[ad_1]

The money charge might have been saved on maintain at 4.1% for the third time working, however mortgage charges have continued to maneuver, with quite a few lenders altering their mounted and variable charges during the last week, in line with Canstar’s weekly rate of interest wrap and insights.

From Sept. 11 to 18, two lenders – AMP Financial institution and MyState Financial institution – lifted 15 owner-occupier and investor variable charges by a mean 0.24%; whereas one other two – Bendigo Financial institution and NAB, minimize 5 of theirs by a mean 0.39%. See desk under for these variable charge adjustments.

Be aware: Based mostly on proprietor occupier and funding loans out there for $500,000, 80% LVR and principal & curiosity and/or interest-only funds in Canstar’s database. Excludes introductory and first residence purchaser solely residence loans.

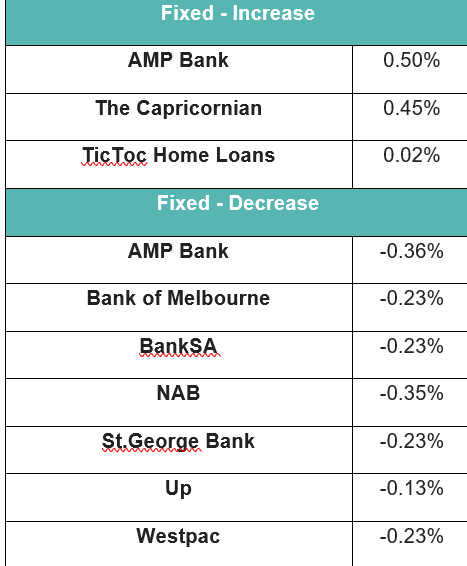

Over the identical interval, some mounted charges adjustments have additionally been made. Three – AMP Financial institution, The Capricornian, and TicToc Dwelling Loans – elevated 42 owner-occupier and investor mounted charges by a mean 0.27%, whereas seven – AMP Financial institution, Financial institution of Melbourne, BankSA, NAB, St. George Financial institution, Up, and Westpac – had 38 of theirs slashed by a mean 0.27%. See desk under for the mounted charge adjustments this week.

Be aware: Based mostly on proprietor occupier and funding loans out there for $500,000, 80% LVR and principal & curiosity and/or interest-only funds in Canstar’s database. Excludes introductory and first residence purchaser solely residence loans.

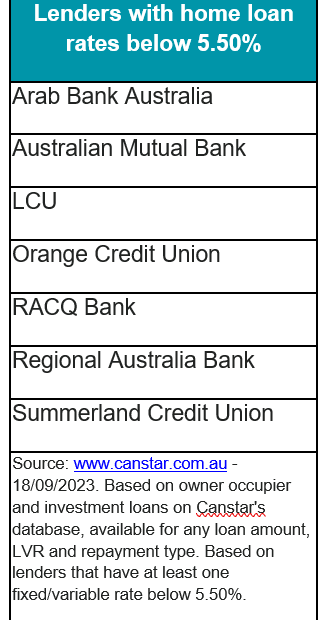

Canstar’s database confirmed the common variable rate of interest for proprietor occupiers paying principal and curiosity is 6.68% at 80% LVR and the bottom variable charge for any LVR is 5.44%, which is obtainable by Orange Credit score Union.

The Canstar database additionally confirmed that there have been 13 charges under 5.5%, down from 14 the prior week. These charges have been from the lenders listed within the desk under.

In the meantime, Effie Zahos (pictured above), Canstar cash skilled and editor-at-large, stated the spring property season had properly and actually kicked off.

“The newest knowledge from CoreLogic reveals the circulation of latest capital metropolis listings is rising sharply,” Zahos stated. “The circulation of recent inventory to market is 6.3% increased than the identical time final yr and 11% above the earlier five-year common. With most consultants predicting the money charge has peaked, we may even see a rise in patrons prepared to leap in as they really feel a larger sense of stability.”

The Canstar chief urged anybody planning to purchase a property to think about searching for pre-approval for a mortgage.

“Primarily this provides patrons a stable concept of how a lot they might probably borrow,” Zahos stated. “It’s essential to grasp that pre-approved loans should not 100% assured. “Lenders nonetheless want to substantiate that they’ll settle for the chosen property as safety and that your particulars haven’t modified because you first sought the pre-approval. Fee adjustments may additionally influence your utility.”

For example, a charge hike in a rising rate of interest market, may scale back Australians’ borrowing capability.

“It’s additionally value noting that you wouldn’t be capable to ask for a charge lock-facility as they sometimes should not out there on pre-approved loans,” Zahos stated.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day e-newsletter.

[ad_2]