[ad_1]

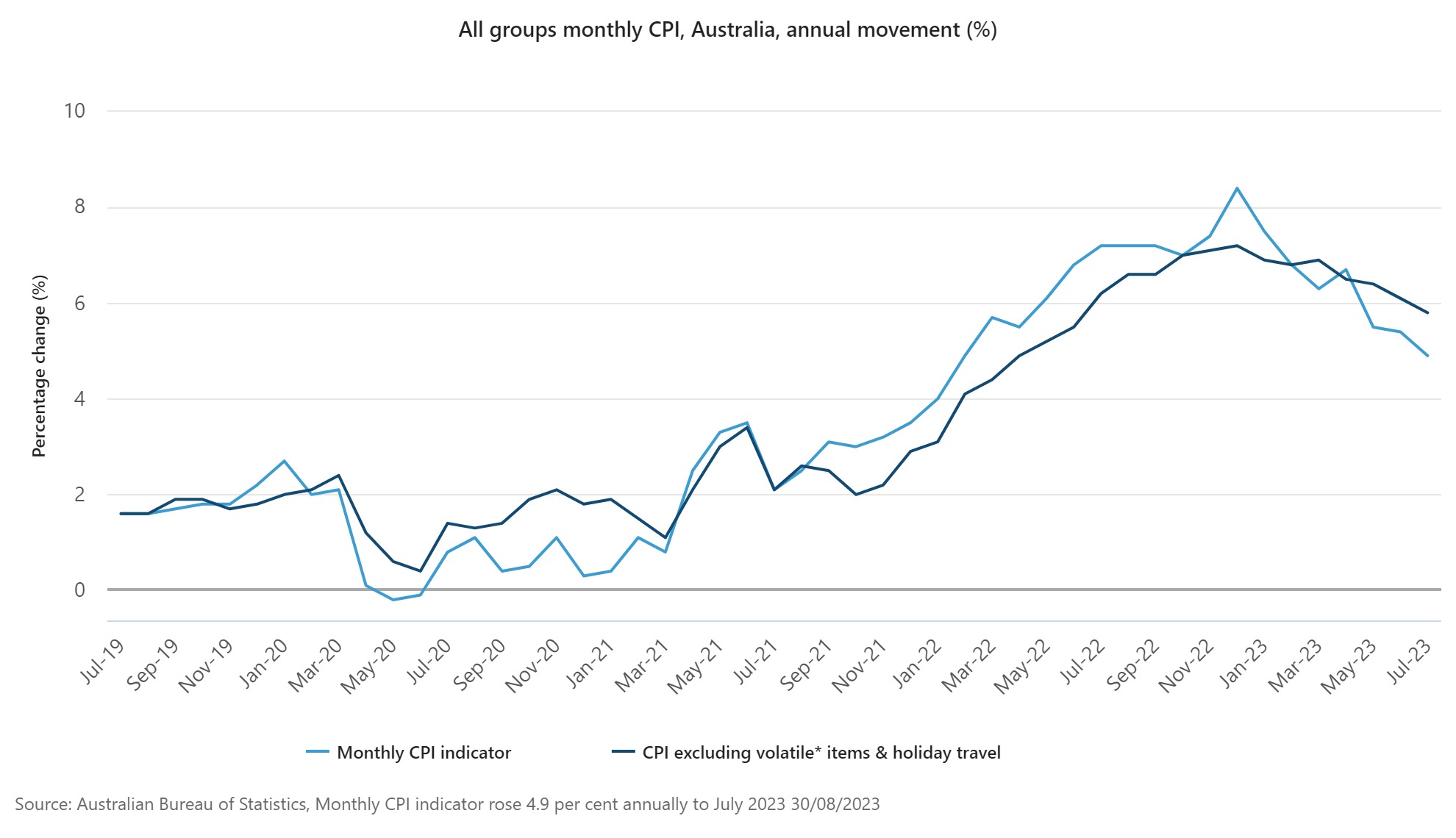

The month-to-month Client Value Index (CPI) indicator rose 4.9% within the 12 months to July 2023 down from 5.4% in June, based on the most recent information from the Australian Bureau of Statistics (ABS).

Nevertheless, it stays to be seen whether or not the most recent inflation information can have any impact on the official money price, which will likely be determined on the subsequent RBA board assembly subsequent Tuesday, September 5.

Michelle Marquardt (pictured above), ABS head of costs statistics, stated annual value rises proceed to ease from the height of 8.4% in December 2022.

“CPI inflation is commonly impacted by objects with unstable value adjustments like automotive gas, fruit and greens, and vacation journey. It may be useful to exclude this stuff from the headline CPI indicator to offer a view of underlying inflation,” Marquardt stated.

When excluding these unstable objects, the decline in annual inflation is extra modest at 5.8% in July, in comparison with 6.1% in June.”

What drove inflation?

It was once more the standard suspects, housing and electrical energy, that drove inflation.

Nevertheless, the annual improve for housing of seven.3% was barely decrease than the 7.4% improve in June.

New dwelling costs rose 5.9%, which is the bottom annual rise since October 2021, as constructing materials value will increase continued to ease. Lease costs rose 7.6% in July, up from 7.3% in June, because the rental market stays tight.

Electrical energy costs rose 15.7% year-on-year and rose 6% in simply the month of July.

These will increase replicate value opinions throughout all capital cities. Rebates launched from July decreased the influence of electrical energy value will increase for eligible households.

“The Power Invoice Reduction Fund supplies eligible households with rebates starting from $43.75 to $250 in July. If we exclude the influence of rebates from the July 2023 figures, electrical energy costs would have recorded a month-to-month improve of 19.2%,” Ms Marquardt stated.

Meals and non-alcoholic drinks (+5.6%) was additionally among the many highest contributors of inflation whereas there have been value falls for automotive gas (-7.6%) and fruit and greens.

“Meals inflation continues to ease throughout most classes, whereas fruit and vegetable costs fell 5.4 % in comparison with 12 months in the past on account of beneficial rising circumstances resulting in elevated provide,” Ms Marquardt stated.

Will the RBA money price pause or go up?

Whereas there may be nonetheless no definitive strategy to know whether or not the RBA will increase the official money price or maintain it paused for a 3rd consecutive month, the choice is much less on a knife-edge when in comparison with earlier months.

Inflation is mostly monitoring down in direction of the RBA’s goal band of two%-3% and the RBA’s earlier wording had indicated a shift in direction of stability in earlier months.

Whereas the decision is cut up on the money price’s peak, with ANZ, Westpac, and CBA say 4.10% is as excessive as rates of interest will go whereas NAB predicts another 25-basis-point hike, it’s unanimous among the many massive 4 that it received’t rise in September, based on Mozo.

NAB forecasts the speed rise to hit by December 2023, bringing the money price as much as 4.35%, till it slowly declines over subsequent yr.

At the very least that is the case on the time of writing with the financial institution’s recognized to re-evaluate their forecasts after the inflation information in earlier months.

[ad_2]