[ad_1]

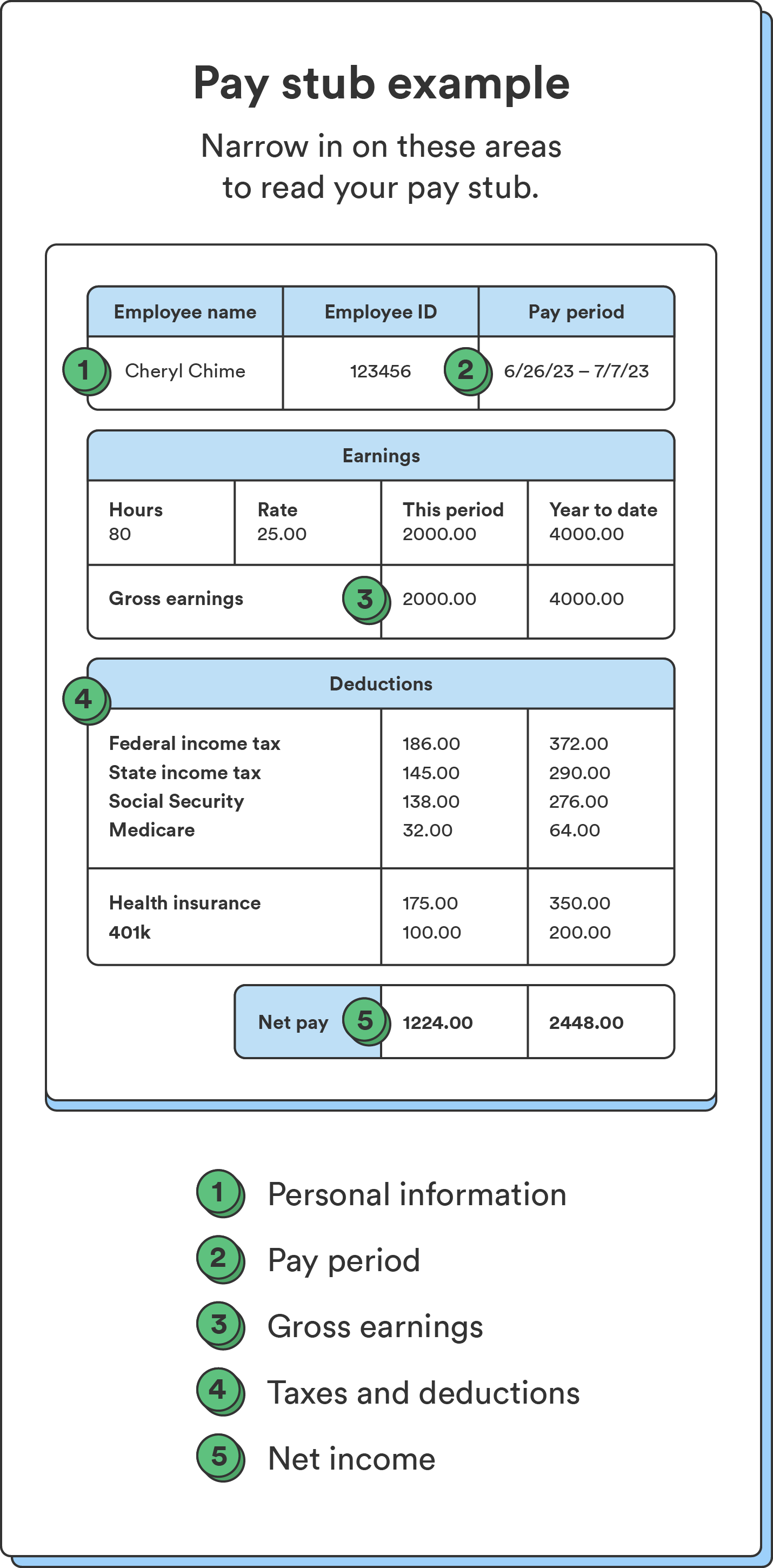

So that you’ve received your pay stub in hand (or in your display screen), however how do you learn it? There are 5 major sections to a typical pay stub:

- Private data

- Pay interval

- Gross earnings

- Taxes and deductions

- Web earnings

Let’s check out every of those pay stub components for a greater understanding:

1. Private data

The highest of your pay stub will embody your authorized title, Social Safety quantity, residence tackle, and normally your submitting standing and exemptions.

The pay stub might also embody work particulars, like the quantity of paid day without work you’ve accrued and brought, your worker ID, and the way you’re paid (hourly vs. wage).

The corporate’s title and tackle may also normally be printed on the high.

Chime Tip: Confirm that your submitting standing is right for tax season, as your employer makes use of this standing to foretell your tax withholdings (how a lot cash to withhold out of your paycheck for taxes). In the event that they withhold too little as a result of your submitting standing is improper, you would find yourself owing cash in April.

2. Pay interval

Earlier than the precise fee data, pay stubs additionally sometimes record the pay interval (the date vary for which your employer is issuing fee) and the date the fee was issued.

3. Gross earnings

Right here’s the place pay stubs get thrilling: This portion particulars how a lot cash you earned throughout the pay interval.

In case you’re salaried, the quantity will look constant from pay stub to pay stub – till you get a increase, take unpaid day without work, or earn a bonus. In case you’re an hourly employee, the pay stub will point out the variety of hours you labored throughout the pay interval, your hourly charge, and the ensuing earnings.

Extra earnings, like reimbursement for an expense or extra time pay (and the speed), may also seem on this part.

This part sometimes reveals gross earnings for the present pay interval and the year-to-date.

4. Taxes and deductions

Don’t get too connected to that enticing quantity within the gross earnings part. It’s not what you’ll truly take residence. The following part of your pay stub is devoted to the cash you owe.

First, you’ve received to pay Uncle Sam his fair proportion in federal taxes, and your state – and perhaps even your metropolis and/or college district – might also take a portion. You’ll additionally see Social Safety and Medicare deductions right here.

In case you obtain medical insurance by means of your employer, you seemingly pay the premium out of your paycheck, in order that’ll present up within the deductions as effectively. Different widespread deductions embody 401(okay) contributions, FSA contributions, and HSA contributions.

As with gross pay, your pay stub normally reveals you deductions for the present pay interval and YTD.

5. Web earnings

Lastly, your web earnings represents how a lot cash you’re truly being paid. It’s your gross earnings minus your taxes and deductions. This quantity ought to match what lands in your checking account.

You’ll be able to normally see web earnings for the present pay interval and YTD.

[ad_2]