[ad_1]

What You Must Know

- The simplified kind can be much like Kind 1040-EZ because it existed in 2017.

- The invoice would additionally increase the International Earned Earnings Exclusion to incorporate earnings earned abroad like pensions and distributions from retirement funds.

- Duplicative kinds required by the International Account Tax Compliance Act and the Financial institution Secrecy Act would even be eradicated.

New laws, the Tax Simplification for People Overseas Act, would require the IRS to create a short-form certification for People dwelling overseas who owe no U.S. tax and earn lower than $400,000 yearly.

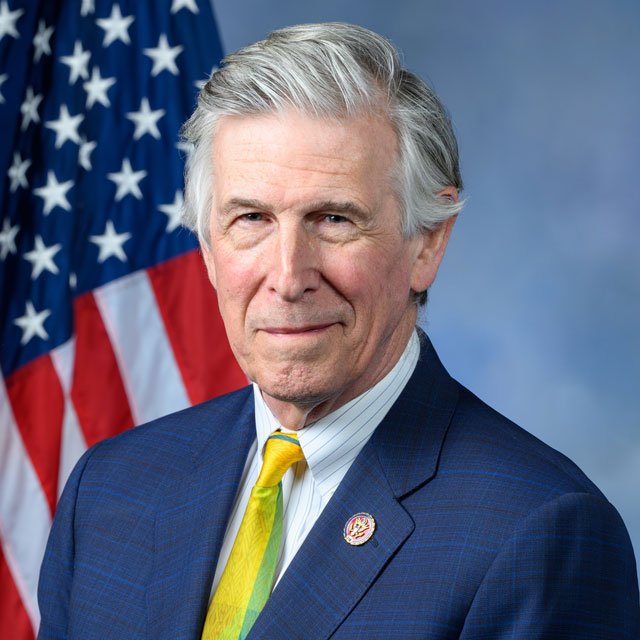

The invoice, H.R. 5432, launched Wednesday by Reps. Don Beyer, D-Va., and Dina Titus, D-Nev., would additionally increase the International Earned Earnings Exclusion to incorporate extra varieties of earnings earned abroad, resembling pensions and distributions from retirement funds.

The laws would additionally “consolidate duplicative and burdensome kinds” that taxpayers should file below the International Account Tax Compliance Act (FATCA) and the Financial institution Secrecy Act.

The simplified kind, in accordance with the invoice, can be “much like Kind 1040-EZ because it existed in 2017.”

“Atypical People dwelling overseas are sometimes missed when U.S. tax coverage is written, which may make it extraordinarily troublesome and costly for them to navigate the tax system,” Beyer mentioned in a press release.

The invoice, Beyer mentioned, “would assist extraordinary People fulfill their obligations with out having to retain an costly accountant to certify that they owe no U.S. taxes, and take away a number of the frustrations confronted by People dwelling overseas who simply wish to observe the legislation.”

[ad_2]