship the additional cash to financial savings. For those who’re making an attempt to save lots of up for an enormous buy or trip, then take into account sending any leftover cash out of your money envelopes to that financial savings account. It is a nice technique to keep motivated to spend even lower than you’d have deliberate!

- Possibility 4: Ship the additional cash to debt. For those who’re in your debt free journey, then take into account taking any leftover money and making an additional debt cost! It will make it easier to make extra progress in your debt journey.

What To Do If You Run Out Of Cash

However what when you run out of cash earlier than payday?

I want I might say this has by no means occurred to me, however that may be a lie. There have been a number of instances when our money envelope was empty earlier than the following payday. And THIS is when money envelopes train you a lesson. For those who run out of cash, it’s easy. You CAN’T spend any cash.

Not like utilizing a bank card, you actually can not purchase something in case your money envelope is empty. That is your funds’s approach of telling you that you simply’re minimize off.

When you have $100 in your Grocery envelope, you actually can not spend greater than $100. In case your grocery invoice is over $100 you then’ll be pressured to place one thing again.

Utilizing money envelopes helps maintain you accountable to the funds you set. So long as you stick with utilizing your money envelopes, you WILL keep on funds.

For those who proceed to expire of cash month after month, then it is perhaps time to check out your funds. Decide when you’re really budgeting sufficient for that class in your funds. It is a signal it is perhaps time to extend your funds!

Making Money Envelopes Work With A Partner

When you have a partner or associate, you is perhaps anxious that the money envelope system received’t work for your loved ones. This isn’t true!

My husband and I’ve been utilizing money envelopes because the first 12 months we have been married, and so they have helped us take again management of our cash. Under are a couple of tricks to make money envelopes work for 2 or extra individuals:

1. At all times have a plan in place.

So typically, individuals say that their partner forgot to seize the envelope earlier than work after which ran by the shop on the best way residence that afternoon. What are they alleged to do? One of many biggest advantages of money envelopes is that they pressure you to be ready and suppose prematurely.

Earlier than you ever go away your home, suppose by your day. Will that you must run any errands throughout your lunch break? Did you propose on selecting up dinner on the best way residence from work? If that’s the case, be sure you seize the envelopes that you will want!

2. Permit every particular person to have their very own envelope.

As a substitute of sharing one “Enjoyable Cash” or “Miscellaneous” envelope, permit every partner to have their very own envelope. My husband and I each have our personal “allowance.” We take $50 out in money every month. Each of us are allowed to spend this cash on no matter we wish. We every maintain our envelope with us always.

That is good for my husband who has a protracted commute. If he needs to cease and choose one thing up on the best way residence, he can! He has his personal money envelope with cash inside. When he runs out, he’s out! He should wait till the following time we refill the envelopes to spend cash on one thing he needs only for enjoyable.

3. Examine-in every week.

For those who’re sharing money envelopes with a partner, then set a time every week to verify in with one another in your funds and money envelopes. I wish to name this a Household Enterprise Assembly. My husband and I sit down each Sunday night to debate our funds, a couple of targets for the week, in addition to our meal plan. That is the good time to go over how we’re doing with our spending and depend how a lot cash is left in our money envelopes.

The important thing to utilizing money envelopes efficiently with a partner comes right down to communication. The extra you talk about spending, the higher off you’ll be!

The place To Maintain Your Money Envelopes

Once I first began utilizing money envelopes, the concept of carrying my money round terrified me! I used to stroll round with ALL my money envelopes tucked into my purse. Once I walked out my door, I instantly felt like everybody knew I had a whole lot of {dollars} with me.

Carrying round my money envelopes all of sudden was a HUGE mistake that I made! Fortunately, nobody ever stole my cash, however I’ve discovered that money envelopes are supposed to be left at residence.

Don’t (I repeat) DO NOT maintain all of your money envelopes with you always! It’s not clever to hold such a lot of cash with you in all places you go.

As a substitute, retailer your money envelopes at residence in a really secure spot. You may disguise your envelopes someplace in your house or maintain them locked up in a secure.

Merely seize the envelopes you want earlier than you allow the home. Simply keep in mind to place them again once you get residence!

Can I “Steal” From Different Money Envelopes

A whole lot of readers will ask me if it’s okay to “steal” from different envelopes. Often, they wish to exit to eat, however they don’t have any cash left of their restaurant envelope. As a substitute, they are going to take cash out of their grocery envelope and head to a restaurant.

