[ad_1]

Nonetheless sleeping in your SRS funds? That is your wake-up name to do one thing with them, or slowly watch its worth erode particularly in at present’s high-interest price surroundings. If it’s essential take a reference from what others have already completed, right here’s what different Singaporeans are investing their SRS in.

Psst, if you happen to didn’t already know, the funds in your Supplementary Retirement Scheme (SRS) are solely incomes 0.05% p.a.

And no, though most banks have raised their rates of interest during the last 2 years, this doesn’t apply to your SRS account. Go forward and verify – you’re nonetheless solely incomes 50 cents for each $1,000 saved. In the event you had maximized your SRS contributions to cut back your revenue tax, that’s solely $7.65 on each $15,300.

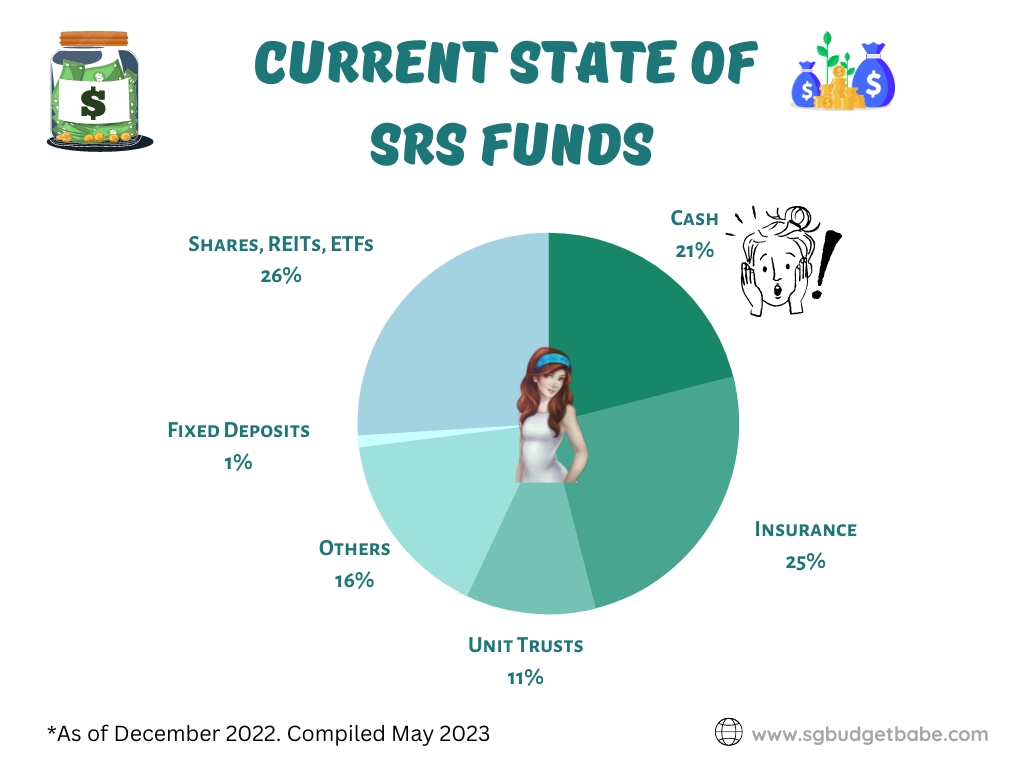

The state of SRS funds at present

In the event you’ve been sleeping in your SRS funds, it is a wake-up name to do one thing with them.

SRS statistics – the newest launched by the Ministry of Finance (MOF) simply 7 months in the past in December 2022 – present that the preferred instrument amongst SRS traders are shares, REITS and exchange-traded funds (ETFs), adopted by insurance coverage merchandise and unit trusts. SRS money inflows into native ETFs have additionally greater than doubled in recent times. What’s extra, the variety of SRS account holders has virtually doubled within the final 3 years alone.

Nevertheless, about 1 in 5 proceed to depart their money sitting idle of their SRS accounts – which will be unlucky since you’re solely incomes 0.05% p.a. curiosity. In the event you’re amongst that 21%, this primarily implies that your cash is shedding buying energy – particularly in at present’s local weather the place inflation has steadily climbed to greater than 5%.

ETFs proceed to be standard for a lot of SRS traders, and it’s simple to see why. Since your SRS funds are possible being parked away for the long term, this additionally makes it a fuss-free solution to get probably greater than what the banks can pay you in your SRS account.

Investing your SRS funds in SGX-listed ETFs

In the event you don’t have the time to do intensive analysis on particular person shares, then investing in ETFs and unit trusts might be a neater method.

Between the 2, most unit trusts are usually actively managed, the place the fund supervisor seeks to outperform the index as a substitute of simply replicating its efficiency. In consequence, most unit trusts are likely to cost larger charges, and you’ll typically solely purchase them by the banks or monetary advisors – which generally incurs a one-off gross sales cost and/or redemption costs as excessive as 5%.

Word: With the rise of disruptive robo-advisory platforms comparable to MoneyOwl or EndowUs, we now have entry to decrease value unit trusts.

However, ETFs tend to trace a passive index and are therefore in a position to cost decrease charges. As an illustration, respected ETF managers – comparable to Nikko Asset Administration – normally cost charges under 1% p.a.

In consequence, traders looking for a lower-cost method can contemplate ETFs over Unit Trusts.

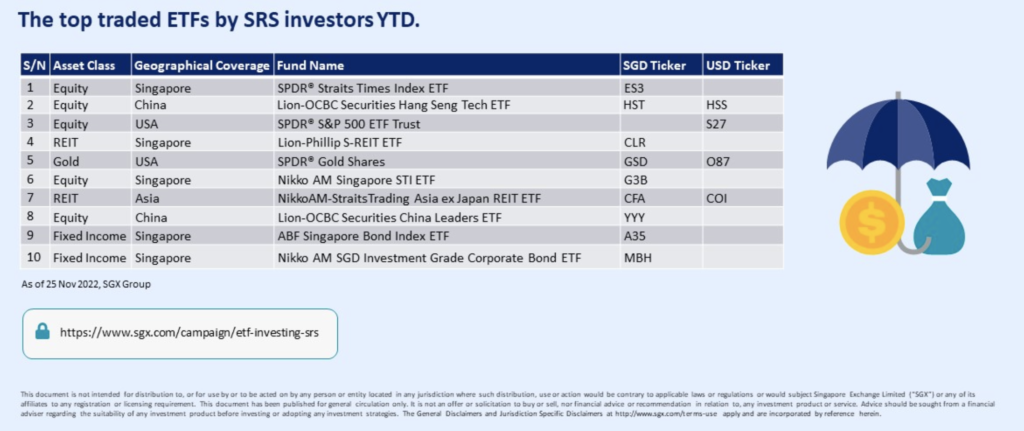

What are the preferred ETFs amongst SRS traders?

Among the many high 10 ETFs traded by SRS traders, 4 of them are managed by Nikko Asset Administration, so right here’s a more in-depth look:

ABF Singapore Bond Index Fund (SGX:A35)

With $1 billion of complete belongings beneath administration, the ABF Singapore Bond Index Fund is among the many largest native bond ETFs since its launch 18 years in the past.

| Whole expense ratio | 0.24% p.a. |

| Underlying benchmark | iBoxx ABF Singapore Bond Index |

| What it tracks | Singapore greenback bonds issued by the Singapore Authorities or Singapore Authorities-linked entities (e.g. Housing Improvement Board, Temasek, and Land Transport Authority)1.

The index might also embody SGD bonds issued by supranational monetary establishments or another Asian authorities or quasi-government entities (e.g. Export-Import Financial institution of Korea)1. |

| Distribution Frequency# | Semi-annually (twice a yr) |

About 80% of the ABF Singapore Bond Index Fund is invested in bonds issued by the federal government of Singapore. The opposite 20% is unfold throughout bonds issued by authorities linked entities (e.g. HDB, LTA, Temasek and SP Energy Belongings.)