Though you’re technically not “stealing” cash, you take cash from one class to pay for an additional class in your funds. I personally attempt to restrict how typically this occurs. From time to time I’ll take cash from one class for an additional, but it surely’s very uncommon.

For those who’re “stealing” cash typically out of your money envelopes, then likelihood is that you must return and check out your funds. It is perhaps time to extend the quantity you’re sending to that class in your funds. Ensure that you’ve gotten an affordable quantity set for every class in your funds. The extra affordable your funds, the extra doubtless you might be to stay to it!

Suggestions On Getting Began

Able to get began with money envelopes? Under you’ll discover my favourite tips about the way to begin the money envelope system and see outcomes!

Tip #1: Give your self an allowance.

Allowances aren’t only for children! Giving your self (or different members in your loved ones) an allowance lets you have private spending cash that nobody else can contact.

It is going to train you the way to be affected person with cash, save up for objects you need, and suppose earlier than spending.

Tip #2: Maintain observe of what you’re spending.

While you’re first beginning out with money envelopes, it’s useful to maintain observe of precisely what you’re spending your money on. You are able to do this by writing down your transactions on the again of your envelope.

For those who’d relatively not write in your envelope, take into account itemizing out your transactions on a plain notecard. Slip the notecard inside your envelope for safekeeping.

Tip #3: Get monetary savings on ink by shopping for coloured card inventory to your envelopes.

I like printing my money envelopes on coloured card inventory. Not solely do I lower your expenses on ink for my pc, however my envelopes are stronger when they’re printed on card inventory. Use packing tape to safe them and also you’re all set!

Tip #4: Begin with simply 2 money envelopes.

The thought of utilizing money envelopes could be annoying. To maintain it straightforward, begin by selecting 2 money envelope classes. Use these money envelopes for a couple of months. If you find yourself liking the money envelope system, slowly add to your money envelope classes!

Tip #5: Discover a buddy or accountability associate to make use of money envelopes with.

Every little thing appears to be simpler (and extra enjoyable!) with a buddy. For those who’re simply beginning on this journey, ask a buddy to affix you. Supply encouragement to at least one one other and take into account checking in on one another together with your spending.

You don’t need to share your complete funds with this particular person. However generally having somewhat additional accountability will make it easier to achieve success!

Tip #6: Don’t quit (attempt money envelopes for at the very least 3 months).

Have you ever ever heard that 21 days kind a behavior? I truthfully suppose it’s longer! Decide to making an attempt money envelopes for 3 months. This offers you time to learn to use them nicely, and observe your spending. You’ll be capable of see when you’ve spent much less and in case your cash habits have improved!

My Private Expertise With Money Envelopes

Money envelopes helped train me the way to not purchase all of the issues and develop this pretty behavior I wish to name “endurance.” Let’s again up first although. To grasp the total story, you’ll need to know that my husband and I paid off over $111,000 of debt on 2 instructor salaries (you possibly can learn extra about that HERE and HERE).

However to say that I jumped on the money envelope system immediately could be a flat out LIE.

In late 2011 our household hit all-time low. We have been younger, married, newly pregnant, and had no earthly concept what we have been doing. However we knew one factor for certain…we have been spending approach an excessive amount of cash every month.

As in, we didn’t have the funds for left over to cowl daycare prices when our bundle of pleasure arrived. To assist retrain how we spent cash, we discovered the way to write a funds and use the money envelope system.

Quick ahead 8+ years and this little system of ours has little question saved us THOUSANDS over time. We’ve got completely modified the best way that we spend and lower your expenses.

However I do know what you’re pondering proper now. You’re pondering “However Allison, I’m totally different. I don’t suppose that would work for me.” And to that I might say “Yeah, it is totally different. However don’t knock it till you attempt it.” And that’s what I need you to do. Simply attempt it. You by no means know the way it can change your life!

Want extra assist?

For those who’re uninterested in residing paycheck to paycheck cycle and wish to learn to funds so you may get out of debt for good, I’ve acquired a free useful resource only for you. You may seize the Budgeting and Debt Payoff Cheat Sheet to get easy and actionable tricks to take management of your cash as we speak.

[ad_2]

![How To Use Money Envelopes in 2023 [Free Printable Included] How To Use Money Envelopes in 2023 [Free Printable Included]](https://inspiredbudget.com/wp-content/uploads/2021/01/cash-envelope-system-featured-image.jpg)