Learn extra about how the ABF Singapore Bond Index Fund works right here.

Nikko AM Singapore STI ETF (SGX:G3B)

The Nikko AM Singapore STI ETF is one other high choose by many SRS traders, because it tracks the return of the highest 30 Singapore-listed firms and has been round for 14 years.

| Whole expense ratio | 0.30% p.a. |

| Underlying benchmark | The Straits Occasions Index (STI) |

| What it tracks | The highest 30 firms listed on the SGX-ST Mainboard, ranked by full market capitalisation. |

| Distribution Frequency^ | Semi-annually (twice a yr) |

The STI Index additionally has one of many highest dividend yields in comparison with different international market indices primarily based on the common dividend yield throughout the final 10 years2. It’s thus no surprise that this appeals to traders who want to put money into acquainted grounds (Singapore) and but obtain diversification.

Learn extra about how the Nikko AM Singapore STI ETF works right here.

Nikko AM SGD Funding Grade Company Bond ETF (SGX:MBH)

I’d beforehand reviewed the Nikko AM SGD Funding Grade Company Bond ETF a number of years in the past right here on my weblog when it was first launched. What makes it engaging is that traders can use it to entry investment-grade company bonds for as little as S$1*, whereas it might in any other case value them a minimal of $250,000 only for a single bond subject.

* The Nikko AM SGD Funding Grade Company Bond ETF trades in minimal lot sizes of 1 unit, which implies that you would be able to get entry to the ETF with simply roughly S$1 at at present’s costs (30 Might 2023.) Please be aware that that is excluding any buying and selling or transaction prices.

| Whole expense ratio | 0.26% p.a. |

| Underlying benchmark | iBoxx SGD Non-Sovereigns Massive Cap Funding Grade Index |

| What it tracks | The efficiency of SGD denominated funding grade bonds, excluding Singapore Authorities Securities. |

| Distribution Frequency^ | Semi-annually (twice a yr) |

The Index includes of bonds issued by recognizable establishments comparable to DBS Group, HDB, PUB, HSBC, NTUC Earnings, Temasek, Lendlease, Singtel2 and extra. Therefore, for these seeking to get publicity to the company bond market with out the excessive sums or larger threat, this may be extra accessible.

Learn extra about how the Nikko AM SGD Funding Grade Company Bond ETF works right here.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF (SGX:CFA)

As the biggest REIT ETF listed on the SGX by fund dimension, it’s no surprise why that is one other standard alternative amongst SRS traders.

| Whole expense ratio | 0.58% p.a. |

| Underlying benchmark | FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index |

| What it tracks | The index efficiency of qualifying REITS (or REIT-type securities) from China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. |

| Distribution Frequency^ | Quarterly |

Extra individuals are additionally investing in REIT ETFs, which has resulted within the complete mixed belongings beneath administration (AUM) greater than doubling inside the final 3 years alone, with retail investor possession overtaking institutional traders. This notable pattern was first reported in The Enterprise Occasions on 31 March 2023.

What if I don’t have an SRS account?

In fact, if you happen to haven’t opened an SRS account since you don’t have the necessity for one but, you too can put money into the above funds immediately as they’re tradable on the Singapore Change.

What’s extra, Singaporeans may make investments utilizing your CPF funds, because the above funds are CPFIS-included investments.

Try the complete listing of investments included beneath the CPFIS right here.

Conclusion

At the same time as we work to extend our take-home salaries, I imagine that extra Singaporeans ought to contemplate utilizing the SRS as a solution to legitimately cut back their taxes.

Nevertheless, with about 1 in 5 folks merely leaving their money idle within the SRS account, this isn’t splendid…particularly in at present’s surroundings of rising rates of interest.

In the event you’re amongst that 21%, please begin to look into your numerous funding choices and discover what could be appropriate for you. For extra particulars on what you possibly can make investments your SRS funds in (and my most popular SRS funding selections), take a look at this text.

Considering of investing your SRS funds? As a good asset supervisor in Asia, Nikko Asset Administration presents all kinds of ETFs for retail traders to select from with a low payment that will help you hold your funding prices low.

Sponsored Message

Discover out extra about the way to put money into Nikko Asset Administration ETFs utilizing your SRS right here.

Extra particulars on the ETFs lined on this article will be discovered right here:

Disclosure: This put up is dropped at you in collaboration with Nikko Asset Administration. All analysis and opinions are that of my very own. I extremely advocate that you just use this as a place to begin to know extra concerning the numerous ETFs provided by NikkoAM which you should use for SRS and CPF investing, after which click on into the respective hyperlinks above to retrieve the fund prospectus and efficiency in order that will help you resolve whether or not it suits into your funding aims.

# Distributions should not assured and are on the absolute discretion of the Supervisor. Any distribution is predicted to lead to a direct discount of ETF's NAV. Distributions will solely be paid to the extent that they're out there for distribution pursuant to the Belief Deed and lined by revenue acquired from the underlying investments of the ETF. ^Distributions should not assured and are on the absolute discretion of the Supervisor. Any distribution is predicted to lead to a direct discount of ETF's NAV. Distributions could also be paid out of capital which is able to lead to capital erosion and discount within the ETF's NAV, which will probably be mirrored within the redemption value of the Items. 1 Reference to particular person securities are for illustrative functions solely and doesn't assure their continued inclusion within the fund/ETF, nor represent a suggestion to purchase or promote. 2 Supply: Bloomberg as of 28 February 2023. The worldwide indices talked about listed below are Cling Seng Index, Topix Index, S&P 500 Index, STOXX Europe 600 Index, MSCI AC World Index. Dividend yield of the Straits Occasions Index just isn't the identical as that of the Nikko AM Singapore STI ETF fund. Previous dividend yields should not indicative of future dividend yields.

Vital Data by Nikko Asset Administration Asia Restricted:

This doc is solely for informational functions solely as a right given to the particular funding goal, monetary scenario and explicit wants of any particular individual. It shouldn't be relied upon as monetary recommendation. Any securities talked about herein are for illustration functions solely and shouldn't be construed as a suggestion for funding. You need to search recommendation from a monetary adviser earlier than making any funding. Within the occasion that you just select not to take action, you must contemplate whether or not the funding chosen is appropriate for you. Investments in funds should not deposits in, obligations of, or assured or insured by Nikko Asset Administration Asia Restricted (“Nikko AM Asia”).

Previous efficiency or any prediction, projection or forecast just isn't indicative of future efficiency. The Fund or any underlying fund might use or put money into monetary by-product devices. The worth of models and revenue from them might fall or rise. Investments within the Fund are topic to funding dangers, together with the doable lack of principal quantity invested. You need to learn the related prospectus (together with the danger warnings) and product highlights sheet of the Fund, which can be found and could also be obtained from appointed distributors of Nikko AM Asia or our web site (www.nikkoam.com.sg) earlier than deciding whether or not to put money into the Fund.

The knowledge contained herein will not be copied, reproduced or redistributed with out the specific consent of Nikko AM Asia. Whereas cheap care has been taken to make sure the accuracy of the data as on the date of publication, Nikko AM Asia doesn't give any guarantee or illustration, both specific or implied, and expressly disclaims legal responsibility for any errors or omissions. Data could also be topic to alter with out discover. Nikko AM Asia accepts no legal responsibility for any loss, oblique or consequential damages, arising from any use of or reliance on this doc. This commercial has not been reviewed by the Financial Authority of Singapore.

The efficiency of the ETF’s value on the Singapore Change Securities Buying and selling Restricted (“SGX-ST”) could also be completely different from the online asset worth per unit of the ETF. The ETF might also be suspended or delisted from the SGX-ST. Itemizing of the models doesn't assure a liquid marketplace for the models. Traders ought to be aware that the ETF differs from a typical unit belief and models might solely be created or redeemed immediately by a collaborating supplier in giant creation or redemption models.

The models of Nikko AM Singapore STI ETF should not in any means sponsored, endorsed, bought or promoted by FTSE Worldwide Restricted ("FTSE"), the London Inventory Change Plc (the "Change"), The Monetary Occasions Restricted ("FT") SPH Information Companies Pte Ltd ("SPH") or Singapore Press Holdings Ltd ("SGP") (collectively, the "Licensor Events") and not one of the Licensor Events make any guarantee or illustration in any way, expressly or impliedly, both as to the outcomes to be obtained from using the Straits Occasions Index ("Index") and/or the determine at which the stated Index stands at any explicit time on any explicit day or in any other case. The Index is compiled and calculated by FTSE. Not one of the Licensor Events shall be beneath any obligation to advise any individual of any error therein. "FTSE®", "FT-SE®" are commerce marks of the Change and the FT and are utilized by FTSE beneath license. "STI" and "Straits Occasions Index" are commerce marks of SPH and are utilized by FTSE beneath licence. All mental property rights within the ST index vest in SPH and SGP.

The models of NikkoAM-StraitsTrading Asia ex Japan REIT ETF should not in any means sponsored, endorsed, bought or promoted by FTSE Worldwide Restricted ("FTSE''), by the London Inventory Change Group firms ("LSEG''), Euronext N.V. ("Euronext"), European Public Actual Property Affiliation ("EPRA"), or the Nationwide Affiliation of Actual Property Funding Trusts ("NAREIT") (collectively the "Licensor Events") and not one of the Licensor Events make any guarantee or illustration in any way, expressly or impliedly, both as to the outcomes to be obtained from using the FTSE EPRA/NAREIT Asia ex Japan Internet Whole Return REIT Index (the "Index") and/or the determine at which the stated Index stands at any explicit time on any explicit day or in any other case. The Index is compiled and calculated by FTSE. Nevertheless, not one of the Licensor Events shall be liable (whether or not in negligence or in any other case) to any individual for any error within the Index and not one of the Licensor Events shall be beneath any obligation to advise any individual of any error therein. "FTSE®" is a commerce mark of LSEG, "NAREIT®" is a commerce mark of the Nationwide Affiliation of Actual Property Funding Trusts and "EPRA®" is a commerce mark of EPRA and all are utilized by FTSE beneath licence."

Neither Markit, its Associates or any third get together information supplier makes any guarantee, specific or implied, as to the accuracy, completeness or timeliness of the information contained herewith nor as to the outcomes to be obtained by recipients of the information. Neither Markit, its Associates nor any information supplier shall in any means be liable to any recipient of the information for any inaccuracies, errors or omissions within the Markit information, no matter trigger, or for any damages (whether or not direct or oblique) ensuing therefrom. Markit has no obligation to replace, modify or amend the information or to in any other case notify a recipient thereof within the occasion that any matter acknowledged herein adjustments or subsequently turns into inaccurate. With out limiting the foregoing, Markit, its Associates, or any third get together information supplier shall haven't any legal responsibility in any way to you, whether or not in contract (together with beneath an indemnity), in tort (together with negligence), beneath a guaranty, beneath statute or in any other case, in respect of any loss or injury suffered by you on account of or in reference to any opinions, suggestions, forecasts, judgments, or another conclusions, or any plan of action decided, by you or any third get together, whether or not or not primarily based on the content material, data or supplies contained herein. Copyright © 2023, Markit Indices Restricted.

The Markit iBoxx SGD Non-Sovereigns Massive Cap Funding Grade Index are marks of Markit Indices Lmited and have been licensed to be used by Nikko Asset Administration Asia Restricted. The Markit iBoxx SGD Non-Sovereigns Massive Cap Funding Grade Index referenced herein is the property of Markit Indices Restricted and is used beneath license. The Nikko AM SGD Funding Grade Company Bond ETF just isn't sponsored, endorsed, or promoted by Markit Indices Restricted.

Nikko Asset Administration Asia Restricted. Registration Quantity 198202562H.

[ad_2]